Fillable Printable Form 472P - Missouri Department Of Revenue

Fillable Printable Form 472P - Missouri Department Of Revenue

Form 472P - Missouri Department Of Revenue

Form 472P (Revised 08-2017)

Submit the listed items to ensure the Department of Revenue can process your claim. All required information

must be submitted to avoid a delay or denial.

• Claim Form - A fully completed and signed Purchaser’s Claim Under Section 144.190.4(2) for Sales or Use Tax Refund

(Form 472P).

• Exemption Certification and Letters - A copy of all exemption certificates or exemption letters for the exempt purchases in

your claim.

• Worksheet - A worksheet (any format) detailing how you calculated the refund amount.

• Invoices - Invoices supporting the claim.

• Refunds in Excess of $100,000 - If you request a refund of $100,000 or more, it will be processed through Automated

Clearing House (ACH). Submit an Agreement to Receive Refund by ACH Transfer (Form 5378). Visit

//dor/mo.gov/forms/ to obtain Form 5378.

• Additional Verification, As Requested - The Department may ask for additional records to verify a claim, such as

documentation of returns filed in electronic format or a listing of all items on which tax was accrued and paid for the periods

a refund is being requested. You will be given a reasonable amount of time to comply with the request.

• Power of Attorney - If someone other than an owner, partner, or officer is the contact person for this claim, an executed

Power of Attorney (Form 2827) must be submitted. If the power of attorney should receive copies of the correspondence

relating to the claim and the final approval or denial, check the appropriate box in the Purchaser and Seller Information

section on the claim.

• Consumer’s Use Tax - If you are requesting a refund of consumer’s use tax you paid directly to the Department, submit

amended returns for the period(s) in which you originally reported the tax. You do not need to submit Form 5433 or

Form 5440 as described below under the Assignment of Rights heading.

•AssignmentofRights-If you are requesting a refund of sales or vendor’s use tax, you must submit a completed Form 5433 or

Fo rm 5440 with your claim. As the purchaser, you can request a refund with the seller’s approval by contacting the seller

to complete an Assignment of Rights From The Seller To Purchaser For Refund Under Section 144.190.4(2) (Form 5433). If

you are unable to obtain a completed Form 5433 from the seller, you may complete a Statement Confirming Purchaser’s

Efforts To Obtain An Assignment of Rights From The Seller For Refund Under Section 144.190.4(2) (Form 5440). Form

5433 must be signed by an officer, power of attorney, or an employee of the seller. If the person signing the Form 5433 is

not registered with the Department as an officer, it must be accompanied by a Power of Attorney (Form 2827) or a letter

from the signatory’s immediate supervisor on company letterhead authorizing the employee to act on the seller’s behalf.

• You must provide the original Form 5433 or Form 5440. The Department cannot accept a copy, fax, or e-mailed copy

because the statute requires the form be notarized.

1. I am ling a claim that involves more than one ling period. Do I need to le a separate Form 472P claim for each period?

No. Submit one Form 472P for the entire claim. Indicate the periods for which the claim is being submitted. If your claim is

for multiple consumer’s use tax periods, you are still required to submit amended returns for each period of your claim.

2. Does the state pay interest on overpayments?

Usually not. Interest is included in a refund only if the overpayment is not refunded within 120 days from the latest of:

- the last day prescribed for ling a tax return or refund claim, without regard to any extension of time granted;

- the date the return, payment or claim is led; or

- the date the taxpayer les for a refund and provides accurate and complete documentation to support the claim.

3. What is the oldest period for which I may request a refund?

You may le a claim within three years of the due date of the original return or the date paid by the seller or vendor,

whichever is later.

4. What is my recourse if a claim has been denied?

A denial of a claim is the nal decision of the Director of Revenue. A taxpayer may appeal any decision to the Administrative

Hearing Commission (AHC). Appeals must be submitted in writing to the Administrative Hearing Commission, 301 West

High Street, Harry S. Truman State Ofce Building, P.O. Box 1557, Jefferson City, Missouri 65105 within 60 days after the

date the decision is mailed or the date it is delivered, whichever date is earlier. If your appeal is sent by registered or

certied mail, the appeal will be deemed led on the date it is mailed. If the appeal is sent by any method other than

registered mail, it will be deemed led on the date it is received by the AHC.

Frequently Asked QuestionsRequired Documents

Form

472P

Missouri Department of Revenue

Purchaser’s Claim Under Section 144.190.4

for Sales or Use Tax Refund

*14000000001*

14000000001

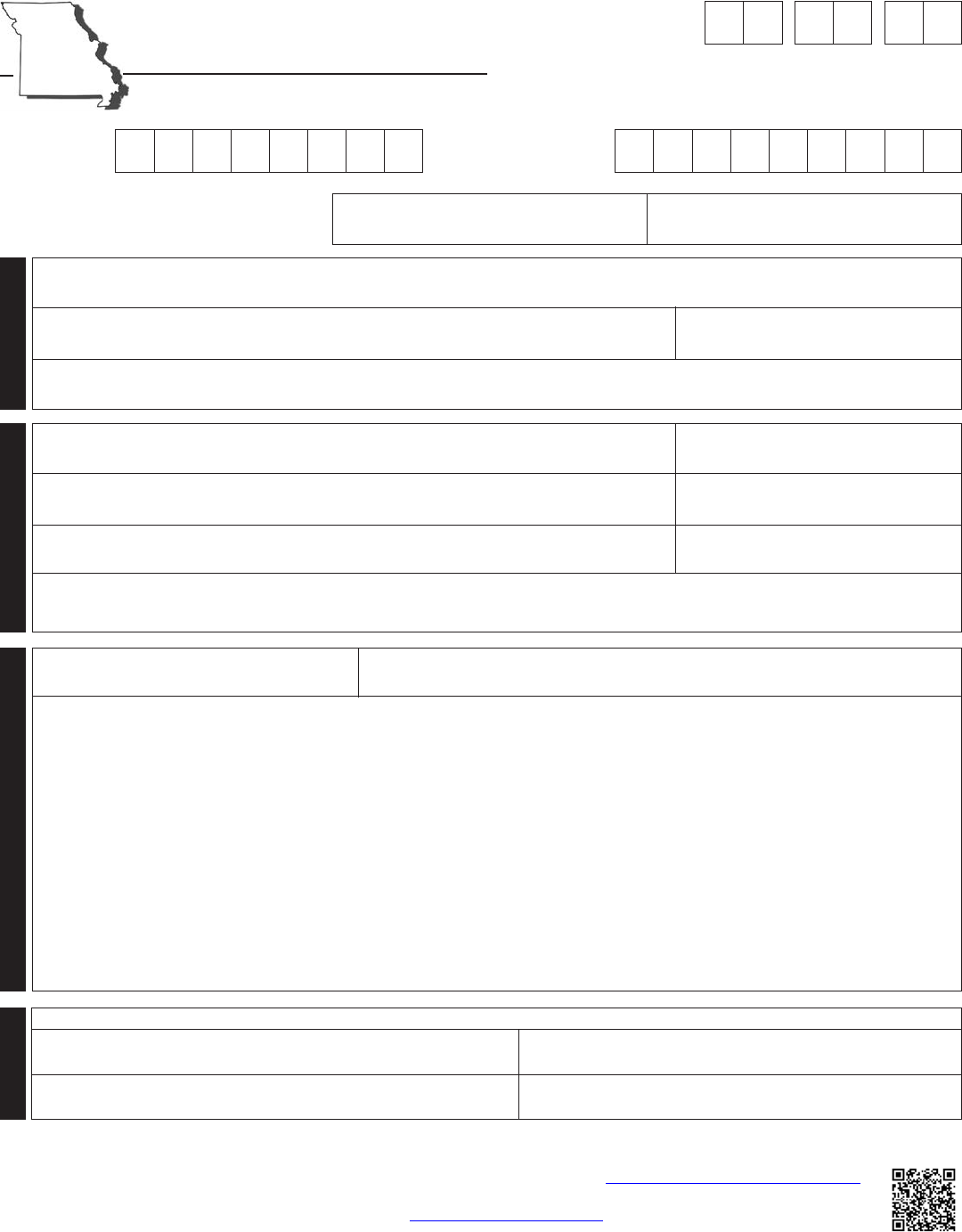

Name of Seller

( ___ ___ ___ ) - ___ ___ ___ - ___ ___ ___ ___

Contact Telephone Number

Address

City, State, and ZIP Code

Seller

Name of Purchaser

( ___ ___ ___ ) - ___ ___ ___ - ___ ___ ___ ___

Contact Telephone Number

Address

City, State, and ZIP Code

Do you want the Department of Revenue to send copies of any correspondence relating to this refund and the final refund approval or denial to

your attorney? r No r Yes (If yes, include a copy of the Power of Attorney (Form 2827) with the refund application.)

Purchaser

Missouri Tax Identification Number

| | | | | | |

$

Requested Refund Amount Filing Periods Covered by Refund Claim

Reason for requesting a refund - Explain the specic grounds upon which your claim for refund is based. If your refund request is for an amount

that exceeds $100,000, an Agreement To Receive Refund By ACH Transfer (Form 5378) is required.

Refund information

Mail to:Missouri Department of Revenue Phone: (573) 526-9938

Taxation Division TTY: (800) 735-2966

P.O. Box 3350 Fax: (573) 751-9409

Visit //dor.mo.gov/business/sales/

for additional information.

Signature of Taxpayer or Power of Attorney Printed Name

Date (MM/DD/YYYY)

Signature

___ ___ / ___ ___ / ___ ___ ___ ___

Under penalties of perjury, I declare that the above information and any attached supplement is true, completed, and correct.

I conrm that I am the following (check one)

r Taxpayer r Power of Attorney

Claim Number (Department Use Only) Certified Number (Department Use Only)

Form 472P (Revised 08-2017)

Form

472P

Missouri Department of Revenue

Purchaser’s Claim Under Section 144.190.4

for Sales or Use Tax Refund

Department Use Only

(MM/DD/YY)

Seller Missouri

Tax I.D. Number

Seller Federal

Employer I.D. Number

*14011010001*

14011010001

Purchaser FEIN

Reset Form

Print Form