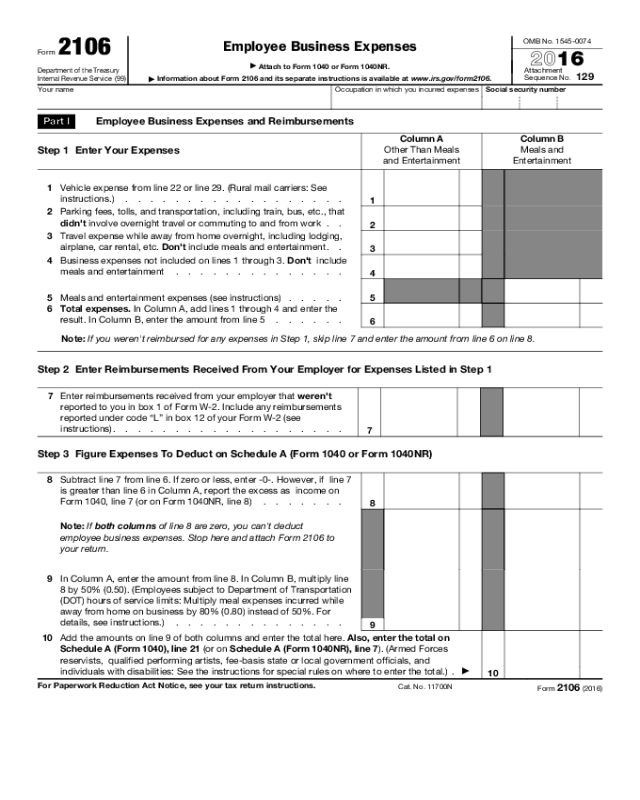

Form 2106 (2016)

Page 2

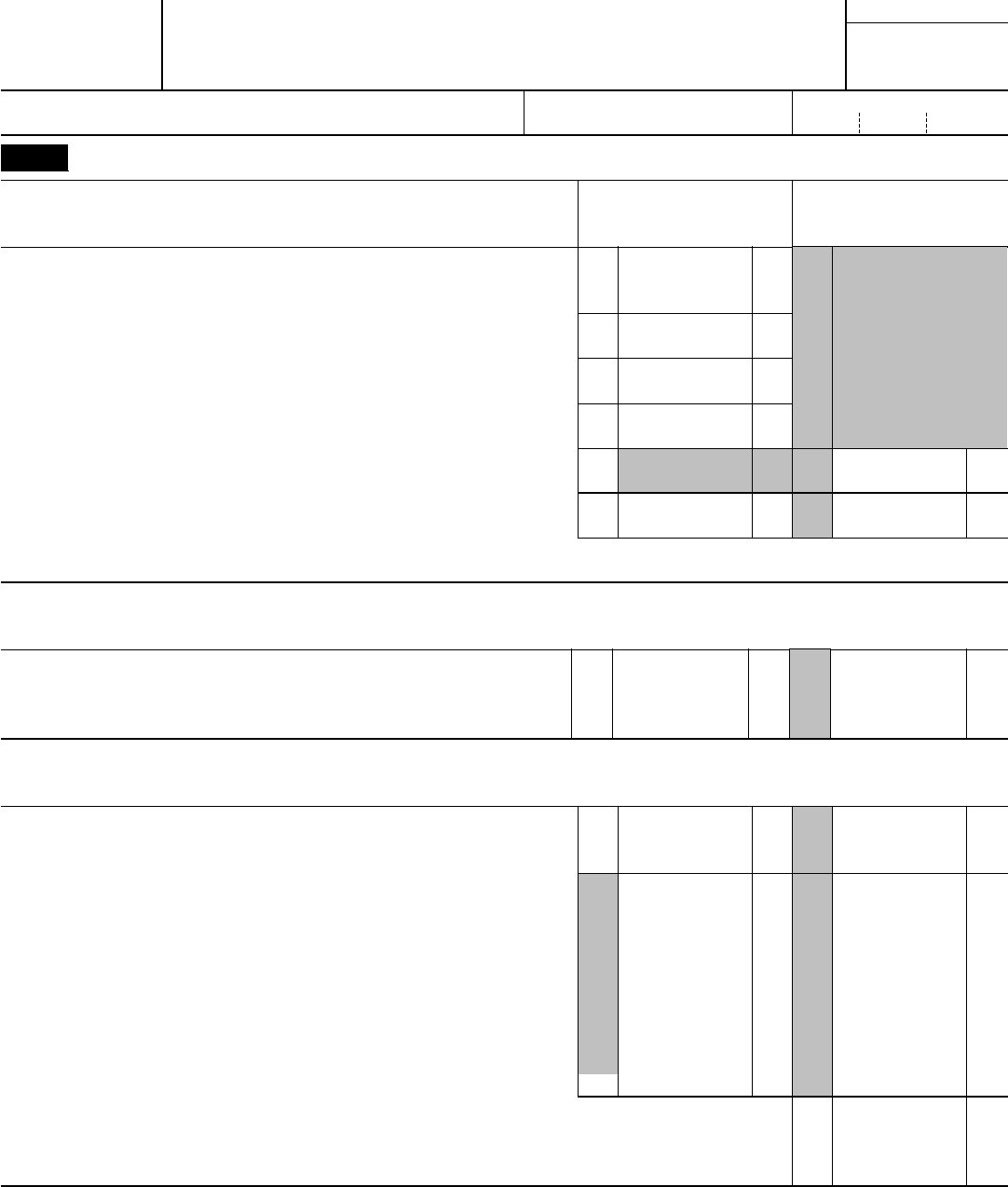

Part II Vehicle Expenses

Section A—General Information (You must complete this section if you

are claiming vehicle expenses.)

(a) Vehicle 1 (b) Vehicle 2

11 Enter the date the vehicle was placed in service . . . . . . . . .

11

/ / / /

12 Total miles the vehicle was driven during 2016 . . . . . . . . . 12 miles miles

13 Business miles included on line 12 . . . . . . . . . . . . .

13 miles miles

14 Percent of business use. Divide line 13 by line 12 . . . . . . . . .

14 % %

15 Average daily roundtrip commuting distance . . . . . . . . . .

15 miles miles

16 Commuting miles included on line 12 . . . . . . . . . . . .

16 miles miles

17 Other miles. Add lines 13 and 16 and subtract the total from line 12 . .

17 miles miles

18 Was your vehicle available for personal use during off-duty hours? . . . . . . . . . . . . .

Yes No

19 Do you (or your spouse) have another vehicle available for personal use? . . . . . . . . . . .

Yes No

20 Do you have evidence to support your deduction? . . . . . . . . . . . . . . . . . .

Yes No

21 If “Yes,” is the evidence written? . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

Section B—Standard Mileage Rate (See the instructions for Part II to find out whether to complete this section or Section C.)

22 Multiply line 13 by 54¢ (0.54). Enter the result here and on line 1 . . . . . . . . . . . 22

Section C—Actual Expenses

(a) Vehicle 1 (b) Vehicle 2

23

Gasoline, oil, repairs, vehicle

insurance, etc. . . . . . .

23

24a Vehicle rentals . . . . . . 24a

b

Inclusion amount (see instructions) .

24b

c

Subtract line 24b from line 24a .

24c

25 Value of employer-provided

vehicle (applies only if 100% of

annual lease value was included

on Form W-2—see instructions)

25

26 Add lines 23, 24c, and 25. . . 26

27

Multiply line 26 by the percentage

on line 14 . . . . . . . .

27

28 Depreciation (see instructions) . 28

29

Add lines 27 and 28. Enter total

here and on line 1 . . . . .

29

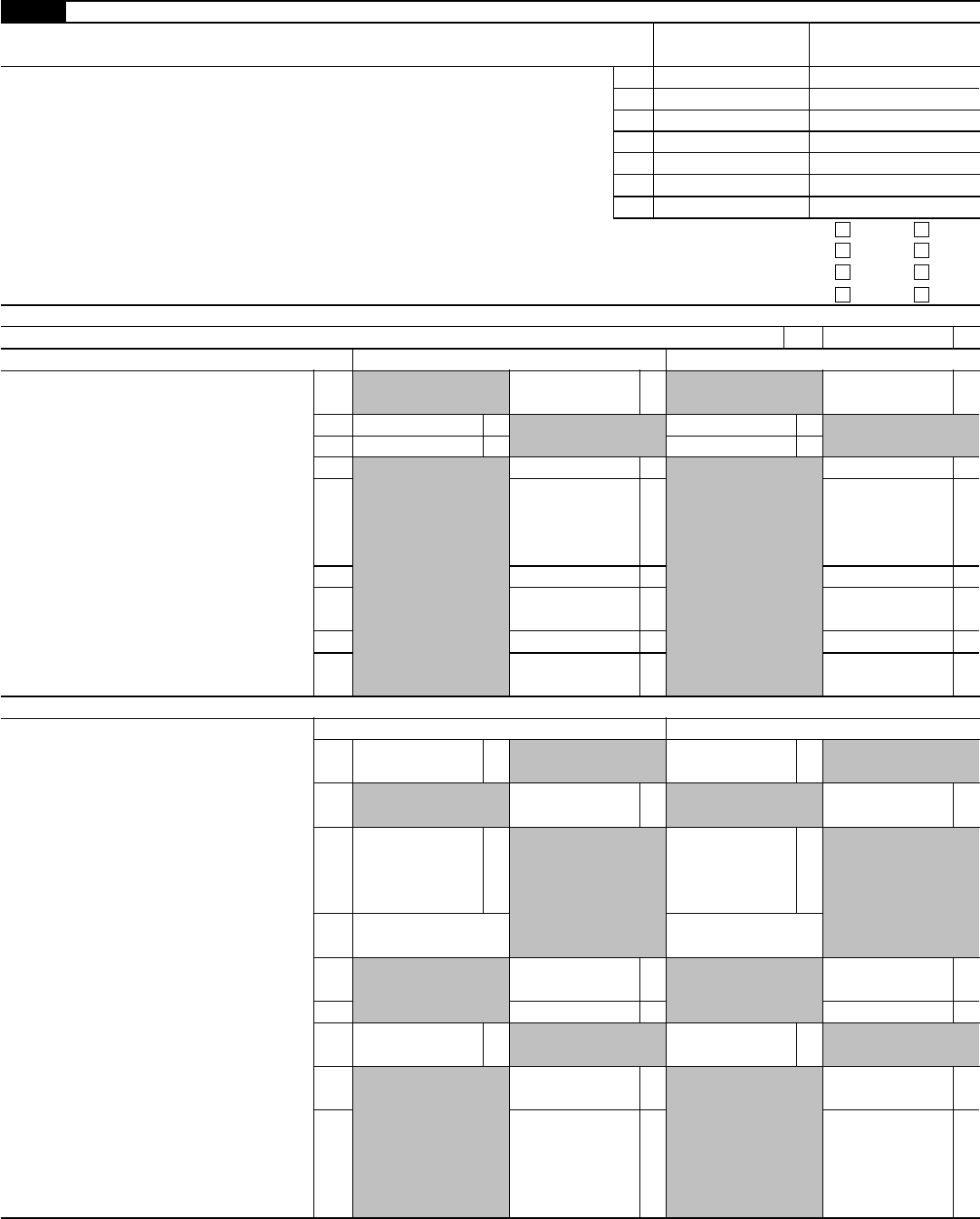

Section D—Depreciation of Vehicles (Use this section only if you owned the vehicle and are completing Section C for the vehicle.)

(a) Vehicle 1 (b) Vehicle 2

30

Enter cost or other basis (see

instructions) . . . . . . .

30

31

Enter section 179 deduction and

special allowance (see instructions)

31

32

Multiply line 30 by line 14 (see

instructions if you claimed the

section 179 deduction or special

allowance). . . . . . . . 32

33

Enter depreciation method and

percentage (see instructions) .

33

34

Multiply line 32 by the percentage

on line 33 (see instructions) . .

34

35 Add lines 31 and 34 . . . . 35

36

Enter the applicable limit explained

in the line 36 instructions . . .

36

37

Multiply line 36 by the percentage

on line 14 . . . . . . . .

37

38

Enter the smaller of line 35 or line

37. If you skipped lines 36 and 37,

enter the amount from line 35.

Also enter this amount on line 28

above . . . . . . . . .

38

Form 2106 (2016)