Fillable Printable Form 1099K

Fillable Printable Form 1099K

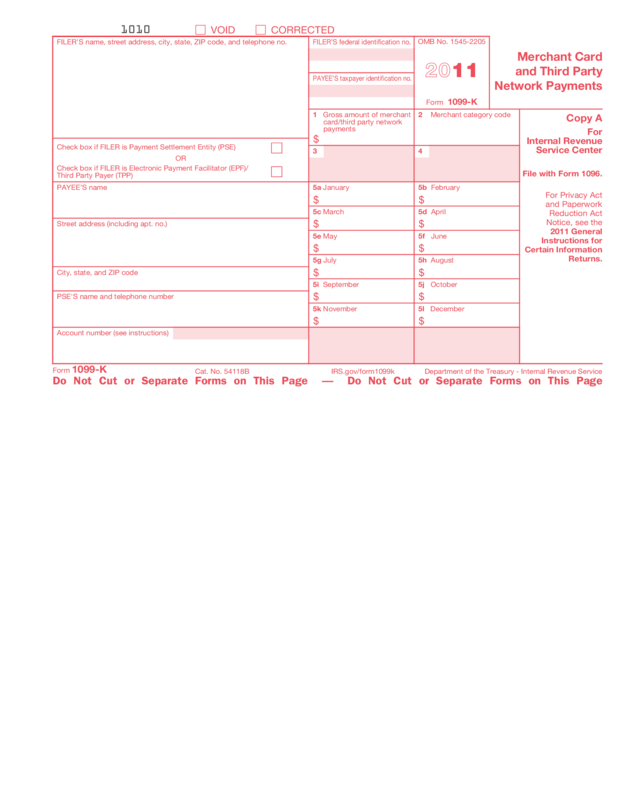

Form 1099K

Form 1099-K

2011

Cat. No. 54118B

Merchant Card

and Third Party

Network Payments

Copy A

For

Internal Revenue

Service Center

File with Form 1096.

Department of the Treasury - Internal Revenue Service

OMB No. 1545-2205

For Privacy Act

and Paperwork

Reduction Act

Notice, see the

2011 General

Instructions for

Certain Information

Returns.

1010

VOID CORRECTED

FILER’S name, street address, city, state, ZIP code, and telephone no.

Check box if FILER is Payment Settlement Entity (PSE)

OR

Check box if FILER is Electronic Payment Facilitator (EPF)/

Third Party Payer (TPP)

PAYEE’S name

Street address (including apt. no.)

City, state, and ZIP code

PSE'S name and telephone number

Account number (see instructions)

FILER’S federal identification no.

PAYEE’S taxpayer identification no.

1 Gross amount of merchant

card/third party network

payments

$

2 Merchant category code

3 4

5a January

$

5b February

$

5c March

$

5d April

$

5e May

$

5f June

$

5g July

$

5h August

$

5i September

$

5j October

$

5k November

$

5l December

$

Form 1099-K

IRS.gov/form1099k

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

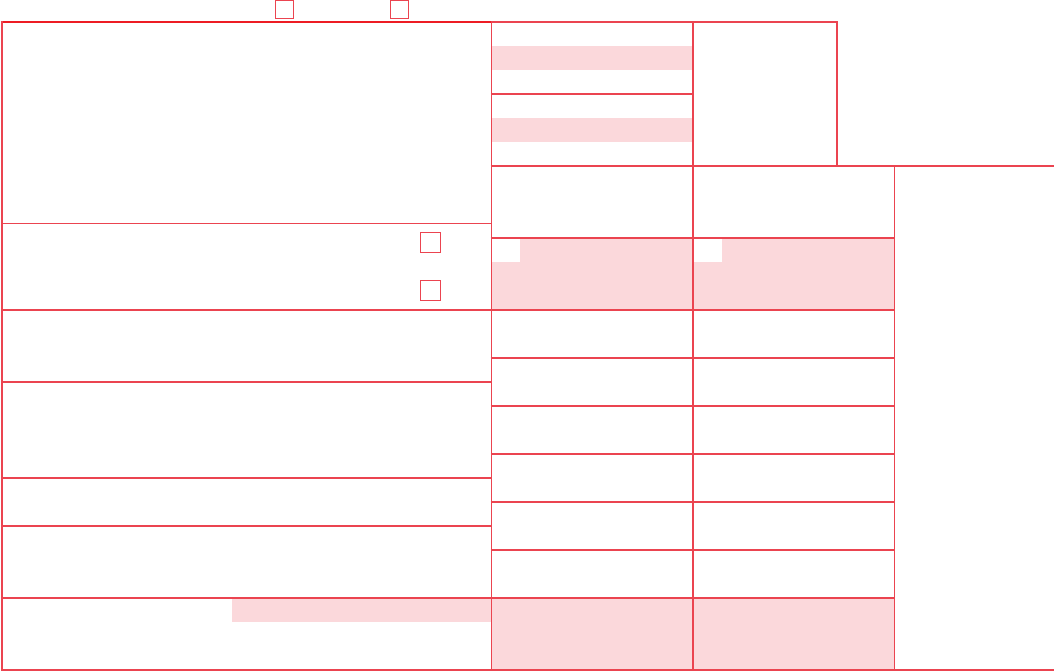

Form 1099-K

2011

Merchant Card

and Third Party

Network Payments

Copy B

For Payee

Department of the Treasury - Internal Revenue Service

This is important tax

information and is

being furnished to

the Internal Revenue

Service. If you are

required to file a

return, a negligence

penalty or other

sanction may be

imposed on you if

taxable income

results from this

transaction and the

IRS determines that it

has not been

reported.

OMB No. 1545-2205

CORRECTED

FILER’S name, street address, city, state, ZIP code, and telephone no.

If checked, FILER is Payment Settlement Entity (PSE)

OR

If checked, FILER is Electronic Payment Facilitator (EPF)/

Third Party Payer (TPP)

PAYEE’S name

Street address (including apt. no.)

City, state, and ZIP code

PSE'S name and telephone number

Account number (see instructions)

FILER’S federal identification no.

PAYEE’S taxpayer identification no.

1 Gross amount of merchant

card/third party network

payments

$

2 Merchant category code

3 4

5a January

$

5b February

$

5c March

$

5d April

$

5e May

$

5f June

$

5g July

$

5h August

$

5i September

$

5j October

$

5k November

$

5l December

$

Form 1099-K

(Keep for your records) IRS.gov/form1099k

Instructions for Payee

You have received this form because you have

accepted merchant cards for payments, or because you

received payments through a third party network that (1)

exceeded $20,000 in gross total reportable payment

transactions and (2) the total number of those

transactions exceeded 200 for the calendar year.

Merchant card and third party network payers, as

payment settlement entities (PSE), must report the

proceeds of payment card and third party network

transactions made to you on Form 1099-K under

Internal Revenue Code section 6050W. The PSE may

have contracted with an electronic payment facilitator

(EPF) or other third party payer (TPP) to make payments

to you.

If you have questions about the amounts reported on

this form, contact the FILER whose information is

shown in the upper left corner on the front of this form.

If you do not recognize the FILER shown in the upper

left corner of the form, contact the PSE whose name

and phone number are shown in the lower left corner of

the form above your account number.

See the separate instructions for your income tax

return for how to use the information reported on this

form.

Account number. May show an account number or

other unique number the PSE assigned to distinguish

your account.

Box 1. Shows the aggregate gross amount of merchant

card/third party network payments made to you through

the PSE during the tax year.

Box 2. Shows the merchant category code used for

merchant card/third party network payments (if

available) reported on this form.

Boxes 5a-5l. Shows the gross amount of merchant

card/third party network payments received by you for

each month of the calendar year.

For the latest developments regarding Form 1099-K

that may occur after these instructions are printed, visit

www.irs.gov/form1099k.

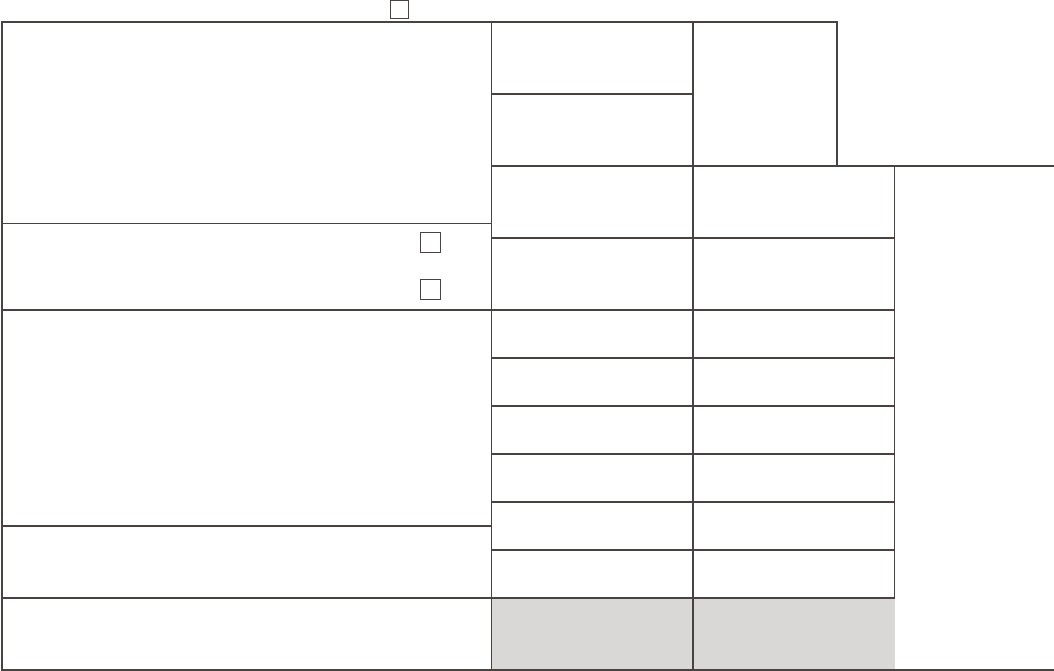

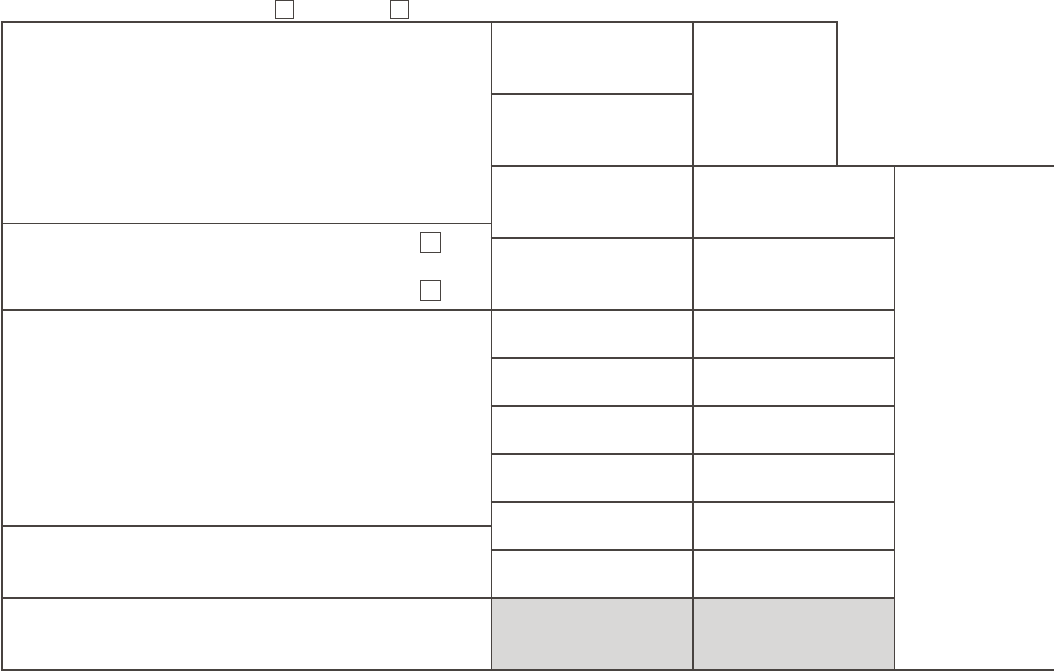

Form 1099-K

2011

Merchant Card

and Third Party

Network Payments

Copy C

For Filer

Department of the Treasury - Internal Revenue Service

OMB No. 1545-2205

For Privacy Act

and Paperwork

Reduction Act

Notice, see the

2011 General

Instructions for

Certain Information

Returns.

VOID CORRECTED

FILER’S name, street address, city, state, ZIP code, and telephone no.

Check box if FILER is Payment Settlement Entity (PSE)

OR

Check box if FILER is Electronic Payment Facilitator (EPF)/

Third Party Payer (TPP)

PAYEE’S name

Street address (including apt. no.)

City, state, and ZIP code

PSE'S name and telephone number

Account number (see instructions)

FILER’S federal identification no.

PAYEE’S taxpayer identification no.

1 Gross amount of merchant

card/third party network

payments

$

2 Merchant category code

3 4

5a January

$

5b February

$

5c March

$

5d April

$

5e May

$

5f June

$

5g July

$

5h August

$

5i September

$

5j October

$

5k November

$

5l December

$

Form 1099-K

IRS.gov/form1099k

Instructions for Payment Settlement Entity/

Third Party Payer

General and specific form instructions are provided as

separate products. The products you should use to

complete Form 1099-K are the 2011 General

Instructions for Certain Information Returns and the

2011 Instructions for Form 1099-K. A chart in the

general instructions gives a quick guide to which form

must be filed to report a particular payment. To order

these instructions and additional forms, visit IRS.gov or

call 1-800-TAX-FORM (1-800-829-3676).

Caution: Because paper forms are scanned during

processing, you cannot file Forms 1096, 1097, 1098,

1099, 3921, 3922, or 5498 that you print from the IRS

website.

Due dates. Furnish Copy B of this form to the recipient

by January 31, 2012.

File Copy A of this form with the IRS by February 28,

2012. If you file electronically, the due date is April 2,

2012. To file electronically, you must have software that

generates a file according to the specifications in Pub.

1220, Specifications for Filing Forms 1097, 1098, 1099,

3921, 3922, 5498, 8935, and W-2G Electronically. The

IRS does not provide a fill-in form option.

Need help? If you have questions about reporting on

Form 1099-K, call the information reporting customer

service site toll free at 1-866-455-7438 or 304-263-8700

(not toll free). For TTY/TDD equipment, call

304-579-4827 (not toll free). The hours of operation are

Monday through Friday from 8:30 a.m. to 4:30 p.m.,

Eastern time.

For the latest developments regarding Form 1099-K

that may occur after these instructions are printed, visit

www.irs.gov/form1099k.