Fillable Printable Form 426 - Missouri Department Of Revenue

Fillable Printable Form 426 - Missouri Department Of Revenue

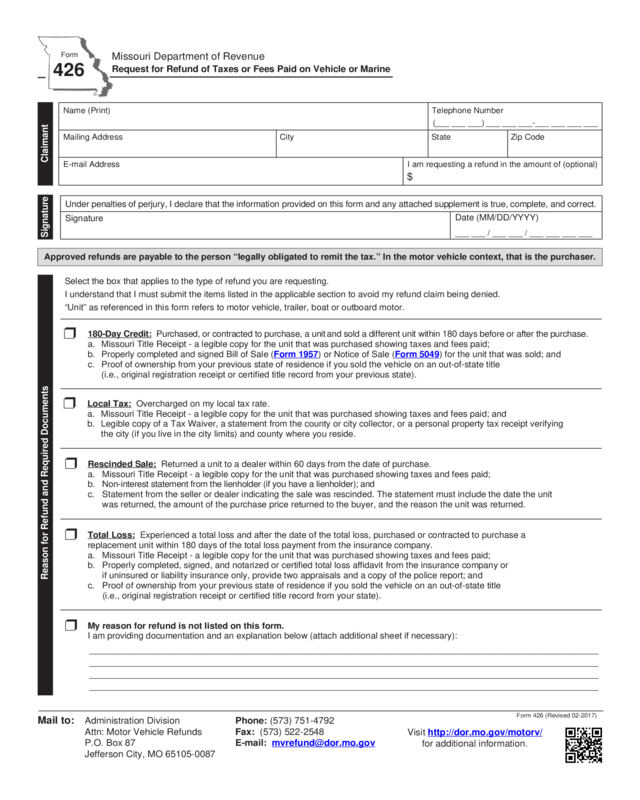

Form 426 - Missouri Department Of Revenue

Name (Print) Telephone Number

(___ ___ ___) ___ ___ ___-___ ___ ___ ___

Mailing Address City State Zip Code

E-mail Address I am requesting a refund in the amount of (optional)

$

r 180-Day Credit: Purchased, or contracted to purchase, a unit

and sold a different unit within 180 days before or after the purchase.

a. Missouri Title Receipt - a legible copy for the unit that was purchased showing taxes and fees paid;

b. Properly completed and signed Bill of Sale (Form 1957) or Notice of Sale (Form 5049) for the unit that was sold; and

c. Proof of ownership from your previous state of residence if you sold the vehicle on an out-of-state title

(i.e., original registration receipt or certified title record from your previous state).

r Total Loss: Experienced a total loss and after the date of the total loss, purchased or contracted to purchase a

replacement unit within 180 days of the total loss payment from the insurance company.

a. Missouri Title Receipt - a legible copy for the unit that was purchased showing taxes and fees paid;

b. Properly completed, signed, and notarized or certified total loss affidavit from the insurance company or

if uninsured or liability insurance only, provide two appraisals and a copy of the police report; and

c. Proof of ownership from your previous state of residence if you sold the vehicle on an out-of-state title

(i.e., original registration receipt or certified title record from your state).

r Local Tax: Overcharged on my local tax rate.

a. Missouri Title Receipt - a legible copy for the unit that was purchased showing taxes and fees paid; and

b. Legible copy of a Tax Waiver, a statement from the county or city collector, or a personal property tax receipt verifying

the city (if you live in the city limits) and county where you reside.

rRescinded Sale: Returned a unit to a dealer within 60 days from the date of purchase.

a. Missouri Title Receipt - a legible copy for the unit that was purchased showing taxes and fees paid;

b. Non-interest statement from the lienholder (if you have a lienholder); and

c. Statement from the seller or dealer indicating the sale was rescinded. The statement must include the date the unit

was returned, the amount of the purchase price returned to the buyer, and the reason the unit was returned.

Form

426

Missouri Department of Revenue

Request for Refund of Taxes or Fees Paid on Vehicle or Marine

Form 426 (Revised 02-2017)

Mail to: Administration Division Phone: (573) 751-4792

Attn: Motor Vehicle Refunds Fax: (573) 522-2548

Jefferson City, MO 65105-0087

Claimant

Approved refunds are payable to the person “legally obligated to remit the tax.” In the motor vehicle context, that is the purchaser.

Reason for Refund and Required Documents

r My reason for refund is not listed on this form.

I am providing documentation and an explanation below (attach additional sheet if necessary):

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

Visit http://dor.mo.gov/motorv/

for additional information.

Under penalties of perjury, I declare that the information provided on this form and any attached supplement is true, complete, and correct.

Signature

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Signature

Select the box that applies to the type of refund you are requesting.

I understand that I must submit the items listed in the applicable section to avoid my refund claim being denied.

“Unit” as referenced in this form refers to motor vehicle, trailer, boat or outboard motor.

Reset Form

Print Form

Frequently Asked Questions

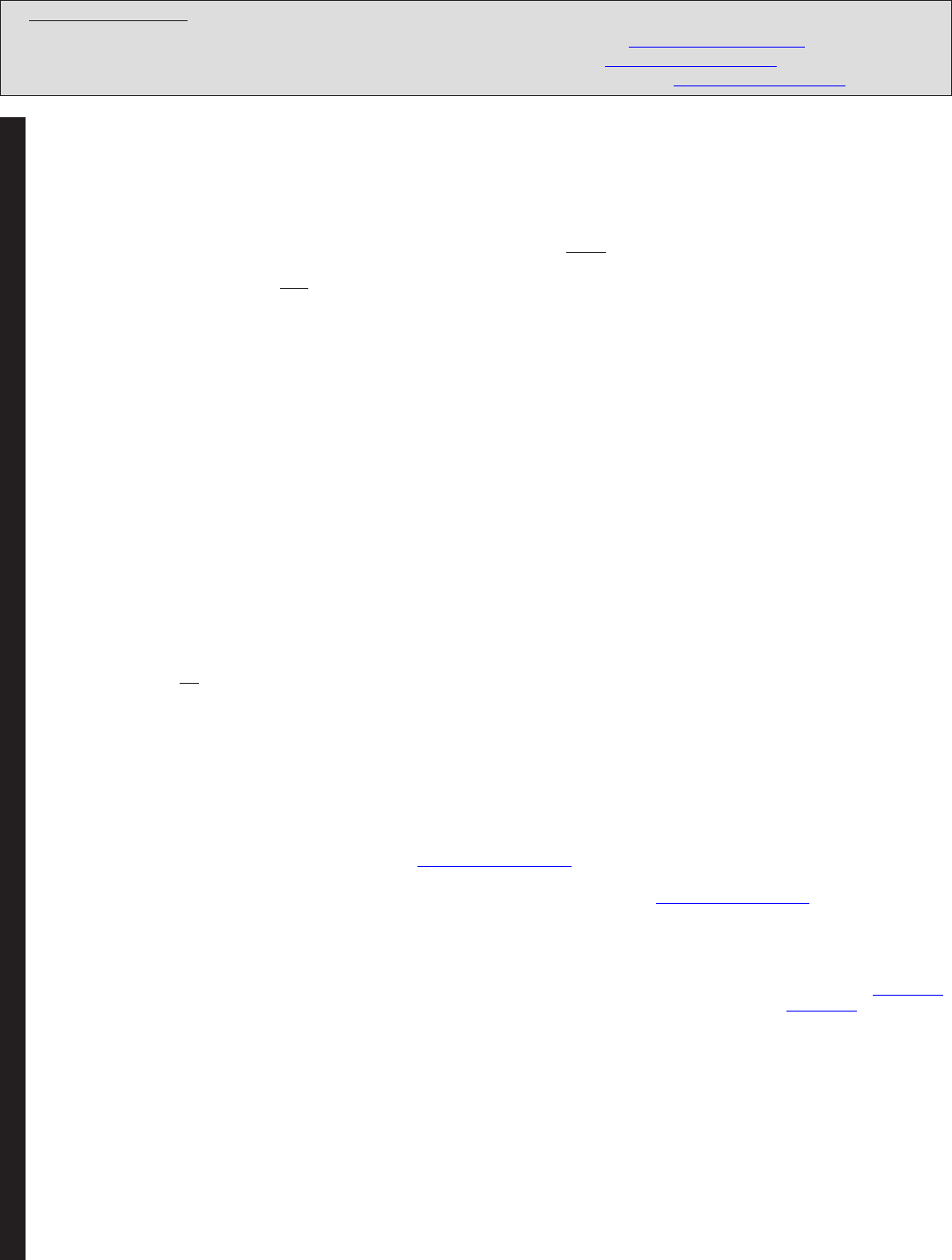

Statute of Limitations:

A claim for taxes must be filed within three years from date of overpayment pursuant to Section 144.190.1, RSMo.

A claim for fees must be filed within two years from the date of payment pursuant to Section 136.035.1 RSMo.

A claim for a rescinded sale must be filed within one year after payment of the tax pursuant to Section 144.071.1 RSMo.

Form 426 (Revised 02-2017)

1. If I decide to sell my unit to another person rather than use it as a trade-in when I purchase a replacement, am I entitled to

receive a tax credit based upon the sales price of my original unit? You are entitled to receive a tax credit based upon the sales

price of your original unit if you purchase a replacement within 180 days before or after the date of sale of your original unit. The tax

credit cannot exceed the tax due on the purchase price of the replacement unit. The unit being purchased or contracted to purchase

must be titled in the same owner’s name as the unit being sold.

2. How may I claim my tax credit for my original unit when I sell it to another person and purchase a replacement rather than use it

as a trade-in for a replacement? If you sell your original unit within 180 days before you purchase your replacement, you may present to

the License Office a copy of your bill of sale for the original unit. You will be given credit against the tax due on the replacement unit. If you

sell your original within 180 days after you purchase your replacement unit or if you sold the original within 180 days prior to purchasing the

replacement and you did not receive the tax credit when you titled your replacement, you may file a request for refund with the Missouri

Department of Revenue. The request for refund must be filed within three years from the date of payment of the tax on the replacement.

3. If I trade in my original unit when I purchase a replacement and the trade-in value is more than the purchase price of the

replacement, do I receive a tax credit based upon the full amount of the trade-in value? You will receive a tax credit only up to

the tax due on the purchase price of the replacement unit. There is no credit for the trade-in value in excess of the purchase price of the

replacement unit. Example: If you purchased a vehicle from a dealer for $12,000 and received a trade-in value of $15,000 on your original

vehicle, the value of the trade-in offsets the purchase price of the replacement and results in no tax due when you title the replacement.

You are not entitled to a credit or refund based upon the excess $3,000 trade-in value.

4. If I sell my original unit rather than trade it for a replacement and the sale price of the original unit is more than the cost of

replacement, do I receive a tax credit based upon the full amount I received for my original unit? As with a trade-in, you will

be entitled to a tax credit only up to the tax due on the purchase price of the replacement unit. You are not entitled to a credit or refund

based upon the difference between the sale price of your original unit and your replacement.

5. If I purchase a unit and decide to sell it within 180 days, am I entitled to the tax refund? You are not entitled to the tax refund if

you purchase and sell the same unit. You must purchase a replacement unit to be entitled to a credit or refund.

6. If the original unit being sold is titled in another person’s name, may I receive a tax credit or refund when I purchase another unit?

In order for the tax credit or refund to be allowed, at least one owner listed on the title of the original unit being sold must also be listed on

the title of the replacement unit.

7. May I claim the tax credit or refund if a unit titled in the name of my personal trust is sold and the replacement unit is titled in my

name? You are not entitled to claim the tax credit or refund. A trust is considered to be a separate legal entity or person. Since at least

one owner listed on the title of the original unit must be listed on the title of the replacement, the trust must be named on the title of the

replacement unit for the tax credit or refund to apply.

8. If my unit is determined by my insurance company to be a total loss due to theft or casualty loss, how long do I have to

purchase a replacement unit in order to claim the tax credit or refund? You must purchase a replacement unit within 180 days of

the date of payment by the insurance company. If you do not have insurance coverage, you may still receive the tax credit or refund if you

purchase or contract to purchase a replacement unit within 180 days after the date of the loss. Note: The replacement unit must be a like

unit, i.e., replacing a boat for a boat, trailer for trailer, etc. At least one of the titled owners of the total loss unit must be an owner of the

replacement unit, regardless of any other name(s) listed on the insurance statement.

9. May I receive a refund of license plate or tab fees? Section 136.035, RSMo, allows refunds of any overpayment or erroneous

payment in exceptional circumstances such as plates or tabs issued in error, defective plates, or duplicate issuance, and for license

plates for commercial motor vehicles licensed for a gross weight in excess of 54,000 pounds. Section 301.140, RSMo, states in part

that no refunds shall be made on the unused portion of any license plates.

10. If I am a common carrier and qualified for the common carrier exemption or the commercial motor vehicle or trailer exemption, but

I paid sales tax when I titled my vehicle or trailer, can I apply for a refund? Yes, if you or your company meets the definition of a

common carrier; the commercial vehicle is licensed for a gross weight of 24,000 pounds or more; the commercial vehicle is not a vehicle

on the Department’s non-qualifying vehicles chart; and either Sales Tax Exemption Statement for Authorized Common Carriers (Form 5095)

or the Application for Sales Tax Exemption - Commercial Motor Vehicles or Trailers Greater Than 54,000 Pounds (Form 5435) is submitted

and completed in its entirety.

11. If I sold multiple vehicles at different times and received a credit for one of them at the time I titled a replacement vehicle, can

I apply for a refund after I sell the second vehicle? No, in this case the second vehicle was sold after the purchased vehicle had been

titled and therefore, you are not eligible for a refund.

12. If my claim for a tax credit or refund is denied, may I appeal that decision? You may appeal any decision by the Department denying

a tax credit or refund. To appeal the denial, you must file a petition with the Administrative Hearing Commission located at 301 West High

Street, Harry S Truman State Office Building, P.O. Box 1557, Jefferson City, Missouri 65102, within 60 days after the date the decision was

mailed or the date it was delivered, whichever date was earlier. If any such petition is sent by registered mail or certified mail, it will be

deemed filed on the date it is mailed. If it is sent by any other method other than registered or certified mail, it will be deemed filed with the

Commission on the date it is received by the Commission.