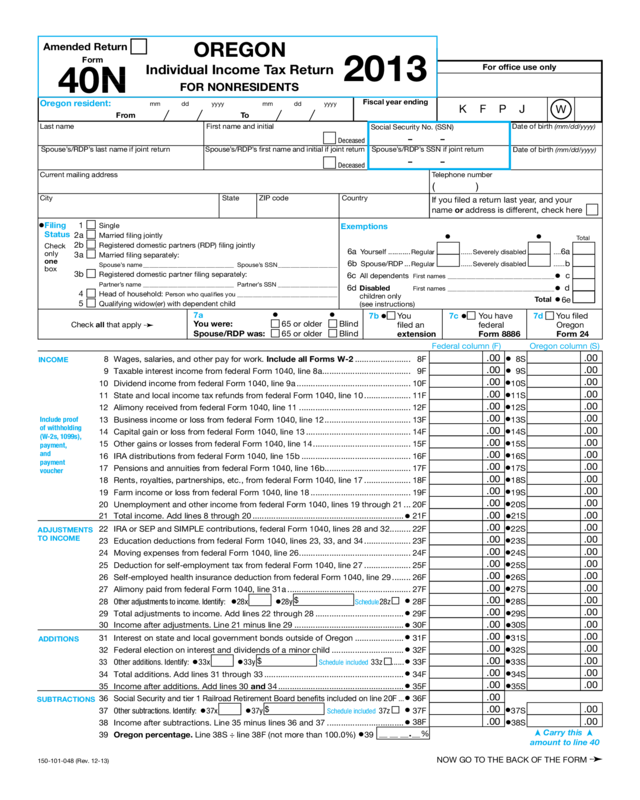

Fillable Printable Form 40N, Nonresident Individual Income Tax Return

Fillable Printable Form 40N, Nonresident Individual Income Tax Return

Form 40N, Nonresident Individual Income Tax Return

8 Wages, salaries, and other pay for work. Include all Forms W-2 ........................ 8F

•

8S

9 Taxable interest income from federal Form 1040, line 8a ...................................... 9F

•

9S

10 Dividend income from federal Form 1040, line 9a ................................................. 10F

•

10S

11 State and local income tax refunds from federal Form 1040, line 10 .................... 11F

•

11S

12 Alimony received from federal Form 1040, line 11 ................................................ 12F

•

12S

13 Business income or loss from federal Form 1040, line 12 ..................................... 13F

•

13S

14 Capital gain or loss from federal Form 1040, line 13 ............................................. 14F

•

14S

15 Other gains or losses from federal Form 1040, line 14 .......................................... 15F

•

15S

16 IRA distributions from federal Form 1040, line 15b ............................................... 16F

•

16S

17 Pensions and annuities from federal Form 1040, line 16b ..................................... 17F

•

17S

18 Rents, royalties, partnerships, etc., from federal Form 1040, line 17 .................... 18F

•

18S

19 Farm income or loss from federal Form 1040, line 18 ........................................... 19F

•

19S

20

Unemployment and other income from federal Form 1040, lines 19 through 21

... 20F

•

20S

21 Total income. Add lines 8 through 20 .................................................................

•

21F

•

21S

22 IRA or SEP and SIMPLE contributions, federal Form 1040, lines 28 and 32 ......... 22F

•

22S

23 Education deductions from federal Form 1040, lines 23, 33, and 34 .................... 23F

•

23S

24 Moving expenses from federal Form 1040, line 26 ................................................ 24F

•

24S

25 Deduction for self-employment tax from federal Form 1040, line 27 .................... 25F

•

25S

26 Self-employed health insurance deduction from federal Form 1040, line 29 ........ 26F

•

26S

27 Alimony paid from federal Form 1040, line 31a ..................................................... 27F

•

27S

28 Other adjustments to income. Identify:

•

28x

•

28y

$

Schedule

28z

•

28F

•

28S

29 Total adjustments to income. Add lines 22 through 28 ......................................

•

29F

•

29S

30 Income after adjustments. Line 21 minus line 29 ...............................................

•

30F

•

30S

31 Interest on state and local government bonds outside of Oregon .....................

•

31F

•

31S

32 Federal election on interest and dividends of a minor child ...............................

•

32F

•

32S

33

Other additions. Identify:

•

33x

•

33y

$

Schedule included 33z

......

•

33F

•

33S

34 Total additions. Add lines 31 through 33 ............................................................

•

34F

•

34S

35 Income after additions. Add lines 30 and 34 ......................................................

•

35F

•

35S

36

Social Security and tier 1 Railroad Retirement Board benefits included on line 20F

...

•

36F

37 Other subtractions. Identify:

•

37x

•

37y

$

Schedule included

37z

•

37F

•

37S

38 Income after subtractions. Line 35 minus lines 36 and 37 .................................

•

38F

•

38S

39

Oregon percentage. Line 38S ÷ line 38F (not more than 100.0%)

•

39

Federal column (F)

ADDITIONS

INCOME

Include proof

of withholding

(W-2s, 1099s),

payment,

and

payment

voucher

ADJUSTMENTS

TO INCOME

SUBTRACTIONS

__ __ __.__%

Oregon column (S)

➤

Carry this

➤

amount to line 40

NOW GO TO THE BACK OF THE FORM

➛

Fiscal year ending

Oregon resident:

FromTo

mm dd yyyymm dd yyyy

Last nameFirst name and initial

Social Security No. (SSN)

– –

– –

Telephone number

Current mailing address

CityStateZIP code

If you filed a return last year, and your

name or address is different, check here

( )

Date of birth (mm/dd/yyyy)

For office use only

Country

Date of birth

(mm/dd/yyyy)

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

.00.00

K F P J

Deceased

Deceased

.00

.00

.00

.00

.00

FOR NONRESIDENTS

OREGON

Individual Income Tax Return

Amended Return

150-101-048 (Rev. 12-13)

Spouse’s/RDP’s rst name and initial if joint returnSpouse’s/RDP’s last name if joint returnSpouse’s/RDP’s SSN if joint return

•

1 Single

2aMarried ling jointly

2bRegistered domestic partners (RDP) ling jointly

3aMarried ling separately:

Spouse’s name _____________________________ Spouse’s SSN ___________________

3bRegistered domestic partner ling separately:

Partner’s name _____________________________ Partner’s SSN ___________________

4Head of household: Person who qualies you ________________________________

5Qualifying widow(er) with dependent child

Filing

Status

Check

only

one

box

Exemptions

6a

Yourself ...........Regular ......Severely disabled ....6a

6b Spouse/RDP ...Regular ...... Severely disabled ......b

6cAll dependents First names __________________________________

•

c

6d

DisabledFirst names __________________________________

•

d

children only

(see instructions)

Total

Total

6e

•

••

7d You filed

Oregon

Form 24

7c

•

You have

federal

Form 8886

7b

•

You

filed an

extension

Check all that apply

➛

7a

• •

You were: 65 or older Blind

Spouse/RDP was: 65 or older Blind

2013

Form

40N

HW

Clear Form

DIRECT

DEPOSIT

Important: Include a copy of your federal Form 1040, 1040A, 1040EZ, or 1040NR.

•

Preparer license no.

Under penalty for false swearing, I declare that the information in this return is true, correct, and complete.

Signature of preparer other than taxpayerYour signatureDate

AddressTelephone no.

X

X

Spouse’s/RDP’s signature (if filing jointly, BOTH must sign)Date

X

These will

reduce

your refund

EITHER,

NOT BOTH

ADD TOGETHER

ADD TOGETHER

PAYMENTS AND

REFUNDABLE

CREDITS

ADD TOGETHER

DEDUCTIONS

AND

MODIFICATIONS

OREGON

TAX

NONREFUNDABLE

CREDITS

Include Schedule

WFC-N/P if you

claim this credit

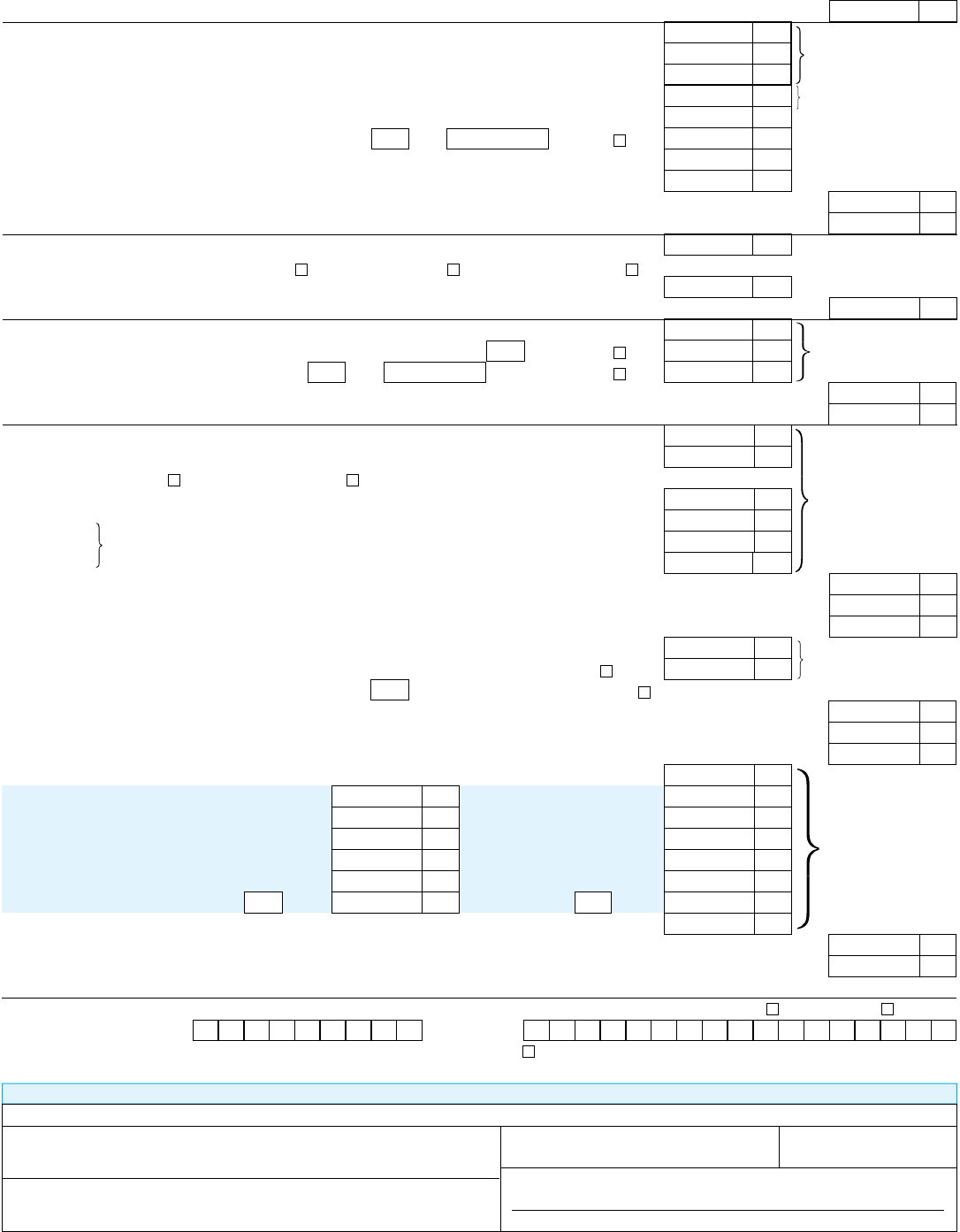

40 Amount from front of form, line 38S (Oregon amount) ...................................................................................... 40

41 Itemized deductions from federal Schedule A, line 29 .........................................

•

41

42 State income tax claimed as itemized deduction .................................................

•

42

43 Net Oregon itemized deductions. Line 41 minus line 42 ......................................

•

43

44 Standard deduction from page 26 ........................................................................

•

44

45

2013 federal tax liability ($0–$6,250; see instructions for the correct amount)

....

•

45

46 Other deductions and modifications. Identify:

•

46x

•

46y

$

Schedule

46z

•

46

47 Deductions and modifications X Oregon percentage. See page 26 .....................

•

47

48Deductions and modifications not multiplied by the Oregon percentage. See page 29

•

48

49 Total deductions and other modifications. Add lines 47 and 48 ....................................................................

•

49

50 Oregon taxable income. Line 40 minus line 49 ...............................................................................................

•

50

51 Tax. See page 29 for instructions. Enter tax here ................................................

•

51

Check if tax is from: 51a

Tax charts or

•

51b Form FIA-40N or

•

51c

Worksheet FCG

52 Interest on certain installment sales ......................................................................

•

52

53 Total tax before credits. Add lines 51 and 52 ................................................................... OREGON TAX

➛

•

53

54 Exemption credit. See instructions, page 30 ......................................................

•

54

55 Credit for income taxes paid to another state. State:

•

55y

Schedule 55z

•

55

56 Other credits. Identify:

•

56x

•

56y

$

Schedule included

56z

•

56

57 Total non-refundable credits. Add lines 54 through 56 ..................................................................................

•

57

58 Net income tax. Line 53 minus line 57. If line 57 is more than line 53, enter -0-

............................................

•

58

59 Oregon income tax withheld from income. Include Forms W-2 and 1099 .........

•

59

60 Estimated tax payments for 2013 and payments made with your extension .......

•

60

•

60a Wolf depredation

•

60b Claim of right

61 Tax payments from pass-through entity and real estate transactions ..................

•

61

62 Earned income credit. See instructions, page 32 .................................................

•

62

63 Working family child care creditfrom WFC-N/P, line 21 ..................................

•

63

64 Mobile home park closure credit. Include Schedule MPC ....................................

•

64

65 Total payments and refundable credits. Add lines 59 through 64 ..................................................................

•

65

66 Overpayment. Is line 58 less than line 65? If so, line 65 minus line 58

...................

OVERPAYMENT

➛

•

66

67 Tax to pay. Is line 58 more than line 65? If so, line 58 minus line 65

...............................

TAX TO PAY

➛

•

67

68 Penalty and interest for filing or paying late. See instructions, page 33 ..................68

69

Interest on underpayment of estimated tax. Include Form 10 and check box

...

•

69

Exception # from Form 10, line 1

•

69a Check box if you annualized

•

69b

70 Total penalty and interest due. Add lines 68 and 69 ......................................................................................... 70

71 Amount you owe. Line 67 plus line 70 .................................................................AMOUNT YOU OWE

➛

•

71

72 Refund. Is line 66 more than line 70? If so, line 66 minus line 70

............................................

REFUND

➛

•

72

73 Estimated tax.Fill in the part of line 72 you want applied to 2014 estimated tax

•

73

American Diabetes Assoc.

•

74 Oregon Coast Aquarium

•

75

SMART

•

76 SOLV

•

77

The Nature Conservancy

•

78 St. Vincent DePaul Soc. of OR

•

79

Oregon Humane Society

•

80 The Salvation Army

•

81

Doernbecher Children’s Hosp.

•

82 Oregon Veteran’s Home

•

83

Charity code

•

84a

•

84b

Charity code

•

85a

•

85b

86 Total Oregon 529 College Savings Plan deposits. See instructions, page 34 ......

•

86

87 Total. Add lines 73 through 86. Total can’t be more than your refund on line 72 ..........................................

•

87

88 NET REFUND. Line 72 minus line 87. This is your net refund .........................................NET REFUND

➛

•

88

89 For direct deposit of your refund, see instructions, page 34.

•

Type of account: Checking or Savings

Will this refund go to an account outside the United States? • Yes

•

Routing No.

•

Account No.

CHARITABLE

CHECKOFF

DONATIONS,

PAGE 34

I want to donate

part of my tax

refund to the

following fund(s)

Page 2 — 2013 Form 40N

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00.00

.00.00

.00.00

.00

.00.00

.00.00

.00

.00

.00

150-101-048 (Rev. 12-13)