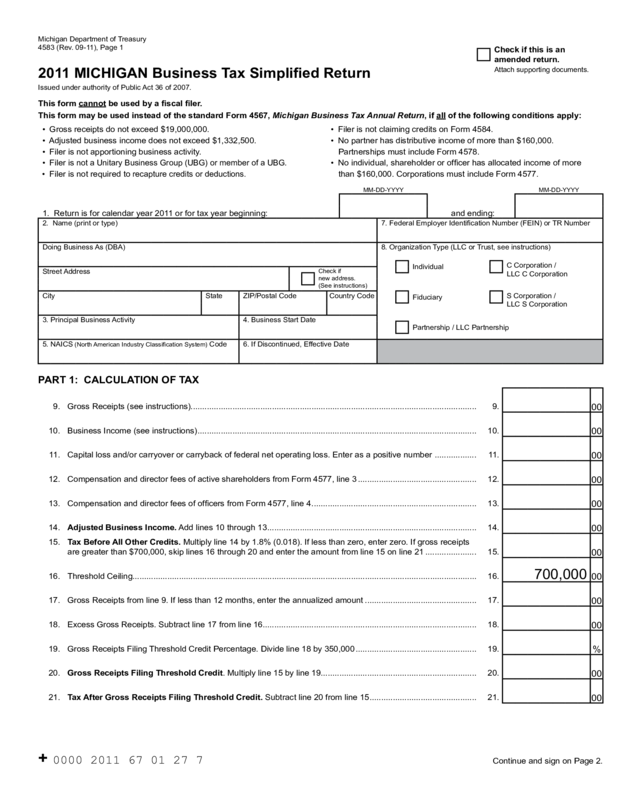

Fillable Printable Form 4583, 2011 Michigan Business Tax Simplified Return

Fillable Printable Form 4583, 2011 Michigan Business Tax Simplified Return

Form 4583, 2011 Michigan Business Tax Simplified Return

Michigan Department of Treasury

4583 (Rev. 09-11), Page 1

Check if this is an

amended return.

Attach supporting documents.

Issued under authority of Public Act 36 of 2007.

This form cannot

This form may be used instead of the standard Form 4567, Michigan Business Tax Annual Return, if all of the following conditions apply:

• Gross receipts do not exceed $19,000,000.

• Adjusted business income does not exceed $1,332,500.

• Filer is not apportioning business activity.

• Filer is

not a Unitary Business Group (UBG) or member of a UBG

.

• Filer is not required to

recapture credits or deductions.

• Filer is not claiming credits on Form 4584.

• No partner has distributive income of more than $160,000.

Partnerships must include Form 4578.

• No individual, shareholder or ofcer has allocated income of more

than $160,000. Corporations must include Form 4577.

MM-DD-YYYY MM-DD-YYYY

1. Return is for calendar year 2011 or for tax year beginning: and ending:

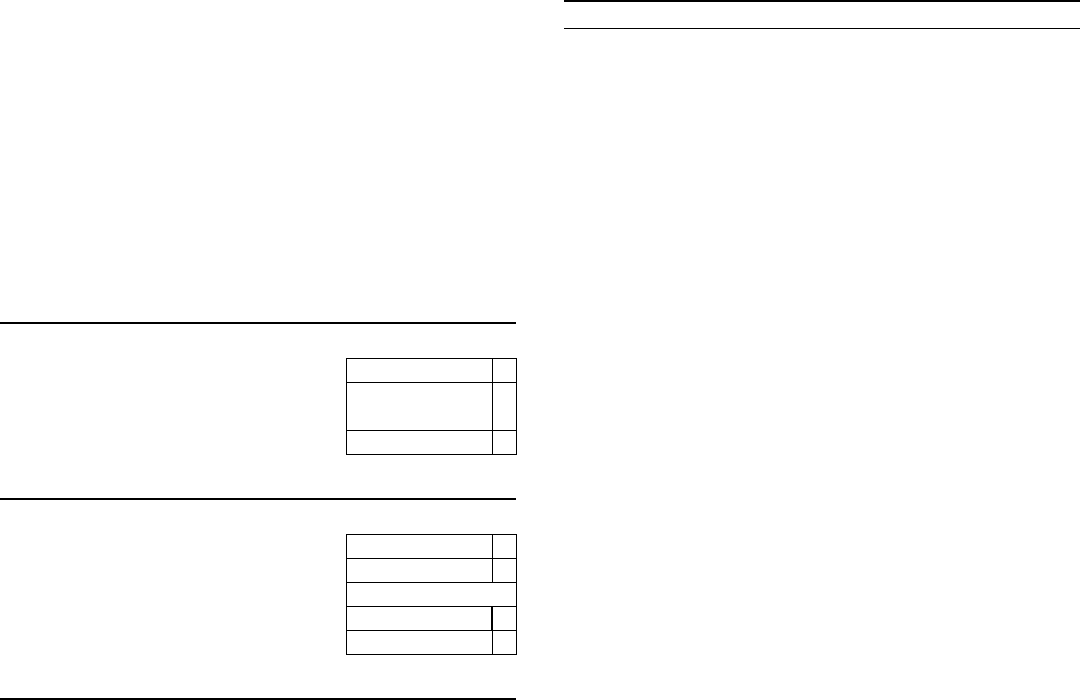

2. Name (print or type) 7. Federal Employer Identication Number (FEIN) or TR Number

Doing Business As (DBA) 8. Organization Type (LLC or Trust, see instructions)

Individual

C Corporation /

LLC C Corporation

Street Address

Check if

new address.

(See instructions)

City State ZIP/Postal Code Country Code

Fiduciary

S Corporation /

LLC S Corporation

3. Principal Business Activity 4. Business Start Date

Partnership / LLC Partnership

5. NAICS

(North American Industry Classication System) Code 6. If Discontinued, Effective Date

9. Gross Receipts (see instructions)........................................................................................................................... 9.

00

10. Business Income (see instructions) ........................................................................................................................ 10.

00

11. Capital loss and/or carryover or carryback of federal net operating loss. Enter as a positive number .................. 11.

00

12. Compensation and director fees of active shareholders from Form 4577, line 3 ................................................... 12.

00

13. Compensation and director fees of ofcers from Form 4577, line 4 ....................................................................... 13.

00

14. Adjusted Business Income. Add lines 10 through 13 .......................................................................................... 14.

00

15. Multiply line 14 by 1.8% (0.018). If less than zero, enter zero. If gross receipts

are greater than $700,000, skip lines 16 through 20 and enter the amount from line 15 on line 21 ...................... 15.

00

16. Threshold Ceiling.................................................................................................................................................... 16. 700,000

00

17. Gross Receipts from line 9. If less than 12 months, enter the annualized amount ................................................ 17.

00

18. Excess Gross Receipts. Subtract line 17 from line 16............................................................................................ 18.

00

19. Gross Receipts Filing Threshold Credit Percentage. Divide line 18 by 350,000 .................................................... 19.

%

20. . Multiply line 15 by line 19................................................................... 20.

00

21. Subtract line 20 from line 15 .............................................. 21.

00

+ 0000 2011 67 01 27 7 Continue and sign on Page 2.

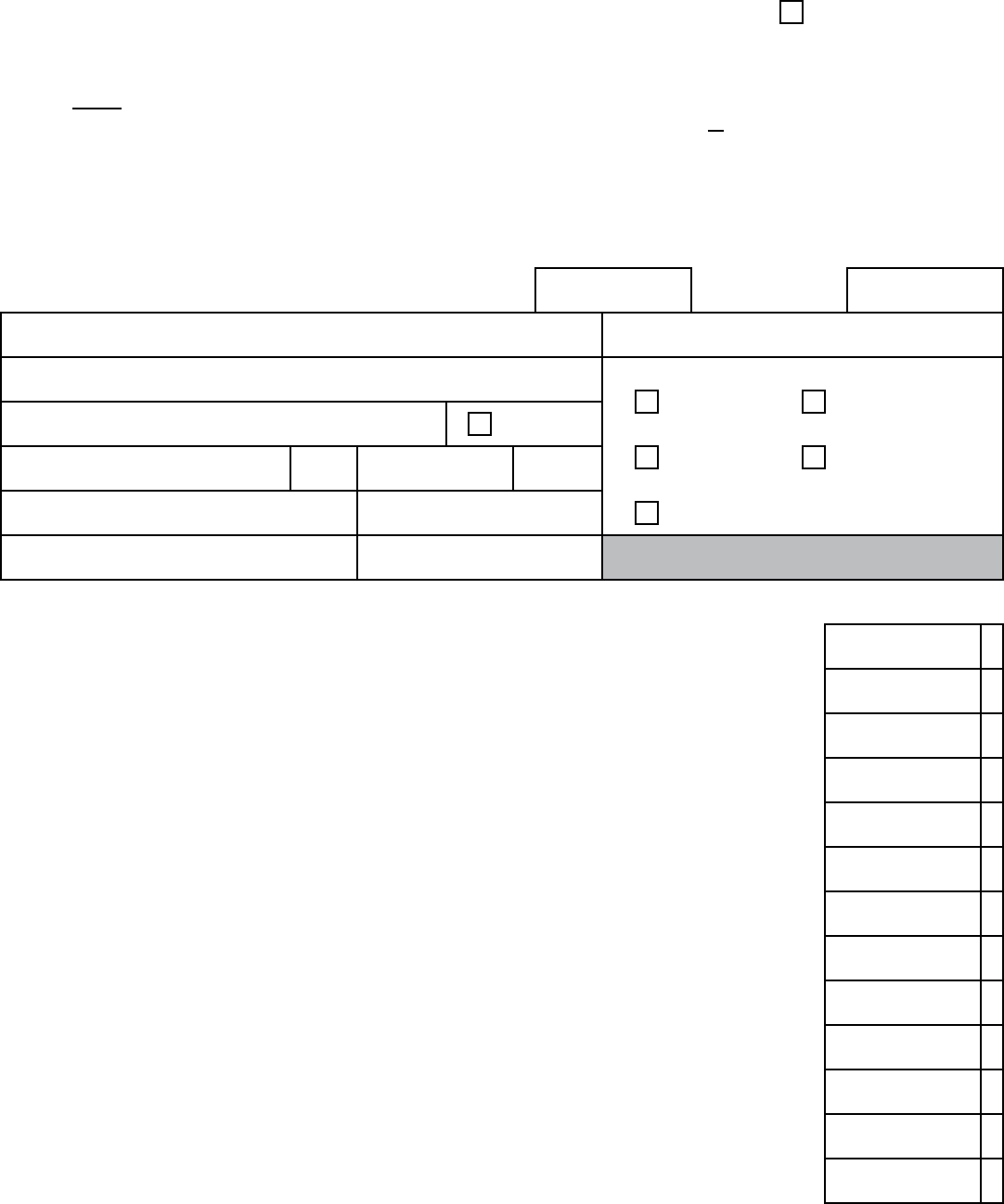

4583, Page 2

FEIN or TR Number

22. Overpayment credited from prior MBT return ........................................................................................................ 22.

00

23. Estimated tax payments ........................................................................................................................................ 23.

00

24. Tax paid with request for extension ....................................................................................................................... 24.

00

25. Refundable credits from Form 4574, line 31 ......................................................................................................... 25.

00

26. Total. Add lines 22 through 25. (If not amending, skip to line 28.) ........................................................................ 26. 00

a. Payment made with the original return ................................ 27a.

00

27.

b. Overpayment received on the original return ...................... 27b.

00

c. Add lines 26 and 27a and subtract line 27b from the sum ..... ................................................... 27c.

00

28. Subtract line 26 (or line 27c, if amending) from line 21. If less than zero, leave blank ........................ 28.

00

29. Underpaid estimate penalty and interest from Form 4582, line 38 ........................................................................ 29.

00

30. Annual return penalty (a) % = (b) 00 plus interest of (c) 00 . Total ...... 30d.

00

31. If line 28 is blank, go to line 32. Otherwise, add lines 28, 29 and 30d and enter here .............. 31.

00

32.

Overpayment. Subtract lines 21, 29 and 30d from line 26 (or line 27c, if amending).

If less than zero, leave blank (see instructions)..................................................................................................... 32.

00

33. Amount on line 32 to be credited forward and used as an estimate for next tax year ........ 33.

00

34. Amount on line 32 to be refunded......................................................................................................... 34.

00

I declare under penalty of perjury that the information in this

return and attachments is true and complete to the best of my knowledge.

I declare under penalty of perjury that this

return is based on all information of which I have any knowledge.

Preparer’s PTIN, FEIN or SSN

By checking this box, I authorize Treasury to discuss my return with my preparer.

Authorized Signature for Tax Matters Preparer’s Business Name (print or type)

Authorized Signer’s Name (print or type) Date Preparer’s Business Address and Telephone Number (print or type)

Title Telephone Number

Mail return to: Pay amount on

line 31 and mail check and return to:

Make check payable to “State of Michigan.”

Print taxpayer’s FEIN or TR Number, the tax

year, and “MBT” on the front of the check. Do

not staple the check to the return.

Michigan Department of Treasury

P.O. Box 30783

Lansing, MI 48909

Michigan Department of Treasury

P.O. Box 30113

Lansing, MI 48909

+ 0000 2011 67 02 27 5

Purpose

This form allows qualifying standard taxpayers to claim the

Small Business Alternative Credit and to le and pay the MBT

due without computing the Business Income Tax or Modied

Gross Receipts Tax imposed under Sections 201 and 203 of the

MBT Act. Qualied taxpayers may also use this form to claim

the Gross Receipts Filing Threshold Credit and any refundable

credits for which they are eligible.

NOTE: The MBT Election of Refund or Carryforward of Credits

(Form 4584) cannot be used in conjunction with this form.

Credit

Standard taxpayers (all taxpayers who are not nancial

institutions or insurance companies) are eligible to use this

form if all of the following conditions apply:

• Gross receipts do not exceed $19,000,000.

• Adjusted business income does not exceed $1,332,500.

• Adjusted business income does not exceed $160,000 for

Individuals or Fiduciaries.

• Filer is not a Unitary Business Group (UBG) or member of

a UBG.

• Filer does not have to complete the MBT Schedule of

Recapture of Certain Business Tax Credits and Deductions

(Form 4587), and does not have net Investment Tax Credit

recapture from the MBT Credits for Compensation, Investment,

and Research and Development (Form 4570).

• Filer is not apportioning business activity.

• No partner has distributive income of more than $160,000.

Partnerships must include the MBT Schedule of Partners (Form

4578).

• No individual, shareholder, or ofcer has allocated income

over $160,000. Corporations must include the MBT Schedule

of Shareholders and Ofcers (Form 4577). (Does not apply to

Individuals and Fiduciaries ling as Individuals.)

• Filer is not a scal ler.

NOTE: Taxpayers leasing employees from professional

employer organizations must include the compensation

of ofcers and shareholders (of the operating company)

who receive compensation from the professional employer

organizations in determining the taxpayers’ eligibility for

Small Business Alternative Credit.

NOTE: A member of a Limited Liability Company (LLC) is

characterized for MBT purposes as a partner, shareholder, or

owner based on the federal tax classication of the LLC. An

LLC taxed as a Partnership for federal purposes must le

as a Partnership for MBT. Similarly, an LLC taxed as a C

Corporation or S Corporation for federal purposes must le

under that same status for MBT.

Corporations: Allocated income in the case of a C

Corporation is either:

a) Shareholder or ofcer compensation and director fees from

Form 4577, column L, or

b) Shareholder or ofcer compensation, director fees, and

share of business income or loss from Form 4577, column N.

If either (a) or (b) is greater than $160,000, the Corporation is

not eligible to le this form.

Allocated income for an S Corporation is shareholder

compensation, director fees, and share of business income or

loss from Form 4577, column N.

Even if eligible to le this form, a taxpayer may pay a lower

tax by ling the MBT Annual Return (Form 4567) and taking

the Small Business Alternative Credit using the MBT Common

Credits for Small Businesses (Form 4571). This is especially

true if any of the following applies:

• An MBT business loss carryforward exists, or

• A nonrefundable or hybrid (Form 4584) credit may be

claimed.

Tax Period Less Than 12 Months: If a business operates less

than 12 months, annualize gross receipts, business income, and

all income of shareholders, ofcers, and partners to determine

the eligibility for a Small Business Alternative Credit. Do not

use annualized numbers on the return, unless requested; use

them only to determine ling requirements and qualications

for credits.

Lines not listed are explained on the form.

Dates must be entered in MM-DD-YYYY format.

For periods less than 12 months, see the “General Information

for Standard Taxpayers” in the MBT Forms and Instructions

for Standard Taxpayers (Form 4600).

A taxpayer, other than a UBG, that does not le a separate

federal return (e.g., a taxpayer that is a federally disregarded

entity and that did not le as a separate entity, or a taxpayer

that is a member of a federal consolidated group) must prepare

a pro forma federal return or equivalent schedule and use it as

the basis for preparing its MBT return. A taxpayer (other than

a UBG) that owns one or more federally disregarded entities

must prepare a pro forma federal return or equivalent schedule

that excludes the activity of the disregarded entity(ies), and

use it as the basis for preparing its MBT return. For standard

members of a UBG, this pro forma requirement is addressed

in the MBT UBG Combined Filing Schedule for Standard

Members (Form 4580), Part 2A, and its instructions. For

additional information, see “Changes for Disregarded Entities”

in the “Important Information” section of the MBT Forms and

Instructions for Standard Taxpayers (Form 4600).

Amended Returns: To amend a current or prior year annual

return, complete the Form 4583 that is applicable for that year,

check the box in the upper-right corner of the return, and

attach a separate sheet explaining the reason for the changes.

Include an amended federal return or a signed and dated

Internal Revenue Service (IRS) audit document. Include all

schedules led with the original return, even if not amending

that schedule. Enter the gures on the amended return as they

should be. Do not include a copy of the original return with

your amended return.

Refund Only: For taxpayers with allocated gross receipts less

than $350,000, who are otherwise eligible to use this form and are

ling this form to claim a refund of estimates paid, skip lines 10

through 21 and lines 28 through 31.

Line 1: If not a calendar year taxpayer, enter the beginning

and ending dates that correspond to the taxable period reported

to the IRS.

Tax year means the calendar year, or the scal year ending

during the calendar year, upon the basis of which the tax base

of a taxpayer is computed. If a return is made for a part of a

year, tax year means the period for which the return is made.

Generally, a taxpayer’s tax year is for the same period as is

covered by its federal income tax return.

Line 2: Enter the complete address and, if other than the

United States, enter the two-digit abbreviation for the country

code. See the list of country codes in Form 4600.

Correspondence about and any refund from this return will

be sent to the address used here. Check the new address box

if the address used on this line has changed from last ling.

The taxpayer’s primary address in Department of Treasury

(Treasury) les, identied as the legal address and used for all

purposes other than refund and correspondence on a specic

MBT return, will not change unless the taxpayer les a Notice of

Change or Discontinuance (Form 163). Exception: If mail sent

to the legal address has been returned to Treasury by the United

States Postal Service, Treasury will update the taxpayer’s legal

address with the address used on this line in the most recent

MBT return.

Line 3: Enter a brief description of business activity

(for example, forestry, sheries, mining, construction,

manufacturing, transportation, communication, electric, gas,

sanitary services, wholesale trade, retail trade, nance, or

services, etc.).

Line 4: Enter the start date of rst business activity in Michigan.

Line 5: Enter the entity’s six-digit North American Industry

Classication System (NAICS) code. For a complete list of six-

digit NAICS codes, see the U.S. Census Bureau Web site at

www.census.gov/eos/www/naics/, or enter the same NAICS

code used when ling the entity’s U.S. Form 1120, Schedule K,

U.S. Form 1120S, U.S. Form 1065 or U.S. Form 1040,

Schedule C.

Line 6: Enter the date, if applicable, on which taxpayer went

out of existence. To complete the discontinuance for Michigan

taxes, le Form 163, which is available on Treasury’s Web site

at www.michigan.gov/treasuryforms. If the taxpayer is still

subject to another tax administered by Treasury, do not use this

line.

Line 7: Use the taxpayer’s Federal Employer Identication

Number (FEIN) or the Michigan Treasury (TR) assigned

number. Be sure to use the same account number on all forms.

If the taxpayer does not have an FEIN or TR number,

the taxpayer MUST

register before ling this form.

Taxpayers are encouraged to register online at

www.michigan.gov/businesstaxes. The Web site provides

information on obtaining an FEIN, which is required to submit

taxes through e-le. Taxpayers usually can obtain an FEIN from

the IRS within 48 hours. Taxpayers registering with the State

online usually receive an account number within seven days.

Returns received without a registered account number will not

be processed until such time as a number is provided.

Line 8: Check the box that describes the organization type.

A Trust or LLC should check the appropriate box based on its

federal return.

NOTE: A federally disregarded entity that les MBT as

a distinct entity is classied for MBT purposes according

to the federal tax classication of its owner. For additional

information, see “Changes for Disregarded Entities” in the

“Important Information” section of the MBT Forms and

Instructions for Standard Taxpayers (Form 4600).

Part 1: Calculation of Tax

Line 9: Gross receipts means the entire amount received by

the taxpayer, as determined by using the taxpayer’s method of

accounting for federal income tax purposes, from any activity,

whether in intrastate, interstate, or foreign commerce, carried

out for direct or indirect gain, benet, or advantage to the

taxpayer or to others, with certain exceptions.

Calculation of gross receipts also involves a phased-in

deduction (75 percent in the 2011 tax year) of any amount

deducted as bad debt for federal income tax purposes that

corresponds to items of gross receipts included in the modied

gross receipts tax base for the current tax year or past tax

years. This partial reduction is reected in the Gross Receipts

Worksheet (Worksheet 4700) discussed below. Receipts

include, but are not limited to:

• Receipts (sales proceeds) from the sale of assets used in a

business activity

• Sale of products

• Services performed

• Gratuities stipulated on a bill

• Sales tax collected on the sale of tangible personal property,

subject to a phase-out schedule

• Dividend and interest income

• Gross commissions earned

• Rents

• Royalties

• Sales of scrap and other similar items

• Client reimbursed expenses not obtained in an agency

capacity

• Gross proceeds from sales between afliated companies,

including members of a UBG.

Use Worksheet 4700, in Form 4600, to calculate gross receipts.

Attach this worksheet to the return. Gross receipts are not

necessarily derived from the federal return; however, this

worksheet will calculate gross receipts as dened by law in

most instances. Taxpayers and tax professionals are expected to

be familiar with uncommon situations within their experience,

which produce gross receipts not identied by specic lines on

this form, and report that amount on the most appropriate line.

Treasury may adjust the amount resulting from this worksheet

to account properly for such uncommon situations.

Line 10: Business income means that part of federal taxable

income derived from business activity. For MBT purposes,

federal taxable income means taxable income as dened in

Internal Revenue Code (IRC) § 63, except that federal taxable

income shall be calculated as if IRC § 168(k) [as applied to

qualied property placed in service after December 31, 2007] and

IRC § 199 were not in effect. For a Partnership or S Corporation

(or LLC federally taxed as such), business income includes

payments and items of income and expense that are attributable

to business activity of the Partnership or S Corporation and

separately reported to the partners or shareholders.

Use the Business Income Worksheet (Worksheet 4746), in Form

4600, to calculate business income. Attach this worksheet

to the return. This worksheet will calculate business income

as dened by law in most circumstances. Taxpayers and tax

professionals are expected to be familiar with uncommon

situations within their experience, which produce business

income not identied by specic lines on this worksheet, and

report that amount on the most appropriate line. Treasury may

adjust the amount resulting from this worksheet to account

properly for such uncommon situations.

For an organization that is a mutual or cooperative electric

company exempt under IRC § 501(c)(12), business income

equals the organization’s excess or deciency of revenues over

expenses as reported to the federal government, less capital

credits paid to members of that organization, less income

attributed to equity in another organization’s net income,

and less income resulting from a charge approved by a state

or federal regulatory agency that is restricted for a specied

purpose and refundable if it is not used for the specied

purpose.

For a tax-exempt person, business income means only that

part of federal taxable income (as dened for MBT purposes)

derived from unrelated business activity.

For an Individual or an Estate, or for a Partnership or Trust

organized exclusively for estate or gift planning purposes,

business income is that part of federal taxable income (as

dened for MBT purposes) derived from transactions,

activities, and sources in the regular course of the taxpayer’s

trade or business, including the following:

• All income from tangible and intangible property if the

acquisition, rental, management, or disposition of the property

constitutes integral parts of the taxpayer’s regular trade or

business operations.

• Gains or losses incurred in the taxpayer’s trade or

business from stock and securities of any foreign or domestic

Corporation and dividend and interest income.

• Income derived from isolated sales, leases, assignment,

licenses, divisions, or other infrequently occurring dispositions,

transfers, or transactions involving property if the property is or

was used in the taxpayer’s trade or business operation.

• Income derived from the sale of a business.

NOTE: Personal investment income, gains from the sale of

property held for personal use and enjoyment or other assets

not used in a trade or business, and any other income not

specically derived from a trade or business that is earned,

received, or otherwise acquired by an Individual, an Estate,

or a Trust or Partnership organized or established exclusively

for estate or gift planning purposes, are not included in the

Business Income Tax base. This exclusion only applies to the

specic types of taxpayers identied above. Investment income

and any other types of income earned or received by all other

types of persons or taxpayers not specically referenced must

be included in the business income of the taxpayer.

Line 11: Enter all capital losses that were used federally to

offset capital gain. This is not the net amount found on the

U.S. Schedule D lines identied below, but rather the amount

of capital losses that were used in reaching the net amount on

those federal return lines. If ling U.S. Form 1040 or 1041,

include the capital loss amount that the Individual or Fiduciary

was able to use against the capital gain and the capital loss

amount that the Individual or Fiduciary was permitted to

deduct from ordinary income ($3,000 or less). Use both long-

term and short-term capital losses here.

Identify the capital losses used in calculating the net amount

using “Net short-term capital gain or (loss)” and “Net long-

term capital gain or (loss)” from Schedule D of federal Forms

1040, 1041, 1065, 1120 and 1120S, as applicable.

Also include on this line the net operating loss carryback or

carryover from the federal schedule that was included in the

business income reported on line 10. Report each of these

amounts as a positive number.

Line 17: For tax periods less than 12 months, enter annualized

gross receipts.

Line 23: Enter the total tax paid with the MBT Quarterly

Tax Return (Form 4548), or the estimated MBT paid with the

Combined Return for Michigan Taxes (Form 160), or the amount

paid through Electronic Funds Transfer. Include all payments

made on returns that apply to the current tax year. For example,

calendar-year lers include money paid with Form 160 for return

periods January through December.

Line 27a:

Enter payment made with original return.

Line 27b:

Enter overpayment received (refund received plus

credit forward created) on the original return.

Line 27c:

Add lines 26 and 27a and subtract line 27b from

the sum.

Line 29: If penalty and interest are owed for not ling estimated

returns or for underestimating a tax, complete the MBT Penalty

and Interest Computation for Underpaid Estimated Tax (Form

4582) to compute penalty and interest due. If a taxpayer prefers

not to le this form, Treasury will compute the penalty and

interest and bill for payment.

Line 30: Enter the annual return penalty rate in line 30a. Add

the overdue tax penalty in line 30b to the overdue tax interest

in line 30c. Enter total in line 30d.

Refer to the “Computing Penalty and Interest” section in Form

4600 to determine the annual return penalty rate and applicable

daily interest rate. Then use the following “Overdue Tax

Penalty” and “Overdue Tax Interest” worksheets.

A. Tax due from Form 4583, line 28 ........

00

B. Late/extension or insufcient payment

penalty percentage ...............................

%

C. Multiply line A by line B .....................

00

Carry amount from line C to Form 4583, line 30b.

A. Tax due from Form 4583, line 28 ........

00

B. Applicable daily interest percentage ..

%

C. Number of days return was past due ...

D. Multiply line B by line C ....................

%

E. Multiply line A by line D ....................

00

Carry amount from line E to Form 4583 line 30c.

Line 30c: NOTE: If the late period spans more than one

interest rate period, divide the late period into the number

of days in each of the interest rate periods identied in the

“Computing Penalty and Interest” section in Form 4600, and

apply the calculations in the “Overdue Tax Interest” worksheet

separately to each portion of the late period. Combine these

interest subtotals and carry the total to Form 4583, line 30c.

Line 32: If the amount of the overpayment, less any penalty

and interest due on lines 29 and 30d is less than zero, enter the

difference (as a positive number) on line 31. If the amount is

greater than zero, enter on line 32.

NOTE: If an overpayment exists, a taxpayer must elect a

refund of all or a portion of the amount and/or designate all or

a portion of the overpayment to be used as an estimate for the

next MBT tax year. Complete lines 33 and 34 as applicable.

Line 33: If the taxpayer anticipates an MBT liability in the

ling period subsequent to this return, some or all of any

overpayment from line 32 may be credited forward to the next

tax year as an estimated payment. Enter the desired amount to

use as an estimate for the next MBT tax year.

Reminder: Taxpayers must sign and date returns. Tax

preparers must provide a Preparer Taxpayer Identication

Number (PTIN), FEIN or Social Security number (SSN), a

business name, and a business address and phone number.

Federal Forms: Attach copies of these forms to the return.

• C Corporations: U.S. Form 1120 (pages 1 through 4),

Schedule D, Form 851, Form 4562, and Form 4797. If ling

as part of a consolidated federal return, attach a pro forma or

consolidated schedule.

• S Corporations: U.S. Form 1120-S (pages 1 through 4)*,

Schedule D, Form 851, Form 4562, Form 4797, Form 8825.

• Individuals: U.S. Form 1040 (pages 1 and 2), Schedules C,

C-EZ, D, E, and Form 4797.

• Fiduciaries: U.S. Form 1041 (pages 1 through 4),

Schedule D, and Form 4797.

• Partnerships: U.S. Form 1065 (pages 1 through 5)*,

Schedule D, Form 4797, and Form 8825.

• Limited Liability Companies: Attach appropriate

schedules shown above based on federal return led.

• Federally Exempt Entities: In certain circumstances, a

federally tax exempt entity must le an MBT return. In those

cases, attach U.S. Form 990-T (pages 1 through 4).

NOTE: A federally disregarded entity that is qualied to le

an MBT return as a stand-alone entity or as a member of a

UBG will prepare its MBT return on the basis of a pro forma

federal return or equivalent schedule, using the same federal

return type as its owner. Attach a copy of the applicable pro

forma return and schedules listed above. For additional

information, see “Changes for Disregarded Entities” in the

“Important Information” section of the MBT Forms and

Instructions for Standard Taxpayers (Form 4600).

* Do not send copies of K-1s. Treasury will request them if

necessary.