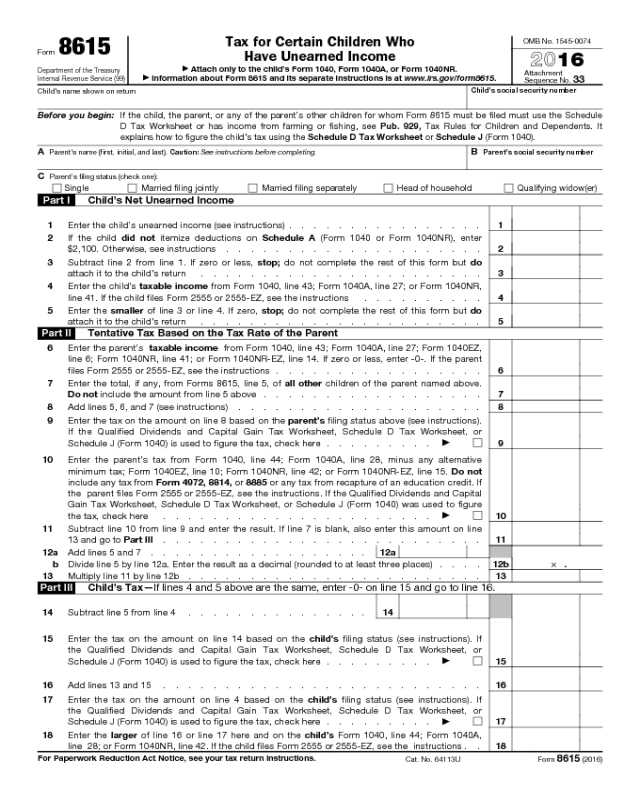

Form 8615

Form 8615

Department of the Treasury

Internal Revenue Service (99)

Tax for Certain Children Who

Have Unearned Income

▶

Attach only to the child’s Form 1040, Form 1040A, or Form 1040NR.

▶

Information about Form 8615 and its separate instructions is at www.irs.gov/form8615.

OMB No. 1545-0074

2016

Attachment

Sequence No.

33

Child’s name shown on return

Child’s social security number

Before you begin: If the child, the parent, or any of the parent’s other children for whom Form 8615 must be filed must use the Schedule

D Tax Worksheet or has income from farming or fishing, see Pub. 929, Tax Rules for Children and Dependents. It

explains how to figure the child’s tax using the Schedule D Tax Worksheet or Schedule J (Form 1040).

A Parent’s name (first, initial, and last). Caution: See instructions before completing. B Parent’s social security number

C Parent’s filing status (check one):

Single Married filing jointly Married filing separately Head of household Qualifying widow(er)

Part I Child’s Net Unearned Income

1 Enter the child’s unearned income (see instructions) . . . . . . . . . . . . . . . . 1

2

If the child did not itemize deductions on Schedule A (Form 1040 or Form 1040NR), enter

$2,100. Otherwise, see instructions . . . . . . . . . . . . . . . . . . . . .

2

3

Subtract line 2 from line 1. If zero or less, stop; do not complete the rest of this form but do

attach it to the child’s return . . . . . . . . . . . . . . . . . . . . . . .

3

4

Enter the child’s taxable income from Form 1040, line 43; Form 1040A, line 27; or Form 1040NR,

line 41. If the child files Form 2555 or 2555-EZ, see the instructions . . . . . . . . . .

4

5

Enter the smaller of line 3 or line 4. If zero, stop; do not complete the rest of this form but do

attach it to the child’s return . . . . . . . . . . . . . . . . . . . . . . .

5

Part II Tentative Tax Based on the Tax Rate of the Parent

6

Enter the parent’s taxable income from Form 1040, line 43; Form 1040A, line 27; Form 1040EZ,

line 6; Form 1040NR, line 41; or Form 1040NR-EZ, line 14. If zero or less, enter -0-. If the parent

files Form 2555 or 2555-EZ, see the instructions . . . . . . . . . . . . . . . . .

6

7

Enter the total, if any, from Forms 8615, line 5, of all other children of the parent named above.

Do not include the amount from line 5 above . . . . . . . . . . . . . . . . . .

7

8 Add lines 5, 6, and 7 (see instructions) . . . . . . . . . . . . . . . . . . . . 8

9

Enter the tax on the amount on line 8 based on the parent’s filing status above (see instructions).

If the Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or

Schedule J (Form 1040) is used to figure the tax, check here . . . . . . . . .

▶

9

10

Enter the parent’s tax from Form 1040, line 44; Form 1040A, line 28, minus any alternative

minimum tax; Form 1040EZ, line 10; Form 1040NR, line 42; or Form 1040NR-EZ, line 15. Do not

include any tax from Form 4972, 8814, or 8885 or any tax from recapture of an education credit. If

the parent files Form 2555 or 2555-EZ, see the instructions. If the Qualified Dividends and Capital

Gain Tax Worksheet, Schedule D Tax Worksheet, or Schedule J (Form 1040) was used to figure

the tax, check here . . . . . . . . . . . . . . . . . . . . . .

▶

10

11

Subtract line 10 from line 9 and enter the result. If line 7 is blank, also enter this amount on line

13 and go to Part III . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12a Add lines 5 and 7 . . . . . . . . . . . . . . . . . . 12a

b Divide line 5 by line 12a. Enter the result as a decimal (rounded to at least three places) . . . . 12b

× .

13 Multiply line 11 by line 12b . . . . . . . . . . . . . . . . . . . . . . . .

13

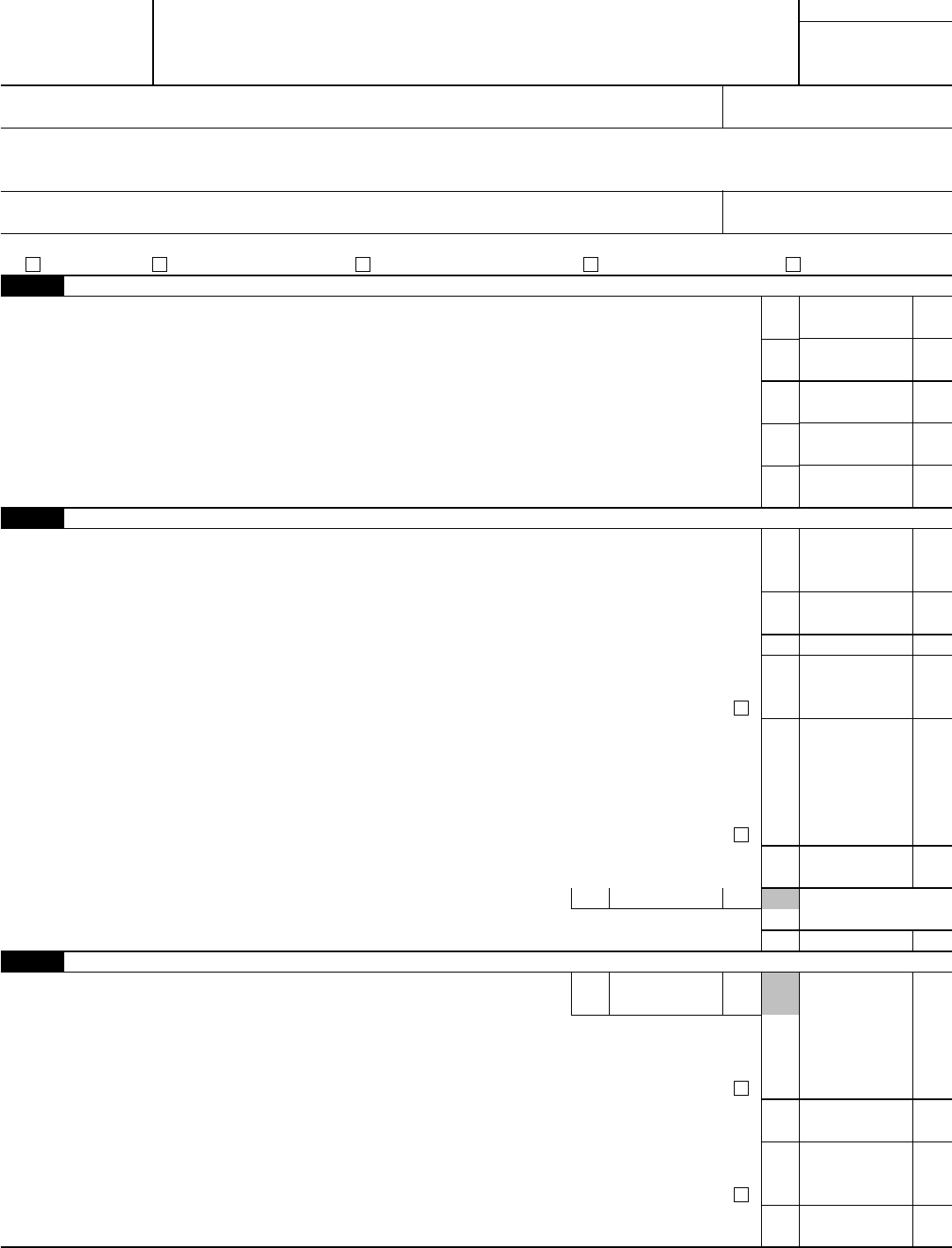

Part III Child’s Tax—If lines 4 and 5 above are the same, enter -0- on line 15 and go to line 16.

14 Subtract line 5 from line 4 . . . . . . . . . . . . . . . 14

15

Enter the tax on the amount on line 14 based on the child’s filing status (see instructions). If

the Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or

Schedule J (Form 1040) is used to figure the tax, check here . . . . . . . . .

▶

15

16 Add lines 13 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17

Enter the tax on the amount on line 4 based on the child’s filing status (see instructions). If

the Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or

Schedule J (Form 1040) is used to figure the tax, check here . . . . . . . . .

▶

17

18

Enter the larger of line 16 or line 17 here and on the child’s Form 1040, line 44; Form 1040A,

line 28; or Form 1040NR, line 42. If the child files Form 2555 or 2555-EZ, see the instructions . .

18

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 64113U

Form 8615 (2016)