Fillable Printable Form 50469

Fillable Printable Form 50469

Form 50469

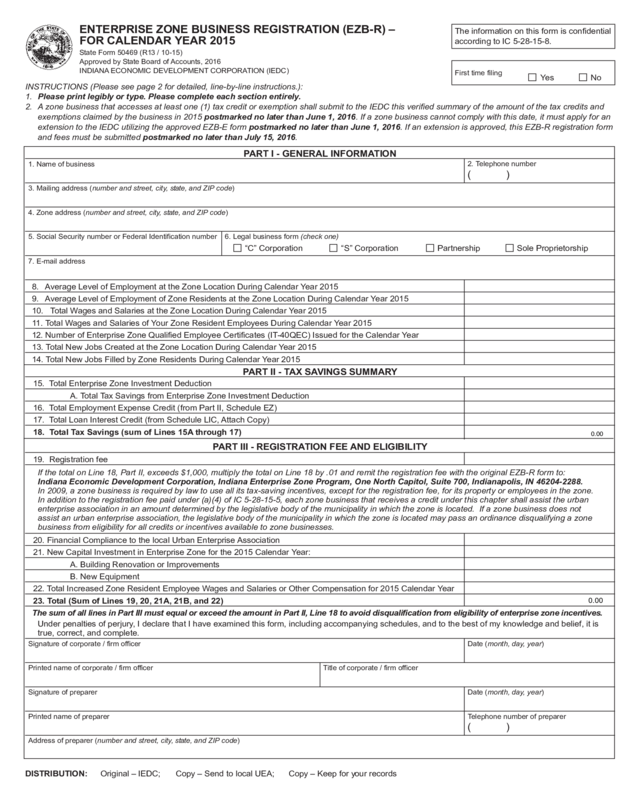

ENTERPRISE ZONE BUSINESS REGISTRATION (EZB-R) –

FOR CALENDAR YEAR 2015

State Form 50469 (R13 / 10-15)

Approved by State Board of Accounts, 2016

INDIANA ECONOMIC DEVELOPMENT CORPORATION (IEDC)

PART I - GENERAL INFORMATION

1. Name of business

5. Social Security number or Federal Identification number

2. Telephone number

( )

INSTRUCTIONS (Please see page 2 for detailed, line-by-line instructions.):

1. Please print legibly or type. Please complete each section entirely.

2. A zone business that accesses at least one (1) tax credit or exemption shall submit to the IEDC this verified summary of the amount of the tax credits and

exemptions claimed by the business in 2015 postmarked no later than June 1, 2016. If a zone business cannot comply with this date, it must apply for an

extension to the IEDC utilizing the approved EZB-E form postmarked no later than June 1, 2016. If an extension is approved, this EZB-R registration form

and fees must be submitted postmarked no later than July 15, 2016.

DISTRIBUTION: Original – IEDC; Copy – Send to local UEA; Copy – Keep for your records

The information on this form is confidential

according to IC 5-28-15-8.

3. Mailing address (number and street, city, state, and ZIP code)

4. Zone address (number and street, city, state, and ZIP code)

6. Legal business form (check one)

“C” Corporation “S” Corporation Partnership Sole Proprietorship

8. Average Level of Employment at the Zone Location During Calendar Year 2015

9. Average Level of Employment of Zone Residents at the Zone Location During Calendar Year 2015

10. Total Wages and Salaries at the Zone Location During Calendar Year 2015

11. Total Wages and Salaries of Your Zone Resident Employees During Calendar Year 2015

12. Number of Enterprise Zone Qualified Employee Certificates (IT-40QEC) Issued for the Calendar Year

13. Total New Jobs Created at the Zone Location During Calendar Year 2015

14. Total New Jobs Filled by Zone Residents During Calendar Year 2015

Address of preparer (number and street, city, state, and ZIP code)

Printed name of preparer Telephone number of preparer

( )

Signature of preparer Date (month, day, year)

Printed name of corporate / firm officer

Signature of corporate / firm officer Date (month, day, year)

Title of corporate / firm officer

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules, and to the best of my knowledge and belief, it is

true, correct, and complete.

PART II - TAX SAVINGS SUMMARY

15. Total Enterprise Zone Investment Deduction

A. Total Tax Savings from Enterprise Zone Investment Deduction

16. Total Employment Expense Credit (from Part II, Schedule EZ)

17. Total Loan Interest Credit (from Schedule LIC, Attach Copy)

18. Total Tax Savings (sum of Lines 15A through 17)

PART III - REGISTRATION FEE AND ELIGIBILITY

19. Registration fee

If the total on Line 18, Part II, exceeds $1,000, multiply the total on Line 18 by .01 and remit the registration fee with the original EZB-R form to:

Indiana Economic Development Corporation, Indiana Enterprise Zone Program, One North Capitol, Suite 700, Indianapolis, IN 46204-2288.

In 2009, a zone business is required by law to use all its tax-saving incentives, except for the registration fee, for its property or employees in the zone.

In addition to the registration fee paid under (a)(4) of IC 5-28-15-5, each zone business that receives a credit under this chapter shall assist the urban

enterprise association in an amount determined by the legislative body of the municipality in which the zone is located. If a zone business does not

assist an urban enterprise association, the legislative body of the municipality in which the zone is located may pass an ordinance disqualifying a zone

business from eligibility for all credits or incentives available to zone businesses.

20. Financial Compliance to the local Urban Enterprise Association

21. New Capital Investment in Enterprise Zone for the 2015 Calendar Year:

A. Building Renovation or Improvements

B. New Equipment

22. Total Increased Zone Resident Employee Wages and Salaries or Other Compensation for 2015 Calendar Year

23. Total (Sum of Lines 19, 20, 21A, 21B, and 22)

The sum of all lines in Part III must equal or exceed the amount in Part II, Line 18 to avoid disqualification from eligibility of enterprise zone incentives.

First time filing

Yes No

7. E-mail address

Reset Form

0.00

0.00

INSTRUCTIONS FOR COMPLETING THE EZB-R

Part of State Form 50469 (R13 / 10-15)

Part I General Information

Line 1: Enter legal name of the business.

Line 2: Enter the business telephone and fax number (including area code).

Line 3: Enter the mailing address of the business.

Line 4: Enter the address of the business location in the enterprise zone or inventory location.

Line 5: Enter the Social Security number or the federal identification number of the business.

Line 6: Check the appropriate organizational form of the business.

Line 7: Enter e-mail address.

Line 8: List the total number of employees at the zone location on the 15th day of each month, add the column, divide by 12 and enter the number on line 8.

Example for line 8:

Date Employees

January 15 30

February 15 30

March 15 30

April 15 30

May 15 30

June 15 45

July 15 45

August 15 45

September 15 25

October 15 25

November 15 30

December 15 30

Year Total 395

395 ÷ 12 = 32.9 Enter 32.9 on line 8

Line 9: List the total number of zone residents employed at the zone location on the 15th day of each month, divide the resulting figure by 12 and enter the

number on line 9 (see example in line 8 instructions). Every participating business must complete this line, even if your business does not

utilize the hiring tax credits.

Line 10: Enter the total of all wages and salaries paid at the zone location for the calendar year for which you are filing.

Line 11: Enter the total wages and salaries paid to zone resident employees at the zone location for the calendar year for which you are filing.

Line 12: Enter the total number of Enterprise Zone Qualified Employee Certificates (IT-40QEC) issued for the calendar year for which you are filing.

Line 13: Enter the total number of new jobs created at the zone location during the calendar year for which you are filing.

Line 14 Enter the total number of new jobs filled by zone residents during the calendar year for which you are filing.

Part II Tax Savings Summary

If you are a new business or have no tax savings to report for the calendar year for which this form applies, please skip to Part III of this form.

Line 15: Enter the total Enterprise Zone Investment Deduction.

A. Enter the total Tax Savings from Enterprise Zone Investment Deduction.

Line 16: Enter the employment expense credit amount from Schedule EZ.

Line 17: Enter the loan interest credit amount from Schedule LIC.

Line 18: Add the amounts in Lines 15A-17 and enter amount.

Part III Registration Fee and Eligibility

Line 19: If the total on line 18, Part II exceeds $1,000, multiply the amount by .01 and enter that amount on this line. If a zone business receives tax-saving

incentives in excess of $1,000 in any year, the business MUST pay an annual registration fee of one percent (1%) of its tax savings to the INDIANA

ECONOMIC DEVELOPMENT CORPORATION, or be denied credits and incentives, and disqualified from further participation according to

IC 5-28-15-7. REMIT THE AMOUNT ON THIS LINE WITH THE ORIGINAL EZB-R TO: INDIANA ECONOMIC DEVELOPMENT CORPORATION,

One North Capitol, Suite 700, Indianapolis, IN 46204-2288.

You must still submit an EZB-R even if your business does not owe a registration fee!

Line 20: Multiply the amount on line 18, Part II of this form by the local UEA rate and enter that amount on this line (please contact the local UEA to determine

the rate). REMIT THE AMOUNT ON THIS LINE TO THE LOCAL UEA WITH A COPY OF THIS EZB-R.

Line 21: New Capital Investment for the Calendar Year

A. Enter the total dollar amount spent in the calendar year for zone business renovation and improvements at the zone location.

B. Enter the total dollar amount spent in the calendar year for new equipment at the zone location.

Line 22: Enter the amount of zone resident employee wages for the calendar year that exceeds each taxpayer’s base period qualified wages AND/OR the

total dollar amount spent on employee training.

Line 23: Add lines 19, 20, 21A, 21B, and 22 enter that amount on this line.

Signature Lines

Corporate/firm officer must sign this form and print name below written signature. Failure to sign and print name and title may delay processing and may

result in your form being returned to you. If someone other than the corporate/firm officer prepared this form, their name, signature, address and telephone

number are required.

GENERAL EZB-R QUESTIONS

Part of State Form 50469 (R13 / 10-15)

Who should file the EZB-R?: Any zone business or entity that claims any of the incentives available to zone businesses must submit to the

Indiana Economic Development Corporation (IEDC) a verified summary of the amount of tax credits and exemptions claimed by the business

in the preceding year. Failure to file an EZB-R while claiming an exemption or credit will result in denial of the tax credits and exemptions

available and disqualification from further participation in the enterprise zone program.

When should the EZB-R be filed?: Any entity that accesses one or more Enterprise Zone tax incentives is required to file a registration form

with the IEDC postmarked no later than June 1 of each year. This means that forms must be postmarked by the post office, not

meter-dated or faxed.

What if a business cannot meet the June 1 filing deadline?: If the June 1 date cannot be met, the extension form should be filed to

provide additional time to complete the registration form. The registration extension form (EZB-E) is due postmarked no later than June 1.

The IEDC may approve an extension time of up to 45 days. (If approved, the EZB-E will be returned with “APPROVED” stamped on it.

Please attach an approved EZB-E to the EZB-R.)

What if I miss the June 1 deadline to file an extension?: If a business misses the June 1 deadline to file an extension, the business has

forty-five (45) days to submit the EZB-R form AND pay a 15% penalty to the IEDC. The 15% penalty is based on the total tax savings of

the business for the tax year.

What if I do not know what my tax savings is by June 1st or July 15th?: If the business does not know their tax savings by June 1, they

should file an extension (EZB-E) by June 1, which will enable them to file the EZB-R form by July 15. If the business still will not know the tax

savings by July 15, an EZB-R form is still due by July 15; however, the form will be incomplete. As soon as the tax savings amount is known,

the business must submit a complete EZB-R form (and if applicable) send a check for 1 percent of the tax savings to the IEDC.

What if a business has several locations?: A separate form is required for each zone business or entity claiming an exemption or credit.

If the business has more than one location or subsidiary, a separate registration form must be filed for each business location.

Who should receive the EZB-R form?: The revised EZB-R is a single form with instructions on the reverse side.

The original form (with the original signatures) must be sent to the IEDC. The original form should be accompanied with a

registration fee (if tax savings are greater than $1,000). The registration fee is equaled to a zone business’ total tax savings

multiplied by 0.01. In addition, a copy must be mailed to the local Urban Enterprise Association along with the contribution check in

accordance with the rate set by the city council of a particular zone. This contribution is separate from an in addition to the registration fee

that is sent to the IEDC. Please contact your local UEA to obtain information about its contribution rate. Finally, the participating business

should keep one copy of the EZB-R for their records.

Please note the following:

Any information omissions on the registration form may delay processing.

A corporate or firm officer must sign the registration form.

The registration fee must accompany the registration form.

If the EZB-R is returned for completion, omission of check, or correction, the business has forty-five (45) days in which to return the

corrected EZB-R.