Fillable Printable Form 2823 2016 Credit Institution Tax Return

Fillable Printable Form 2823 2016 Credit Institution Tax Return

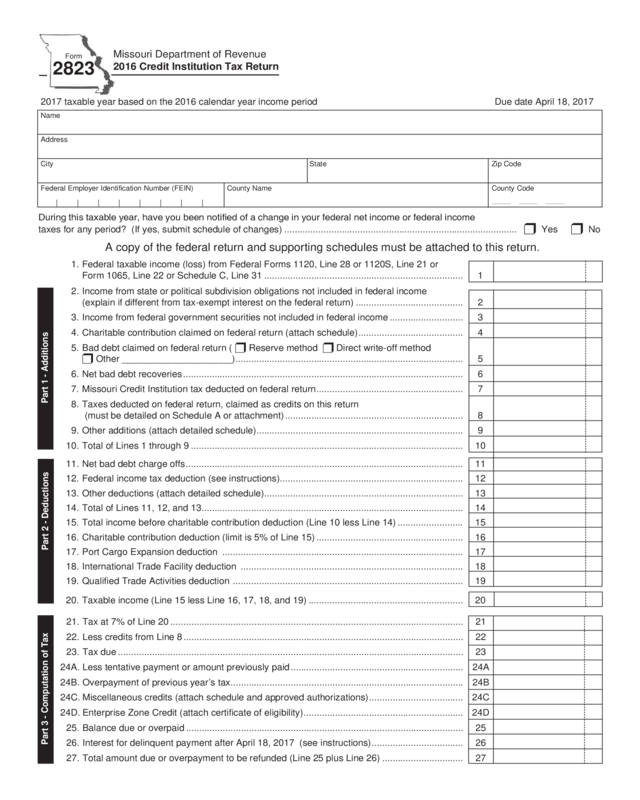

Form 2823 2016 Credit Institution Tax Return

1. Federal taxable income (loss) from Federal Forms 1120, Line 28 or 1120S, Line 21 or

Form 1065, Line 22 or Schedule C, Line 31 ............................................................................ 1

2. Income from state or political subdivision obligations not included in federal income

(explain if different from tax-exempt interest on the federal return) ......................................... 2

3. Income from federal government securities not included in federal income ............................ 3

4. Charitable contribution claimed on federal return (attach schedule) ........................................ 4

5. Bad debt claimed on federal return ( rReserve method rDirect write-off method

rOther _____________________) ....................................................................................... 5

6. Net bad debt recoveries ........................................................................................................... 6

7. Missouri Credit Institution tax deducted on federal return ........................................................ 7

8. Taxes deducted on federal return, claimed as credits on this return

(must be detailed on Schedule A or attachment) .................................................................... 8

9. Other additions (attach detailed schedule)............................................................................... 9

10. Total of Lines 1 through 9 ........................................................................................................ 10

Form

2823

Missouri Department of Revenue

2016 Credit Institution Tax Return

Part 1 - Additions

A copy of the federal return and supporting schedules must be attached to this return.

During this taxable year, have you been notied of a change in your federal net income or federal income

taxes for any period? (If yes, submit schedule of changes)

.........................................................................................r Yes r No

Part 2 - Deductions

| | | | | | | |

2017 taxable year based on the 2016 calendar year income period Due date April 18, 2017

Name

Address

City State Zip Code

Federal Employer Identification Number (FEIN) County Name County Code

11. Net bad debt charge offs .......................................................................................................... 11

12. Federal income tax deduction (see instructions)...................................................................... 12

13. Other deductions (attach detailed schedule)............................................................................ 13

14. Total of Lines 11, 12, and 13.................................................................................................... 14

15. Total income before charitable contribution deduction (Line 10 less Line 14) ......................... 15

16. Charitable contribution deduction (limit is 5% of Line 15) ........................................................ 16

17. Port Cargo Expansion deduction ............................................................................................ 17

18. International Trade Facility deduction ..................................................................................... 18

19. Qualified Trade Activities deduction ........................................................................................ 19

20. Taxable income (Line 15 less Line 16, 17, 18, and 19) ........................................................... 20

21. Tax at 7% of Line 20 ................................................................................................................ 21

22. Less credits from Line 8 ........................................................................................................... 22

23. Tax due .................................................................................................................................... 23

24A. Less tentative payment or amount previously paid .................................................................. 24A

24B. Overpayment of previous year’s tax......................................................................................... 24B

24C. Miscellaneous credits (attach schedule and approved authorizations) .................................... 24C

24D. Enterprise Zone Credit (attach certificate of eligibility) ............................................................. 24D

25. Balance due or overpaid .......................................................................................................... 25

26. Interest for delinquent payment after April 18, 2017 (see instructions) ................................... 26

27. Total amount due or overpayment to be refunded (Line 25 plus Line 26) ............................... 27

Part 3 - Computation of Tax

Reset Form

Print Form

Mail to:Taxation Division Phone: (573) 751-2326

P.O. Box 898 Fax: (573) 522-1721

Jefferson City, MO 65105-0898 TTY: (800) 735-2966

E-mail:[email protected]

Visit //dor.mo.gov/business/finance/

for additional information.

Form 2823 (Revised 12-2016)

Description (Do not list tangible personal property tax on leased property) Amount

Schedule A - Taxes Claimed as Credits

1. List all Missouri offices or locations for which this return is made. Indicate the complete address of each office or location.

Include the percentage of gross income of each office or location to the total income of the company in Missouri. (Attach a

separate page if additional space is needed.)

2. Is this return made on the basis of actual receipts and disbursements? If not, describe fully what other basis or method

was used in computing net income.

3. What is the principal source of income?

4. If the business is a pawnbroker, what percent of the total business is your loan business?

Complete Additional Information

Authorization and Signature

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to

the best of my knowledge and belief, it is true, complete, and correct. Declaration of preparer (other than taxpayer) is based on

all information of which he or she has any knowledge.

Total (Enter on Lines 8 and 22, Page 1)

I authorize the Director of Revenue or delegate to discuss my return and attachments with the preparer or any

member of his or her firm, or if internally prepared, any member of the internal staff

............................................rYesrNo

Signature of Officer (Required) Title of Officer Phone Number Date (MM/DD/YYYY)

(___ ___ ___)___ ___ ___-___ ___ ___ ___ __ __ /__ __ /__ __ __ __

Preparer’s Signature (Including Internal Preparer) Preparer’s FEIN, SSN, or PTIN Phone Number Date (MM/DD/YYYY)

(___ ___ ___)___ ___ ___-___ ___ ___ ___ __ __ /__ __ /__ __ __ __

Make check or money order payable to “Missouri Department of Revenue”. Mail completed form and attachments to the address below.

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any returned check may be presented

again electronically.

Section 148.120 – 148.230, RSMo

This information is for guidance only and does not state the complete law.

The Form 2823 must be completed and filed by April 18, 2017

(tax becomes delinquent after this date and is subject to interest).

An extension of time to file this return may be obtained from

the Department of Revenue upon written request. Such

request should indicate the extension period requested,

the reason for the request and must be accompanied by a

tentative return and payment for the estimated tax due.

An extension of time to file the return does not extend the

time for payment of the tax. An extension of time may

not exceed 180 days from the due date (April 18) pursuant to

Regulation 12 CSR 10-10.090.

Filing Requirement — Every person, firm, partnership, or

corporation engaged principally in the consumer credit or loan

business in the making of loans of money, credit, goods,

or things in action, or in the buying, selling or discounting of,

or investing in, negotiable or non-negotiable instruments given

as security for or in payment of the purchase price of consumer

goods exercising such franchise within the state of Missouri,

but shall not include real estate mortgage loan companies,

banks, trust companies, credit unions, insurance companies,

mutual savings and loans associations and savings and loan

associations.

Credit Institution Tax Return — If any taxpayer shall operate

more than one office in Missouri, the taxpayer shall file one

return giving the address of each such office and allocating to

each office its share of the net income of the taxpayer in the

ratio that the gross receipts of that office bears to the total gross

receipts of the taxpayer.

County Code — Enter your three digit county code of the

principal place of your institution from the list provided at the end

of these instructions.

Part 1

Line 1Taxpayers that are members of an afliated group ling

a consolidated federal income tax return shall compute federal

taxable income as if a separate federal tax return had been

led.A pro forma federal return or appropriate schedules should

then be attached together with a copy of pages 1 through 4 of the

consolidated federal income tax return.

Line 2

Enter all income received on state or political subdivision

obligations excluded from the federal return. This income is

taxable on this return. Explain if different from tax-exempt interest

shown on the federal return.

Line 3

Enter all income received on federal securities excluded

from the federal return (e.g., non-taxable portion Federal Reserve

Bank dividends). This income is taxable on this return.

Line 4

Enter the charitable contribution deduction claimed on the

federal return.

Line 5

Enter the bad debt claimed on the federal return or any

additions to a bad debt reserve claimed as a de duc tion on the

federal return. (The reserve method is not a permissible method

on this return.) In the appropriate box, indicate the bad debt

method used on the federal return.

Line 6

Enter the excess, if any, of recoveries of bad debts

previously charged off over current year charge offs. Attach

schedule of bad debt computation.

Line 7

Enter any Missouri Credit Institution tax deducted on the

federal return. This is not an allowable deduction on this return.

Line 8

Enter here and on Line 22 taxes to be claimed as credits

on this return. All taxes paid directly to the state of Missouri or

any political subdivision thereof are eligible except taxes on real

estate, unemployment taxes, credit institution tax, and taxes on

tangible personal property owned by the taxpayer and held for

lease or rental to others. Show detail on Schedule A.

Attach schedule of taxes deducted on federal Form 1120, Line

17 or Form 1120S, Line 12 or Form 1065, Line 14 or Form 1040,

Schedule C, Line 23 for verication purposes.

An accrual basis taxpayer that is a member of an afliated group

ling a consolidated Missouri income tax return shall allocate a

portion of the consolidated Missouri income tax liability for the

year by multiplying such liability by a fraction, the numerator of

which is the separate Missouri taxable in come of such member,

and the denominator of which is the sum of the separate Missouri

taxable incomes of all members having Missouri taxable income

for the year.

A cash basis taxpayer that is a member of an afliated group

ling a consolidated Missouri income tax return shall allocate

each component of the consolidated Missouri income tax paid

(or refunded) during the year by multiplying each component

by a fraction, the numerator of which is the separate Missouri

taxable income of such member for the applicable year, and the

denominator of which is the sum of the separate Missouri taxable

incomes of all members having Missouri taxable income for the

applicable year.

In the computation of separate Missouri taxable income, each

member of a group ling a consolidated Missouri income tax

return shall start with its separate federal taxable income as

computed pursuant to the method applicable to the group under

Treasury Regulation 1.1552-1. The amount of the federal income

tax deduction of each member under Section 143.171.1, RSMo,

shall be that portion of the actual federal consolidated income tax

liability of the group as is required to be allocated to such member

under Internal Revenue Code Section 1552 without regard to any

additional allocations under Treasury Regulation 1.1502-33(d).

Line 9 Enter deductions claimed on the federal return which

are not allowable on this return and income not included on the

federal return which is required to be included on this return (attach

schedule). Include all income shown on federal Form 1120S,

Schedule K, Lines 2-10. The environmental tax under Section 59A

of the Internal Revenue Code must be added back to income.

Line 10

Enter the total of Lines 1 through 9.

Missouri Department of Revenue

General Instructions - 2016 Credit Institution Tax Return

Instructions

Part 2

Line 11Enter the excess, if any, of bad debt charge offs over

current year recoveries. Attach schedule of bad debt computation.

Line 12 Enter the current year deduction for federal income tax

related to the Credit Institution tax. The current year deduction will

be the amount actually accrued (if an accrual basis taxpayer) or

paid (if a cash basis taxpayer) during the year. Attach a schedule

of the computation.

Accrual basis taxpayers that are members of an afliated group

ling a consolidated federal income tax return shall allocate a

portion of the consolidated federal tax liability for the year by using

the same method used by the group under Internal Revenue

Code Section 1552 without regard to any additional allocations

under Treasury Regulation 1.1502-33(d).

Cash basis taxpayers that are members of an afliated group

ling a consolidated federal income tax return shall allocate each

component of the consolidated federal tax paid (or refunded)

during the year by using the same method used by the group

under Internal Revenue Code Section 1552 for the applicable

year without regard to any additional allocations under Treasury

Regulation 1.1502-33(d).

Line 13 Enter the total amount of any deduction claimed on this

return and not included on the federal return. These deductions

must be itemized on a schedule attached to this return.

Line 14 Enter the total of Lines 11 through 13.

Line 15 Subtract Line 14 from Line 10 and enter amount. If “loss”,

indicate by brackets “( )” and enter “none” on Line 21.

Line 16 Enter the charitable contribution claimed on this return.

The contribution deduction is limited to 5% of taxable income

before the contribution deduction. Only current year contributions

are allowed. Attach a schedule.

Line 17 Enter the amount of the Port Cargo Expansion deduction

approved by the Missouri Department of Economic Development.

Attach a copy of the certicate authorizing the deduction.

Line 18 Enter the amount of the International Trade Facility

deduction approved by the Missouri Department of Economic

Development. Attach a copy of the certicate authorizing the

deduction.

Line 19Enter the amount of the Qualied Trade Activities

deduction approved by the Missouri Department of Economic

Development. Attach a copy of the certicate authorizing the

deduction. The amount of the deduction cannot exceed fty

percent (50%) of Line 10.

Line 20 Subtract Line 16, 17, 18 and 19 from Line 15 and enter

amount.

Part 3

Line 21 Multiply the taxable income amount on Line 20 by 7%

and enter the amount.

Line 22 Enter the amount from Line 8.

Line 23 Subtract Line 22 from Line 21 and enter amount. If

amount on Line 22 exceeds amount on Line 21, enter “none”.

Line 24A Enter the amount of tentative payment, if applicable.

Line 24B Enter overpayment of previous year’s tax.

Line 24C Enter the amount of tax credits claimed from the list

below. Attach a schedule listing the amounts for each tax credit. A

copy of the approved authorization must be attached to the return.

Line 24D Enter the approved Enterprise Zone Credit claimed.

To be eligible for this credit, you must use the percentage from the

second paragraph of the Department of Economic Development

(DED) certication letter and attach this to the return. Compute

the allowable Enterprise Zone Credit using the greater of the

following two methods.

1. Line 20 (taxable income) x DED percentage of income x 7%

or

2. Line 21 (tax liability) x DED percentage of tax

Line 25 Subtract Lines 24A through 24D from Line 23.

Line 26 Calculate interest for period which tax payment is

delinquent. Interest should be calculated from the due date of

April 18 through date of payment at the annual rate. The annual

interest rate can be obtained from the Department’s website at:

//dor.mo.gov/intrates.php.

Line 27 Enter the total of Lines 25 and 26. If a balance due, submit

this amount.

Form 2823 Instructions (Revised 12-2016)

Taxation Division Phone: (573) 751-2326

P.O. Box 898 TTY: (800) 735-2966

Jefferson City, MO 65105-0898 Fax: (573) 522-1721

E-mail:[email protected]

Visit //dor.mo.gov/business/finance/

for additional information.

Affordable Housing Assistance

Agricultural Products Utilization

Alternative Fuel Infrastructure

Bond Enhancement

Brownfield “Jobs and Investment”

Business Use Incentives for

Large-scale Development (BUILD)

Demolition

Development Reserve

Developmental Disability Care Provider

Distressed Areas Land Assemblage

Export Finance

Family Development Account

Family Farms Act

Film Production

Historic Preservation

Infrastructure Development

Innovation Campus

Maternity Home

Missouri Low Income Housing

Missouri Quality Jobs

Missouri Works

Neighborhood Assistance

New Enhanced Enterprise Zone

New Enterprise Creation

New Generation Cooperative

New Market

Pregnancy Resource

Rebuilding Communities

Rebuilding Communities and

Neighborhood Preservation Act

Remediation

Residential Treatment Agency

Shelter for Victims of Domestic

Violence

Small Business Incubator

Small Business Investment

Special Needs Adoption

Sporting Contribution

Sporting Event

Youth Opportunities

Available Tax Credits

Code County Code County Code County Code County Code County

001 Adair 047 Clay 093 Iron 139 Montgomery 185 St Clair

003 Andrew 049 Clinton 095 Jackson 141 Morgan 187 St Francois

005 Atchison 051 Cole 097 Jasper 143 New Madrid 189 St Louis County

007 Audrain 053 Cooper 099 Jefferson 145 Newton 193 Ste Genevieve

009 Barry 055 Crawford 101 Johnson 147 Nodaway 195 Saline

011 Barton 057 Dade 103 Knox 149 Oregon 197 Schuyler

013 Bates 059 Dallas 105 Laclede 151 Osage 199 Scotland

015 Benton 061 Daviess 107 Lafayette 153 Ozark 201 Scott

017 Bollinger 063 Dekalb 109 Lawrence 155 Pemiscot 203 Shannon

019 Boone 065 Dent 111 Lewis 157 Perry 205 Shelby

021 Buchanan 067 Douglas 113 Lincoln 159 Pettis 207 Stoddard

023 Butler 069 Dunklin 115 Linn 161 Phelps 209 Stone

025 Caldwell 071 Franklin 117 Livingston 163 Pike 211 Sullivan

027 Callaway 073 Gasconade 119 McDonald 165 Platte 213 Taney

029 Camden 075 Gentry 121 Macon 167 Polk 215 Texas

031 Cape Girardeau 077 Greene 123 Madison 169 Pulaski 217 Vernon

033 Carroll 079 Grundy 125 Maries 171 Putnam 219 Warren

035 Carter 081 Harrison 127 Marion 173 Ralls 221 Washington

037 Cass 083 Henry 129 Mercer 175 Randolph 223 Wayne

039 Cedar 085 Hickory 131 Miller 177 Ray 225 Webster

041 Chariton 087 Holt 133 Mississippi 179 Reynolds 227 Worth

043 Christian 089 Howard 135 Moniteau 181 Ripley 229 Wright

045 Clark 091 Howell 137 Monroe 183 St Charles 510 St Louis City

County Codes