Fillable Printable Form 163 Sales Tax Protest Payment Affidavit

Fillable Printable Form 163 Sales Tax Protest Payment Affidavit

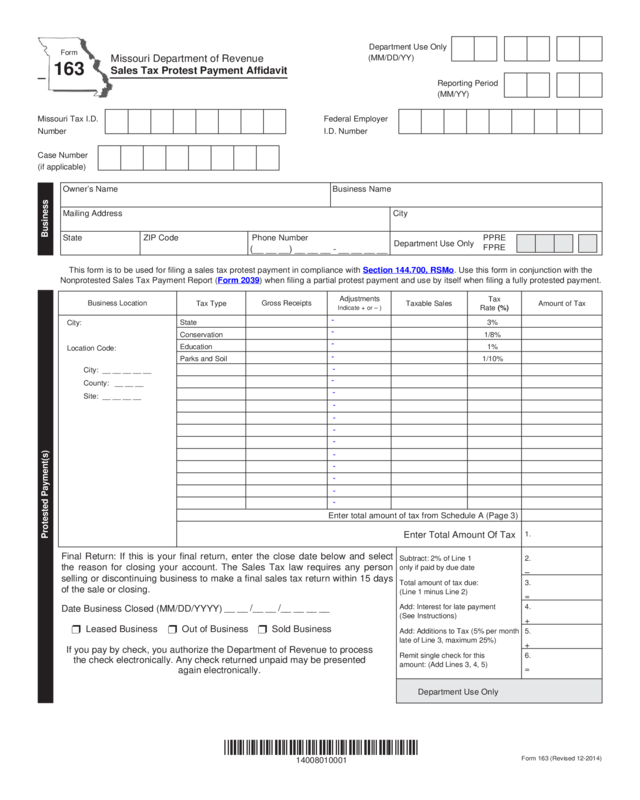

Form 163 Sales Tax Protest Payment Affidavit

Adjustments

Indicate + or – )

Amount of Tax

Business Location

*14008010001*

14008010001

Owner’s Name Business Name

Mailing Address City

State ZIP Code Phone Number PPRE

FPRE

Department Use Only

Business

(__ __ __) __ __ __ - __ __ __ __

Form 163 (Revised 12-2014)

State 3%

Conservation 1/8%

Education 1%

Parks and Soil 1/10%

This form is to be used for filing a sales tax protest payment in compliance with Section 144.700, RSMo. Use this form in conjunction with the

Nonprotested Sales Tax Payment Report (Form 2039) when filing a partial protest payment and use by itself when filing a fully protested payment.

Taxable Sales

Gross Receipts

Tax Type

Tax

Rate (%)

Enter total amount of tax from Schedule A (Page 3)

Enter Total Amount Of Tax

Final Return: If this is your final return, enter the close date below and select

the reason for closing your account. The Sales Tax law requires any person

selling or discontinuing business to make a final sales tax return within 15 days

of the sale or closing.

Date Business Closed (MM/DD/YYYY)

r Leased Business r Out of Business r Sold Business

City:

Location Code:

City: __ __ __ __ __

County: __ __ __

Site: __ __ __ __

__ __ /__ __ /__ __ __ __

Protested Payment(s)

If you pay by check, you authorize the Department of Revenue to process

the check electronically. Any check returned unpaid may be presented

again electronically.

Department Use Only

Subtract: 2% of Line 1

only if paid by due date

Total amount of tax due:

(Line 1 minus Line 2)

Add: Interest for late payment

(See Instructions)

Add: Additions to Tax (5% per month

late of Line 3, maximum 25%)

Remit single check for this

amount: (Add Lines 3, 4, 5)

1.

2.

–

3.

=

4.

+

5.

+

6.

=

Form

163

Missouri Department of Revenue

Sales Tax Protest Payment Affidavit

Case Number

Department Use Only

(MM/DD/YY)

Missouri Tax I.D.

Number

Federal Employer

I.D. Number

Reporting Period

(MM/YY)

(if applicable)

Reset Form

Print Form

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

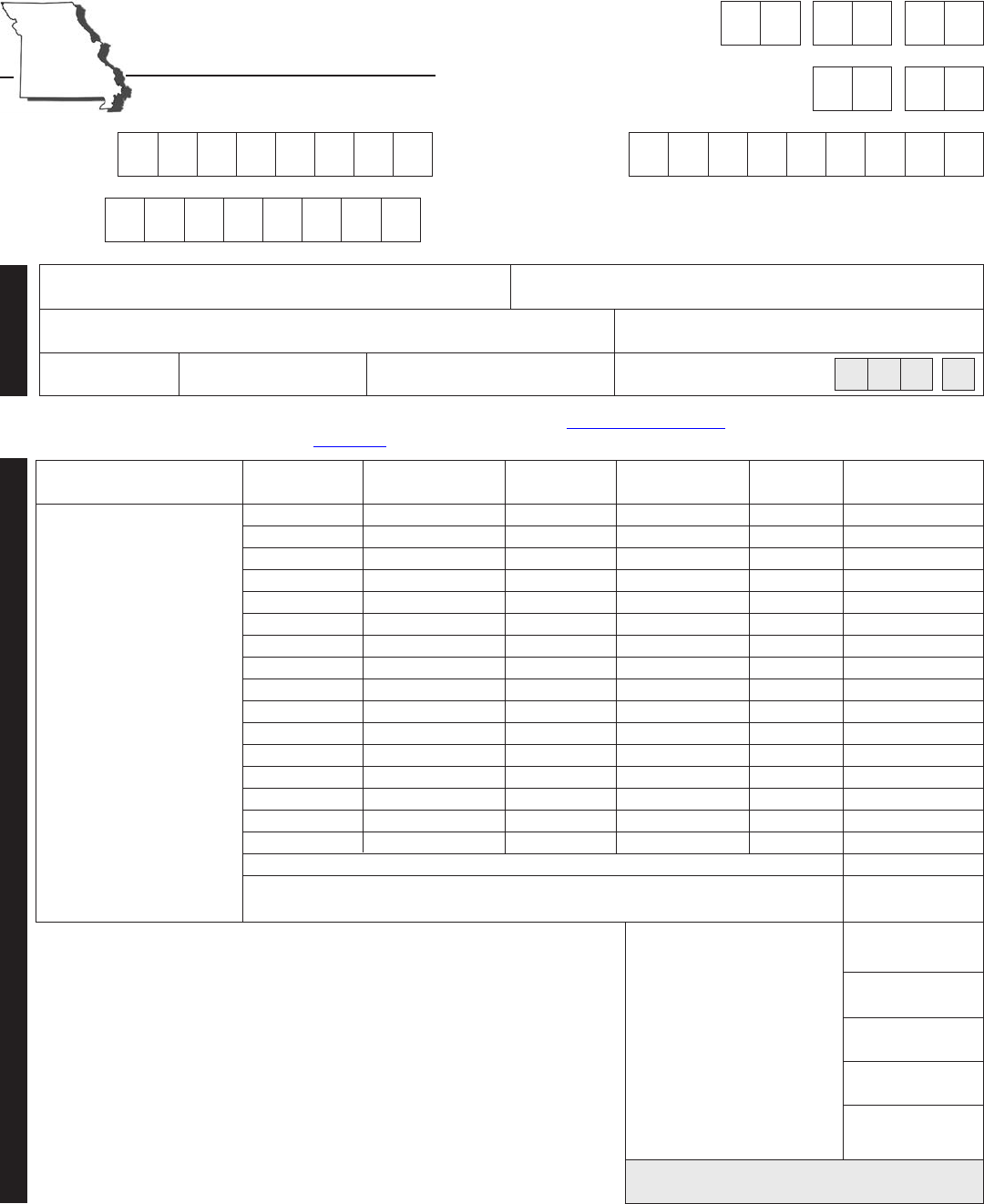

Page 2

Reasons for Protest

Note: Sales Tax Regulation 12 CSR 10-3.552 or Section 144.700, RSMo, must be complied with or the protest payment will be deposited to General

Revenue.

Subscribed and sworn before me, this

day of year

State County (or City of St. Louis) My Commission Expires

Notary Public Signature

Notary Public Name (Typed or Printed)

Notary

Embosser or black ink rubber stamp seal

Department Use Only

Disposition Reason Date

__ __ /__ __ /__ __ __ __

Form 163 (Revised 12-2014)

Mail to: Taxation Division Phone: (573) 526-9938

P.O. Box 3350 TTY: (800) 735-2966

Jefferson City, MO 65105-3350 Fax: (573) 751-9409

E-mail: [email protected]

Visit http://dor.mo.gov/business/sales/

for additional information.

Taxpayer or Authorized Agent’s Signature Title Date (MM/DD/YYYY)

Printed Name Tax Period (MM/DD/YYYY) though (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __ through __ __ /__ __ /__ __ __ __

Signature

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I have direct control,

supervision, or responsibility for filing this return and payment of the tax due. I attest that I have no gross receipts to report for locations left blank.

__ __ /__ __ /__ __ __ __

*14008020001*

14008020001

Reset This Page Only

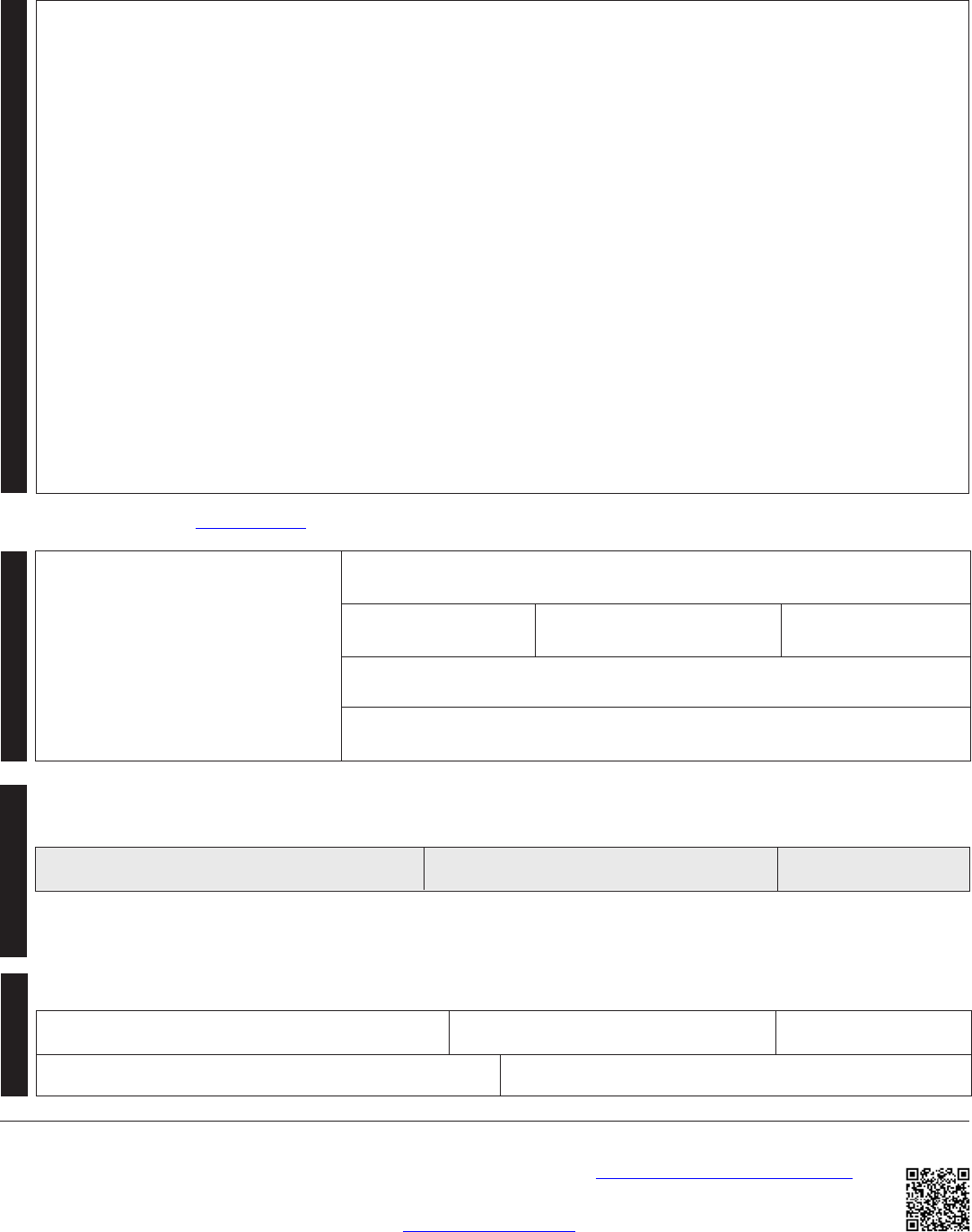

State 3%

Conservation 1/8%

Education 1%

Parks and Soil 1/10%

Amount of Tax

Taxable Sales

Adjustments

Indicate + or – )

Gross Receipts

Tax Type

Business Location

Tax

Rate (%)

Enter total amount of tax

Enter total amount on page 1

City:

Location Code:

City: __ __ __ __ __

County: __ __ __

Site: __ __ __ __

Page 3

This schedule is to be used only if the space provided on page 1 of the Protest Affidavit is insufficient to report all protest payments.

To complete Schedule A, refer to instructions on page 3.

State 3%

Conservation 1/8%

Education 1%

Parks and Soil 1/10%

Amount of Tax

Taxable Sales

Adjustments

Indicate + or – )

Gross Receipts

Tax Type

Business Location

Tax

Rate (%)

City:

Location Code:

City: __ __ __ __ __

County: __ __ __

Site: __ __ __ __

Schedule(s) A

State 3%

Conservation 1/8%

Education 1%

Parks and Soil 1/10%

Amount of Tax

Taxable Sales

Adjustments

Indicate + or – )

Gross Receipts

Tax Type

Business Location

Tax

Rate (%)

City:

Location Code:

City: __ __ __ __ __

County: __ __ __

Site: __ __ __ __

Form 163 (Revised 12-2014)

*14008030001*

14008030001

Reset This Page Only

Reset This Section Only

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Reset This Section Only

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Reset This Section Only

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

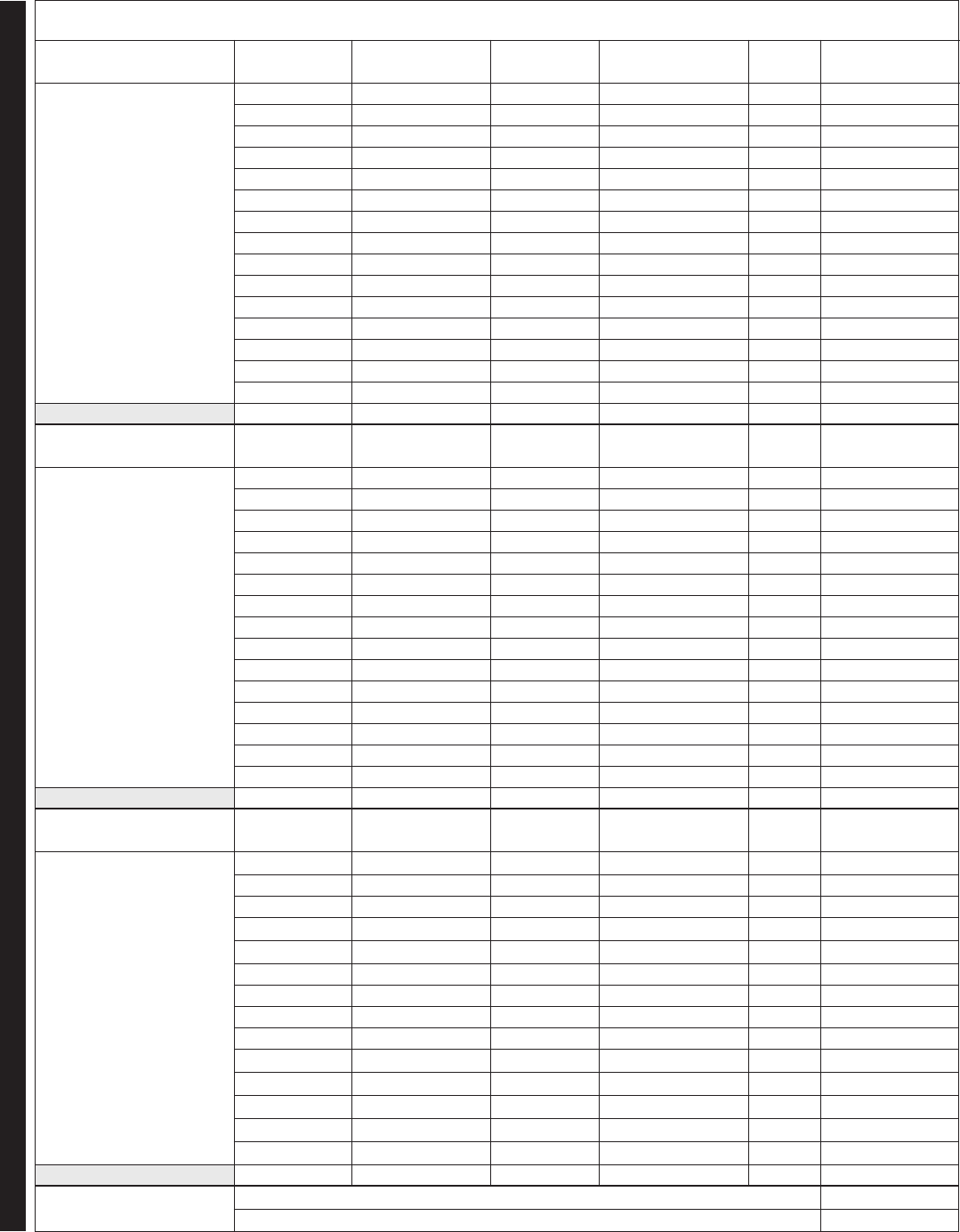

Business Identification: Enter Missouri Tax Identification Number, reporting period, owner’s name, business name, and mailing address.

Business Location: Enter the address and code of each business location for which you are reporting a protest payment.

Tax Type: Listed in this column are the sales taxes administered by the Department. It is your responsibility to know which taxes you are liable

for at each business location. Enter each city and county tax type which is being protested.

Gross Receipts: Enter protested amount of gross receipts by each specific tax type for each business location.

Adjustments: Enter authorized adjustments. Be sure to indicate “plus” or “minus” for each adjustment.

Taxable Sales: Compute taxable sales for each entry.

Gross Receipts (+) or (–) Adjustments = Taxable Sales

Tax Rate: The state, conservation, education, and parks and soil sales tax rates are preprinted in this column. If you are protesting a city or

county tax payment, enter the local sales tax rate for each city or county tax type.

Amount of tax: Multiply taxable sales by the tax rate of each specific tax.

Total from Schedule A: Enter total amount of tax from Schedule A.

Line 1 — Total amount of tax: Compute total amount of taxes shown in the amount of tax column.

Line 2 — Timely payment allowance: If you file and pay on or before the due date, enter 2% of the amount shown on Line 1.

Line 3 — Follow instructions shown on front of form.

Line 4 — Interest For Late Payment: If tax is not paid by the due date, multiply Line 3 by the annual percentage rate and then multiply this

amount by the number of days late divided by 365 (or 366 in a leap year). The annual percentage rate is subject to change each year. You can

access the annual percentage rate on our website at http://dor.mo.gov/intrates.php.

Lines 5 and 6 — Follow instructions shown on front of form.

Instructions

*14000000001*

14000000001

Form 163 (Revised 12-2014)