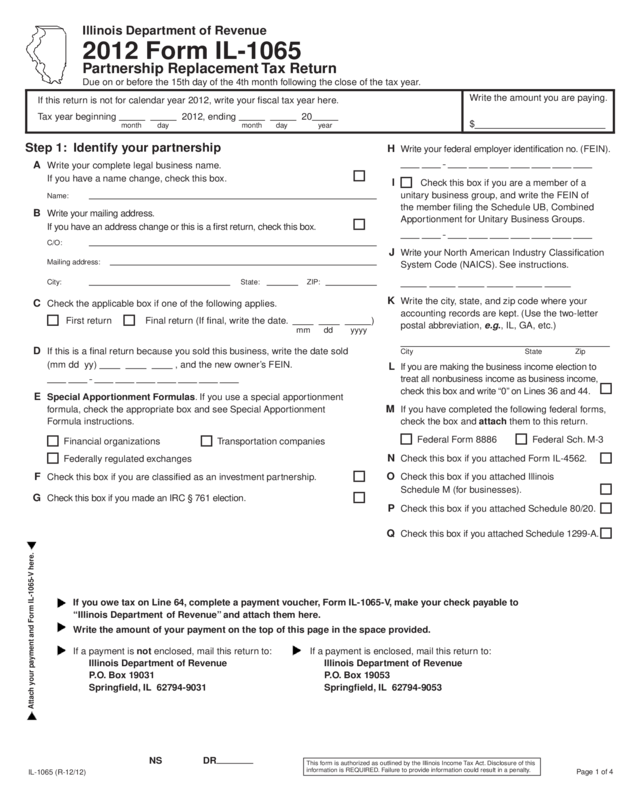

Fillable Printable Form 2012 Il-1065, Partnership Replacement Tax Return

Fillable Printable Form 2012 Il-1065, Partnership Replacement Tax Return

Form 2012 Il-1065, Partnership Replacement Tax Return

Page 1 of 4

IL-1065 (R-12/12)

Illinois Department of Revenue

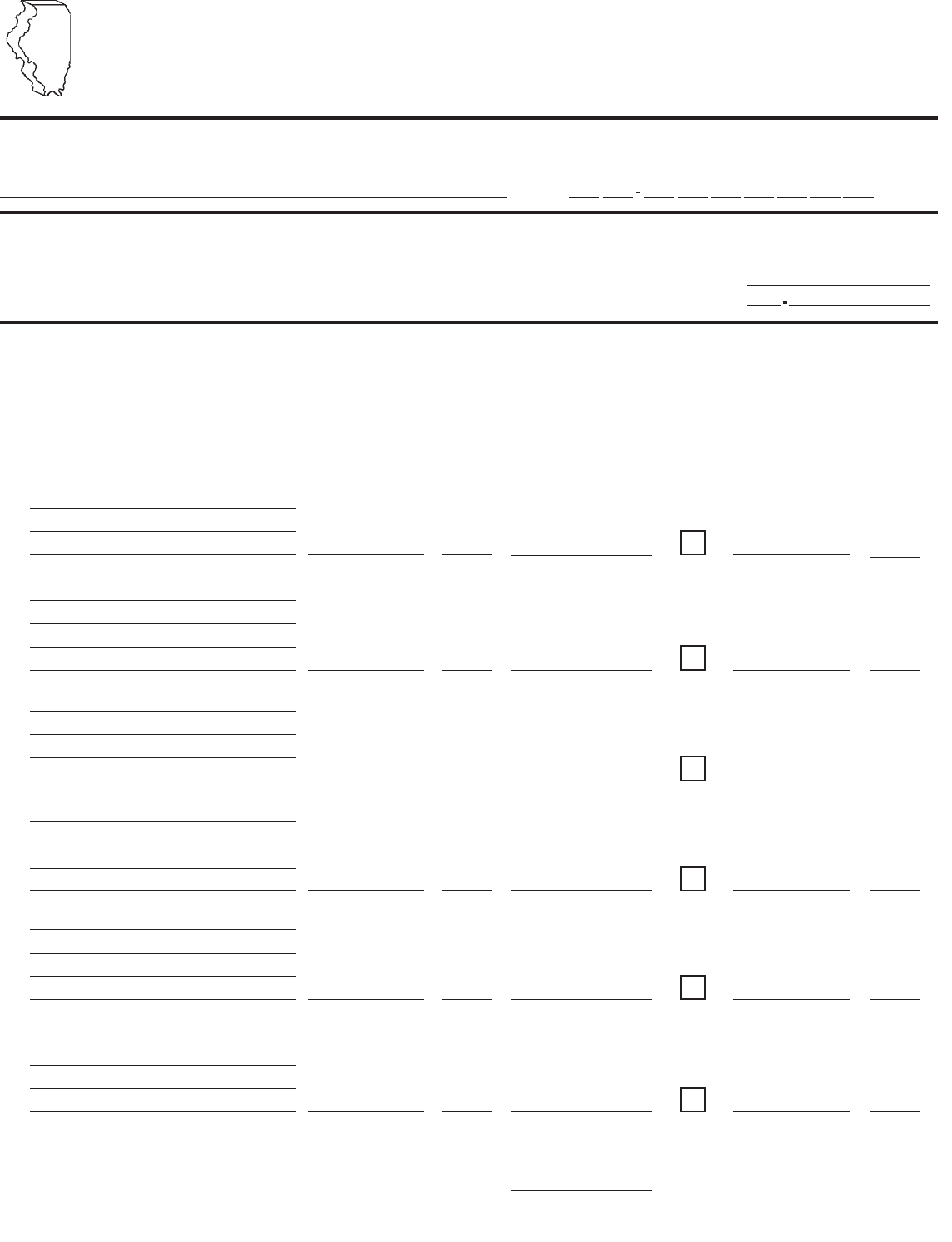

2012 Form IL-1065

Partnership Replacement Tax Return

Due on or before the 15th day of the 4th month following the close of the tax year.

If this return is not for calendar year 2012, write your fiscal tax year here.

Tax year beginning 2012, ending 20

month day month day year

Step 1: Identify your partnership

A Write your complete legal business name.

If you have a name change, check this box.

Name:

B Write your mailing address.

If you have an address change or this is a first return, check this box.

C/O:

Mailing address:

City: State: ZIP:

C Check the applicable box if one of the following applies.

First return Final return (If final, write the date. )

mm dd yyyy

D If this is a final return because you sold this business, write the date sold

(mm dd yy) , and the new owner’s FEIN.

E Special Apportionment Formulas. If you use a special apportionment

formula, check the appropriate box and see Special Apportionment

Formula instructions.

Financial organizations Transportation companies

Federally regulated exchanges

F Check this box if you are classified as an investment partnership.

G Check this box if you made an IRC § 761 election.

If you owe tax on Line 64, complete a payment voucher, Form IL-1065-V, make your check payable to

“Illinois Department of Revenue” and attach them here.

Write the amount of your payment on the top of this page in the space provided.

If a payment is not enclosed,

mail this return to:

If a payment is enclosed,

mail this return to:

Illinois Department of Revenue Illinois Department of Revenue

P.O. Box 19031 P.O. Box 19053

Springfield, IL 62794-9031

Springfield, IL 62794-9053

NS DR

H Write your federal employer identification no. (FEIN).

I Check this box if you are a member of a

unitary business group, and write the FEIN of

the member filing the Schedule UB, Combined

Apportionment for Unitary Business Groups.

J Write your North American Industry Classification

System Code (NAICS). See instructions.

K Write the city, state, and zip code where your

accounting records are kept. (Use the two-letter

postal abbreviation, e.g., IL, GA, etc.)

City State Zip

L If you are making the business income election to

treat all nonbusiness income as business income,

check this box and write “0” on Lines 36 and 44.

M If you have completed the following federal forms,

check the box and attach them to this return.

Federal Form 8886 Federal Sch. M-3

N Check this box if you attached Form IL-4562.

O Check this box if you attached Illinois

Schedule M (for businesses).

P Check this box if you attached Schedule 80/20.

Q Check this box if you attached Schedule 1299-A.

Write the amount you are paying.

$

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

Attach your payment and Form IL-1065-V here.

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

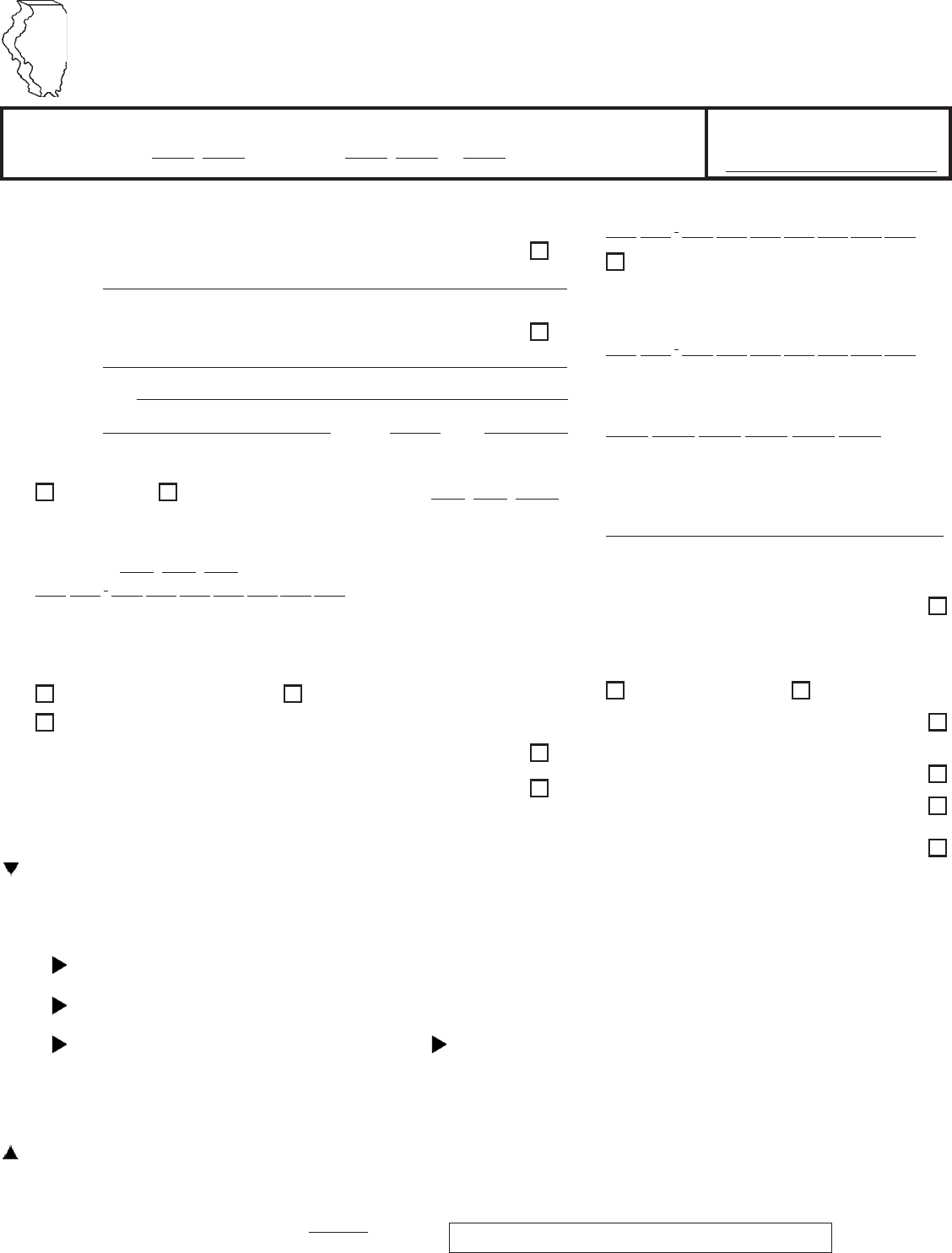

Page 2 of 4

IL-1065 (R-12/12)

Step 2: Figure your ordinary income or loss

1 1Ordinary income or loss, or equivalent from federal Schedule K.

00

2 2Net income or loss from all rental real estate activities.

00

3 Net income or loss from other rental activities. 3

00

4 4Portfolio income or loss.

00

5 5Net IRC Section 1231 gain or loss.

00

6 All other items of income or loss that were not included in the computation of income or loss on

Page 1 of U.S. Form 1065 or 1065-B. See instructions. Identify: 6

00

7 7Add Lines 1 through 6. This is your ordinary income or loss.

00

Step 3: Figure your unmodified base income or loss

8 8Charitable contributions.

00

9 9Expense deduction under IRC Section 179.

00

10 10Interest on investment indebtedness.

00

11 All other items of expense that were not deducted in the computation of ordinary income or loss on

11Page 1 of U.S. Form 1065 or 1065-B. See instructions. Identify:

00

12 12Add Lines 8 through 11.

00

13 13Subtract Line 12 from Line 7. This amount is your total unmodified base income or loss.

00

Step 4: Figure your income or loss

14 14Write your unmodified base income or loss from Line 13.

00

15 15State, municipal, and other interest income excluded from Line 14.

00

16 16Illinois replacement tax deducted in arriving at Line 14.

00

17 Illinois Special Depreciation addition. Attach Form IL-4562. 17

00

18 Related-party expenses addition. Attach Schedule 80/20. 18

00

19 Distributive share of additions. Attach Schedule(s) K-1-P or K-1-T. 19

00

20 Guaranteed payments to partners from U.S. Form 1065 or 1065-B. 20

00

21 The amount of loss distributable to a partner subject to replacement tax.

Attach Schedule B. 21

00

22 22Other additions. Attach Illinois Schedule M (for businesses).

00

23 23Add Lines 14 through 22. This amount is your income or loss.

00

Step 5: Figure your base income or loss

24 24Interest income from U.S. Treasury obligations or other exempt federal obligations.

00

25 25August 1,1969, valuation limitation amount. Attach Schedule F.

00

26

26Personal service income or reasonable allowance for compensation of partners.

00

27 27Share of income distributable to a partner subject to replacement tax. Attach Schedule B.

00

28 Enterprise Zone or River Edge Redevelopment Zone

Dividend subtraction. Attach Schedule 1299-A. 28

00

29 High Impact Business Dividend subtraction. Attach Schedule 1299-A. 29

00

30 Illinois Special Depreciation subtraction. Attach Form IL-4562. 30

00

31 Related-party expenses subtraction. Attach Schedule 80/20. 31

00

32 Distributive share of subtractions. Attach Schedule(s) K-1-P or K-1-T. 32

00

33 33Other subtractions. Attach Schedule M (for businesses).

00

34 34Total subtractions. Add Lines 24 through 33.

00

35 35Base income or loss. Subtract Line 34 from Line 23.

00

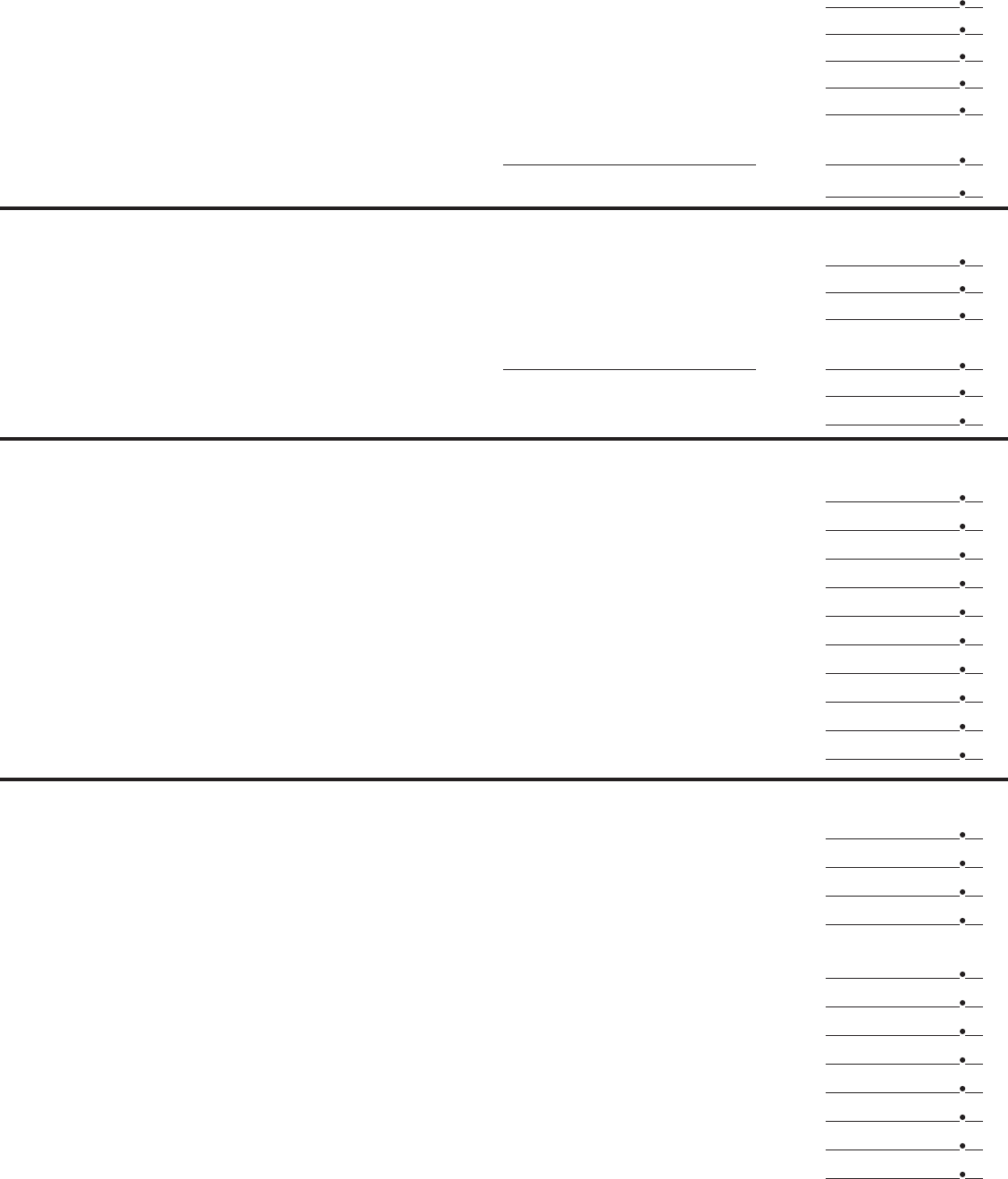

Page 3 of 4

IL-1065 (R-12/12)

Step 6: Figure your income allocable to Illinois (Complete only if you checked the box on Line B, above.)

36 Nonbusiness income or loss. Attach Schedule NB. 36

00

37 Trust, estate, and non-unitary partnership business income or loss included in Line 35. 37

00

38 Add Lines 36 and 37. 38

00

39 Business income or loss. Subtract Line 38 from Line 35. 39

00

40 Total sales everywhere. This amount cannot be negative. 40

00

41 Total sales inside Illinois. This amount cannot be negative. 41

00

42 Apportionment factor. Divide Line 41 by Line 40 (carry to six decimal places). 42

43 Business income or loss apportionable to Illinois. Multiply Line 39 by Line 42. 43

00

44 Nonbusiness income or loss allocable to Illinois. Attach Schedule NB. 44

00

45 Trust, estate, and non-unitary partnership business income or loss apportionable to Illinois. 45

00

46 Base income or loss allocable to Illinois. Add Lines 43 through 45. 46

00

Step 7: Figure your net income

47 Base income or net loss from Step 5, Line 35, or Step 6, Line 46. 47

00

48 Illinois net loss deduction. Attach Schedule NLD.

If Line 47 is zero or a negative amount, write “0”. 48

00

49 Income after NLD. Subtract Line 48 from Line 47. 49

00

50 Write the amount from Step 5, Line 35. 50

00

51 Divide Line 47 by Line 50. (This figure cannot be greater than “1”.) 51

52 Exemption allowance. Multiply Line 51 by $1,000. (Short-year filers, see instructions.) 52

00

53 Net income. Subtract Line 52 from Line 49. 53

00

Step 8: Figure your net replacement tax

54 Replacement tax. Multiply Line 53 by 1.5% (.015). 54

00

55 Recapture of investment credits. Attach Schedule 4255. 55

00

56 Replacement tax before investment credits. Add Lines 54 and 55. 56

00

57 Investment credits. Attach Form IL-477. 57

00

58 Net replacement tax. Subtract Line 57 from Line 56. Write “0” if this is a negative amount. 58

00

Step 9: Figure your refund or balance due

59 Payments.

a Credit from 2011 overpayment. 59a

00

b Form IL-505-B (extension) payment. 59b

00

c Pass-through entity payments. Attach Schedule(s) K-1-P or K-1-T. 59c

00

d Gambling withholding. Attach Form(s) W-2G. 59d

00

60 Total payments. Add Lines 59a through 59d. 60

00

61 Overpayment. If Line 60 is greater than Line 58, subtract Line 58 from Line 60. 61

00

62 Amount to be credited to 2013. 62

00

63 Refund. Subtract Line 62 from Line 61. This is the amount to be refunded. 63

00

64 Tax Due. If Line 58 is greater than Line 60, subtract Line 60 from Line 58. This is the amount you owe. 64

00

Step 10: Sign here

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

Check this box if we may

discuss this return with the

preparer shown in this step.

Signature of partner

Signature of preparer

Preparer’s firm name (or yours, if self-employed) Address Phone

Date

Date

Title

Preparer’s Social Security number or firm’s FEIN

Phone

( )

( )

A If the amount on Line 35 is derived inside Illinois only, check this box and write the amount from Step 5, Line 35

on Step 7, Line 47. You may not complete Step 6. (You must leave Step 6, Lines 36 through 46 blank.)

B If any portion of the amount on Line 35 is derived outside Illinois, check this box and complete all lines of Step 6.

See instructions.

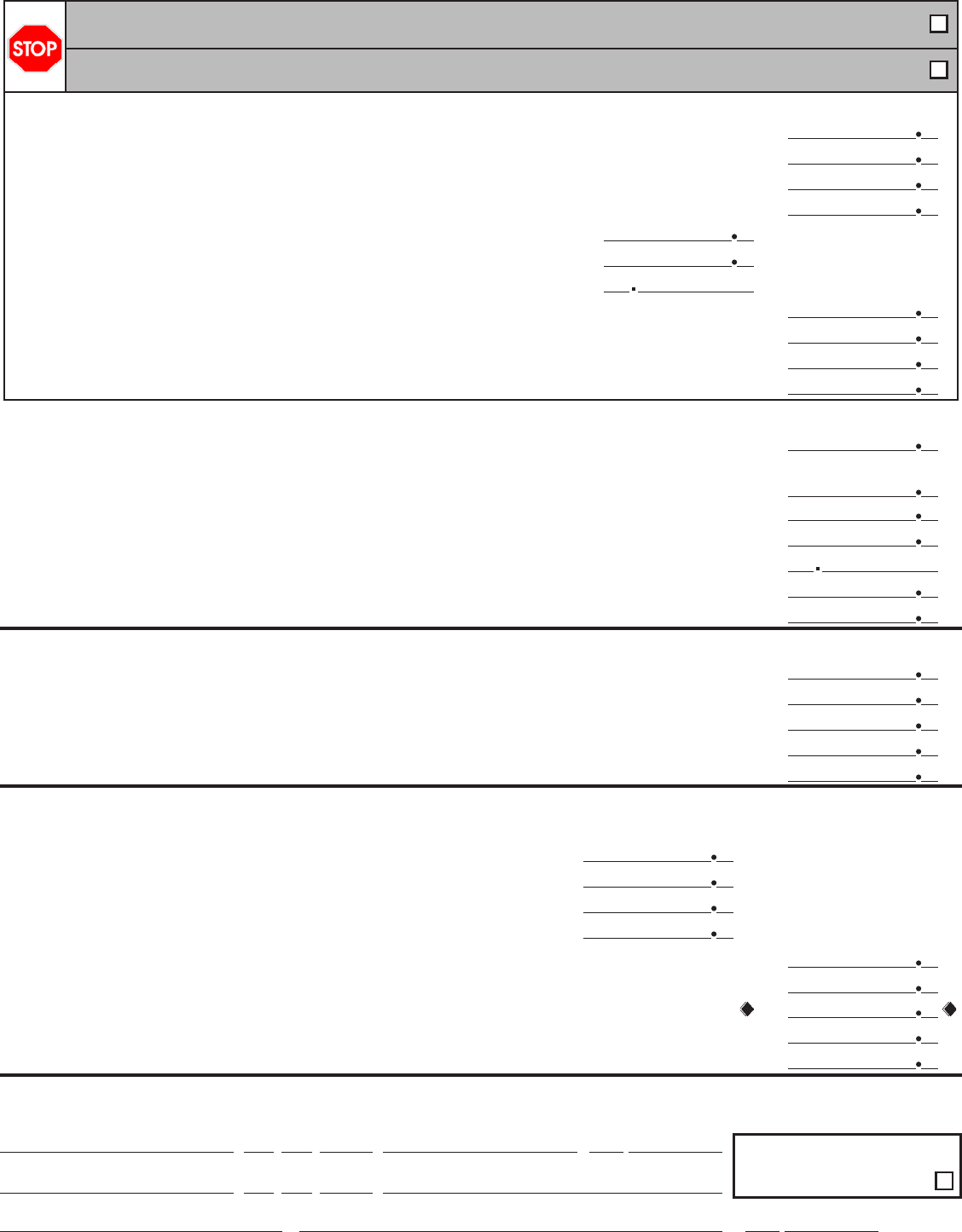

Page 4 of 4

IL-1065 (R-12/12)

Illinois Department of Revenue Year ending

Schedule B

Partners’ or Shareholders’ Identification

Month Year

Attach to your Form IL-1065 or Form IL-1120-ST

Write your name as shown on your Form IL-1065 or Form IL-1120-ST. Write your federal employer identification number (FEIN).

Step 1: Provide the following information

1 Write the amount of base income or net loss from your Form IL-1065 or Form IL-1120-ST, Line 47. 1

2 Write the apportionment factor from your Form IL-1065 or Form IL-1120-ST, Line 42. 2

Step 2: Identify your partners or shareholders. Attach additional sheets if necessary.

A B C D E F G

Total amount of Member Pass-through Excluded from

Partner or base income (loss) subject to Illinois entity payment pass-through

Shareholder type distributable replacement tax amount entity payments

Name and Address SSN or FEIN (See instructions.) (See instr.) (See instr.) (See instr.) (See instr.)

1

2

3

4

5

6

7 Add the amounts shown in Column D for partners or

shareholders for which you have entered a check mark

in Column E. Write the total here. (See instructions.) 7

Schedule B (R-12/12)

IL Attachment no. 1

Reset

Print