Fillable Printable Form 248-036-000

Fillable Printable Form 248-036-000

Form 248-036-000

Statewide Payee Registration for

Washington StateDepartment of Labor and Industries

STEP 1: Is this a NEW registration or CHANGE to an existing registration (check one)?

NEW REGISTRATION― complete the ENTIREform (STEPS 1 ― 6)

EXISTING REGISTRATION – complete the ENTIREform (STEPS 1 – 6)and check below what is updated:

Adding a New Provider Name/DBA Address Contact Information EmailPayment Options

Direct Deposit Additional Information

If you know your Stat ewide Vendor Number, enter it here:

SWV

STEP 2: Enter information about the payee and contact pe rson

Legal Name (a s show n on your income tax ret urn)

SSN OR EIN

Busines s Nam e, if dif f er e nt from Lega l Na m e abov e – e.g. Doing Busi ne s s As (DBA) Name

Contact Person

PaymentAddress(where payme nts wil l be sent)

Contact Telephone Number

City, Sta t e, and Zip Code

Contact Fa x Number

Email to recei v e St ate wi de Ve ndor Num be r a nd payment noti f ic ations

For L&I Use Only:

2350 / MIPS / O /

Type of Busine s s

L&I #/ System / Ownership / L&I Provider #

STEP 3: Select Payment Option:

Direct Deposit to bank (recommended)

Check in US mail (terminates any previous banking information on file)

If dir e ct deposit is checked, complete STEP 4.

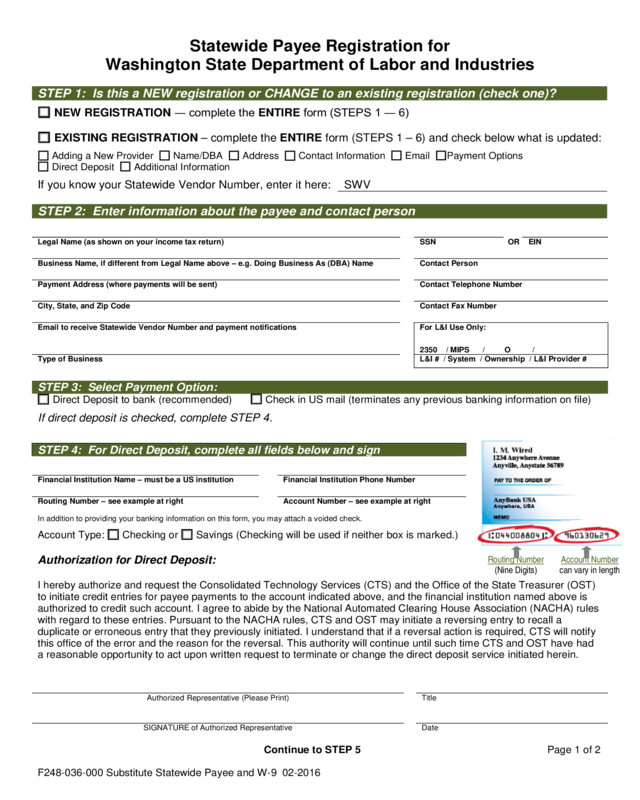

STEP 4: For Direct Deposit, complete all fields below and sign

Financial Institution Name – must be a US institut ion

Financial Institution Phone Number

Routing Numbe r – see example at right

Account Numbe r – see example at right

In addition to providing your banking information on this form, you may attach avoided check .

Account Type: Checking or Savings (Checking will be used if neither box is marked.)

Authorization for Direct Deposit:

I hereby authorize and request the Consolidated Technology Servi ces (CTS) and the Office of the State Treasurer (OST)

to initiate credit entri es for payee payments to the account indicated above, and the financial institution named above is

authorized to credit such account. I agree to abide by the National Automated Clearing House Association (NACHA) rules

with regard to these entries. Pursuant to the NACHA rules, CTS and OST may initiate a reversing entry to recall a

duplicate or erroneous entry that theypreviously initiated. I understand that if a reversal action is required, CTS will notify

this office of the error and the reason for the reversal. This authority will continue until such time CTS and OST have had

a reasonable opportunity to act upon written request to terminate or change the direct deposit service i nitiated herein.

Authorized Representative (Please Print)

Title

SI GNATURE of Authorized R epresen tativ e

Date

Continue to STEP 5Page 1 of 2

Routing Number

(Nine Digits)

Account Number

can vary in length

F248-036-000 Substitute Statewide Payee and W-9 02-2016

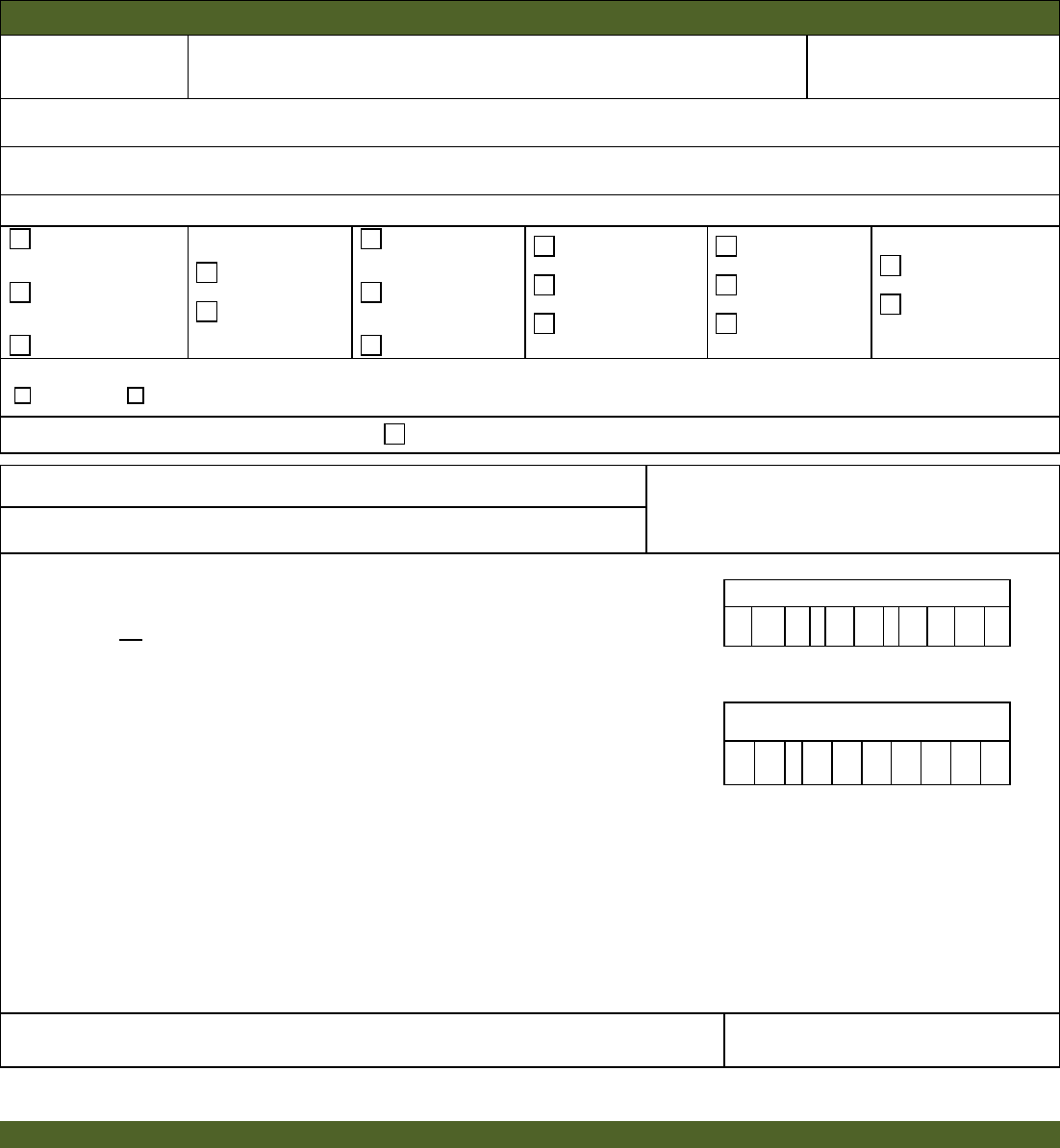

STEP 5: REQUIRED – Completeand sign the Reques t for Taxpaye r Identifica ti on Number (W-9)

Substitute

Form

W-9

Request for Taxpayer

Identification Number and Certification

1.Legal Name (as shown on your income tax return)

2.Business Name, if different from Legal Name above – eg. Doing Business As (DBA) Name

3.Check ONLY ONE box below (see W-9 instructions for additional information)

Individual or

Sole Proprietor

LLC filing as a sole

proprietor

Partnership

Corporation

S-Corp

LLC filing as

Corporation

LLC filing as

Partnership

LLC filing as S-Corp

Non Profit Organization

Volunteer

Board /Committee

Member

Local Government

State Government

Federal Government

(includingtribal)

Tax-exempt organization

Trust/Estate

4. For Corporation, S-Corp, Partnership or LLC, check one box below if applicable:

Medical Attorney/Legal

5. If exempt from backup withh olding, check here: (See instru ctions for W-9 to determine if you are exempt from backup withhol di ng.)

6.Address (number, street, and apt. or suite no.)

Department of Labor and Industries

Attn: Provider Credentialing and Compliance

PO Box 44261

Olympia Wa 98504-4261

7.Cit y, State, and ZIP code

8. Taxpayer Identification Number (TIN)

Enter your EIN ORSSN in the appropriate box to the right (do not enter both)

For individuals, this is your soc i al security number (SSN).

For other entities, it is your empl oyer identification num ber (EI N).

NOTE: The EIN or SSN must match the Legal Nameas reported to the IRS. For a resident alien, sole

proprietor, or disregarded ent i ty , or to find out how to get a Taxpayer Identificati on Number, see the W9

Instructions.If the account is in more than one name, see the W9 Instructions for guidelines on whose

number to enter.

Social security number

-

-

Employer ident ification number

-

9. Certifi cation

Under penalty of perjury, I certify that:

•

The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

•

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the

Internal Revenue Service (IRS) that I am subject to backup withholding as a resultof a failure to report all interest or dividends, or

(c) the IRS has notified me that I am no longer subject to backup withholding, and

•

I am a U.S. person (including a U.S. resident alien).

(For additional information about the W-9 see the W-9 Instructions.)

SIGNATURE of U.S. PERSON

Date

STEP 6: Submit to ONE of the following

For Medical Provider

Provider Account Appli cation & Pay Hold Releases:

FAX:360-902-4484

Provider Network Application (WPA):

FAX:360-902-4563

Crime VictimsCompensation:

FAX: 360-902-5333

Or mail to:

Provider Credentialing & Compliance

PO Box 44261

Olympia, WA 98504-4261

For quest ions contact P r ovider Credenti aling: 36 0 -902-5140and select opti on 4

Page 2 of 2

F248-036-000 Substitute Statewide Payee and W-9 02-2016

Instructions for the Stat ewidePayee Registration Form

The term ‘payee’ refers to an individual or business that received payments from the State of

W ashington. This form is intended to be used for payees to register with the State of Washington,

indicate how they would like to receive payments, and change their registration information.

For prompt payment, it is important that we receive complete and accurate information. We must

return any form tha t is not com pl ete, so please be sure to read and follow these instructions

carefully.

Step 1: Is this a new regis tration or a change to an existing registration?

Select NEW REGISTRATION if:

•You have never completed the Statewide Payee Registration Form.

•You are changing the legal name of a payee already registered.

•You are changing the EIN (Employer Identification Number) or SSN (Social Security

Number) of a payee already registered

•You are changing the reporting type (sole proprietor, corporation, etc) on an existing

registration.

Select CHANGE TO EXISTING REGISTRAT ION for all other changes to an exist ing

registration, and check the items that have changed. Be sure to COMPLETE the ENTIRE

form, even if you are only changing one item. This will help us keep your account up to date

and accurate. If you know your SWVnumber, please enter it on the for m.

Step 2: Payee & contact information

Legal name of payee – enter the name as it appears on federal tax forms.

Business name – “doing business as” name. Enter only if different from legal name.

Paymentaddress – enter the PO Box or street address where you want information sent to

you. If you choose to have checks mailed to you, this is the address where they will be sent.

Email for contact person - enter the email address we should use to communicate with you

about your registration and your payments. We will use the email address to:

•Notify you when your account has been set up.

•Notify you when changes you submitted have been made.

•Notify you when your payment has been processed, if you have signed up for direct

deposit.

Type ofbusiness– enter the primary occupation of the payee.

SSNor EIN– enter the SSNor EIN you use with the IRS for the legal name entered.

Contact person –the person w ecan contact with questions about your registration.

Contact telephone number–t el ep ho ne number of the cont act per son.

Contact fax number – fax number of the contact person.

NOTE: For larger organizations we recommend that you use the email address for a

distribution list to ensure that our notifications are received and processed quickly.

Step 3: Payment options

Indicate if you want to receive your payments via Direct Deposit or via US Mail.

F248-036-000 Substitute Statewide Payee and W-9 02-2016

Step 4: Direct depos it informa tion

Financial ins ti tution name & phone number – enter the name and phone number of the

financial institution where you want your funds deposited. This mustbe a US institution.

Routing number – this is the 9 digit Bank Identification Number assigned by the American

Banking Association. The routing number is the first 9 numbers at the bottom of your check.

See example on form. Do not use the routing number from a generic deposit slip – these beg in

with the number ‘5.’

Account number – this is your bank account number, and can vary in length. It usually follows

the routing number on the check

Account type – select the kind of account your payment will be deposited into. If you do not

make a selection, funds will be transferred into the checking account.

Authorization Signa ture– in order for us to process the Direct Deposit, we need the

signature of the person on file with the bank.

Ste p 5: W-9

The IRS has issued new regulations governing how we report payments and calculate

withholding. We need thiscomplete, signed W-9 in order to process your registration and

verify any ch ang es to it.

1. Legal name of payee – enter the name as it appears on federal tax forms.

2. Business name – “doing business as” name. Enter only if different from legal name.

3. Check one box for your IRS re por ti ng type –you must check ONLY one box to indicate if

you are an individual, corporation, non-profit organization,etc.

4. Check if the business is medical or legal - If you are a corporation, S-corporation,

partnership or LLC, and your business is medical or legal, you must check the appropriate box.

See t he W-9 instructions for more information about reporting types.

5.Select if you are exempt from backup withholding.

6. Address – enter the PO Box or street addresswhere you would like your 1099 mailed.

7. City, State and ZIP

8. Taxpayer Ide nti fication Number –enter the Employer Identification Number (EIN)OR

Social Security Number (SSN) you use with the IRS for the legal name entered. DO NOT

ENTER BOTH. Enter ONLY the one that you use with the IRS for the legal name.

9. SIGN the W-9

Step 6 : Submit to one of the following:

Provider Network Applicati on (WPA)

FAX:360-902-4563

Non-Network Provider Application

FAX:360-902-4484

Crime Victims Compensation

FAX:360-902-5333

Or mail application to: Provider Credentialing & Compliance

PO Box 44261

Ol ympia, WA 98504-4261

For questions, contact Provider Credentialing at 360-902-5140 and select option 4.

F248-036-000 Substitute Statewide Payee and W-9 02-2016