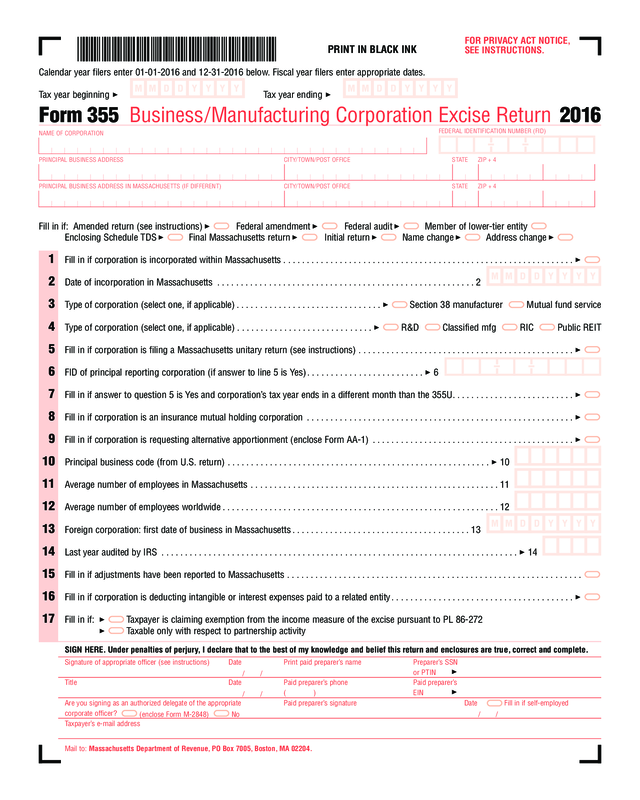

Fillable Printable Form 355 2016

Fillable Printable Form 355 2016

Form 355 2016

File pg. 1

FOR PRIVACY ACT NOTICE,

SEE INSTRUCTIONS.

PRINT IN BLACK INK

Calendar year filers enter 01-01-2016 and 12-31-2016 below. Fiscal year filers enter appropriate dates.

Tax year beginning 3Tax year ending 3

FEDERAL IDENTIFICATION NUMBER (FID)

Form 355 Business/Manufacturing Corporation Excise Return2016

NAME OF CORPORATION

PRINCIPAL BUSINESS ADDRESSCITY/TOWN/POST OFFICESTATEZIP + 4

PRINCIPAL BUSINESS ADDRESS IN MASSACHUSETTS (IF DIFFERENT)CITY/TOWN/POST OFFICESTATEZIP + 4

Fill in if: Amended return (see instructions)3Federal amendment3Federal audit3Member of lower-tier entity

Enclosing Schedule TDS3Final Massachusetts return3Initial return3Name change3Address change3

1Fill in if corporation is incorporated within Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

2Date of incorporation in Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3Type of corporation (select one, if applicable). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3Section 38 manufacturer Mutual fund service

4Type of corporation (select one, if applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3R&D Classified mfg RIC Public REIT

5Fill in if corporation is filing a Massachusetts unitary return (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

6FID of principal reporting corporation (if answer to line 5 is Yes). . . . . . . . . . . . . . . . . . . . . . . . . 36

7Fill in if answer to question 5 is Yes and corporation’s tax year ends in a different month than the 355U. . . . . . . . . . . . . . . . . . . . . . . . . . 3

8Fill in if corporation is an insurance mutual holding corporation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

9Fill in if corporation is requesting alternative apportionment (enclose Form AA-1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

10Principal business code (from U.S. return). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 310

11Average number of employees in Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12Average number of employees worldwide. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13Foreign corporation: first date of business in Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14Last year audited by IRS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 314

15Fill in if adjustments have been reported to Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16Fill in if corporation is deducting intangible or interest expenses paid to a related entity. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

17Fill in if: 3Taxpayer is claiming exemption from the income measure of the excise pursuant to PL 86-272

3Taxable only with respect to partnership activity

SIGN HERE. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Signature of appropriate officer (see instructions)DatePrint paid preparer’s namePreparer’s SSN

/ /

or PTIN

3

TitleDatePaid preparer’s phonePaid preparer’s

/ /

()EIN

3

Are you signing as an authorized delegate of the appropriatePaid preparer’s signatureDateFill in if self-employed

corporate officer?

(enclose Form M-2848)No

/ /

Taxpayer’s e-mail address

Mail to: Massachusetts Department of Revenue, PO Box 7005, Boston, MA 02204.

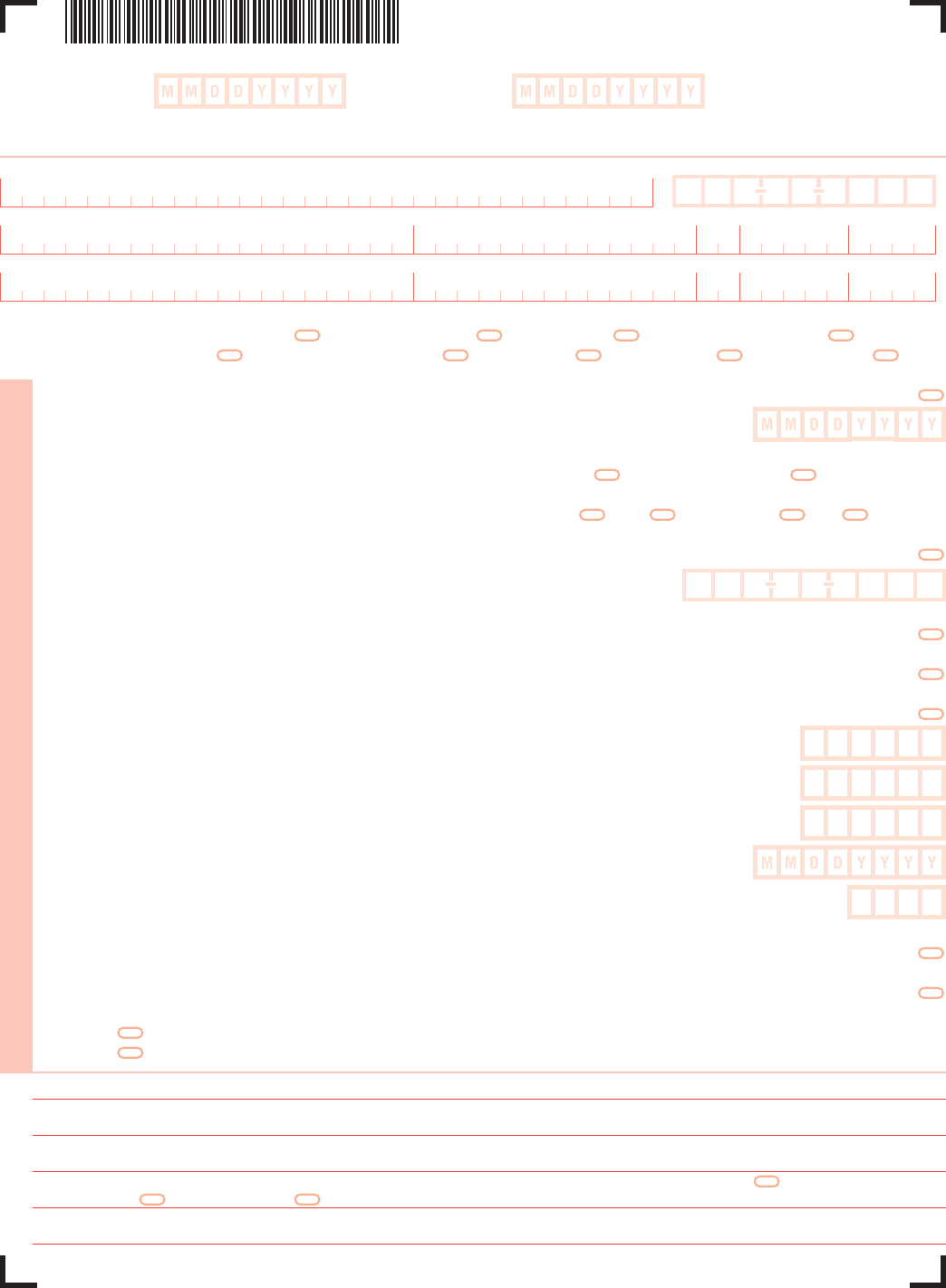

File pg. 2

1Taxable Massachusetts tangible property,

if applicable (from Schedule C, line 4). . . . . . 3×.0026 = 31

2Taxable net worth, if applicable (from

Schedule D, line 10) . . . . . . . . . . . . . . . . . . . . 3×.0026 = 32

3Massachusetts taxable income (from Schedule E,

line 27). Not less than “0”. . . . . . . . . . . . . . . . . . . . . 3×.0800 = 33

4Credit recapture (enclose Credit Recapture Schedule). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . 34

5Additional tax on installment sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

6Excise before credits. Add line 1 or 2, whichever applies, to total of lines 3 through 5. . . . . . . . . . . . . . . . 6

7Total credits (from Credit Manager Schedule; unitary filers, see instructions). . . . . . . . . . . . . . . . . . . . . 37

8Excise after credits. Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9Combined filers only, enter the amount of tax from Schedule U-ST, line 41. . . . . . . . . . . . . . . . . . . . . . . . . 9

10Minimum excise (cannot be prorated; unitary filers, see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11Excise due before voluntary contribution. (line 8 or 10, whichever is greater) . . . . . . . . . . . . . . . . . . . . . . 11

12Voluntary contribution for endangered wildlife conservation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 312

13Excise due plus voluntary contribution. Add lines 11 and 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 313

142015 overpayment applied to your 2016 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 314

152016 Massachusetts estimated tax payments (do not include amount in line 14). . . . . . . . . . . . . . . . . 315

16Payment made with extension. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 316

17Pass-through entity withholding (from Schedule 3K-1)

Payer ID number 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 317

18Total refundable credits (from Credit Manager Schedule). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 318

19Total payments. Add lines 14 through 18. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20Amount overpaid. Subtract line 13 from line 19. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21Amount overpaid to be credited to 2017 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .321

22Amount overpaid to be refunded. Subtract line 21 from line 20. . . . . . . . . . . . . . . . . . . . . . . . Refund 322

23Balance due. Subtract line 19 from line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Balance due323

24a. M-2220 penalty 3b. Late file/pay penalties. . . . a + b = 24

25Interest on unpaid balance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26Payment due at time of filing. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total due 326

2016 FORM 355, PAGE 2

EXCISE CALCULATION

2016 FORM 355, PAGE 3

CORPORATION NAME

FEDERAL IDENTIFICATION NUMBER

Schedule A Balance Sheet2016

A.B. ACCUMULATED DEPRECIATIONC.

ASSETSORIGINAL COSTAND AMORTIZATIONNET BOOK VALUE

1Capital assets in Massachusetts:

a.Buildings. . . . . . . . . . . . . . . . . . 31a3

b.Land. . . . . . . . . . . . . . . . . . . . . . 31b

c.Motor vehicles and trailers. . . . 31c3

d.Machinery taxed locally. . . . . . . 31d3

e.Machinery not taxed locally. . . . . . 1e

f.Equipment. . . . . . . . . . . . . . . . . . . 1f

g.Fixtures. . . . . . . . . . . . . . . . . . . . . 1g

h.Leasehold improvements taxed

locally. . . . . . . . . . . . . . . . . . . . . . . 31h3

i.Leasehold improvements not

taxed locally. . . . . . . . . . . . . . . . . . . . 1i

j.Other fixed depreciable assets. . . . 1j

k.Construction in progress. . . . . . . . 1k

l.Total capital assets in Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31l

2Inventories in Massachusetts:

a.General merchandise. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b.Exempt goods. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32b

3Supplies and other non-depreciable assets in Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4Total tangible assetts in Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

5Capital assets outside of Massachusetts:

a.Buildings and other depreciable

assets. . . . . . . . . . . . . . . . . . . . . . . . . 5a

b.Land. . . . . . . . . . . . . . . . . . . . . . . . 5b

6Leaseholds/leasehold improvements

outside Massachusetts. . . . . . . . . . . . 6

7Total capital assets outside

Massachusetts. . . . . . . . . . . . . . . . . 373

BE SURE TO CONTINUE SCHEDULE A ON OTHER SIDE

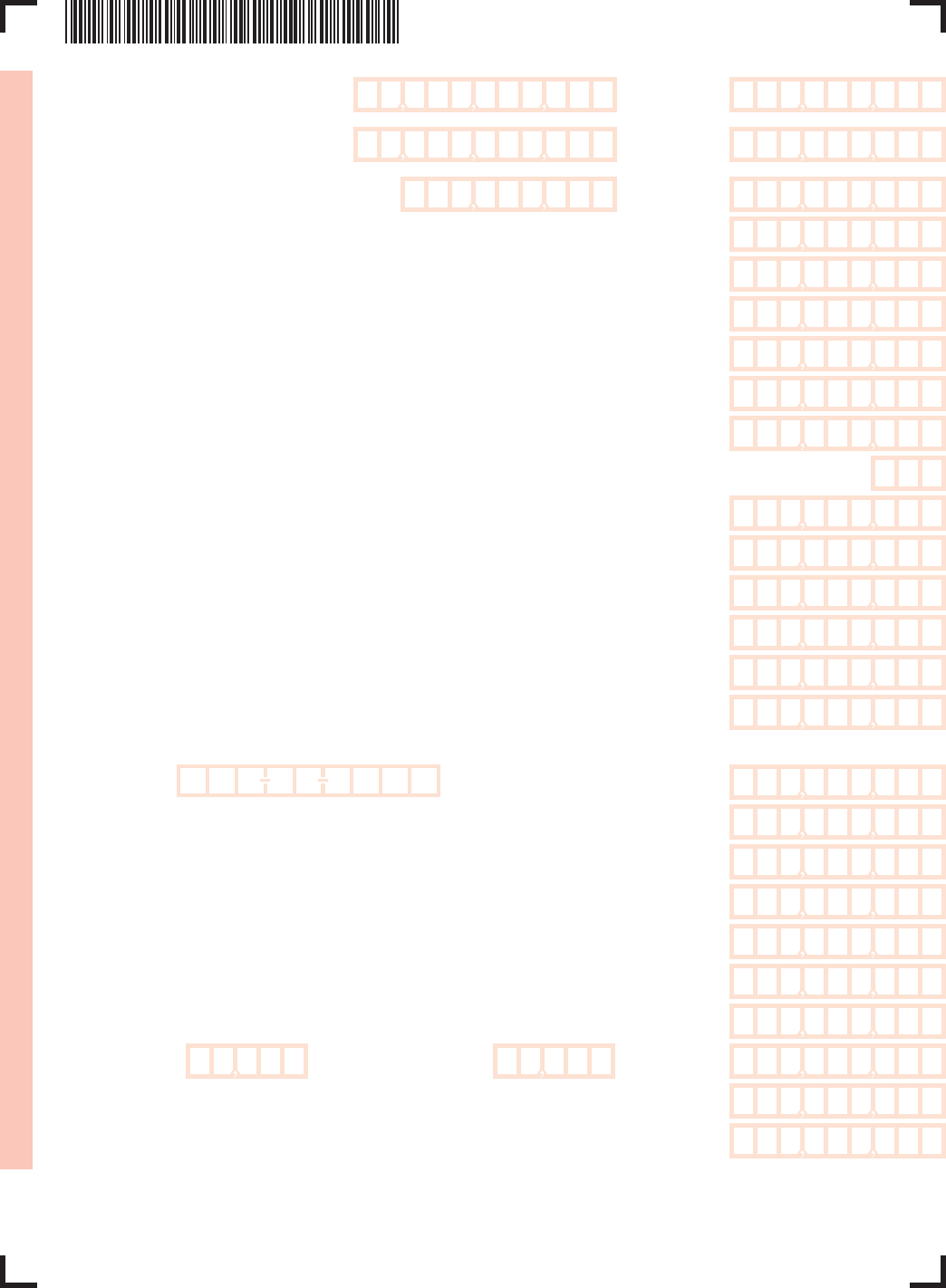

File pg. 4

8Inventories outside Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9Supplies and other non-depreciable assets outside Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10Total tangible assets outside of Massachusetts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11Total tangible assets. Add lines 4 and 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12Investments (capital stock investments and equity contributions only):

a.Investments in subsidiary corporations at least 80% owned. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 312a

b.Other investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 312b

13Notes receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14Accounts receivable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15Intercompany receivables. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 315

16Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17Other assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 318

LIABILITIES AND CAPITAL

19Mortgages on:

a.Massachusetts tangible property taxed locally. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19a

b.Other tangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19b

20Bonds and other funded debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21Accounts payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22Intercompany payables. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 322

23Notes payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24Miscellaneous current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25Miscellaneous accrued liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26Total liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 326

27Total capital stock issued. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28Paid-in or capital surplus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29Retained earnings and surplus reserves. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 329

30Undistributed S corporation net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 330

31Total capital. Add lines 27 through 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32Treasury stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

33Total liabilities and capital. Do not enter less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

FEDERAL IDENTIFICATION NUMBER

2016 FORM 355, PAGE 4

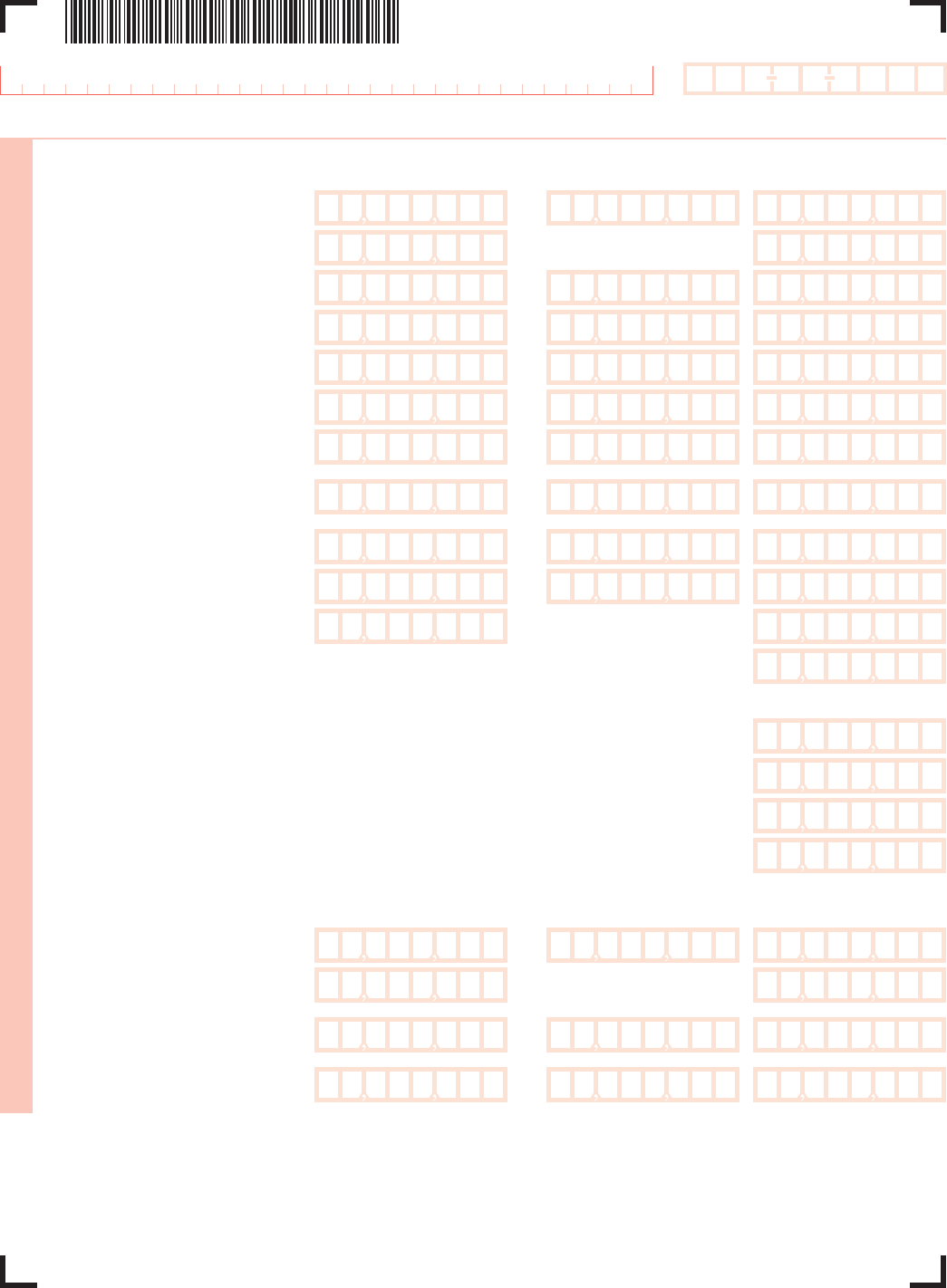

5

If a loss, mark an X in box at left

2016 FORM 355, PAGE 5

CORPORATION NAME

FEDERAL IDENTIFICATION NUMBER

Schedule B Tangible or Intangible Property Corporation Classification2016

Enter all values as net book values from Schedule A, col. c.

1Total Massachusetts tangible property (from Schedule A, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2Massachusetts real estate (from Schedule A, lines 1a and 1b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3Massachusetts motor vehicles and trailers (from Schedule A, line 1c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4Massachusetts machinery taxed locally. Classified manufacturers enter “0” (from Schedule A, line 1d). . . . . . 4

5Massachusetts leasehold improvements taxed locally (from Schedule A, line 1h). . . . . . . . . . . . . . . . . . . . . . . 5

6Massachusetts tangible property taxed locally. Add lines 2 through 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .36

7Massachusetts tangible property not taxed locally. Subtract line 6 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . 7

8Total assets (from Schedule A, line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9Massachusetts tangible property taxed locally (from line 6 above). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10Total assets not taxed locally. Subtract line 9 from line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11Investments in subsidiaries at least 80% owned (from Schedule A, line 12a). . . . . . . . . . . . . . . . . . . . . . . . . 11

12Assets subject to allocation. Subtract line 11 from line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13Income apportionment percentage (from Schedule F, line 5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14Allocated assets. Multiply line 12 by line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 314

15Tangible property percentage. Divide line 7 by line 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Schedule C Tangible Property Corporation

Complete only if Sched. B, line 15 is 10% or more. Enter all values as net book values from Sched. A, col. c.

1Total Massachusetts tangible property (from Schedule A, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2Exempt Massachusetts tangible property:

a.Massachusetts real estate (from Schedule A, lines 1a and 1b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b.Massachusetts motor vehicles and trailers (from Schedule A, line 1c). . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

c.Massachusetts machinery taxed locally. Classified manufacturers enter “0” (from Schedule A, line 1d). . 2c

d.Massachusetts leasehold improvements taxed locally (from Schedule A, line 1h). . . . . . . . . . . . . . . . . . . . 2d

e.Exempt goods (from Schedule A, line 2b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e

f.Certified Massachusetts industrial waste/air treatment facilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2f

g.Certified Massachusetts solar or wind power deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2g

3Total exempt Massachusetts tangible property. Add lines 2a through 2g . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4Taxable Massachusetts tangible property. Subtract line 3 from line 1. Do not enter less than “0.”

Enter result in line 1 of the Excise Calculation on page 2, and enter “0” in line 2 of the Excise Calculation. . . . 4

2016 FORM 355, PAGE 6

CORPORATION NAME

FEDERAL IDENTIFICATION NUMBER

Schedule D Intangible Property Corporation2016

Complete only if Sched. B, line 15 is less than 10%. Enter all values as net book values from Sched. A, col. c.

1Total assets (from Schedule A, line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2Total liabilities (from Schedule A, line 26). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3Massachusetts tangible property taxed locally (from Schedule B, line 6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4Mortgages on Massachusetts tangible property taxed locally (from Schedule A, line 19a). . . . . . . . . . . . . . . . 4

5Subtract line 4 from line 3. Do not enter less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6Investments in subsidiaries at least 80% owned (from Schedule A, line 12a). . . . . . . . . . . . . . . . . . . . . . . . . . 6

7Deductions from total assets. Add lines 2, 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8Allocable net worth. Subtract line 7 from line 1. Do not enter less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9Income apportionment percentage (from Schedule F, line 5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10Taxable net worth. Multiply line 8 by line 9. Enter result in line 2 of the Excise Calculation on page 2, and

enter “0” in line 1 of the Excise Calculation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Schedule E-1 Dividends Deduction

1Total dividends. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2Dividends from Massachusetts corporate trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3Dividends from non-wholly-owned DISCs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4Dividends, if less than 15% of voting stock owned. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5Dividends from RICs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6Dividends from REITs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7Total taxable dividends. Add lines 2 through 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8Dividends eligible for deduction. Subtract line 7 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9Dividends deduction. Multiply line 8 by .95. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

2016 FORM 355, PAGE 7

CORPORATION NAME

FEDERAL IDENTIFICATION NUMBER

Schedule E Taxable Income2016

1Gross receipts or sales (from U.S. Form 1120, line 1c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

2Gross profit (from U.S. Form 1120, line 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

3Other deductions (from U.S. Form 1120, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

4Net income (from U.S. Form 1120, line 28). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

5Allowable U.S. wage credit. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

6Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7State and municipal bond interest not included in U.S. net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

8Foreign, state or local income, franchise, excise or capital stock taxes deducted from U.S. net income 38

9Section 168(k) “bonus” depreciation adjustment. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

10Section 31I and 31K intangible expense add back adjustment. See instructions. . . . . . . . . . . . . . . . . . . . . 310

11Section 31J and 31K interest expense add back adjustment. See instructions. . . . . . . . . . . . . . . . . . . . . . . 311

12Federal production activity add back adjustment. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 312

13Other adjustments, including research and development expenses. See instructions. . . . . . . . . . . . . . 313

14Add lines 6 through 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15Abandoned building renovation deduction. . . . . . . . . . . . . . . ×.10 = 315

16Dividends deduction (from Schedule E-1, line 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 316

17Exception(s) to the add back of intangible expenses (enclose Schedule ABIE). . . . . . . . . . . . . . . . . . . . . . . 317

18Exception(s) to the add back of interest expenses (enclose Schedule ABI). . . . . . . . . . . . . . . . . . . . . . . . . 318

19Income subject to apportionment. Subtract the total of lines 15 through 18 from line 14. . . . . . . . . . . . . 19

20Income apportionment percentage (from Schedule F, line 5 or 1.0, whichever applies). . . . . . . . . . . . . . . . . . . 320

21Multiply line 19 by line 20. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22Income not subject to apportionment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 322

23Total net income allocated or apportioned to Massachusetts. Add lines 21 and 22. . . . . . . . . . . . . . . . 323

24Certified Massachusetts solar or wind power deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 324

25Massachusetts taxable income before net operating loss deduction. Subtract line 24 from line 23. . . . . 25

26Net operating loss deduction (enclose Schedule NOL). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 326

27Massachusetts taxable income. Subtract line 26 from line 25. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28Total net operating loss available for carryover to future years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 328

5

If a loss, mark an X in box at left