Fillable Printable Form 4679 - Missouri Department Of Revenue

Fillable Printable Form 4679 - Missouri Department Of Revenue

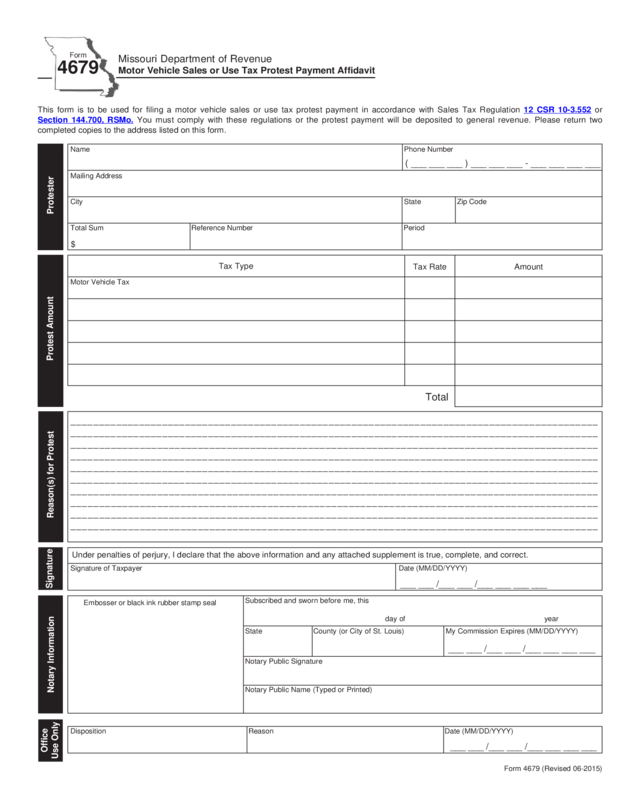

Form 4679 - Missouri Department Of Revenue

Subscribed and sworn before me, this

day of year

State County (or City of St. Louis) My Commission Expires (MM/DD/YYYY)

Notary Public Signature

Notary Public Name (Typed or Printed)

Missouri Department of Revenue

Motor Vehicle Sales or Use Tax Protest Payment Affidavit

Form

4679

Notary Information

Embosser or black ink rubber stamp seal

___ ___ /___ ___ /___ ___ ___ ___

Tax Type

This form is to be used for filing a motor vehicle sales or use tax protest payment in accordance with Sales Tax Regulation 12 CSR 10‑3.552 or

Section 144.700, RSMo. You must comply with these regulations or the protest payment will be deposited to general revenue. Please return two

completed copies to the address listed on this form.

Tax Rate Amount

Motor Vehicle Tax

Form 4679 (Revised 06-2015)

Protester

Total Sum Reference Number Period

Name Phone Number

Mailing Address

City State Zip Code

$

Protest Amount

Total

Reason(s) for Protest

Signature

Signature of Taxpayer Date (MM/DD/YYYY)

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

___ ___ /___ ___ /___ ___ ___ ___

Office

Use Only

Disposition Reason Date (MM/DD/YYYY)

___ ___ /___ ___ /___ ___ ___ ___

( ___ ___ ___ ) ___ ___ ___ - ___ ___ ___ ___

____________________________________________________________________________________________

____________________________________________________________________________________________

___________________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

Reset Form

Print Form

Missouri Revised Statutes, 1994

144.700. Revenue placed in general revenue, exception placement in school district trust fund—payment under protest, procedure,

appeal, refund.

1. All Revenue received by the Director of Revenue from the tax imposed by Sections 144.010 to 144.430 and 144.600 to

144.745, except that Revenue derived from the rate of one cent on the dollar of the tax which shall be held and distributed

in the manner provided in Sections 144.701 and 163.031, RSMo, shall be deposited in the state general revenue fund,

including any payments of the taxes made under protest.

2. The Director of Revenue shall keep accurate records of any payment of the tax made under protest. In the event any payment

shall be made under protest:

(1) A protest affidavit shall be submitted to the Director of Revenue within thirty days after the payment is made; and

(2) An appeal shall be taken in the manner provided in Section 144.261 from any decision of the Director of Revenue

disallowing the making of the payment under protest or an application shall be filed by a protesting taxpayer with the

Director of Revenue for a stay of the period for appeal on the ground that a case is presently pending in the courts involving

the same question, with an agreement by the taxpayer to be bound by the final decision in the pending case.

3. Nothing in this section shall be construed to apply to any refund to which the taxpayer would be entitled under any applicable

provision of law.

4. All payments deposited in the state general revenue fund that are made under protest shall be retained in the state treasury if

the taxpayer does not prevail. If the taxpayer prevails, then taxes paid under protest shall be refunded to the taxpayer, with all

interest income derived therefrom, from funds appropriated by the general assembly for such purpose.

(L. 1959 H.B. 35 § 26, A.L. 1961 p. 630, A.L. 1978 S.B. 661, A.L. 1981 H.B. 129, A.L. 1982 Adopted by initiative, Proposition C, November 2, 1982, A.L. 1983 1st Ex. Sess.

H.B. 10, A.L. 1993 S.B. 380)

Missouri Department of Revenue

Administrative Rule: 12 CSR 10-3.552 Protest Payments

Purpose: This rule interprets the sales tax law as it applies to protest payments.

(1) If the taxpayer in good faith believes that he or she is not subject to the sales tax under the Missouri sales tax act, he or she,

upon payment of the required amount of tax and denoting the payment as a protest payment when made, may file a protest

payment affidavit, in which he or she specifically shall set out why he or she is protesting payment of the tax and give

supporting information. The protest claim shall be made under oath and submitted within thirty (30) days after the protest

payment. Failure to denote the payment as made under protest or to make a protest claim within the time required and under

the conditions specified will void the protest claim.

(2) Protest payment forms (Form 163) are available from the Director of Revenue upon request. Written request should be sent to

the Taxation Division at the address listed below.

(3) If a protest payment is not made by the required due date, interest and additions to tax should be included in the payment to

properly perfect the protest.

Auth: Section 144.270, RSMo (1986).* S.T. regulation 240-3 was last filed Oct. 28, 1975, effective Nov. 7, 1975. Refiled March 30,

1976. Amended: Filed Aug. 13, 1980, effective Jan. 1, 1981. Amended: Filed Sept. 7, 1984, effective Jan. 12, 1985. *Original authority

1939, amended 1941, 1943, 1945, 1947, 1955, 1961.

Form 4679 (Revised 09-2015)

Mail to: Motor Vehicle Bureau Phone: (573) 751-1030

P.O. Box 3350 Fax: (573) 751-8749

Jefferson City, MO 65105-3350 TTY: (800) 735-2966

E‑mail: [email protected]

Visit http://dor.mo.gov/motorv/

for additional information.