Fillable Printable Form 22649

Fillable Printable Form 22649

Form 22649

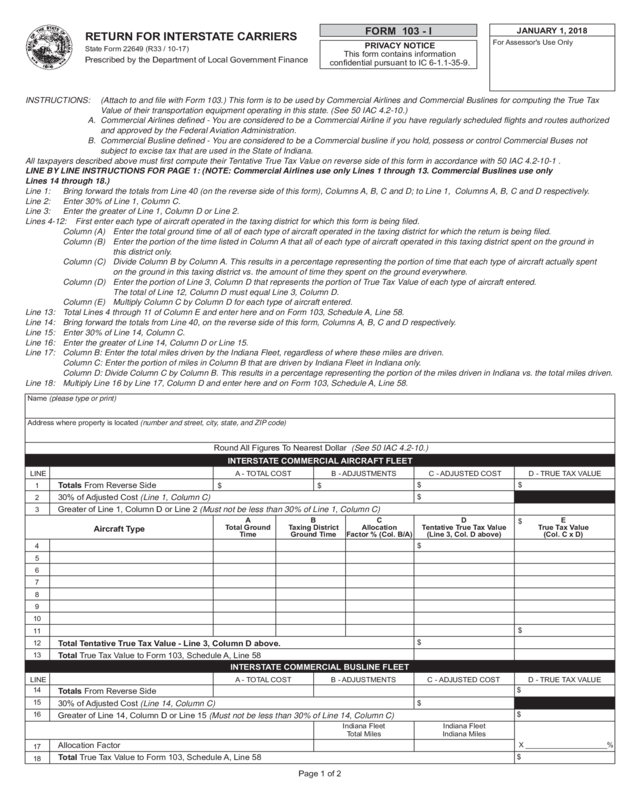

RETURN FOR INTERSTATE CARRIERS

State Form 22649 (R33 / 10-17)

Prescribed by the Department of Local Government Finance

JANUARY 1, 2018

For Assessor's Use Only

INSTRUCTIONS: (Attach to and file with Form 103.) This form is to be used by Commercial Airlines and Commercial Buslines for computing the True Tax

Value of their transportation equipment operating in this state. (See 50 IAC 4.2-10.)

A. Commercial Airlines defined - You are considered to be a Commercial Airline if you have regularly scheduled flights and routes authorized

and approved by the Federal Aviation Administration.

B. Commercial Busline defined - You are considered to be a Commercial busline if you hold, possess or control Commercial Buses not

subject to excise tax that are used in the State of Indiana.

All taxpayers described above must first compute their Tentative True Tax Value on reverse side of this form in accordance with 50 IAC 4.2-10-1 .

LINE BY LINE INSTRUCTIONS FOR PAGE 1: (NOTE: Commercial Airlines use only Lines 1 through 13. Commercial Buslines use only

Lines 14 through 18.)

Line 1: Bring forward the totals from Line 40 (on the reverse side of this form), Columns A, B, C and D; to Line 1, Columns A, B, C and D respectively.

Line 2: Enter 30% of Line 1, Column C.

Line 3: Enter the greater of Line 1, Column D or Line 2.

Lines 4-12: First enter each type of aircraft operated in the taxing district for which this form is being filed.

Column (A) Enter the total ground time of all of each type of aircraft operated in the taxing district for which the return is being filed.

Column (B) Enter the portion of the time listed in Column A that all of each type of aircraft operated in this taxing district spent on the ground in

this district only.

Column (C) Divide Column B by Column A. This results in a percentage representing the portion of time that each type of aircraft actually spent

on the ground in this taxing district vs. the amount of time they spent on the ground everywhere.

Column (D) Enter the portion of Line 3, Column D that represents the portion of True Tax Value of each type of aircraft entered.

The total of Line 12, Column D must equal Line 3, Column D.

Column (E) Multiply Column C by Column D for each type of aircraft entered.

Line 13: Total Lines 4 through 11 of Column E and enter here and on Form 103, Schedule A, Line 58.

Line 14: Bring forward the totals from Line 40, on the reverse side of this form, Columns A, B, C and D respectively.

Line 15: Enter 30% of Line 14, Column C.

Line 16: Enter the greater of Line 14, Column D or Line 15.

Line 17: Column B: Enter the total miles driven by the Indiana Fleet, regardless of where these miles are driven.

Column C: Enter the portion of miles in Column B that are driven by Indiana Fleet in Indiana only.

Column D: Divide Column C by Column B. This results in a percentage representing the portion of the miles driven in Indiana vs. the total miles driven.

Line 18: Multiply Line 16 by Line 17, Column D and enter here and on Form 103, Schedule A, Line 58.

Name (please type or print)

Address where property is located (number and street, city, state, and ZIP code)

Round All Figures To Nearest Dollar (See 50 IAC 4.2-10.)

INTERSTATE COMMERCIAL AIRCRAFT FLEET

LINE

Totals From Reverse Side

30% of Adjusted Cost (Line 1, Column C)

Greater of Line 1, Column D or Line 2 (Must not be less than 30% of Line 1, Column C)

A - TOTAL COST B - ADJUSTMENTS C - ADJUSTED COST D - TRUE TAX VALUE

A

Total Ground

Time

B

Taxing District

Ground Time

C

Allocation

Factor % (Col. B/A)

D

Tentative True Tax Value

(Line 3, Col. D above)

E

True Tax Value

(Col. C x D)

Aircraft Type

1

2

3

4

5

6

7

8

9

10

11

12

13

Total Tentative True Tax Value - Line 3, Column D above.

Total True Tax Value to Form 103, Schedule A, Line 58

$

$

$

$

$

$

$

$

$

$

INTERSTATE COMMERCIAL BUSLINE FLEET

LINE

Totals From Reverse Side

30% of Adjusted Cost (Line 14, Column C)

Greater of Line 14, Column D or Line 15 (Must not be less than 30% of Line 14, Column C)

A - TOTAL COST B - ADJUSTMENTS C - ADJUSTED COST D - TRUE TAX VALUE

$

$

$

14

15

16

17

18

Allocation Factor

Total True Tax Value to Form 103, Schedule A, Line 58

Indiana Fleet

Total Miles

Indiana Fleet

Indiana Miles

X ____________________%

Page 1 of 2

$

FORM 103 - I

PRIVACY NOTICE

This form contains information

confidential pursuant to IC 6-1.1-35-9.

Reset Form

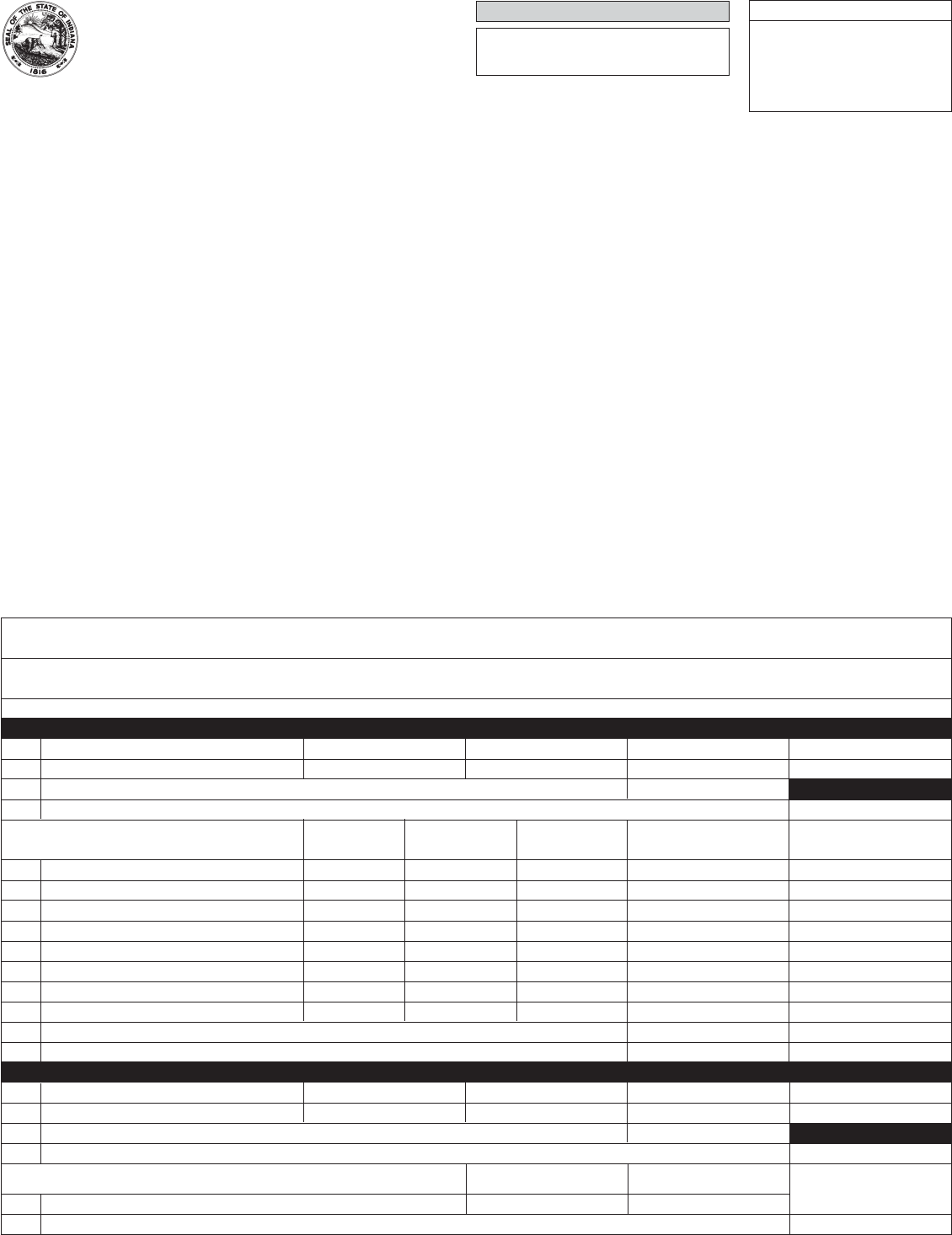

YEAR OF ACQUISITION COLUMN A COLUMN B COLUMN C COLUMN D

LINE

POOL NUMBER: 1

(1 TO 4 YEAR)

TOTAL COST OR

BASE YEAR VALUE

ADJUSTMENTS

** (See Note Below)

ADJUSTED COST T.T.V.% TRUE TAX VALUE

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

POOL NUMBER 2: (5 TO 8 YEAR LIFE)

POOL NUMBER 3: (9 TO 12 YEAR LIFE)

POOL NUMBER 4: (13 YEAR AND LONGER LIFE)

1-2-17 To 1-1-18

1-2-16 To 1-1-17

3-2-15 To 1-1-16

Prior To 3-2-15

TOTAL POOL NUMBER 1

1-2-17 To 1-1-18

1-2-16 To 1-1-17

3-2-15 To 1-1-16

3-2-14 To 3-1-15

3-2-13 To 3-1-14

3-2-12 To 3-1-13

Prior To 3-2-12

TOTAL POOL NUMBER 2

1-2-17 To 1-1-18

1-2-16 To 1-1-17

3-2-15 To 1-1-16

3-2-14 To 3-1-15

3-2-13 To 3-1-14

3-2-12 To 3-1-13

3-2-11 To 3-1-12

3-2-10 To 3-1-11

3-2-09 To 3-1-10

3-2-08 To 3-1-09

Prior To 3-2-08

TOTAL POOL NUMBER 3

1-2-17 To 1-1-18

1-2-16 To 1-1-17

3-2-15 To 1-1-16

3-2-14 To 3-1-15

3-2-13 To 3-1-14

3-2-12 To 3-1-13

3-2-11 To 3-1-12

3-2-10 To 3-1-11

3-2-09 To 3-1-10

3-2-08 To 3-1-09

3-2-07 To 3-1-08

3-2-06 To 3-1-07

Prior To 3-2-06

TOTAL POOL NUMBER 4

65

50

35

20

40

56

42

32

24

18

15

40

60

55

45

37

30

25

20

16

12

10

40

60

63

54

46

40

34

29

25

21

15

10

5

INTERSTATE FLEET DEPRECIABLE POOLS

CONFIDENTIAL

JANUARY 1, 2018

FORM 103-I

See 50 IAC 4.2-10

NOTE: Carry totals on Line 40 below to front of Form 103-I, Line 1 or Line 14.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

TOTAL ALL POOLS

NOTE: All Column B adjustments above must be supported on Form 106.

Page 2 of 2