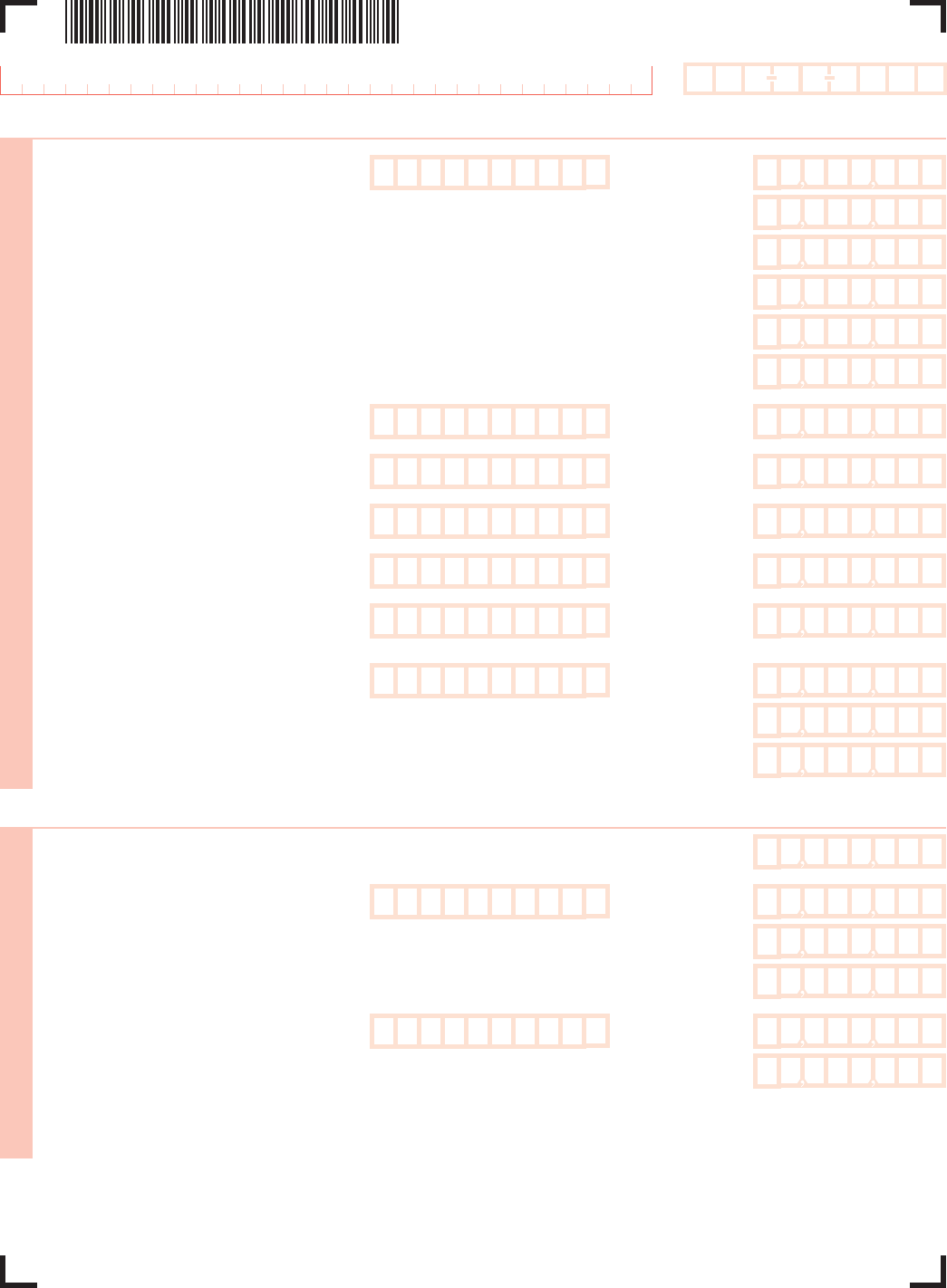

Fillable Printable Form 355 2013

Fillable Printable Form 355 2013

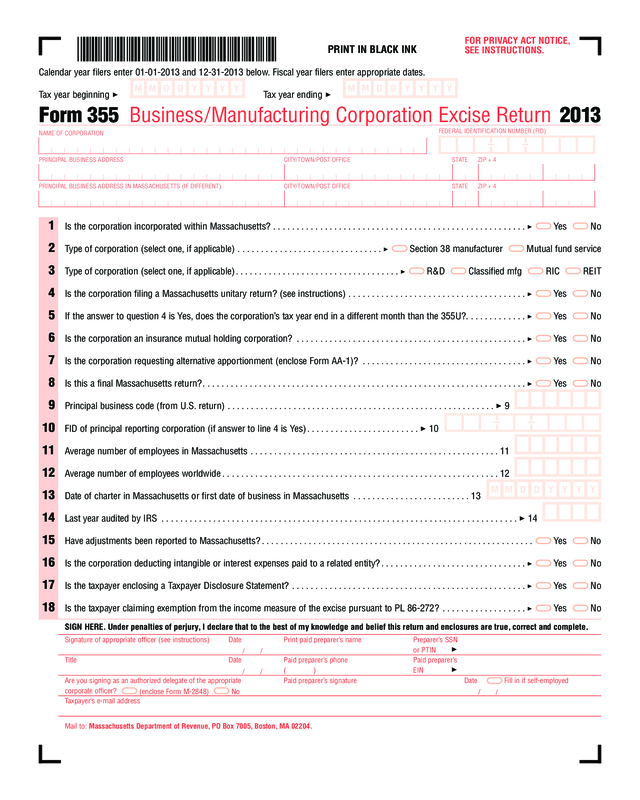

Form 355 2013

File pg. 1

FOR PRIVACY ACT NOTICE,

SEE INSTRUCTIONS.

PRINT IN BLACK INK

Calendar year filers enter 01-01-2013 and 12-31-2013 below. Fiscal year filers enter appropriate dates.

Tax year beginning 3 Tax year ending 3

F

EDERAL IDENTIFICATION NUMBER (FID)

Form 355 Business/Manufacturing Corporation Excise Return 2013

NAME OF CORPORATION

PRINCIPAL BUSINESS ADDRESS CITY/ TOWN/POST OFFICE STATE ZIP + 4

P

RINCIPAL BUSINESS ADDRESS IN MASSACHUSETTS (IF DIFFERENT) CITY/ TOWN/POST OFFICE STATE ZIP + 4

1 Is the corporation incorporated within Massachusetts? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Yes No

2 Type of corporation (select one, if applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Section 38 manufacturer Mutual fund service

3 Type of corporation (select one, if applicable). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 R&D Classified mfg RIC REIT

4 Is the corporation filing a Massachusetts unitary return? (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Yes No

5 If the answer to question 4 is Yes, does the corporation’s tax year end in a different month than the 355U?. . . . . . . . . . . . . 3 Yes No

6 Is the corporation an insurance mutual holding corporation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Yes No

7 Is the corporation requesting alternative apportionment (enclose Form AA-1)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Yes No

8 Is this a final Massachusetts return?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Yes No

9 Principal business code (from U.S. return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

10 FID of principal reporting corporation (if answer to line 4 is Yes). . . . . . . . . . . . . . . . . . . . . . . . 3 10

11 Average number of employees in Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Average number of employees worldwide . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Date of charter in Massachusetts or first date of business in Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Last year audited by IRS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Have adjustments been reported to Massachusetts? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

16 Is the corporation deducting intangible or interest expenses paid to a related entity?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Yes No

17 Is the taxpayer enclosing a Taxpayer Disclosure Statement? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Yes No

18 Is the taxpayer claiming exemption from the income measure of the excise pursuant to PL 86-272? . . . . . . . . . . . . . . . . . . 3 Yes No

SIGN HERE. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Signature of appropriate officer (see instructions) Date Print paid preparer’s name Preparer’s SSN

/ /

or PTIN

3

Title Date Paid preparer’s phone Paid preparer’s

/ /

() EIN

3

Are you signing as an authorized delegate of the appropriate Paid preparer’s signature Date Fill in if self-employed

corporate officer?

(enclose Form M-2848) No

/ /

Taxpayer’s e-mail address

Mail to: Massachusetts Department of Revenue, PO Box 7005, Boston, MA 02204.

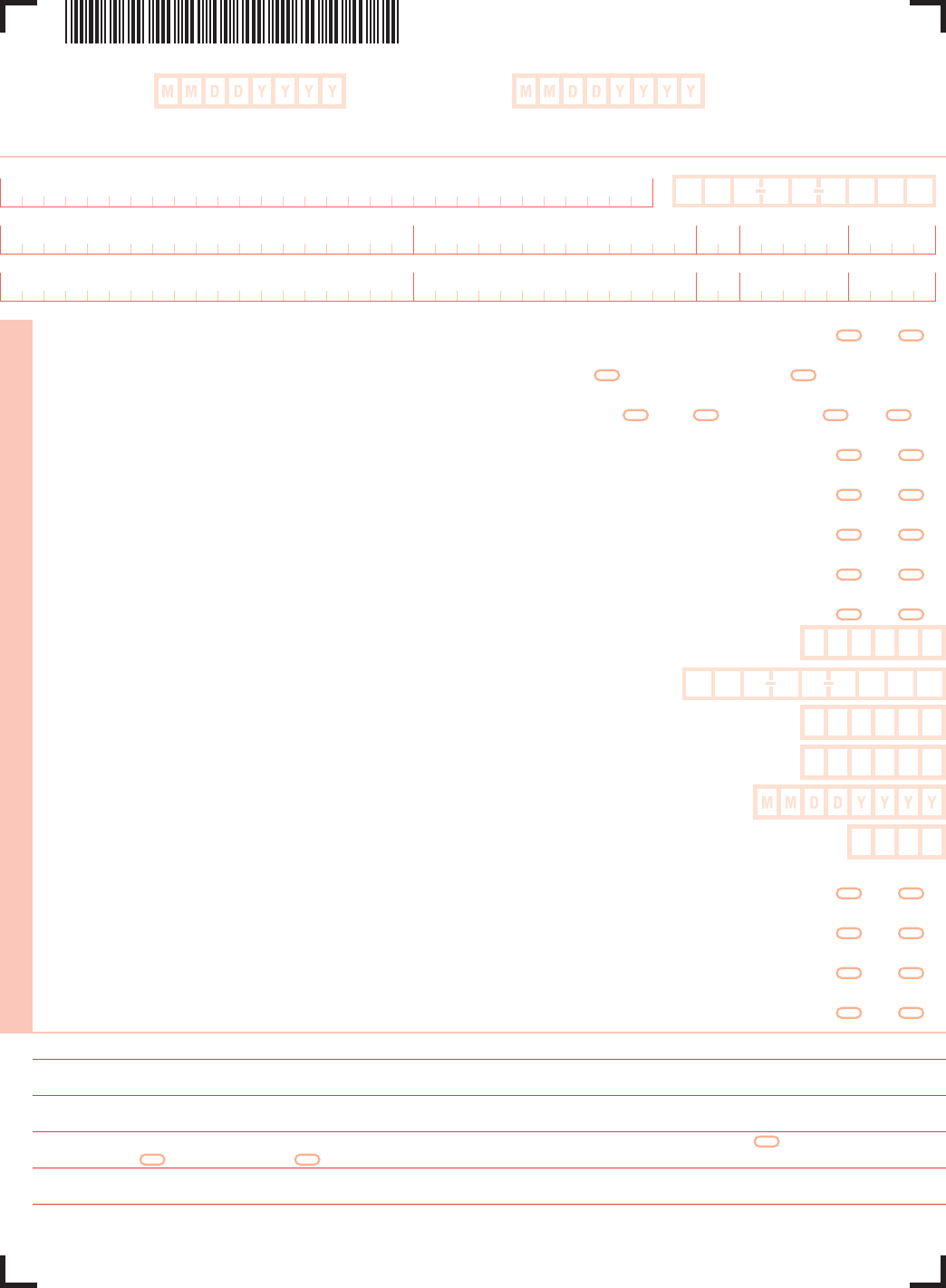

File pg. 2

1 Taxable Massachusetts tangible property,

if applicable (from Schedule C, line 4) . . . . . . 3 × .0026 = 3 1

2 T

axable net worth, if applicable (from

Schedule D, line 10) . . . . . . . . . . . . . . . . . . . . 3 × .0026 = 3 2

3 Massachusetts taxable income (from Schedule E,

line 27). Not less than “0” . . . . . . . . . . . . . . . . . . . . . 3 × .0800 = 3 3

4 Credit recapture (enclose Schedule(s) H and/or H-2). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Additional tax on installment sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

6 Excise before credits. Add line 1 or 2, whichever applies, to total of lines 3 through 5 . . . . . . . . . . . . . . . . 6

7 Total credits (from Schedule CR, line 14; unitary filers, see instructions). . . . . . . . . . . . . . . . . . . . . . . . . 3 7

8 Excise after credits. Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Combined filers only, enter the amount of tax from Schedule U-ST, line 41 . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Minimum excise (cannot be prorated; unitary filers, see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Excise due before voluntary contribution. (line 8 or 10, whichever is greater) . . . . . . . . . . . . . . . . . . . . . . 11

12 Voluntary contribution for endangered wildlife conservation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Excise due plus voluntary contribution. Add lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 13

14 2012 overpayment applied to your 2013 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 2013 Massachusetts estimated tax payments (do not include amount in line 14) . . . . . . . . . . . . . . . . . 3 15

16 Payment made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Pass-through entity withholding (from Schedule 3K-1)

Payer ID number 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Total refundable credits (from Schedule RF, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 18

19 Total payments. Add lines 14 through 18. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Amount overpaid. Subtract line 13 from line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Amount overpaid to be credited to 2014 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 21

22 Amount overpaid to be refunded. Subtract line 21 from line 20 . . . . . . . . . . . . . . . . . . . . . . . . Refund 3 22

23 Balance due. Subtract line 19 from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Balance due 3 23

24 a. M-2220 penalty 3 b. Late file/pay penalties . . . . a + b = 24

25 Interest on unpaid balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Payment due at time of filing. Make check payable to Commonwealth of Massachusetts . . . Total due 3 26

2

013 FORM 355, PAGE 2

EXCISE CALCULATION

2

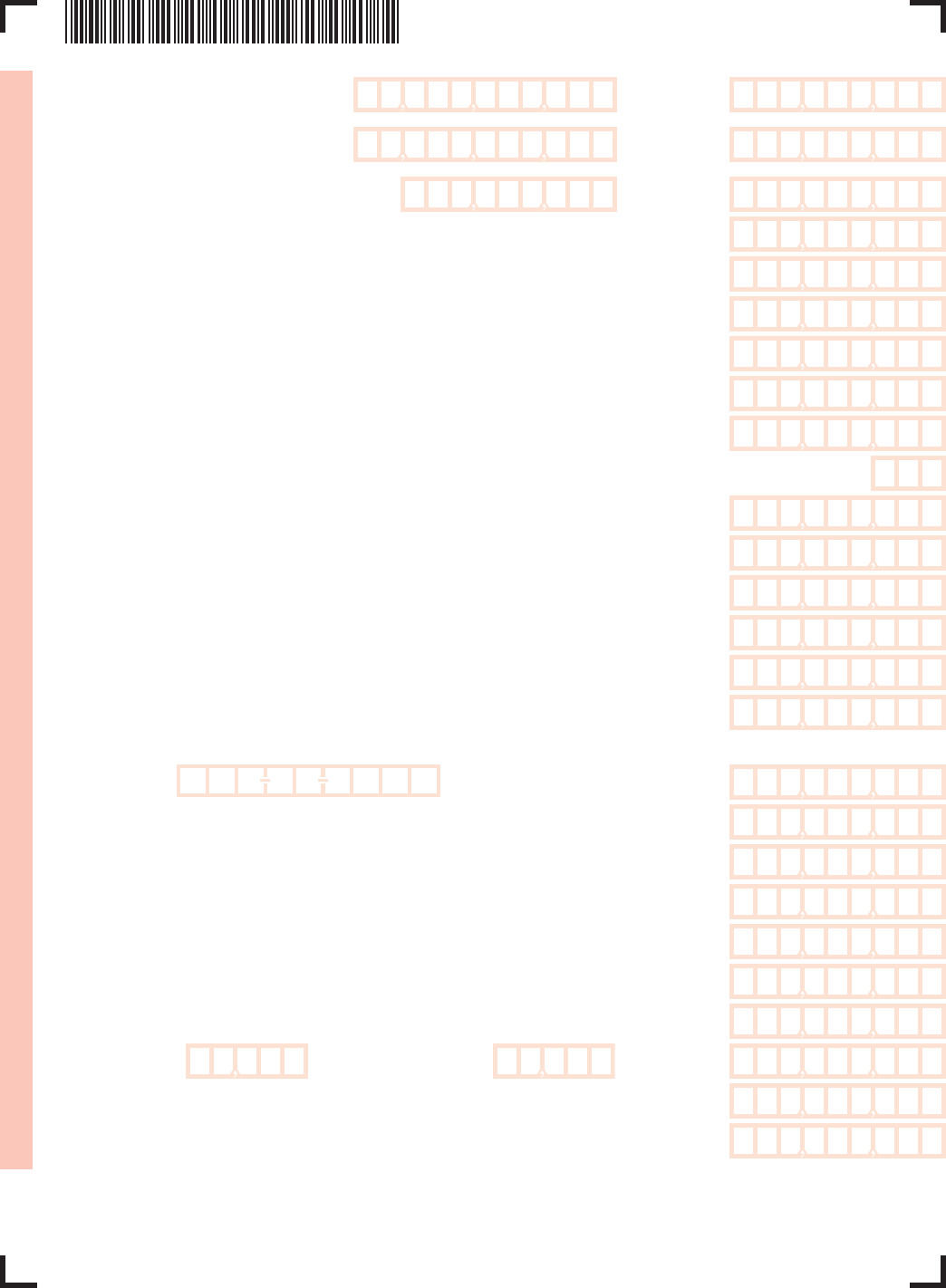

013 FORM 355, PAGE 3

C

ORPORATION NAME

FEDERAL IDENTIFICATION NUMBER

Schedule A Balance Sheet 2013

A. B. ACCUMULATED DEPRECIATION C.

ASSETS ORIGINAL COST AND AMORTIZATION NET BOOK VALUE

1 C

apital assets in Massachusetts:

a. Buildings . . . . . . . . . . . . . . . . . . 3 1a 3

b. Land. . . . . . . . . . . . . . . . . . . . . . 3 1b

c. Motor vehicles and trailers . . . . 3 1c 3

d. Machinery taxed locally. . . . . . . 3 1d 3

e. Machinery not taxed locally. . . . . . 1e

f. Equipment . . . . . . . . . . . . . . . . . . . 1f

g. Fixtures . . . . . . . . . . . . . . . . . . . . . 1g

h. Leasehold improvements taxed

locally . . . . . . . . . . . . . . . . . . . . . . . 3 1h 3

i. Leasehold improvements not

taxed locally . . . . . . . . . . . . . . . . . . . . 1i

j. Other fixed depreciable assets . . . . 1j

k. Construction in progress. . . . . . . . 1k

l. Total capital assets in Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1l

2 Inventories in Massachusetts:

a. General merchandise . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b. Exempt goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2b

3 Supplies and other non-depreciable assets in Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total tangible assetts in Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Capital assets outside of Massachusetts:

a. Buildings and other depreciable

assets . . . . . . . . . . . . . . . . . . . . . . . . . 5a

b. Land. . . . . . . . . . . . . . . . . . . . . . . . 5b

6 Leaseholds/leasehold improvements

outside Massachusetts . . . . . . . . . . . . 6

7 Total capital assets outside

Massachusetts . . . . . . . . . . . . . . . . . 3 7 3

BE SURE TO CONTINUE SCHEDULE A ON OTHER SIDE

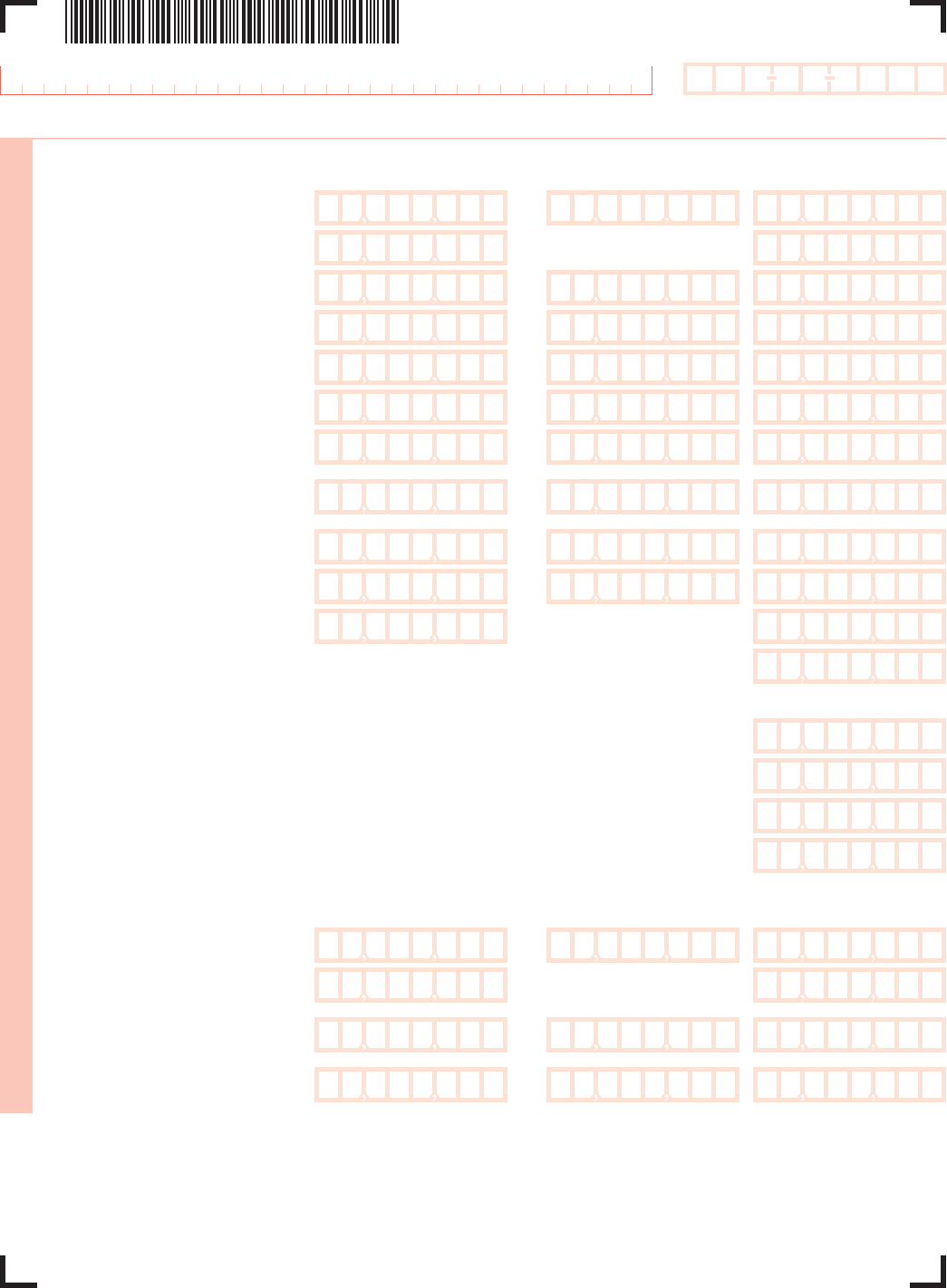

File pg. 4

8 Inventories outside Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Supplies and other non-depreciable assets outside Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total tangible assets outside of Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total tangible assets. Add lines 4 and 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Investments (capital stock investments and equity contributions only):

a. Investments in subsidiary corporations at least 80% owned (enclose Schedule A-1) . . . . . . . . . . . . . . 3 12a

b. Other investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12b

13 Notes receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Intercompany receivables (enclose Schedule A-2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 18

LIABILITIES AND CAPITAL

19 Mortgages on:

a. Massachusetts tangible property taxed locally . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19a

b. Other tangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19b

20 Bonds and other funded debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Intercompany payables (enclose Schedule A-3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

23 Notes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Miscellaneous current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Miscellaneous accrued liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 26

27 Total capital stock issued . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Paid-in or capital surplus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Retained earnings and surplus reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 29

30 Undistributed S corporation net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 30

31 Total capital. Add lines 27 through 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Treasury stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

33 Total liabilities and capital. Do not enter less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

FEDERAL IDENTIFICATION NUMBER

2013 FORM 355, PAGE 4

5

If a loss, mark an X in box at left

2

013 FORM 355, PAGE 5

C

ORPORATION NAME

FEDERAL IDENTIFICATION NUMBER

Schedule B Tangible or Intangible Property Corporation Classification 2013

Enter all values as net book values from Schedule A, col. c.

1 T

otal Massachusetts tangible property (from Schedule A, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Massachusetts real estate (from Schedule A, lines 1a and 1b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Massachusetts motor vehicles and trailers (from Schedule A, line 1c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Massachusetts machinery taxed locally. Classified manufacturers enter “0” (from Schedule A, line 1d). . . . . . 4

5 Massachusetts leasehold improvements taxed locally (from Schedule A, line 1h) . . . . . . . . . . . . . . . . . . . . . . . 5

6 Massachusetts tangible property taxed locally. Add lines 2 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

7 Massachusetts tangible property not taxed locally. Subtract line 6 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Total assets (from Schedule A, line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Massachusetts tangible property taxed locally (from line 6 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total assets not taxed locally. Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Investments in subsidiaries at least 80% owned (from Schedule A, line 12a) . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Assets subject to allocation. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Income apportionment percentage (from Schedule F, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Allocated assets. Multiply line 12 by line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Tangible property percentage. Divide line 7 by line 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Schedule C Tangible Property Corporation

Complete only if Sched. B, line 15 is 10% or more. Enter all values as net book values from Sched. A, col. c.

1 Total Massachusetts tangible property (from Schedule A, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Exempt Massachusetts tangible property:

a. Massachusetts real estate (from Schedule A, lines 1a and 1b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b. Massachusetts motor vehicles and trailers (from Schedule A, line 1c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

c. Massachusetts machinery taxed locally. Classified manufacturers enter “0” (from Schedule A, line 1d) . . 2c

d. Massachusetts leasehold improvements taxed locally (from Schedule A, line 1h). . . . . . . . . . . . . . . . . . . . 2d

e. Exempt goods (from Schedule A, line 2b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e

f. Certified Massachusetts industrial waste/air treatment facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2f

g. Certified Massachusetts solar or wind power deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2g

3 Total exempt Massachusetts tangible property. Add lines 2a through 2g . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Taxable Massachusetts tangible property. Subtract line 3 from line 1. Do not enter less than “0.”

Enter result in line 1 of the Excise Calculation on page 2, and enter “0” in line 2 of the Excise Calculation. . . . 4

2

013 FORM 355, PAGE 6

C

ORPORATION NAME

FEDERAL IDENTIFICATION NUMBER

Schedule D Intangible Property Corporation 2013

Complete only if Sched. B, line 15 is less than 10%. Enter all values as net book values from Sched. A, col. c.

1 T

otal assets (from Schedule A, line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total liabilities (from Schedule A, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Massachusetts tangible property taxed locally (from Schedule B, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Mortgages on Massachusetts tangible property taxed locally (from Schedule A, line 19a) . . . . . . . . . . . . . . . . 4

5 Subtract line 4 from line 3. Do not enter less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Investments in subsidiaries at least 80% owned (from Schedule A, line 12a) . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Deductions from total assets. Add lines 2, 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Allocable net worth. Subtract line 7 from line 1. Do not enter less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Income apportionment percentage (from Schedule F, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Taxable net worth. Multiply line 8 by line 9. Enter result in line 2 of the Excise Calculation on page 2, and

enter “0” in line 1 of the Excise Calculation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Schedule E-1 Dividends Deduction

1 Total dividends. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Dividends from Massachusetts corporate trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Dividends from non-wholly-owned DISCs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Dividends, if less than 15% of voting stock owned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Dividends from RICs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Dividends from REITs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Total taxable dividends. Add lines 2 through 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Dividends eligible for deduction. Subtract line 7 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Dividends deduction. Multiply line 8 by .95 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

2

013 FORM 355, PAGE 7

C

ORPORATION NAME

FEDERAL IDENTIFICATION NUMBER

Schedule E Taxable Income 2013

1 G

ross receipts or sales (from U.S. Form 1120, line 1e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

2 Gross profit (from U.S. Form 1120, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3 Other deductions (from U.S. Form 1120, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 Net income (from U.S. Form 1120, line 28). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Allowable U.S. wage credit. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 State and municipal bond interest not included in U.S. net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

8 Foreign, state or local income, franchise, excise or capital stock taxes deducted from U.S. net income 3 8

9 Section 168(k) “bonus” depreciation adjustment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

10 Section 31I and 31K intangible expense add back adjustment. See instructions . . . . . . . . . . . . . . . . . . . . . 3 10

11 Section 31J and 31K interest expense add back adjustment. See instructions . . . . . . . . . . . . . . . . . . . . . . . 3 11

12 Federal production activity add back adjustment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Other adjustments, including research and development expenses. See instructions . . . . . . . . . . . . . . 3 13

14 Add lines 6 through 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Abandoned building renovation deduction. . . . . . . . . . . . . . . . . × .10 = 3 15

16 Dividends deduction (from Schedule E-1, line 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Exception(s) to the add back of intangible expenses (enclose Schedule ABIE). . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Exception(s) to the add back of interest expenses (enclose Schedule ABI) . . . . . . . . . . . . . . . . . . . . . . . . . 3 18

19 Income subject to apportionment. Subtract the total of lines 15 through 18 from line 14. . . . . . . . . . . . . 19

20 Income apportionment percentage (from Schedule F, line 5 or 1.0, whichever applies). . . . . . . . . . . . . . . . . . . 3 20

21 Multiply line 19 by line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Income not subject to apportionment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

23 Total net income allocated or apportioned to Massachusetts. Add lines 21 and 22 . . . . . . . . . . . . . . . . 3 23

24 Certified Massachusetts solar or wind power deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 24

25 Massachusetts taxable income before net operating loss deduction. Subtract line 24 from line 23 . . . . . 25

26 Net operating loss deduction (enclose Schedule NOL) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 26

27 Massachusetts taxable income. Subtract line 26 from line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Total net operating loss available for carryover to future years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 28

5

If a loss, mark an X in box at left

2

013 FORM 355, PAGE 8

C

ORPORATION NAME

FEDERAL IDENTIFICATION NUMBER

Schedule CR Other Corporate Credits 2013

1 Economic Development Incentive Program credit

Certificate number . . . . . . . . . . . . . . . . . . . . . . . . 3 . . . . . . . . . . . . . 3 1

2 Economic Opportunity Area credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3 3% credit for certain new or expanded investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 Vanpool credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Research credit (from Schedule RC, part 2, line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

6 Harbor Maintenance Tax credit (from Schedule HM, line 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

7 Brownfields credit

Certificate number . . . . . . . . . . . . . . . . . . . . . . . . 3 . . . . . . . . . . . . . 3 7

8 Low-Income Housing credit

Building Identification number. . . . . . . . . . . . . . . 3 . . . . . . . . . . . . . 3 8

9 Historic Rehabilitation credit

Certificate number . . . . . . . . . . . . . . . . . . . . . . . . 3 . . . . . . . . . . . . . 3 9

10 Film Incentive credit

Certificate number . . . . . . . . . . . . . . . . . . . . . . . . 3 . . . . . . . . . . . . 3 10

11 Medical Device credit

Certificate number . . . . . . . . . . . . . . . . . . . . . . . . 3 . . . . . . . . . . . . 3 11

12 Employer Wellness Program credit

Certificate number . . . . . . . . . . . . . . . . . . . . . . . . 3 . . . . . . . . . . . . 3 12

13 Life Science Company credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 13

14 Total credits. Add lines 1 through 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Schedule RF Refundable Credits

1 Refundable Film credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

2 Refundable Dairy credit

Certificate number . . . . . . . . . . . . . . . . . . . . . . . . 3 . . . . . . . . . . . . . 3 2

3 Refundable Life Science credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 Refundable Economic Development Incentive credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Conservation Land credit

Certificate number . . . . . . . . . . . . . . . . . . . . . . . . 3 . . . . . . . . . . . . . 3 5

6 Total refundable credits. Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

An exact copy of U.S. Form 1120 including all applicable schedules and forms and any other documentation required to substantiate entries

made on this return, must be made available to the Department of Revenue upon request. See instructions.