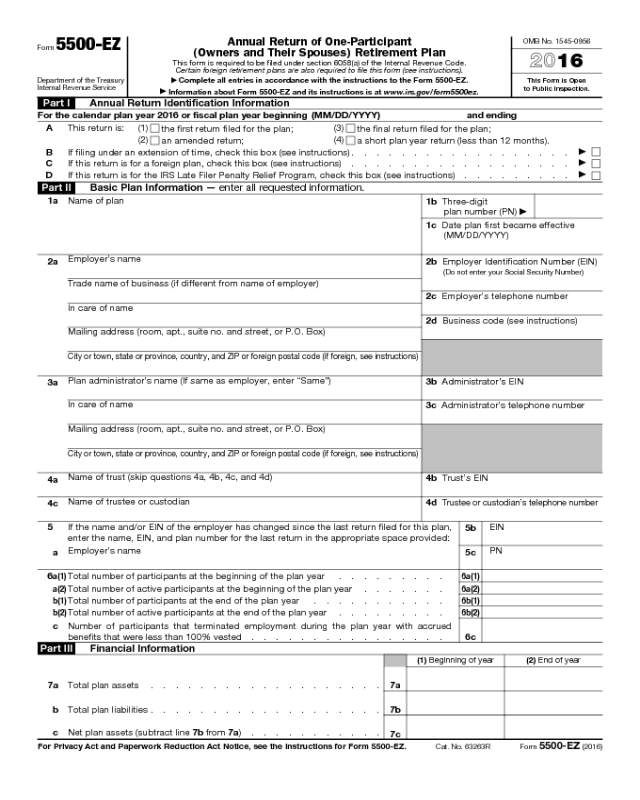

Form 5500-EZ

Form 5500-EZ

Department of the Treasury

Internal Revenue Service

Annual Return of One-Participant

(Owners and Their Spouses) Retirement Plan

This form is required to be filed under section 6058(a) of the Internal Revenue Code.

Certain foreign retirement plans are also required to file this form (see instructions).

▶

Complete all entries in accordance with the instructions to the Form 5500-EZ.

▶

Information about Form 5500-EZ and its instructions is at www.irs.gov/form5500ez.

OMB No. 1545-0956

2016

This Form is Open

to Public Inspection.

Part I Annual Return Identification Information

For the calendar plan year 2016 or fiscal plan year beginning (MM/DD/YYYY) and ending

A This return is: (1)

the first return filed for the plan;

(2)

an amended return;

(3)

the final return filed for the plan;

(4)

a short plan year return (less than 12 months).

B If filing under an extension of time, check this box (see instructions) . . . . . . . . . . . . . . . . . .

▶

C If this return is for a foreign plan, check this box (see instructions) . . . . . . . . . . . . . . . . . .

▶

D If this return is for the IRS Late Filer Penalty Relief Program, check this box (see instructions) . . . . . . . . .

▶

Part II Basic Plan Information — enter all requested information.

1a

Name of plan

1b Three-digit

plan number (PN)

▶

1c Date plan first became effective

(MM/DD/YYYY)

2a

Employer’s name

Trade name of business (if different from name of employer)

In care of name

Mailing address (room, apt., suite no. and street, or P.O. Box)

City or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions)

2b Employer Identification Number (EIN)

(Do not enter your Social Security Number)

2c Employer’s telephone number

2d Business code (see instructions)

3a

Plan administrator’s name (If same as employer, enter “Same”)

In care of name

Mailing address (room, apt., suite no. and street, or P.O. Box)

City or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions)

3b Administrator’s EIN

3c Administrator’s telephone number

4a

Name of trust (skip questions 4a, 4b, 4c, and 4d)

4b Trust’s EIN

4c

Name of trustee or custodian

4d

Trustee or custodian’s telephone number

5 If the name and/or EIN of the employer has changed since the last return filed for this plan,

enter the name, EIN, and plan number for the last return in the appropriate space provided:

a

Employer’s name

5b

EIN

5c

PN

6

a(1)

Total number of participants at the beginning of the plan year . . . . . . . . .

6a(1)

a(2)

Total number of active participants at the beginning of the plan year . . . . . . .

6a(2)

b(1)

Total number of participants at the end of the plan year . . . . . . . . . . .

6b(1)

b(2)

Total number of active participants at the end of the plan year . . . . . . . . .

6b(2)

c

Number of participants that terminated employment during the plan year with accrued

benefits that were less than 100% vested . . . . . . . . . . . . . . . .

6c

Part III Financial Information

(1) Beginning of year (2) End of year

7a Total plan assets . . . . . . . . . . . . . . . . . . . 7a

b Total plan liabilities . . . . . . . . . . . . . . . . . . . 7b

c Net plan assets (subtract line 7b from 7a) . . . . . . . . . . .

7c

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 5500-EZ.

Cat. No. 63263R

Form 5500-EZ (2016)

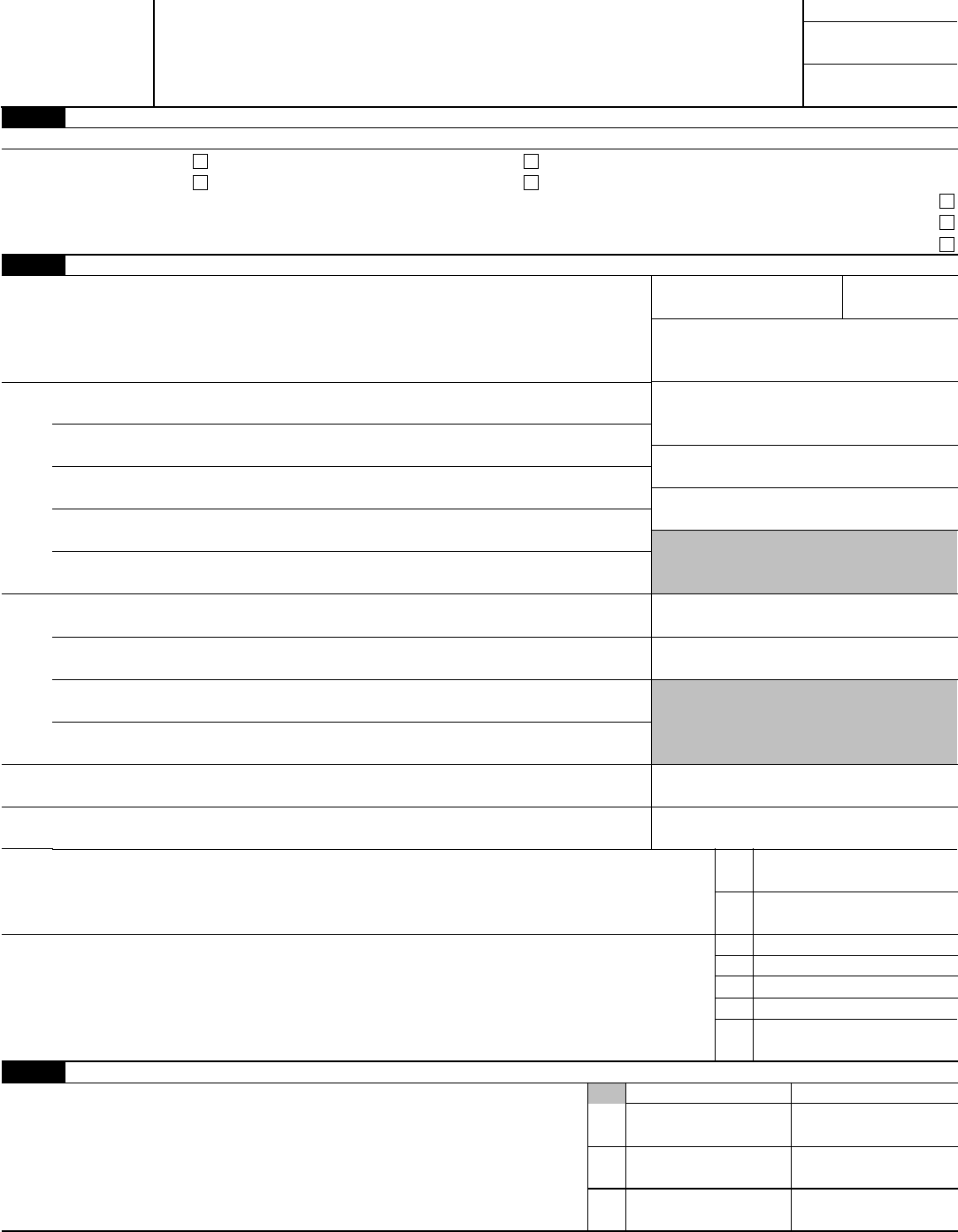

Form 5500-EZ (2016)

Page

2

Part III

(Continued)

8 Contributions received or receivable from:

Amount

a Employers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8a

b Participants . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8b

c Others (including rollovers) . . . . . . . . . . . . . . . . . . . . . . .

8c

Part IV Plan Characteristics

9 Enter the applicable two-character feature codes from the List of Plan Characteristics Codes in the instructions:

Part V Compliance and Funding Questions

Yes No Amount

10 During the plan year, did the plan have any participant loans?

If “Yes,” enter amount as of year end . . . . . . . . . . . . . . . .

10

11 Is this a defined benefit plan that is subject to minimum funding requirements?

If “Yes,” complete Schedule SB (Form 5500) and line 11a below. (See instructions.)

11

a

Enter the unpaid minimum required contributions for all years from Schedule SB (Form 5500), line 40

11a

12 Is this a defined contribution plan subject to the minimum funding requirements

of section 412 of the Code? . . . . . . . . . . . . . . . . . . .

12

If “Yes,” complete lines 12a or 12b, 12c, 12d, and 12e below, as applicable:

a

If a waiver of the minimum funding standard for a prior year is being amortized in this plan

year, enter the month, day, and year (MM/DD/YYYY) of the letter ruling granting the waiver

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

12a

b Enter the minimum required contribution for this plan year . . . . . . . . . . . . . 12b

c Enter the amount contributed by the employer to the plan for this plan year . . . . . . . 12c

d Subtract the amount in line 12c from the amount in line 12b. Enter the result (enter a minus sign

to the left of a negative amount) . . . . . . . . . . . . . . . . . . . . .

12d

Yes No

N/A

e

Will the minimum funding amount reported on line 12d be met by the funding deadline?

12e

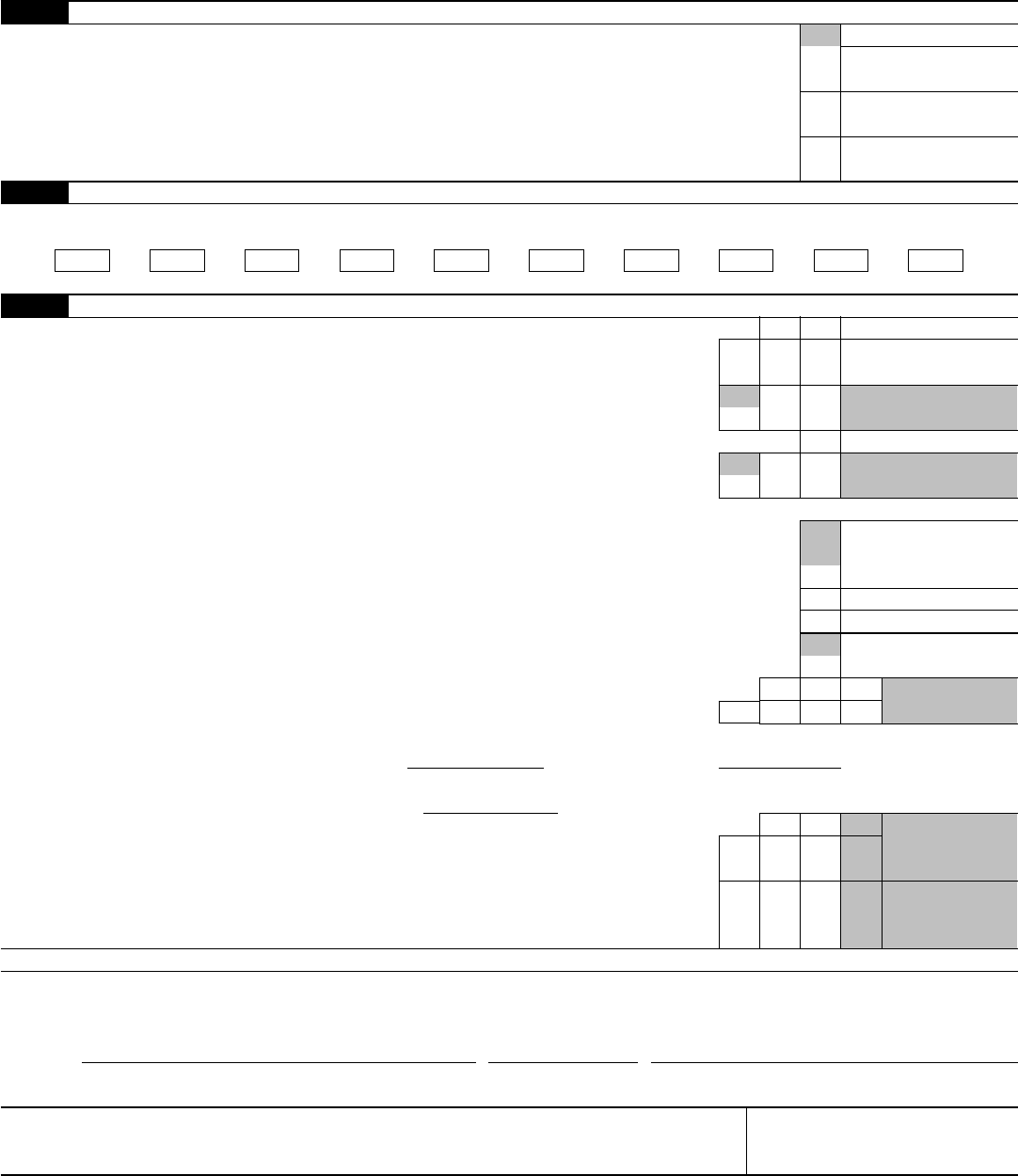

13a

If the plan is a master and prototype plan (M&P) or volume submitter plan that received a favorable IRS opinion letter or advisory

letter, enter the date of the letter (MM/DD/YYYY)

and the serial number (skip this question).

b

If the plan is an individually-designed plan that received a favorable determination letter from the IRS, enter the date of the

most recent determination letter (MM/DD/YYYY) (skip this question).

Yes No

14

Was any plan participant a 5% owner who had attained at least age 70½

during the

prior plan year? (skip this question)

. . . . . . . . . . . . . . . .

14

15

Defined Benefit Plan or Money Purchase Pension Plan only: Were any distributions

made during the plan year to an employee who attained age 62 and had not

separated from service? (skip this question)

. . . . . . . . . . . . .

15

Caution: A penalty for the late or incomplete filing of this return will be assessed unless reasonable cause is established.

Under penalties of perjury, I declare that I have examined this return including, if applicable, any related Schedule MB (Form 5500) or Schedule SB (Form 5500)

signed by an enrolled actuary, and to the best of my knowledge and belief, it is true, correct, and complete.

Sign

Here

▲

Signature of employer or plan administrator Date Type or print name of individual signing as employer or

plan administrator

Preparer’s name (including firm name, if applicable) and address, including room or suite number (skip this question)

Preparer’s telephone number (skip this

question)

Form 5500-EZ (2016)