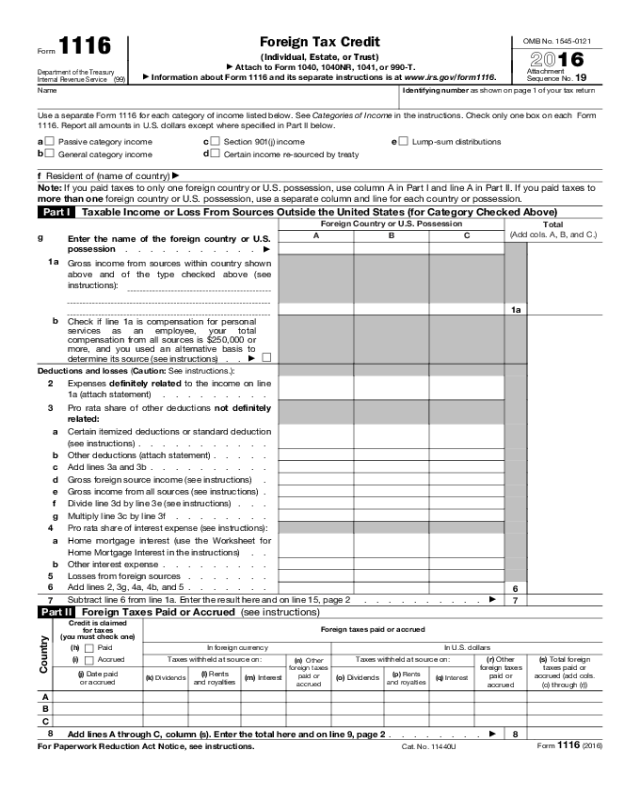

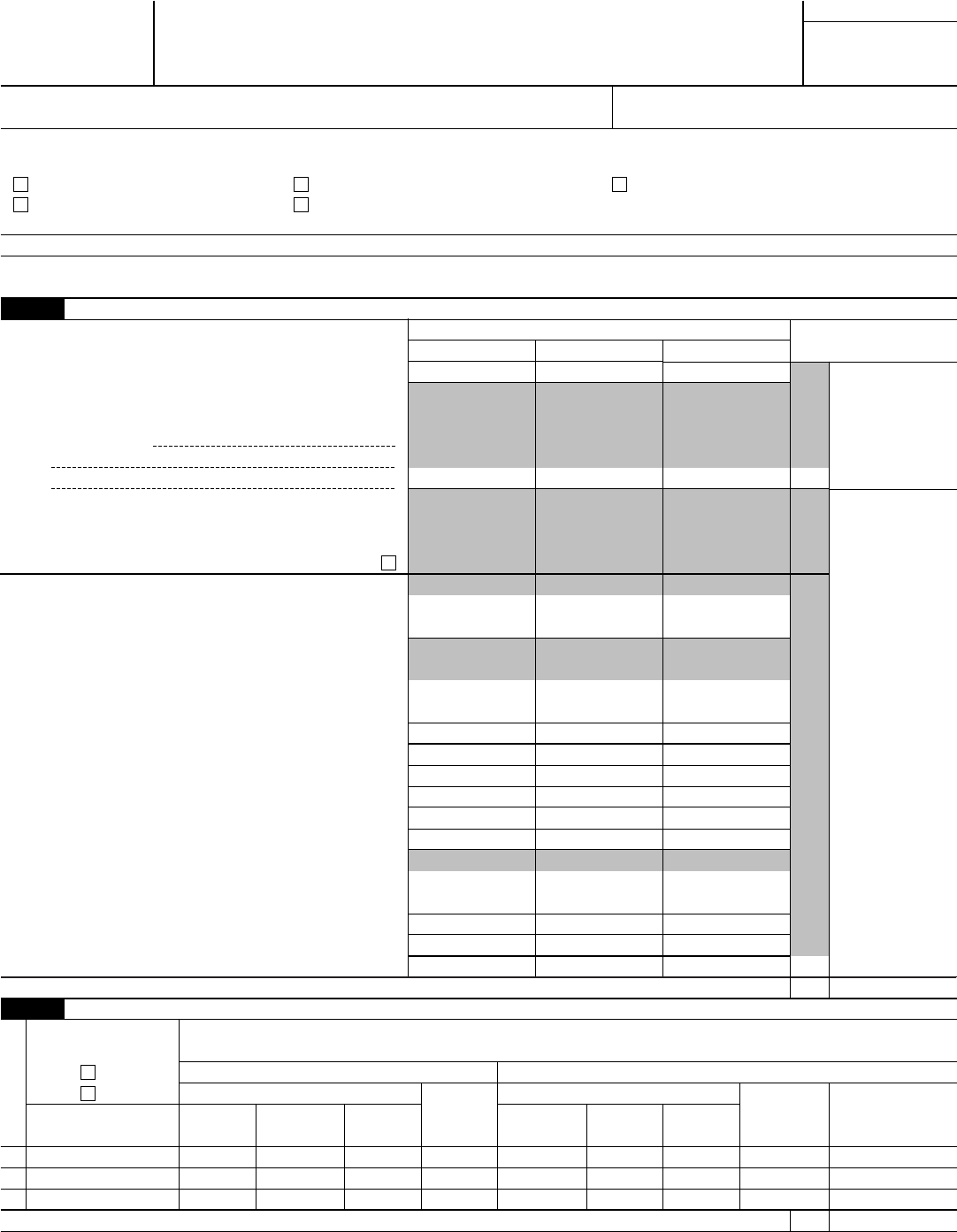

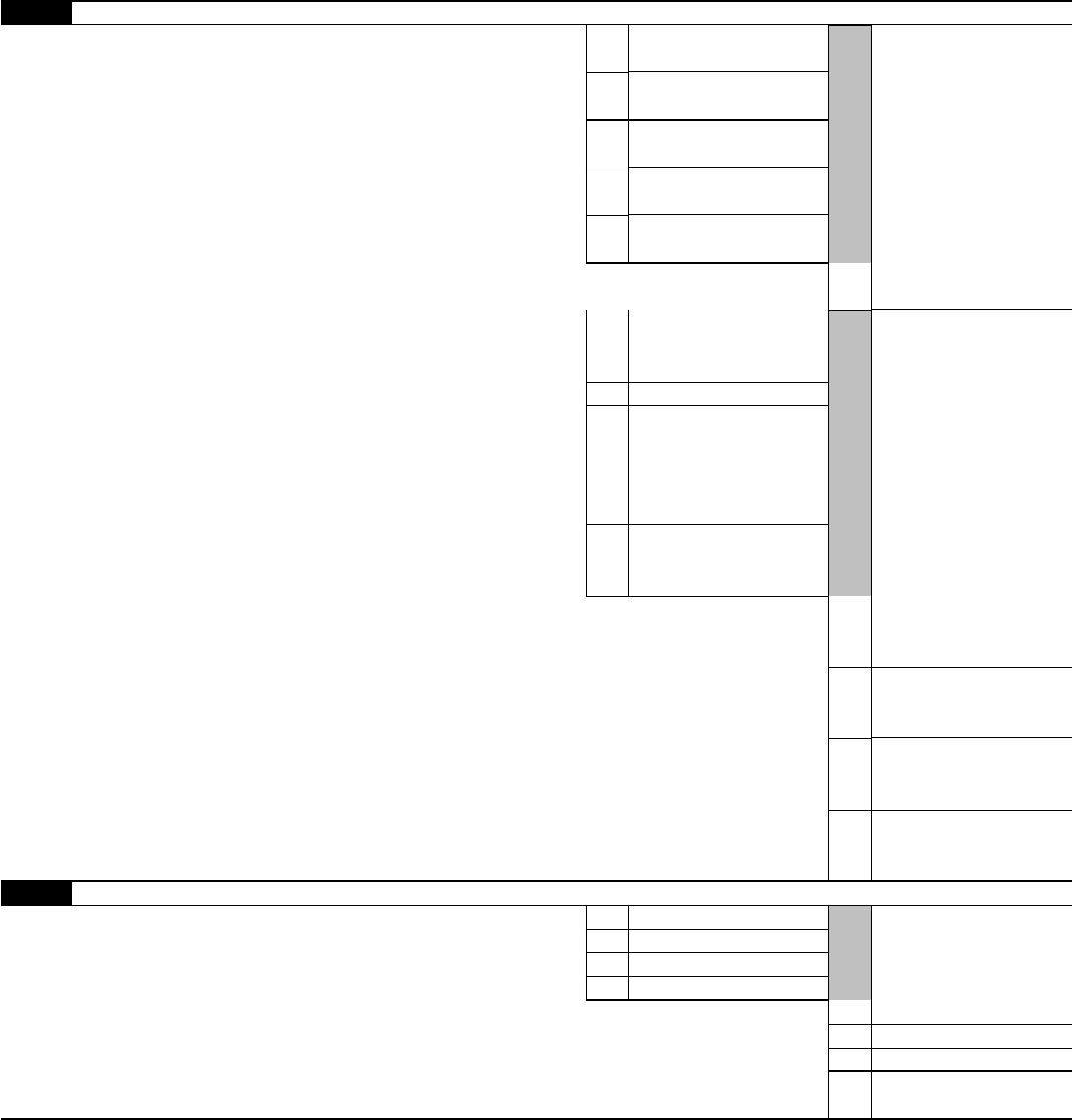

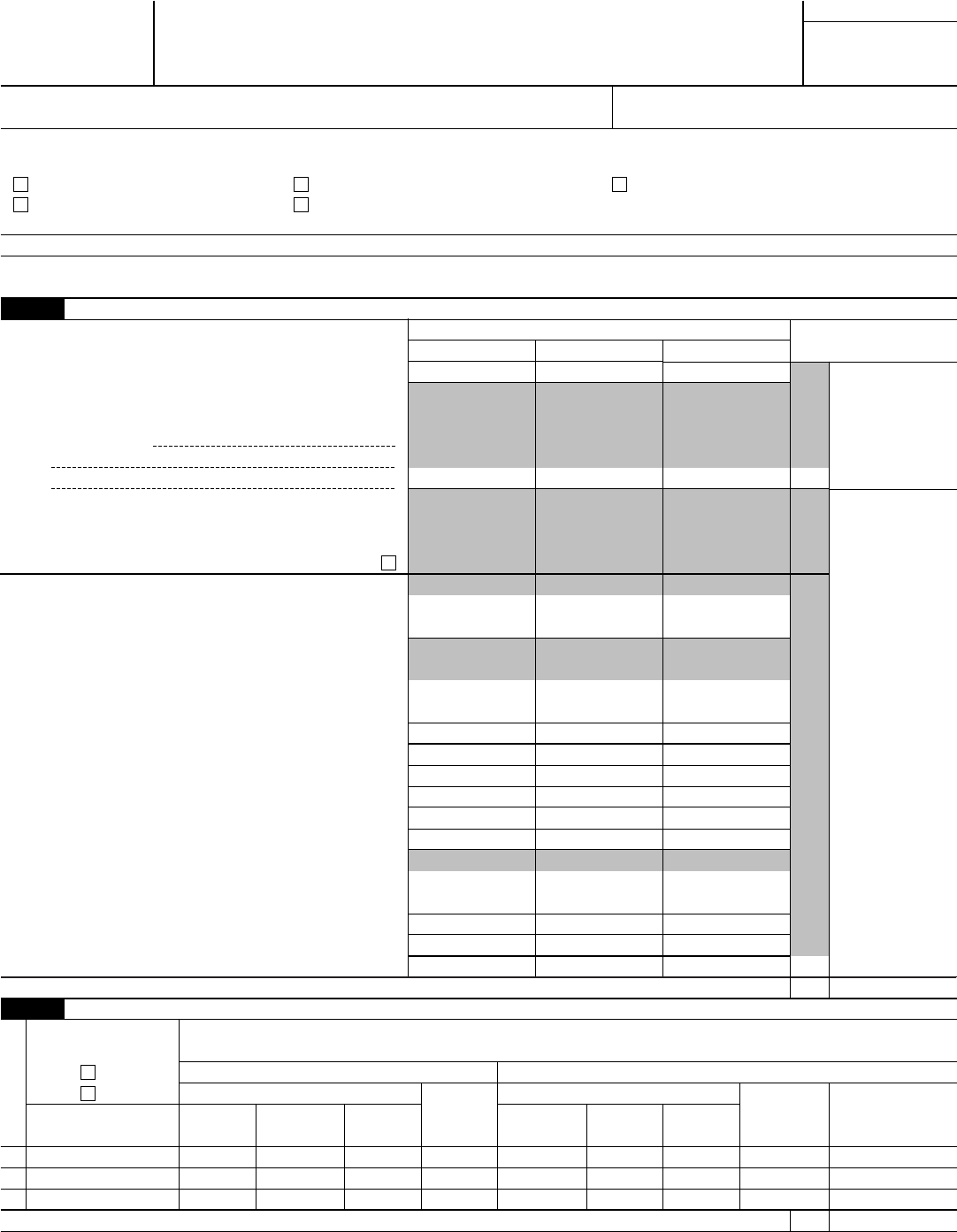

Form 1116

Department of the Treasury

Internal Revenue Service

(99)

Foreign Tax Credit

(Individual, Estate, or Trust)

▶

Attach to Form 1040, 1040NR, 1041, or 990-T.

▶

Information about Form 1116 and its separate instructions is at www.irs.gov/form1116.

OMB No. 1545-0121

2016

Attachment

Sequence No.

19

Name

Identifying number as shown on page 1 of your tax return

Use a separate Form 1116 for each category of income listed below. See Categories of Income in the instructions. Check only one box on each Form

1116. Report all amounts in U.S. dollars except where specified in Part II below.

a

Passive category income

b

General category income

c

Section 901(j) income

d

Certain income re-sourced by treaty

e

Lump-sum distributions

f Resident of (name of country)

▶

Note: If you paid taxes to only one foreign country or U.S. possession, use column A in Part I and line A in Part II. If you paid taxes to

more than one foreign country or U.S. possession, use a separate column and line for each country or possession.

Part I Taxable Income or Loss From Sources Outside the United States (for Category Checked Above)

Foreign Country or U.S. Possession

A B

C

Total

(Add cols. A, B, and C.)

g

Enter the name of the foreign country or U.S.

possession . . . . . . . . . . .

▶

1a

Gross income from sources within country shown

above and of the type checked above (see

instructions):

1a

b

Check if line 1a is compensation for personal

services as an employee, your total

compensation from all sources is $250,000 or

more, and you used an alternative basis to

determine its source (see instructions) . .

▶

Deductions and losses (Caution: See instructions.):

2

Expenses definitely related to the income on line

1a (attach statement) . . . . . . . . .

3

Pro rata share of other deductions not definitely

related:

a

Certain itemized deductions or standard deduction

(see instructions) . . . . . . . . . . .

b Other deductions (attach statement) . . . . .

c Add lines 3a and 3b . . . . . . . . . .

d Gross foreign source income (see instructions) .

e Gross income from all sources (see instructions) .

f Divide line 3d by line 3e (see instructions) . . .

g Multiply line 3c by line 3f . . . . . . . .

4

Pro rata share of interest expense (see instructions):

a

Home mortgage interest (use the Worksheet for

Home Mortgage Interest in the instructions) . .

b Other interest expense . . . . . . . . .

5 Losses from foreign sources . . . . . . .

6 Add lines 2, 3g, 4a, 4b, and 5 . . . . . . .

6

7

Subtract line 6 from line 1a. Enter the result here and on line 15, page 2 . . . . . . . . . .

▶

7

Part II Foreign Taxes Paid or Accrued (see instructions)

Country

Credit is claimed

for taxes

(you must check one)

(h)

Paid

(i)

Accrued

(j) Date paid

or accrued

Foreign taxes paid or accrued

In foreign currency

Taxes withheld at source on:

(k) Dividends

(l) Rents

and royalties

(m) Interest

(n) Other

foreign taxes

paid or

accrued

In U.S. dollars

Taxes withheld at source on:

(o) Dividends

(p) Rents

and royalties

(q) Interest

(r) Other

foreign taxes

paid or

accrued

(s) Total foreign

taxes paid or

accrued (add cols.

(o) through (r))

A

B

C

8

Add lines A through C, column (s). Enter the total here and on line 9, page 2 . . . . . . . .

▶

8

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 11440U

Form 1116 (2016)