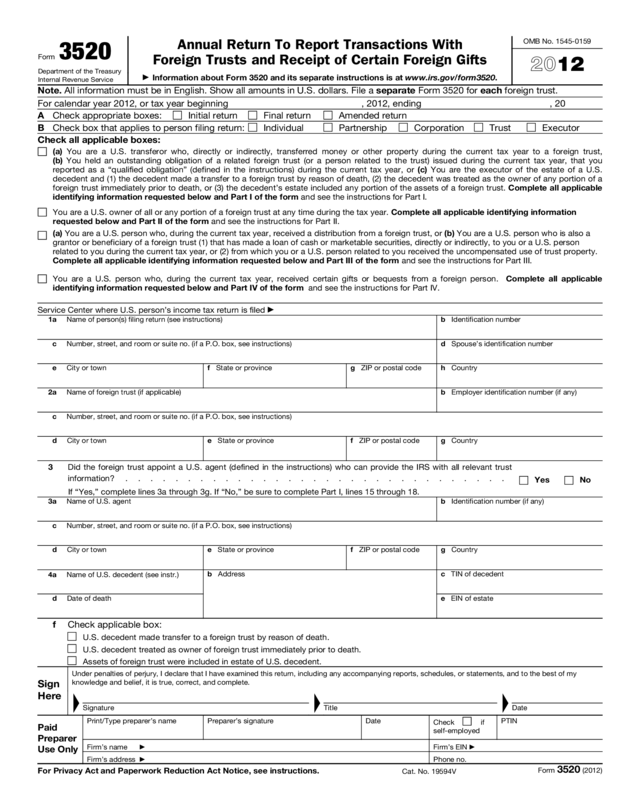

Fillable Printable Form 3520 2012

Fillable Printable Form 3520 2012

Form 3520 2012

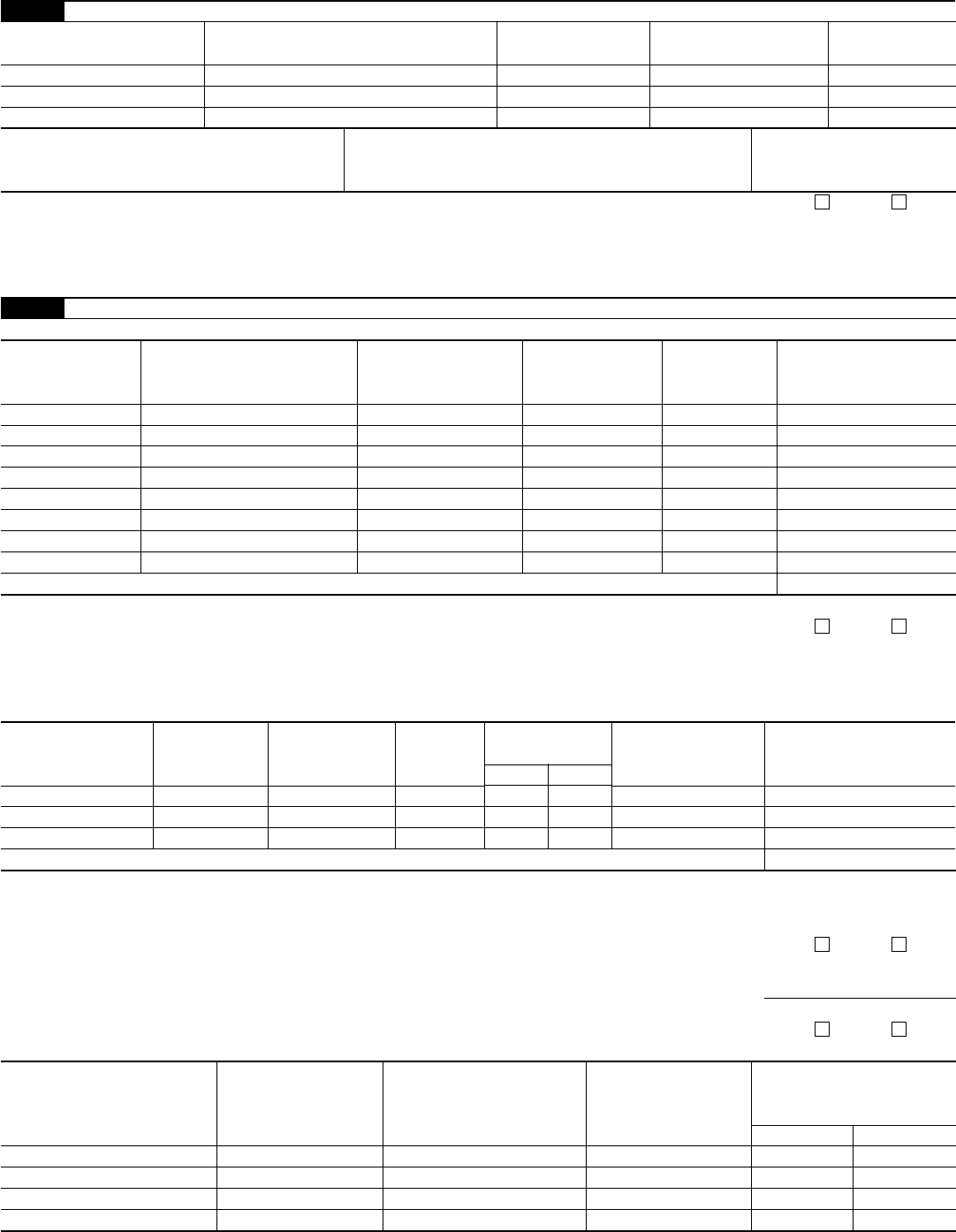

Form 3520

Department of the Treasury

Internal Revenue Service

Annual Return To Report Transactions With

Foreign Trusts and Receipt of Certain Foreign Gifts

▶

Information about Form 3520 and its separate instructions is at www.irs.gov/form3520.

OMB No. 1545-0159

2012

Note. All information must be in English. Show all amounts in U.S. dollars. File a separate Form 3520 for each foreign trust.

For calendar year 2012, or tax year beginning , 2012, ending , 20

A Check appropriate boxes: Initial return Final return Amended return

B Check box that applies to person filing return: Individual Partnership Corporation Trust Executor

Check all applicable boxes:

(a) You are a U.S. transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust,

(b) You held an outstanding obligation of a related foreign trust (or a person related to the trust) issued during the current tax year, that you

reported as a “qualified obligation” (defined in the instructions) during the current tax year, or (c) You are the executor of the estate of a U.S.

decedent and (1) the decedent made a transfer to a foreign trust by reason of death, (2) the decedent was treated as the owner of any portion of a

foreign trust immediately prior to death, or (3) the decedent’s estate included any portion of the assets of a foreign trust. Complete all applicable

identifying information requested below and Part I of the form and see the instructions for Part I.

You are a U.S. owner of all or any portion of a foreign trust at any time during the tax year. Complete all applicable identifying information

requested below and Part II of the form and see the instructions for Part II.

(a) You are a U.S. person who, during the current tax year, received a distribution from a foreign trust, or (b) You are a U.S. person who is also a

grantor or beneficiary of a foreign trust (1) that has made a loan of cash or marketable securities, directly or indirectly, to you or a U.S. person

related to you during the current tax year, or (2) from which you or a U.S. person related to you received the uncompensated use of trust property.

Complete all applicable identifying information requested below and Part III of the form and see the instructions for Part III.

You are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign person. Complete all applicable

identifying information requested below and Part IV of the form and see the instructions for Part IV.

Service Center where U.S. person’s income tax return is filed

▶

1a Name of person(s) filing return (see instructions)

b Identification number

c Number, street, and room or suite no. (if a P.O. box, see instructions) d Spouse’s identification number

e City or town f State or province

g ZIP or postal code

h Country

2a Name of foreign trust (if applicable) b Employer identification number (if any)

c Number, street, and room or suite no. (if a P.O. box, see instructions)

d City or town e State or province

f ZIP or postal code

g Country

3 Did the foreign trust appoint a U.S. agent (defined in the instructions) who can provide the IRS with all relevant trust

information? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

If “Yes,” complete lines 3a through 3g. If “No,” be sure to complete Part I, lines 15 through 18.

3a Name of U.S. agent b Identification number (if any)

c Number, street, and room or suite no. (if a P.O. box, see instructions)

d City or town e State or province

f ZIP or postal code

g Country

4a Name of U.S. decedent (see instr.)

b Address

c TIN of decedent

d Date of death e EIN of estate

f Check applicable box:

U.S. decedent made transfer to a foreign trust by reason of death.

U.S. decedent treated as owner of foreign trust immediately prior to death.

Assets of foreign trust were included in estate of U.S. decedent.

Sign

Here

Under penalties of perjury, I declare that I have examined this return, including any accompanying reports, schedules, or statements, and to the best of my

knowledge and belief, it is true, correct, and complete.

▲

Signature

▲

Title

▲

Date

Paid

Preparer

Use Only

Print/Type preparer’s name Preparer’s signature Date

Check if

self-employed

PTIN

Firm’s name

▶

Firm’s EIN

▶

Firm’s address

▶

Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 19594V

Form

3520 (2012)

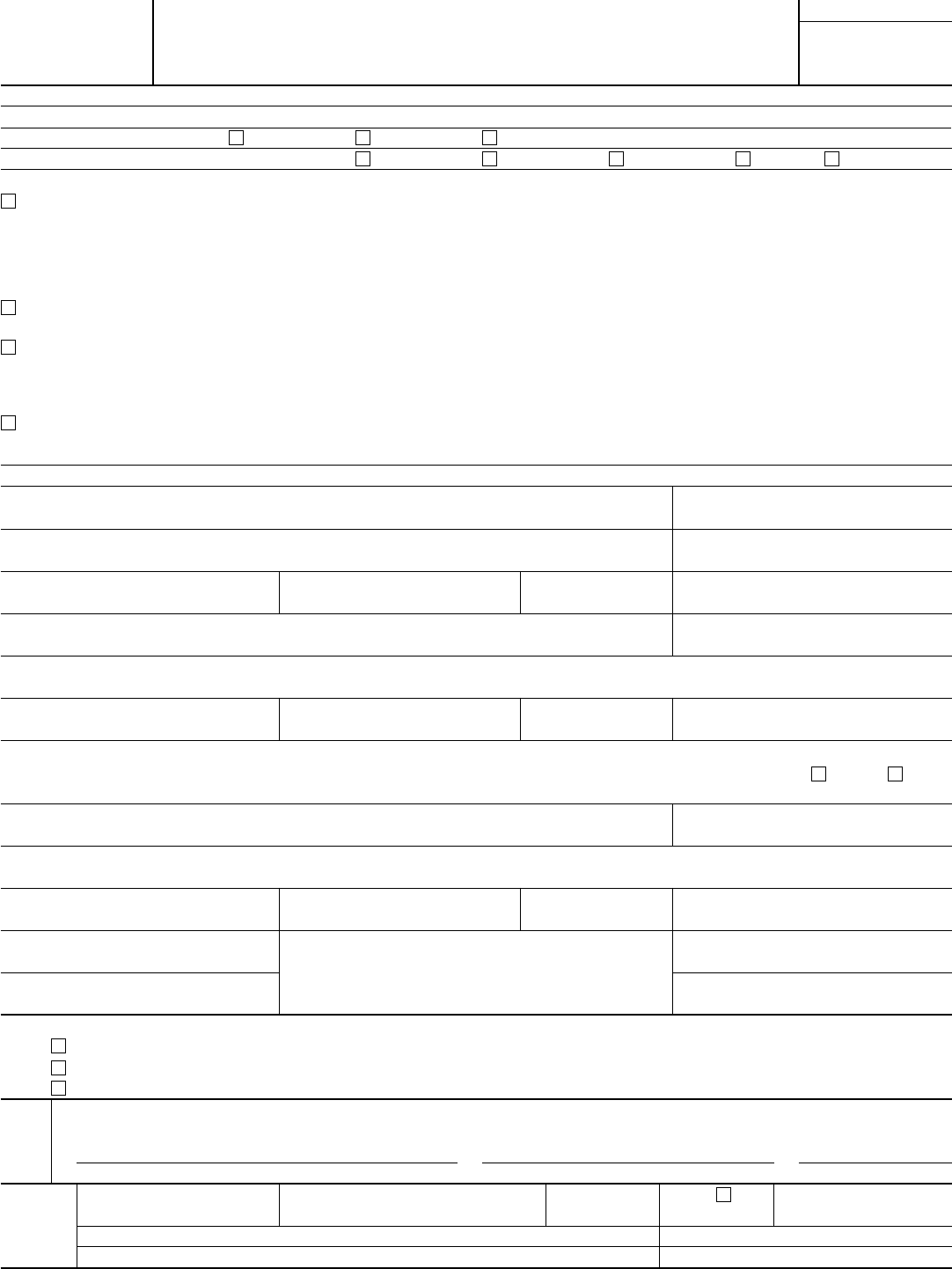

Form 3520 (2012)

Page 2

Part I Transfers by U.S. Persons to a Foreign Trust During the Current Tax Year (see instructions)

5a Name of trust creator

b Address

c Identification number (if any)

6a Country code of country where trust was created b Country code of country whose law governs the trust

c Date trust was created

7a

Will any person (other than the U.S. transferor or the foreign trust) be treated as the owner of the transferred assets after the transfer?

Yes No

b

(i)

Name of other foreign

trust owners, if any

(ii)

Address

(iii)

Country of residence

(iv)

Identification number, if any

(v)

Relevant Code

section

8 Was the transfer a completed gift or bequest? If “Yes,” see instructions . . . . . . . . . . . . . . Yes No

9a Now or in the future, can any part of the income or corpus of the trust benefit any U.S. beneficiary? . . . . . .

Yes No

b If “No,” could the trust be revised or amended to benefit a U.S. beneficiary?. . . . . . . . . . . . .

Yes No

10 Will you continue to be treated as the owner of the transferred asset(s) after the transfer? . . . . . . . . .

Yes No

Schedule A—Obligations of a Related Trust (see instructions)

11 a During the current tax year, did you transfer property (including cash) to a related foreign trust in exchange for an

obligation of the trust or an obligation of a person related to the trust (see instructions)? . . . . . . . . .

Yes No

If “Yes,” complete the rest of Schedule A, as applicable. If “No,” go to Schedule B.

b Were any of the obligations you received (with respect to a transfer described in 11a above) qualified obligations? .

Yes No

If “Yes,” complete the rest of Schedule A with respect to each qualified obligation.

If “No,” go to Schedule B and, when completing columns (a) through (i) of line 13 with respect to each nonqualified

obligation, enter “-0-” in column (h).

(i)

Date of transfer giving rise to obligation

(ii)

Maximum term

(iii)

Yield to maturity

(iv)

FMV of obligation

12

With respect to each qualified obligation you reported on line 11b: Do you agree to extend the period of assessment of

any income or transfer tax attributable to the transfer, and any consequential income tax changes for each year that

the obligation is outstanding, to a date 3 years after the maturity date of the obligation? . . . . . . . . .

Yes No

Note. Generally, you must answer “Yes,” if you checked “Yes” to the question on line 11b.

Schedule B—Gratuitous Transfers (see instructions)

13 During the current tax year, did you make any transfers (directly or indirectly) to the trust and receive less than FMV,

or no consideration at all, for the property transferred? . . . . . . . . . . . . . . . . . . .

Yes No

If “Yes,” complete columns (a) through (i) below and the rest of Schedule B, as applicable.

If “No,” go to Schedule C.

(a)

Date of

transfer

(b)

Description

of property

transferred

(c)

FMV of property

transferred

(d)

U.S. adjusted

basis of

property

transferred

(e)

Gain recognized

at time of

transfer,

if any

(f)

Excess, if any,

of column (c)

over the sum of

columns

(d) and (e)

(g)

Description

of property

received,

if any

(h)

FMV of property

received

(i)

Excess of

column (c) over

column (h)

Totals

▶

$ $

14 You are required to attach a copy of each sale or loan document entered into in connection with a transfer reported on line 13. If these

documents have been attached to a Form 3520 filed within the previous 3 years, attach only relevant updates.

Are you attaching a copy of:

Yes No

Attached

Previously

Year

Attached

a Sale document? . . . . . . . . . . . . . . . . . . . . . .

b Loan document? . . . . . . . . . . . . . . . . . . . . . .

c Subsequent variances to original sale or loan documents? . . . . . . . . . .

Form 3520 (2012)

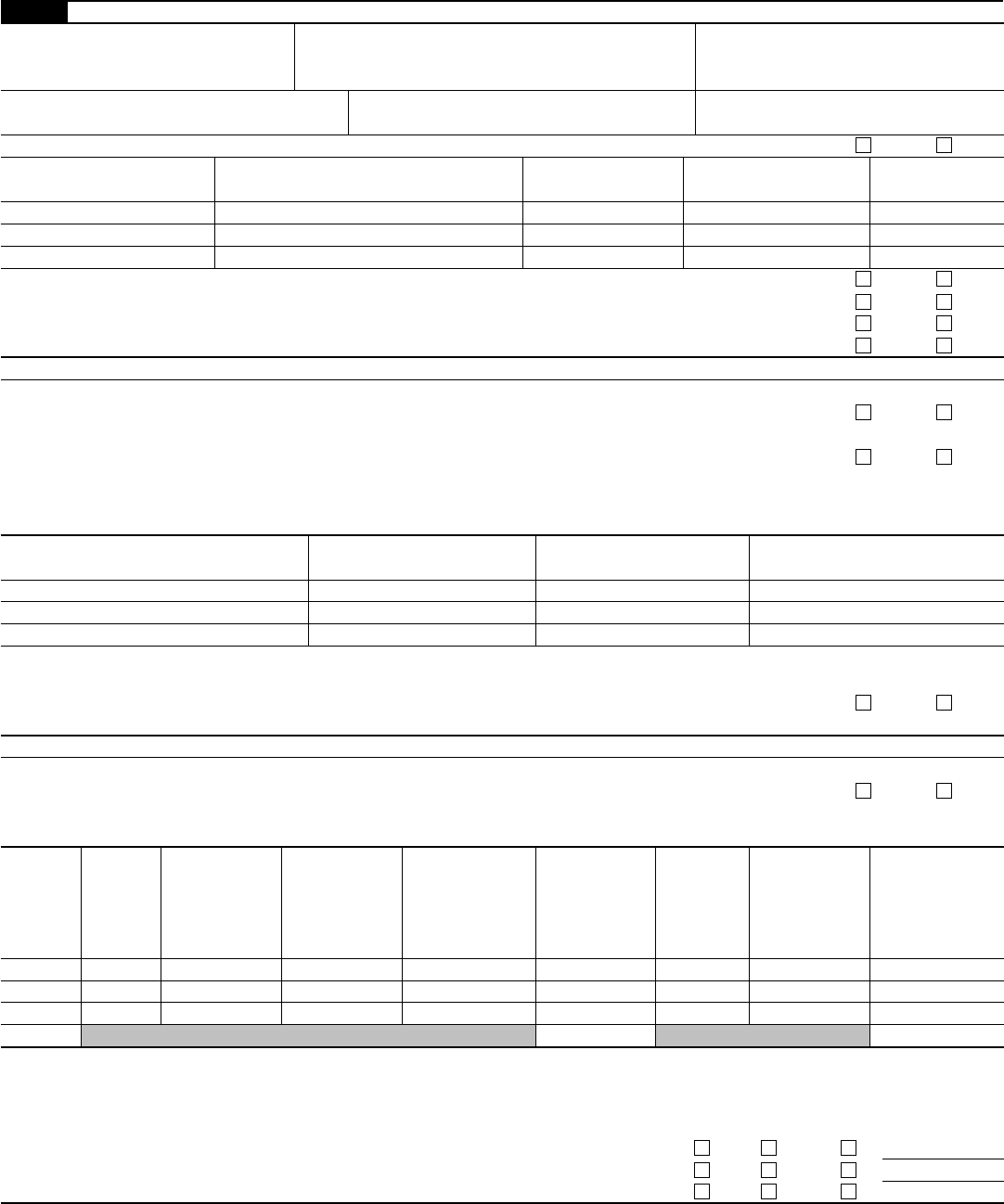

Form 3520 (2012)

Page 3

Part I Schedule B—Gratuitous Transfers (Continued)

Note. Complete lines 15 through 18 only if you answered “No” to line 3, acknowledging that the foreign trust did not appoint a U.S. agent to

provide the IRS with all relevant trust information.

15

(a)

Name of beneficiary

(b)

Address of beneficiary

(c)

U.S. beneficiary?

(d)

Identification number, if any

Yes No

16

(a)

Name of trustee

(b)

Address of trustee

(c)

Identification number, if any

17

(a)

Name of other persons

with trust powers

(b)

Address of other persons with trust powers

(c)

Description of

powers

(d)

Identification number, if any

18 If you checked “No” on line 3 (or did not complete lines 3a through 3g), you are required to attach a copy of all trust documents as indicated

below. If these documents have been attached to a Form 3520-A filed within the previous 3 years, attach only relevant updates.

Are you attaching a copy of:

Yes No

Attached

Previously

Year

Attached

a Summary of all written and oral agreements and understandings relating to the trust? . .

b The trust instrument? . . . . . . . . . . . . . . . . . . . . .

c Memoranda or letters of wishes? . . . . . . . . . . . . . . . . .

d Subsequent variances to original trust documents? . . . . . . . . . . . .

e Trust financial statements? . . . . . . . . . . . . . . . . . . .

f Other trust documents? . . . . . . . . . . . . . . . . . . . .

Schedule C—Qualified Obligations Outstanding in the Current Tax Year (see instructions)

19 Did you, at any time during the tax year, hold an outstanding obligation of a related foreign trust (or a person related to

the trust) that you reported as a “qualified obligation” in the current tax year? . . . . . . . . . . . .

Yes No

If “Yes,” complete columns (a) through (e) below.

(a)

Date of original

obligation

(b)

Tax year qualified

obligation first reported

(c)

Amount of principal

payments made during

the tax year

(d)

Amount of interest

payments made during

the tax year

(e)

Does the obligation

still meet the

criteria for a

qualified obligation?

Yes No

Form 3520 (2012)

Form 3520 (2012)

Page 4

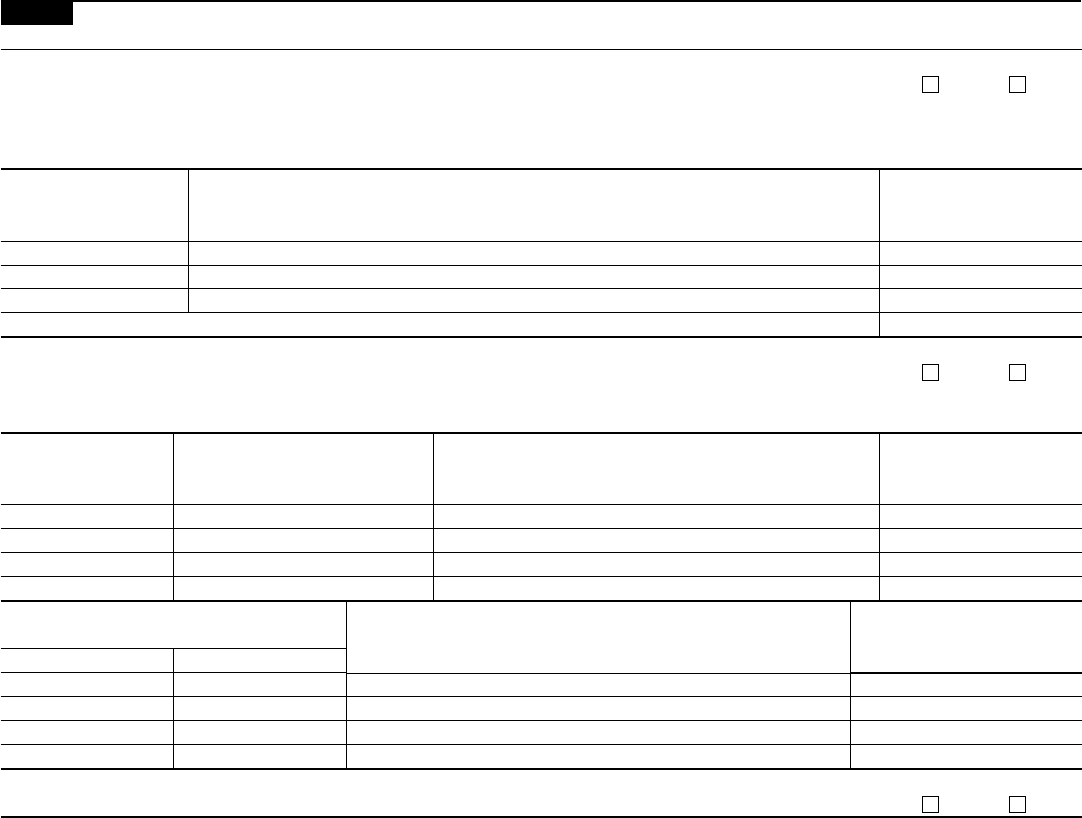

Part II U.S. Owner of a Foreign Trust (see instructions)

20

(a)

Name of other foreign

trust owners, if any

(b)

Address

(c)

Country of residence

(d)

Identification number, if any

(e)

Relevant Code

section

21

(a)

Country code of country where foreign trust

was created

(b)

Country code of country whose law governs the foreign trust

(c)

Date foreign trust was created

22 Did the foreign trust file Form 3520-A for the current year? . . . . . . . . . . . . . . . . . . Yes No

If “Yes,” attach the Foreign Grantor Trust Owner Statement you received from the foreign trust.

If “No,” to the best of your ability, complete and attach a substitute Form 3520-A for the foreign trust.

See instructions for information on penalties.

23 Enter the gross value of the portion of the foreign trust that you are treated as owning . . . . . . . .

▶

$

Part III Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year (see instructions)

24

Cash amounts or FMV of property received, directly or indirectly, during the current tax year, from the foreign trust (exclude loans included on line 25).

(a)

Date of distribution

(b)

Description of property received

(c)

FMV of property received

(determined on date of

distribution)

(d)

Description of

property transferred,

if any

(e)

FMV of property

transferred

(f)

Excess of column (c)

over column (e)

Totals. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

$

25 During the current tax year, did you (or a person related to you) receive a loan from a related foreign trust (including an

extension of credit upon the purchase of property from the trust)? . . . . . . . . . . . . . . . .

Yes No

If “Yes,” complete columns (a) through (g) below for each such loan.

Note. You are considered to have received a loan if you (or a U.S. person related to you) were permitted the

uncompensated use of trust property (as described in section 643(i)). See instructions for additional information,

including how to complete columns (a) through (g) for such transactions.

(a)

FMV of loan proceeds

(b)

Date of original

loan transaction

(c)

Maximum term of

repayment of

obligation

(d)

Interest rate

of obligation

(e)

Is the obligation a

“qualified obligation?”

(f)

FMV of qualified

obligation

(g)

Amount treated as distribution

from the trust (subtract

column (f) from column (a))

Yes No

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

$

26

With respect to each obligation you reported as a “qualified obligation” on line 25: Do you agree to extend the

period of assessment of any income or transfer tax attributable to the transaction, and any consequential income

tax changes for each year that the obligation is outstanding, to a date 3 years after the maturity date of the

obligation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

Note. Generally, you must answer “Yes” if you checked “Yes” in column (e) of line 25.

27 Total distributions received during the current tax year. Add line 24, column (f), and line 25, column (g) . .

▶

$

28 Did the trust, at any time during the tax year, hold an outstanding obligation of yours (or a person related to you)

that you reported as a “qualified obligation” in the current tax year? . . . . . . . . . . . . . .

Yes No

If “Yes,” complete columns (a) through (e) below for each obligation.

(a)

Date of original loan

transaction

(b)

Tax year

qualified obligation

first reported

(c)

Amount of principal

payments made during

the tax year

(d)

Amount of

interest payments

made during

the tax year

(e)

Does the loan still meet the

criteria of a qualified

obligation?

Yes No

Form 3520 (2012)

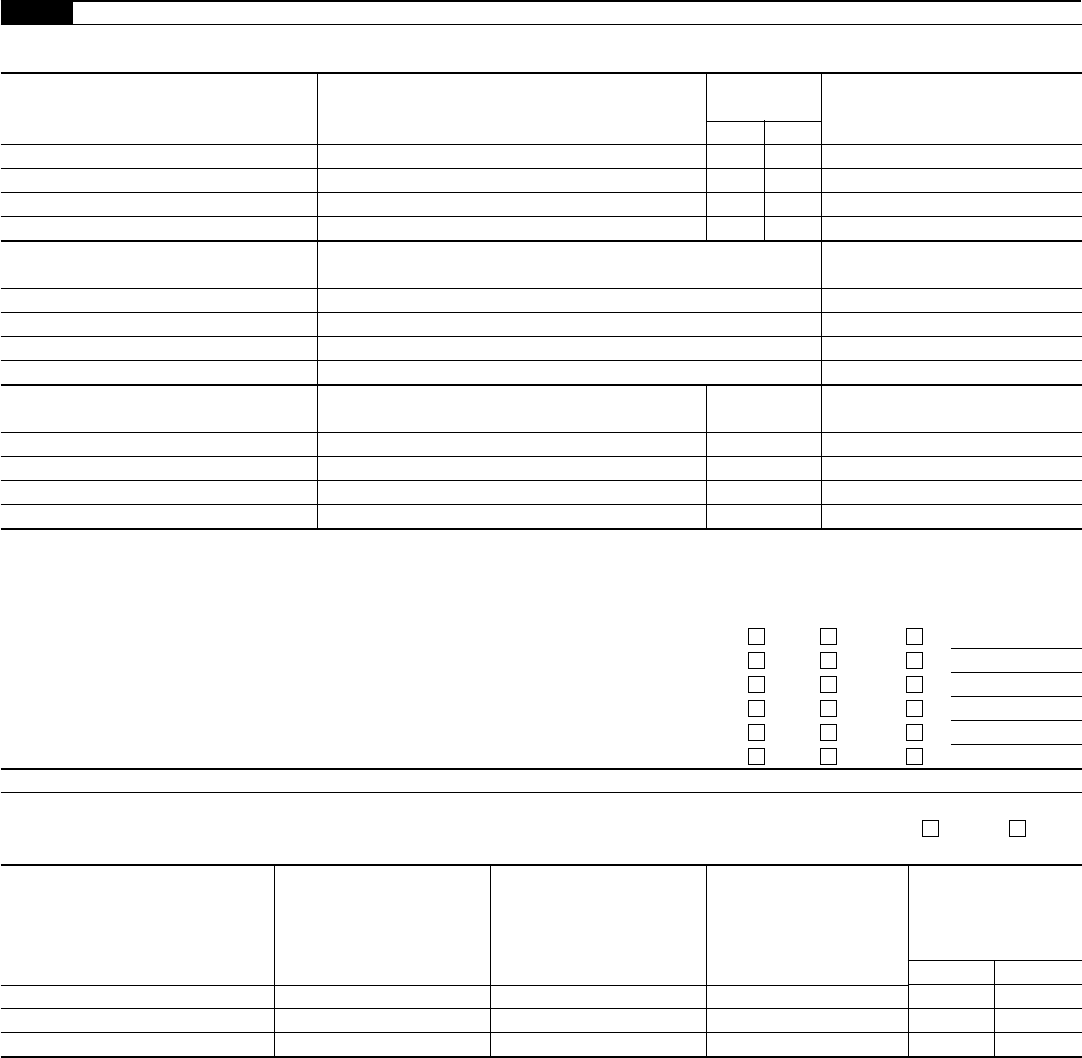

Form 3520 (2012)

Page 5

Part III Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year (Continued)

29 Did you receive a Foreign Grantor Trust Beneficiary Statement from the foreign trust with respect to a

distribution? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No N/A

If “Yes,” attach the statement and do not complete the remainder of Part III with respect to that distribution.

If “No,” complete Schedule A with respect to that distribution. Also complete Schedule C if you enter an

amount greater than zero on line 37.

30 Did you receive a Foreign Nongrantor Trust Beneficiary Statement from the foreign trust with respect to a

distribution? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No N/A

If “Yes,” attach the statement and complete either Schedule A or Schedule B below (see instructions). Also

complete Schedule C if you enter an amount greater than zero on line 37 or line 41a.

If “No,” complete Schedule A with respect to that distribution. Also complete Schedule C if you enter an

amount greater than zero on line 37.

Schedule A—Default Calculation of Trust Distributions (see instructions)

31 Enter amount from line 27 . . . . . . . . . . . . . . . . . . . . . . . . . .

32

Number of years the trust has been a foreign trust (see instructions) . . . . .

▶

33 Enter total distributions received from the foreign trust during the 3 preceding tax years (or during the number of

years the trust has been a foreign trust, if fewer than 3) . . . . . . . . . . . . . . . . . .

34 Multiply line 33 by 1.25 . . . . . . . . . . . . . . . . . . . . . . . . . . .

35 Average distribution. Divide line 34 by 3 (or the number of years the trust has been a foreign trust, if fewer than 3)

and enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36 Amount treated as ordinary income earned in the current year. Enter the smaller of line 31 or line 35. . . . .

37

Amount treated as accumulation distribution. Subtract line 36 from line 31. If -0-, do not complete the rest of Part III

38 Applicable number of years of trust. Divide line 32 by 2 and enter the result here .

▶

Schedule B—Actual Calculation of Trust Distributions (see instructions)

39 Enter amount from line 27 . . . . . . . . . . . . . . . . . . . . . . . . . .

40a Amount treated as ordinary income in the current tax year . . . . . . . . . . . . . . . . .

b

Qualified dividends . . . . . . . . . . . . . . . . . . .

▶

41a Amount treated as accumulation distribution. If -0-, do not complete Schedule C, Part III . . . . . . . .

b

Amount of line 41a that is tax-exempt . . . . . . . . . . . . . .

▶

42a Amount treated as net short-term capital gain in the current tax year . . . . . . . . . . . . . .

b Amount treated as net long-term capital gain in the current tax year . . . . . . . . . . . . . .

c

28% rate gain . . . . . . . . . . . . . . . . . . . . .

▶

d

Unrecaptured section 1250 gain . . . . . . . . . . . . . . .

▶

43 Amount treated as distribution from trust corpus . . . . . . . . . . . . . . . . . . . .

44 Enter any other distributed amount received from the foreign trust not included on lines 40a, 41a, 42a, 42b, and 43

(attach explanation) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

45 Amount of foreign trust’s aggregate undistributed net income . . . . . . . . . . . . . . . .

46 Amount of foreign trust’s weighted undistributed net income . . . . . . . . . . . . . . . .

47 Applicable number of years of trust. Divide line 46 by line 45 and enter the result here

▶

Schedule C—Calculation of Interest Charge (see instructions)

48 Enter accumulation distribution from line 37 or 41a, as applicable . . . . . . . . . . . . . . .

49 Enter tax on total accumulation distribution from line 28 of Form 4970 (attach Form 4970—see instructions) . .

50 Enter applicable number of years of foreign trust from line 38 or 47, as applicable (round

to nearest half-year) . . . . . . . . . . . . . . . . . . .

▶

51 Combined interest rate imposed on the total accumulation distribution (see instructions) . . . . . . . .

52 Interest charge. Multiply the amount on line 49 by the combined interest rate on line 51 . . . . . . . .

53 Tax attributable to accumulation distributions. Add lines 49 and 52. Enter here and as “additional tax” on your

income tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 3520 (2012)

Form 3520 (2012)

Page 6

Part IV

U.S. Recipients of Gifts or Bequests Received During the Current Tax Year From Foreign Persons

(see instructions)

54

During the current tax year, did you receive more than $100,000 that you treated as gifts or bequests from a

nonresident alien or a foreign estate? See instructions for special rules regarding related donors . . . . . .

Yes No

If “Yes,” complete columns (a) through (c) with respect to each such gift or bequest in excess of $5,000. If more space

is needed, attach a statement.

(a)

Date of gift

or bequest

(b)

Description of property received

(c)

FMV of property received

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

$

55 During the current tax year, did you receive more than $14,723 that you treated as gifts from a foreign corporation or a

foreign partnership? See instructions regarding related donors . . . . . . . . . . . . . . . . .

Yes No

If “Yes,” complete columns (a) through (g) with respect to each such gift. If more space is needed, attach a statement.

(a)

Date of gift

(b)

Name of foreign donor

(c)

Address of foreign donor

(d)

Identification number,

if any

(e)

Check the box that applies to the foreign donor

(f)

Description of property received

(g)

FMV of property received

Corporation Partnership

56 Do you have any reason to believe that the foreign donor, in making any gift or bequest described in lines 54 and 55,

was acting as a nominee or intermediary for any other person? If “Yes,” see instructions . . . . . . . . .

Yes No

Form 3520 (2012)