Fillable Printable Form 355Q 2000

Fillable Printable Form 355Q 2000

Form 355Q 2000

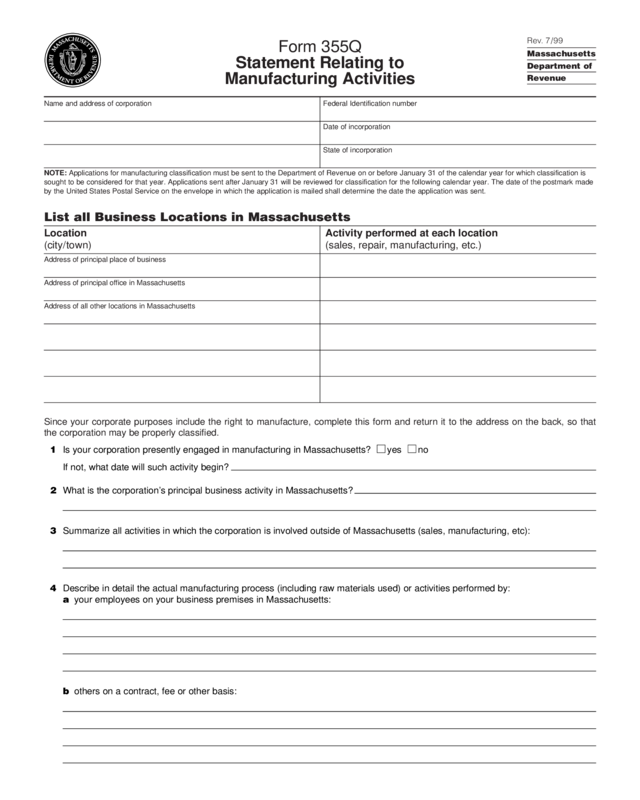

Form 355Q

Statement Relating to

Manufacturing Activities

Rev. 7/99

Massachusetts

Department of

Revenue

Name and address of corporationFederal Identification number

Date of incorporation

State of incorporation

List all Business Locations in Massachusetts

LocationActivity performed at each location

(city/town)(sales, repair, manufacturing, etc.)

Address of principal place of business

Address of principal office in Massachusetts

Address of all other locations in Massachusetts

Since your corporate purposes include the right to manufacture, complete this form and return it to the address on the back, so that

the corporation may be properly classified.

21Is your corporation presently engaged in manufacturing in Massachusetts?yesno

If not, what date will such activity begin?

22What is the corporation’s principal business activity in Massachusetts?

23Summarize all activities in which the corporation is involved outside of Massachusetts(sales, manufacturing, etc):

24Describe in detail the actual manufacturing process (including raw materials used) or activities performed by:

ayour employees on your business premises in Massachusetts:

bothers on a contract, fee or other basis:

NOTE:Applications for manufacturing classification must be sent to the Department of Revenue on or before January 31 of the calendar year for which classification is

sought to be considered for that year. Applications sent after January 31 will be reviewed for classification for the following calendar year. The date of the postmark made

by the United States Postal Service on the envelope in which the application is mailed shall determine the date the application was sent.

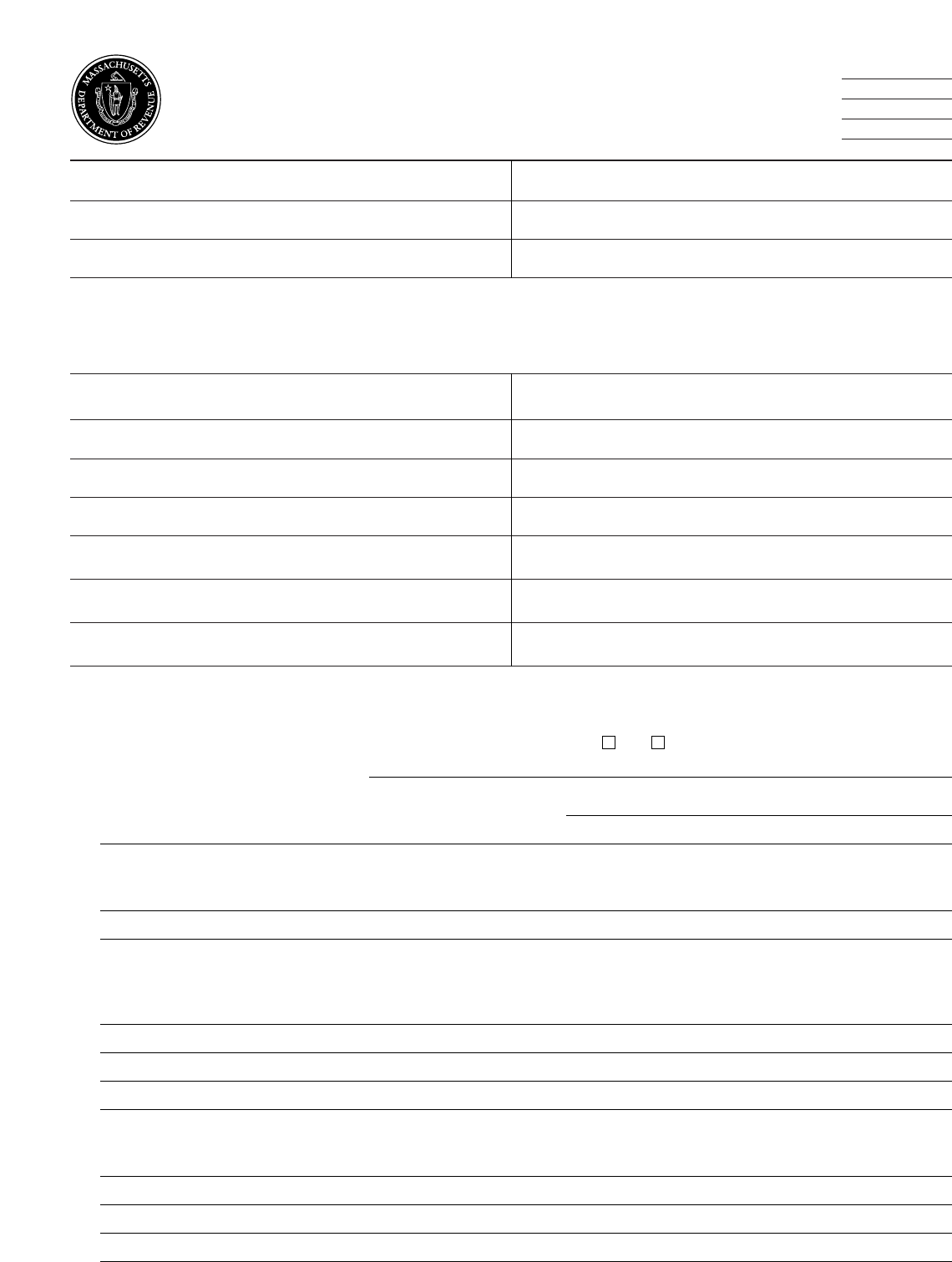

25State the total amount paid to Massachusetts employees and the percentage of that amount received by employees engaged di-

rectly in manufacturing. Also, state the total number of employees in Massachusetts and the percentage of those engaged directly

in manufacturing. The computation of these percentages should not include in the denominator the value or the portion of payroll

attributable to headquarter personnel if the corporation owns or rents the premises outside the Commonwealth:

26Describe in detail the number, type, condition and original cost of your machinery located in Massachusetts and used directly in

manufacturing (if leased, please state the annual rental cost):

27State the original cost of all other machinery located in Massachusetts and not used directly in manufacturing (if leased, please

state the annual rental cost):

28State the original cost of the total tangible property located in Massachusetts (if leased, state the annual rental cost):

29State the total area of floor space owned or leased by the corporation in Massachusetts and the percentage of such space used

directly in manufacturing.The computation of this percentage should not include in the denominator the value or the portion of

space attributable to headquarters if the corporation owns or rents the premises outside the Commonwealth:

10State the total gross receipts of the corporation resulting from activity done in Massachusetts during the preceding year and the

percentage of such receipts derived directly from manufacturing (include allmanufacturing receipts regardless of the destination

of the sales):

11State the estimated total gross receipts of the corporation resulting from activity being done in Massachusetts during the current

yearand the percentage of such receipts being derived directly from manufacturing (include allmanufacturing regardless of the

destination of the sales):

12State any other facts relevant to the corporation's manufacturing activity in Massachusetts to justify its classification as a manu-

facturing corporation:

Declaration

I hereby state, under the penalties of perjury, that I have examined the foregoing statements and to the best of my knowledge and

belief they are true, correct and complete.

Signature of officer and titleDate

Name of contact personTelephone number

Mail completed form to:Massachusetts Department of Revenue

PO Box 7027

Boston, MA 02204