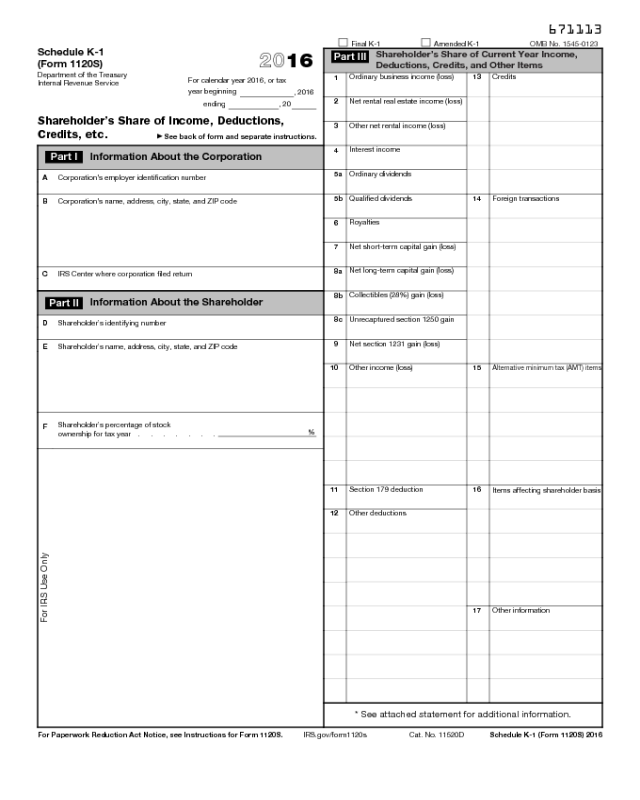

Form 1120 S Schedule K-1

671113

Final K-1 Amended K-1

OMB No. 1545-0123

Schedule K-1

(Form 1120S)

Department of the Treasury

Internal Revenue Service

2016

For calendar year 2016, or tax

year beginning

, 2016

ending , 20

Shareholder’s Share of Income, Deductions,

Credits, etc.

▶

See back of form and separate instructions.

Information About the Corporation

Part I

A Corporation’s employer identification number

B Corporation’s name, address, city, state, and ZIP code

C IRS Center where corporation filed return

Information About the Shareholder

Part II

D Shareholder’s identifying number

E Shareholder’s name, address, city, state, and ZIP code

F

Shareholder’s percentage of stock

ownership for tax year . . . . . . .

%

For IRS Use Only

Shareholder’s Share of Current Year Income,

Deductions, Credits, and Other Items

Part III

1

Ordinary business income (loss)

2

Net rental real estate income (loss)

3

Other net rental income (loss)

4

Interest income

5a

Ordinary dividends

5b

Qualified dividends

6

Royalties

7

Net short-term capital gain (loss)

8a

Net long-term capital gain (loss)

8b

Collectibles (28%) gain (loss)

8c

Unrecaptured section 1250 gain

9

Net section 1231 gain (loss)

10

Other income (loss)

11

Section 179 deduction

12

Other deductions

13

Credits

14 Foreign transactions

15

Alternative minimum tax (AMT) items

16

Items affecting shareholder basis

17

Other information

* See attached statement for additional information.

For Paperwork Reduction Act Notice, see Instructions for Form 1120S. IRS.gov/form1120s Cat. No. 11520D Schedule K-1 (Form 1120S) 2016

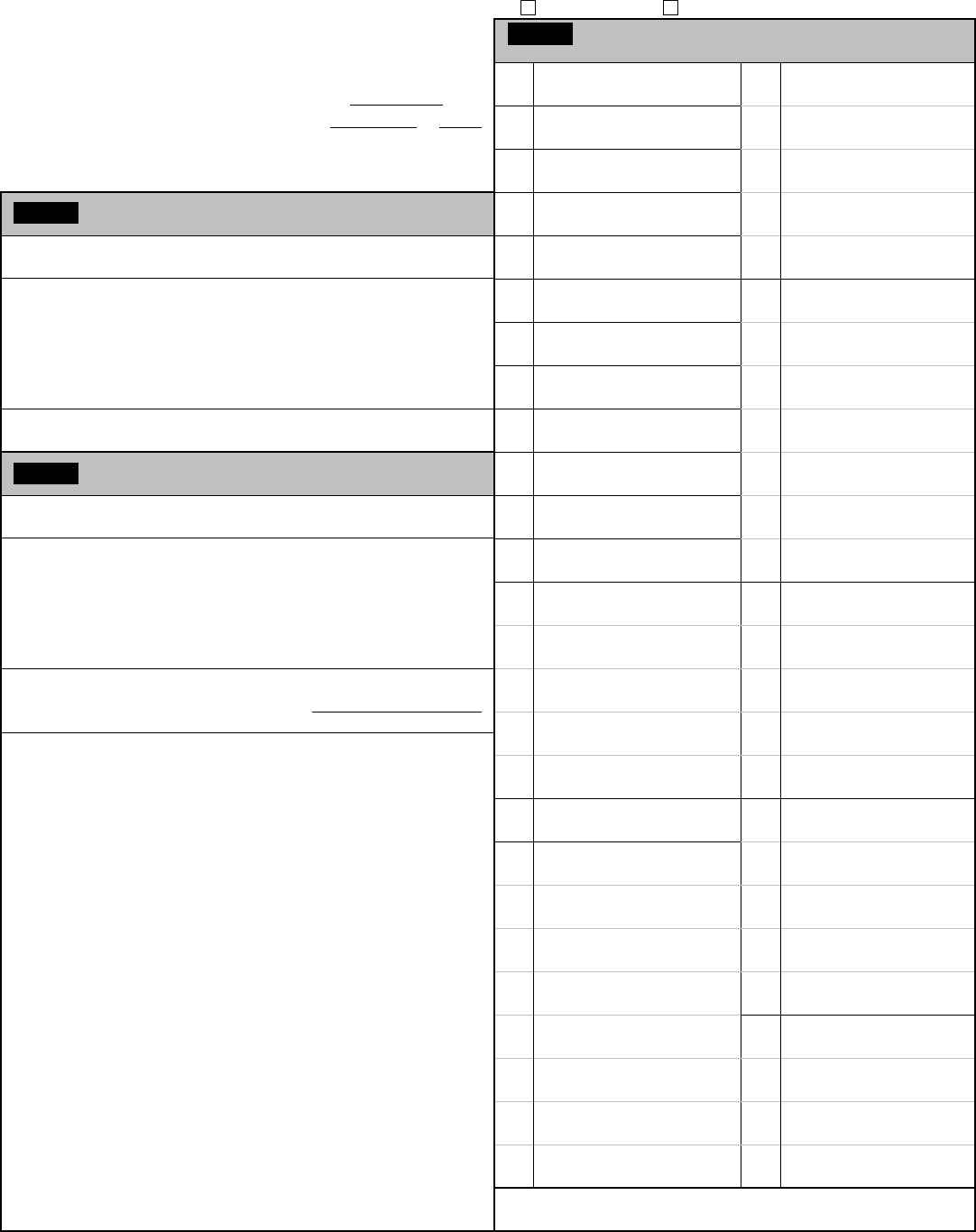

Schedule K-1 (Form 1120S) 2016

Page 2

This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders who file Form 1040.

For detailed reporting and filing information, see the separate Shareholder’s Instructions for Schedule K-1 and the instructions for your income tax return.

1.

Ordinary business income (loss). Determine whether the income (loss) is

passive or nonpassive and enter on your return as follows:

Report on

Passive loss

See the Shareholder’s Instructions

Passive income Schedule E, line 28, column (g)

Nonpassive loss Schedule E, line 28, column (h)

Nonpassive income Schedule E, line 28, column (j)

2. Net rental real estate income (loss) See the Shareholder’s Instructions

3. Other net rental income (loss)

Net income Schedule E, line 28, column (g)

Net loss See the Shareholder’s Instructions

4. Interest income Form 1040, line 8a

5a. Ordinary dividends Form 1040, line 9a

5b. Qualified dividends Form 1040, line 9b

6. Royalties Schedule E, line 4

7. Net short-term capital gain (loss) Schedule D, line 5

8a. Net long-term capital gain (loss) Schedule D, line 12

8b. Collectibles (28%) gain (loss) 28% Rate Gain Worksheet, line 4

(Schedule D instructions)

8c. Unrecaptured section 1250 gain See the Shareholder’s Instructions

9. Net section 1231 gain (loss) See the Shareholder’s Instructions

10. Other income (loss)

Code

A Other portfolio income (loss) See the Shareholder’s Instructions

B Involuntary conversions See the Shareholder’s Instructions

C Sec. 1256 contracts & straddles Form 6781, line 1

D Mining exploration costs recapture

See Pub. 535

E Other income (loss) See the Shareholder’s Instructions

11. Section 179 deduction See the Shareholder’s Instructions

12. Other deductions

A Cash contributions (50%)

B Cash contributions (30%)

C Noncash contributions (50%)

D Noncash contributions (30%)

E Capital gain property to a 50%

organization (30%)

F Capital gain property (20%)

G Contributions (100%)

}

See the Shareholder’s

Instructions

H Investment interest expense Form 4952, line 1

I Deductions—royalty income

Schedule E, line 19

J Section 59(e)(2) expenditures See the Shareholder’s Instructions

K

Deductions—portfolio (2% floor)

Schedule A, line 23

L Deductions—portfolio (other) Schedule A, line 28

M Preproductive period expenses See the Shareholder’s Instructions

N Commercial revitalization deduction

from rental real estate activities

See Form 8582 instructions

O Reforestation expense deduction See the Shareholder’s Instructions

P Domestic production activities

information

See Form 8903 instructions

Q

Qualified production activities income

Form 8903, line 7b

R Employer’s Form W-2 wages Form 8903, line 17

S Other deductions

See the Shareholder’s Instructions

13. Credits

A Low-income housing credit (section

42(j)(5)) from pre-2008 buildings

B

Low-income housing credit (other) from

pre-2008 buildings

C Low-income housing credit (section

42(j)(5)) from post-2007 buildings

D Low-income housing credit (other)

from post-2007 buildings

E Qualified rehabilitation expenditures

(rental real estate)

F Other rental real estate credits

G Other rental credits

}

See the Shareholder’s

Instructions

H

Undistributed capital gains credit

Form 1040, line 73, box a

I

Biofuel producer credit

J Work opportunity credit

K

Disabled access credit

L Empowerment zone employment

credit

M

Credit for increasing research

activities

}

See the Shareholder’s

Instructions

Code

Report on

N Credit for employer social

security and Medicare taxes

O Backup withholding

P Other credits

}

See the Shareholder’s Instructions

14.

Foreign transactions

A Name of country or U.S.

possession

B Gross income from all sources

C Gross income sourced at

shareholder level

}

Form 1116, Part I

Foreign gross income sourced at corporate level

D Passive category

E General category

F Other

}

Form 1116, Part I

Deductions allocated and apportioned at shareholder level

G Interest expense Form 1116, Part I

H Other Form 1116, Part I

Deductions allocated and apportioned at corporate level to foreign source

income

I Passive category

J General category

K Other

}

Form 1116, Part I

Other information

L Total foreign taxes paid Form 1116, Part II

M Total foreign taxes accrued Form 1116, Part II

N Reduction in taxes available for

credit

Form 1116, line 12

O

Foreign trading gross receipts

Form 8873

P

Extraterritorial income exclusion

Form 8873

Q Other foreign transactions

See the Shareholder’s Instructions

15. Alternative minimum tax (AMT) items

A

Post-1986 depreciation adjustment

B Adjusted gain or loss

C Depletion (other than oil & gas)

D

Oil, gas, & geothermal—gross income

E

Oil, gas, & geothermal—deductions

F Other AMT items

}

See the

Shareholder’s

Instructions and

the Instructions for

Form 6251

16. Items affecting shareholder basis

A Tax-exempt interest income Form 1040, line 8b

B Other tax-exempt income

C Nondeductible expenses

D Distributions

E Repayment of loans from

shareholders

}

See the Shareholder’s

Instructions

17. Other information

A Investment income Form 4952, line 4a

B Investment expenses Form 4952, line 5

C Qualified rehabilitation expenditures

(other than rental real estate)

See the Shareholder’s Instructions

D Basis of energy property See the Shareholder’s Instructions

E Recapture of low-income housing

credit (section 42(j)(5))

Form 8611, line 8

F Recapture of low-income housing

credit (other)

Form 8611, line 8

G Recapture of investment credit See Form 4255

H Recapture of other credits See the Shareholder’s Instructions

I

Look-back interest—completed

long-term contracts

See Form 8697

J

Look-back interest—income forecast

method

See Form 8866

K

Dispositions of property with

section 179 deductions

L Recapture of section 179

deduction

M Section 453(l)(3) information

N Section 453A(c) information

O Section 1260(b) information

P Interest allocable to production

expenditures

Q CCF nonqualified withdrawals

R

Depletion information—oil and gas

S Reserved

T

Section 108(i) information

U Net investment income

V Other information

}

See the Shareholder’s

Instructions