Fillable Printable Form 1099G Certain Government Payments.

Fillable Printable Form 1099G Certain Government Payments.

Form 1099G Certain Government Payments.

T

A

B

L

E

A

T

A

B

L

E

B

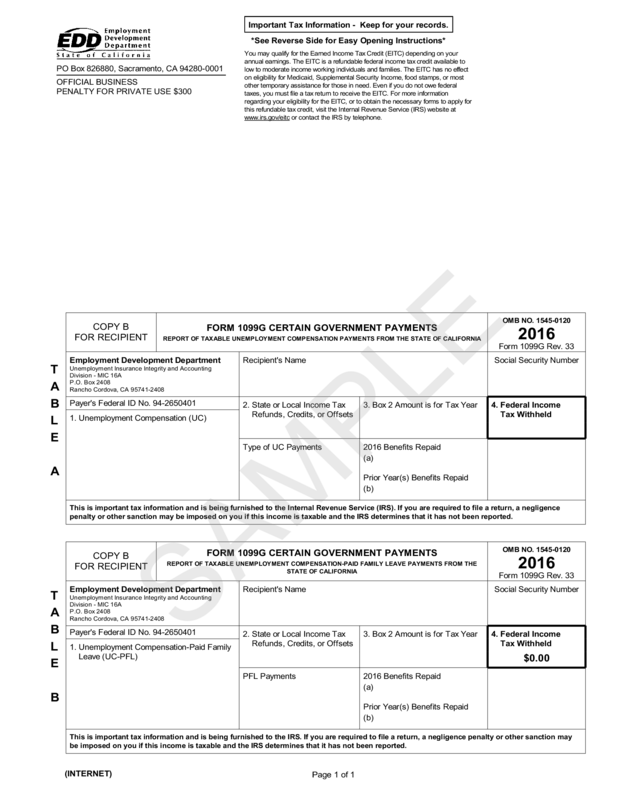

PO Box 826880, Sacramento, CA 94280-0001

OFFICIAL BUSINESS

PENALTY FOR PRIVATE USE $300

Important Tax Information - Keep for your records.

*See Reverse Side for Easy Opening Instructions*

You may qualify for the Earned Income Tax Credit (EITC) depending on your

annual earnings. The EITC is a refundable federal income tax credit available to

low to moderate income working individuals and families. The EITC has no effect

on eligibility for Medicaid, Supplemental Security Income, food stamps, or most

other temporary assistance for those in need. Even if you do not owe federal

taxes, you must file a tax return to receive the EITC. For more information

regarding your eligibility for the EITC, or to obtain the necessary forms to apply for

this refundable tax credit, visit the Internal Revenue Service (IRS) website at

www.irs.gov/eitc

or contact the IRS by telephone.

COPY B

FOR RECIPIENT

FORM 1099G CERTAIN GOVERNMENT PAYMENTS

REPORT OF TAXABLE UNEMPLOYMENT COMPENSATION PAYMENTS FROM THE STATE OF CALIFORNIA

OMB NO. 1545-0120

2016

Form 1099G Rev. 33

Employment Development Department Recipient's Name Social Security Number

Unemployment Insurance Integrity and Accounting

Division - MIC 16A

P.O. Box 2408

Rancho Cordova, CA 95741-2408

Payer's Federal ID No. 94-2650401

2. State or Local Income Tax 3. Box 2 Amount is for Tax Year 4. Federal Income

1. Unemployment Compensation (UC)

Refunds, Credits, or Offsets Tax Withheld

Type of UC Payments 2016 Benefits Repaid

(a)

Prior Year(s) Benefits Repaid

(b)

This is important tax information and is being furnished to the Internal Revenue Service (IRS). If you are required to file a return, a negligence

penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported.

COPY B

FOR RECIPIENT

FORM 1099G CERTAIN GOVERNMENT PAYMENTS

REPORT OF TAXABLE UNEMPLOYMENT COMPENSATION-PAID FAMILY LEAVE PAYMENTS FROM THE

STATE OF CALIFORNIA

OMB NO. 1545-0120

2016

Form 1099G Rev. 33

Employment Development Department Recipient's Name Social Security Number

Unemployment Insurance Integrity and Accounting

Division - MIC 16A

P.O. Box 2408

Rancho Cordova, CA 95741-2408

Payer's Federal ID No. 94-2650401

2. State or Local Income Tax 3. Box 2 Amount is for Tax Year 4. Federal Income

1. Unemployment Compensation-Paid Family

Refunds, Credits, or Offsets Tax Withheld

Leave (UC-PFL)

$0.00

PFL Payments 2016 Benefits Repaid

(a)

Prior Year(s) Benefits Repaid

(b)

This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may

be imposed on you if this income is taxable and the IRS determines that it has not been reported.

(INTERNET)

Page 1 of 1

SAMPLE