Fillable Printable Form 52340

Fillable Printable Form 52340

Form 52340

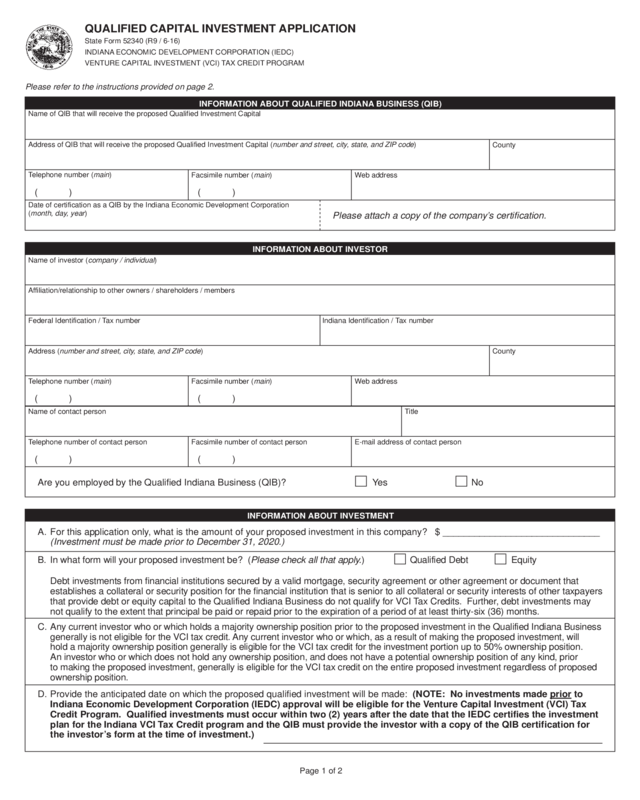

QUALIFIED CAPITAL INVESTMENT APPLICATION

State Form 52340 (R9 / 6-16)

INDIANA ECONOMIC DEVELOPMENT CORPORATION (IEDC)

VENTURE CAPITAL INVESTMENT (VCI) TAX CREDIT PROGRAM

INFORMATION ABOUT QUALIFIED INDIANA BUSINESS (QIB)

Name of QIB that will receive the proposed Qualified Investment Capital

Address of QIB that will receive the proposed Qualified Investment Capital (number and street, city, state, and ZIP code)

Telephone number (main)

Date of certification as a QIB by the Indiana Economic Development Corporation

(month, day, year)

County

Web addressFacsimile number (main)

( ) ( )

Please attach a copy of the company’s certification.

INFORMATION ABOUT INVESTOR

Name of investor (company / individual)

Affiliation/relationship to other owners / shareholders / members

Federal Identification / Tax number

Address (number and street, city, state, and ZIP code)

Telephone number (main)

Name of contact person

Telephone number of contact person

County

( )

Facsimile number (main)

( )

Web address

( )

Facsimile number of contact person E-mail address of contact person

( )

Title

Are you employed by the Qualified Indiana Business (QIB)? Yes No

INFORMATION ABOUT INVESTMENT

A. For this application only, what is the amount of your proposed investment in this company? $ ______________________________

(Investment must be made prior to December 31, 2020.)

B. In what form will your proposed investment be? (Please check all that apply.) Qualified Debt Equity

Debt investments from financial institutions secured by a valid mortgage, security agreement or other agreement or document that

establishes a collateral or security position for the financial institution that is senior to all collateral or security interests of other taxpayers

that provide debt or equity capital to the Qualified Indiana Business do not qualify for VCI Tax Credits. Further, debt investments may

not qualify to the extent that principal be paid or repaid prior to the expiration of a period of at least thirty-six (36) months.

C. Any current investor who or which holds a majority ownership position prior to the proposed investment in the Qualified Indiana Business

generally is not eligible for the VCI tax credit. Any current investor who or which, as a result of making the proposed investment, will

hold a majority ownership position generally is eligible for the VCI tax credit for the investment portion up to 50% ownership position.

An investor who or which does not hold any ownership position, and does not have a potential ownership position of any kind, prior

to making the proposed investment, generally is eligible for the VCI tax credit on the entire proposed investment regardless of proposed

ownership position.

D. Provide the anticipated date on which the proposed qualified investment will be made: (NOTE: No investments made prior to

Indiana Economic Development Corporation (IEDC) approval will be eligible for the Venture Capital Investment (VCI) Tax

Credit Program. Qualified investments must occur within two (2) years after the date that the IEDC certifies the investment

plan for the Indiana VCI Tax Credit program and the QIB must provide the investor with a copy of the QIB certification for

the investor’s form at the time of investment.)

Please refer to the instructions provided on page 2.

Page 1 of 2

Indiana Identification / Tax number

Reset Form

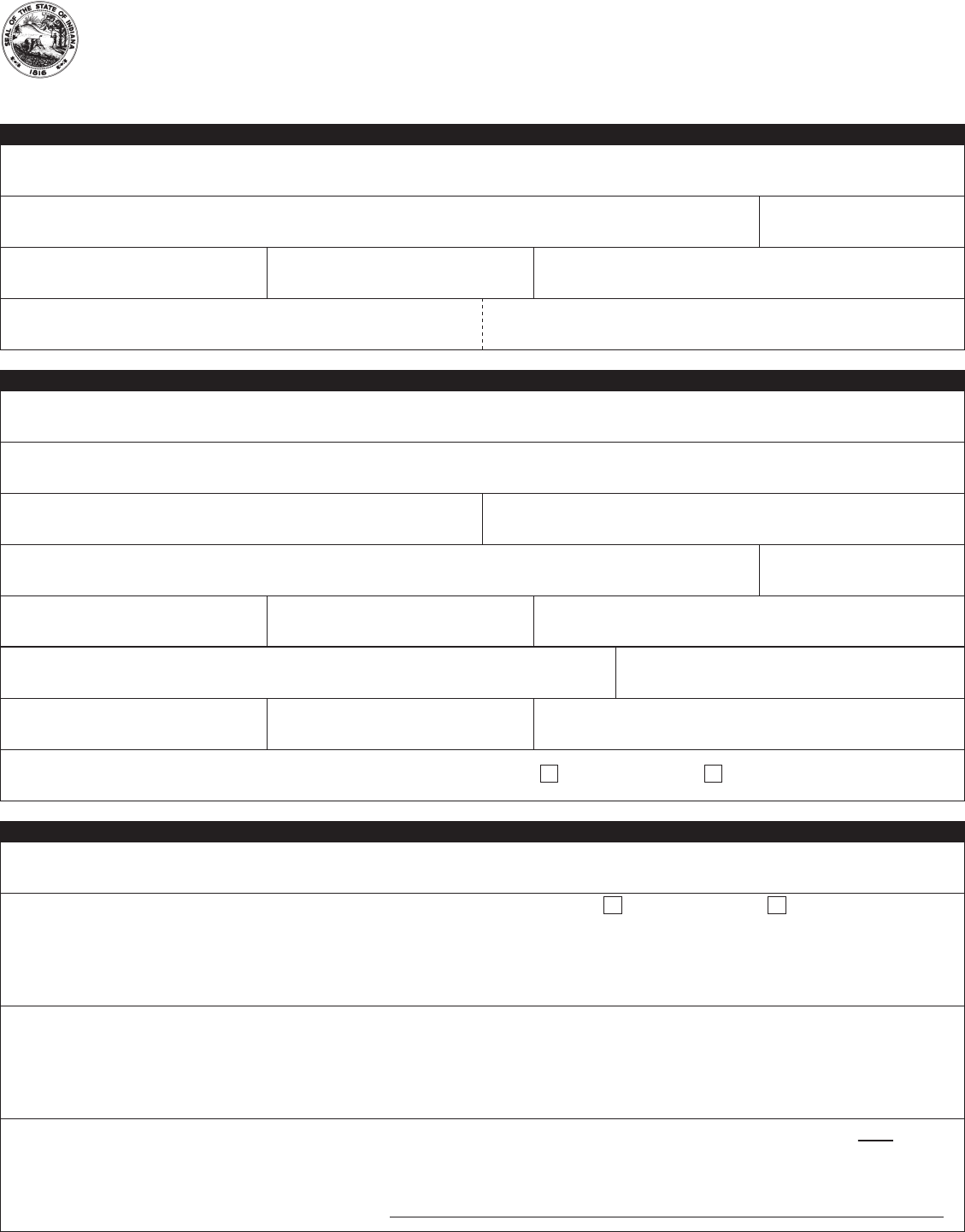

AFFIRMATION

Page 2 of 2

Signature of applicant

Printed name of applicant

Date (month, day, year)

INSTRUCTIONS

1. To have your application processed, please mail this original signed application to:

Indiana Economic Development Corporation

VCI Tax Credit Program

One North Capitol Avenue, Suite 700

Indianapolis, Indiana 46204

2. Please enclose the entire application (including attachments). To do otherwise could cause a delay in the processing of the application.

Processing this application may take up to five (5) to seven (7) business days from the date of receipt of a complete application. If the

allotted time elapses without a decision letter from us, please contact Lee Robinson, at 317-233-3638 or [email protected].

3. After making your investment, please provide a letter from a Qualified Indiana Business (QIB) authorized representative

verifying the investment was made, a copy of an executed stock purchase agreement or other evidence of the investment,

a copy of the canceled check(s) or evidence of the wire transfer(s), and a copy of the QIB certification for the investor’s form.

IEDC’s certification of a tax credit based on this application relies upon representations contained herein and upon representations

made by the Qualified Indiana Business. The information contained in this application and in the application by the Qualified Indiana

Business is subject to verification by the IEDC. If the IEDC is unable to verify any information contained in this application or in the

application by the Qualified Indiana Business or determines any of the information to be inaccurate or misrepresented, a company’s

designation as a Qualified Indiana Business may be revoked and credits issued may be nullified at the IEDC’s sole discretion.

Title

By signing this application, I hereby affirm that I underst and that certain conditions must be satisfied before my investment may be eligible

for a venture capital investment tax credit, related to the types of investment, the ownership positions, and the timing of the investment,

and under the penalties of perjury, that the information contained herein is true and accurate to the best of my knowledge and belief.

I furthermore affirm that I have read and understand the statute governing this program (Indiana Code 6-3.1-24).