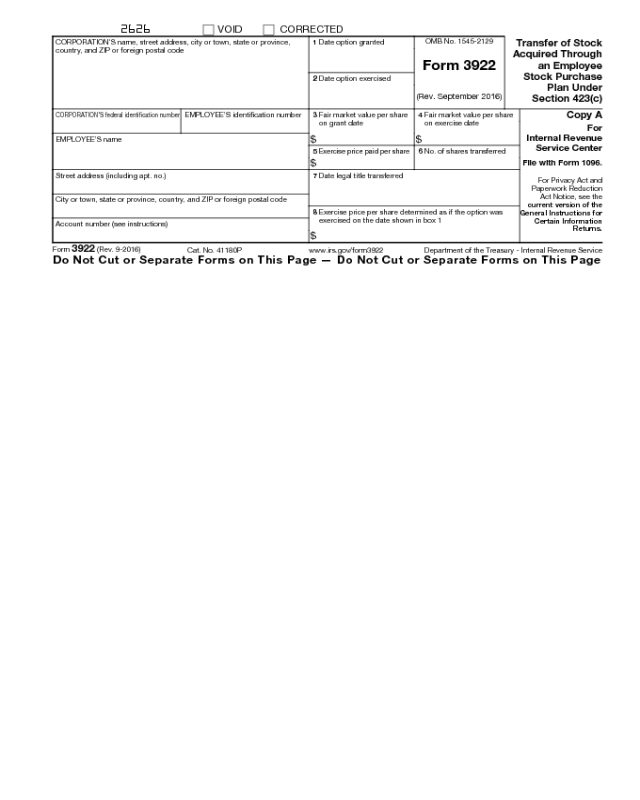

Form 3922

Form 3922

(Rev. September 2016)

Cat. No. 41180P

Transfer of Stock

Acquired Through

an Employee

Stock Purchase

Plan Under

Section 423(c)

Copy A

For

Internal Revenue

Service Center

Department of the Treasury - Internal Revenue Service

File with Form 1096.

OMB No. 1545-2129

For Privacy Act and

Paperwork Reduction

Act Notice, see the

current version of the

General Instructions for

Certain Information

Returns.

2626

VOID CORRECTED

CORPORATION'S name, street address, city or town, state or province,

country, and ZIP or foreign postal code

CORPORATION'S federal identification number

EMPLOYEE’S identification number

EMPLOYEE’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

1 Date option granted

2 Date option exercised

3 Fair market value per share

on grant date

$

4 Fair market value per share

on exercise date

$

5

Exercise price paid per share

$

6 No. of shares transferred

7 Date legal title transferred

8 Exercise price per share determined as if the option was

exercised on the date shown in box 1

$

Form 3922 (Rev. 9-2016)

www.irs.gov/form3922

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

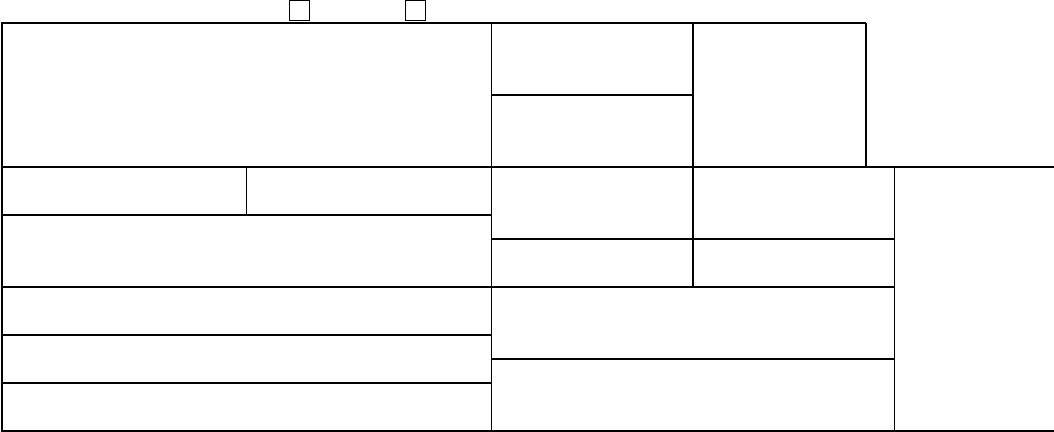

Form 3922

(Rev. September 2016)

Transfer of Stock

Acquired Through

an Employee

Stock Purchase

Plan Under

Section 423(c)

Copy B

For Employee

Department of the Treasury - Internal Revenue Service

This is important tax

information and is

being furnished to

the Internal Revenue

Service.

OMB No. 1545-2129

CORRECTED

CORPORATION'S name, street address, city or town, state or province,

country, and ZIP or foreign postal code

CORPORATION'S federal identification number

EMPLOYEE’S identification number

EMPLOYEE’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

1 Date option granted

2 Date option exercised

3 Fair market value per share

on grant date

$

4 Fair market value per share

on exercise date

$

5

Exercise price paid per share

$

6 No. of shares transferred

7 Date legal title transferred

8 Exercise price per share determined as if the option was

exercised on the date shown in box 1

$

Form 3922 (Rev. 9-2016)

(keep for your records)

www.irs.gov/form3922

Instructions for Employee

You have received this form because (1) your employer (or its

transfer agent) has recorded a first transfer of legal title of

stock you acquired pursuant to your exercise of an option

granted under an employee stock purchase plan, and (2) the

exercise price was less than 100% of the value of the stock on

the date shown in box 1 or was not fixed or determinable on

that date.

No income is recognized when you exercise an option

under an employee stock purchase plan. However, you must

recognize (report) gain or loss on your tax return for the year in

which you sell or otherwise dispose of the stock. Keep this

form and use it to figure the gain or loss. For more information,

see Pub. 525.

Account number. May show an account or other unique

number your employer or transfer agent assigned to

distinguish your account.

Box 1. Shows the date the option to purchase the stock was

granted to you.

Box 2. Shows the date you exercised the option to purchase

the stock.

Box 3. Shows the fair market value (FMV) per share on the

date the option to purchase the stock was granted to you.

Box 4. Shows the FMV per share on the date you exercised

the option to purchase the stock.

Box 5. Shows the price paid per share on the date you

exercised the option to purchase the stock.

Box 6. Shows the number of shares to which legal title was

transferred by you.

Box 7. Shows the date legal title of the shares was first

transferred by you.

Box 8. If the exercise price per share was not fixed or

determinable on the date entered in box 1, box 8 shows the

exercise price per share determined as if the option was

exercised on the date in box 1. If the exercise price per share

was fixed or determinable on the date shown in box 1, then

box 8 will be blank.

Future developments. For the latest information about

developments related to Form 3922 and its instructions, such

as legislation enacted after they were published, go to

www.irs.gov/form3922.

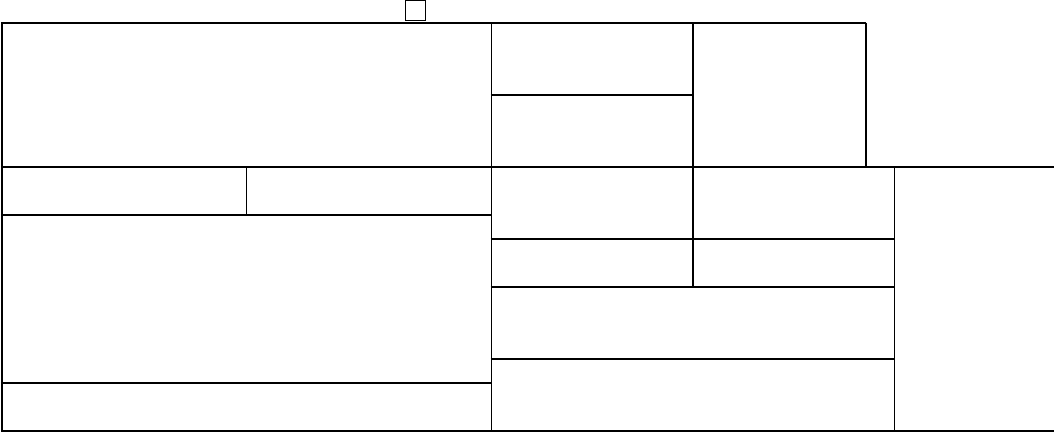

Form 3922

(Rev. September 2016)

Transfer of Stock

Acquired Through

an Employee

Stock Purchase

Plan Under

Section 423(c)

Copy C

For Corporation

Department of the Treasury - Internal Revenue Service

This copy should be

retained by the

corporation.

OMB No. 1545-2129

For Privacy Act and

Paperwork Reduction

Act Notice, see the

current version of the

General Instructions

for Certain

Information Returns.

VOID CORRECTED

CORPORATION'S name, street address, city or town, state or province,

country, and ZIP or foreign postal code

CORPORATION'S federal identification number

EMPLOYEE’S identification number

EMPLOYEE’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

1 Date option granted

2 Date option exercised

3 Fair market value per share

on grant date

$

4 Fair market value per share

on exercise date

$

5

Exercise price paid per share

$

6 No. of shares transferred

7 Date legal title transferred

8 Exercise price per share determined as if the option was

exercised on the date shown in box 1

$

Form 3922 (Rev. 9-2016)

www.irs.gov/form3922

Instructions for Corporation

To complete Form 3922, use:

• The current General Instructions for Certain

Information Returns, and

• The current Instructions for Forms 3921 and 3922.

To get or to order these instructions, go to

www.irs.gov/form3922.

Due dates. Furnish Copy B of this form to the employee

by January 31 of the year following the year of first

transfer of the stock acquired through the employee

stock purchase plan.

File Copy A of this form with the IRS by February 28

of the year following the year of first transfer of the

stock acquired through the employee stock purchase

plan. If you file electronically, the due date is March 31

of the year following the year of first transfer of the

stock acquired through the employee stock purchase

plan. To file electronically, you must have software that

generates a file according to the specifications in Pub.

1220.

Need help? If you have questions about reporting on

Form 3922, call the information reporting customer

service site toll free at 1-866-455-7438 or 304-263-8700

(not toll free). Persons with a hearing or speech

disability with access to TTY/TDD equipment can call

304-579-4827 (not toll free).