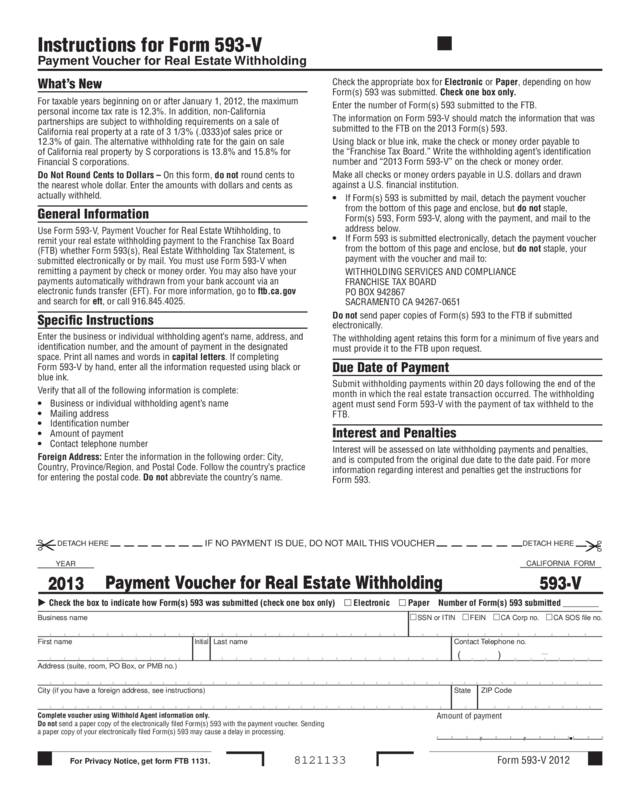

Fillable Printable Form 593-V - Franchise Tax Board

Fillable Printable Form 593-V - Franchise Tax Board

Form 593-V - Franchise Tax Board

Form 593-V 2012

For Privacy Notice, get form FTB 1131.

Business name

SSN or ITIN FEIN CA Corp no. CA SOS file no.

First name

Initial

Last name Contact Telephone no.

Address (suite, room, PO Box, or PMB no.)

City (if you have a foreign address, see instructions) State ZIP Code

Instructions for Form 593-V

Payment Voucher for Real Estate Withholding

What’s New

For taxable years beginning on or after January 1, 2012, the maximum

personal income tax rate is 12.3%. In addition, non-California

partnerships are subject to withholding requirements on a sale of

California real property at a rate of 3 1/3% (.0333)of sales price or

12.3% of gain. The alternative withholding rate for the gain on sale

of California real property by S corporations is 13.8% and 15.8% for

Financial S corporations.

Do Not Round Cents to Dollars – On this form, do not round cents to

the nearest whole dollar. Enter the amounts with dollars and cents as

actually withheld.

General Information

Use Form 593-V, Payment Voucher for Real Estate Wtihholding, to

remit your real estate withholding payment to the Franchise Tax Board

(FTB) whether Form 593(s), Real Estate Withholding Tax Statement, is

submitted electronically or by mail. You must use Form 593-V when

remitting a payment by check or money order. You may also have your

payments automatically withdrawn from your bank account via an

electronic funds transfer (EFT). For more information, go to ftb.ca.gov

and search for eft, or call 916.845.4025.

Specific Instructions

Enter the business or individual withholding agent’s name, address, and

identification number, and the amount of payment in the designated

space. Print all names and words in capital letters. If completing

Form 593-V by hand, enter all the information requested using black or

blue ink.

Verify that all of the following information is complete:

•

Business or individual withholding agent’s name

• Mailing address

• Identification number

• Amount of payment

• Contact telephone number

Foreign Address: Enter the information in the following order: City,

Country, Province/Region, and Postal Code. Follow the country’s practice

for entering the postal code. Do not abbreviate the country’s name.

8121133

Payment Voucher for Real Estate Withholding

CALIFORNIA FORM

593-V

YEAR

2013

Amount of payment

Check the appropriate box for Electronic or Paper, depending on how

Form(s) 593 was submitted. Check one box only.

Enter the number of Form(s) 593 submitted to the FTB.

The information on Form 593-V should match the information that was

submitted to the FTB on the 2013 Form(s) 593.

Using black or blue ink, make the check or money order payable to

the “Franchise Tax Board.” Write the withholding agent’s identification

number and “2013 Form 593-V” on the check or money order.

Make all checks or money orders payable in U.S. dollars and drawn

against a U.S. financial institution.

• If Form(s) 593 is submitted by mail, detach the payment voucher

from the bottom of this page and enclose, but do not staple,

Form(s) 593, Form 593-V, along with the payment, and mail to the

address below.

• If Form 593 is submitted electronically, detach the payment voucher

from the bottom of this page and enclose, but do not staple, your

payment with the voucher and mail to:

WITHHOLDING SERVICES AND COMPLIANCE

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0651

Do not send paper copies of Form(s) 593 to the FTB if submitted

electronically.

The withholding agent retains this form for a minimum of five years and

must provide it to the FTB upon request.

Due Date of Payment

Submit withholding payments within 20 days following the end of the

month in which the real estate transaction occurred. The withholding

agent must send Form 593-V with the payment of tax withheld to the

FTB.

Interest and Penalties

Interest will be assessed on late withholding payments and penalties,

and is computed from the original due date to the date paid. For more

information regarding interest and penalties get the instructions for

Form 593.

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER

DETACH HERE

( )

Check the box to indicate how Form(s) 593 was submitted (check one box only) Electronic Paper Number of Form(s) 593 submitted ________

Complete voucher using Withhold Agent information only.

Do not send a paper copy of the electronically filed Form(s) 593 with the payment voucher. Sending

a paper copy of your electronically filed Form(s) 593 may cause a delay in processing.

.

,

,