Fillable Printable Form 795 - Missouri Motor Fuel Tax License Application

Fillable Printable Form 795 - Missouri Motor Fuel Tax License Application

Form 795 - Missouri Motor Fuel Tax License Application

Missouri Motor Fuel Tax

Application and Instructions

Missouri Department of Revenue

r New Application r Change r Reinstatement

List license number if making a change or requesting reinstatement: ___________________________________________________

Form

795

Missouri Department of Revenue

Missouri Motor Fuel Tax License Application

Business Name and Location

Section 1

Missouri Tax Identification Number IRS 637 Number Federal Identification Number Do you have internet access?

r Yes r No

Business Name E-Mail Address Telephone

(__ __ __)__ __ __–__ __ __ __

DBA Name Internet Site Address (Web Page) Fax

(__ __ __)__ __ __–__ __ __ __

Physical Location of Business City State ZIP Code County

Business Mailing Address City State ZIP Code County

Books and Records Address City State ZIP Code County

Missouri Statute 32.057, RSMo, states that all tax records and information maintained by the Missouri Department of Revenue are confidential. The tax information

can only be given to the owner, partner, member, or officer who is listed with us as such. If you wish to give an employee, attorney, or accountant access to your tax

information, you must supply us with a power of attorney giving us the authority to release confidential information to them.

Contact Person for Registration Telephone Number E-Mail Address

(__ __ __)__ __ __–__ __ __ __

Contact Person Reporting Telephone Number E-Mail Address

(__ __ __)__ __ __–__ __ __ __

Contact Persons

Section 2

r Supplier or position holder in a Missouri terminal (owns product in the terminal for sale or exchange)

r Export Fuel from Missouri List State(s) and License Number(s) _______________________________________________________

r Participate in Exchanges List Exchange Partners __________________________________________________________________

Effective Date for License (MM/DD/YYYY) __ __/__ __/__ __ __ __ Complete Sections 1 Through 16

Type of Activity (select all that apply)

Section 3

r Permissive Supplier or Position Holder in an Out-Of-State Terminal (Out-Of-State Supplier that elects to have a supplier’s license)

Effective Date for License (MM/DD/YYYY) __ __/__ __/__ __ __ __ Complete Sections 1 Through 13, 15 and 16

r Terminal Operator or Operating a Missouri Terminal (owns, operates or controls a terminal) Type of Terminal r Barge r Pipeline

Do you commingle products with those of any other company? r Yes r No

If Yes, list company name(s) _______________________________________________________________________________________

Effective Date for License (MM/DD/YYYY) __ __/__ __/__ __ __ __ Complete Sections 1 Through 9, 12, 15 and 16

r Distributor (imports, exports or blends motor fuel and may qualify as an eligible purchaser authorized to purchase on a tax deferred basis)

Imports - List name of state(s) and license number(s) _____________________________________________________________________

Exports - List name of state(s) and license number(s) _____________________________________________________________________

Blends - List types of fuels blended ___________________________________________________________________________________

r My company wishes to qualify for “eligible purchaser” status as provided for under Section 142.848, RSMo, to purchase fuel on a tax deferred basis.

Effective Date for License (MM/DD/YYYY) __ __/__ __/__ __ __ __ Complete Sections 1 Through 11 and 14 Through 16

r Transporter (operates a pipeline, barge, railroad or transport truck transporting fuel in Missouri)

Do you transport fuel for hire in Missouri? r Yes r No

Effective Date for License (MM/DD/YYYY) __ __/__ __/__ __ __ __ Complete Sections 1 Through 11, 15 and 16

Type of Product (select all that apply)

Section 4

r Gasoline r Ethanol r Aviation Gasoline r Undyed Kerosene r Undyed Diesel Fuel r Bio-Diesel

r Alcohol r Gasohol r Jet Fuel r Dyed Kerosene r Dyed Diesel Fuel r Bio-Diesel - Dyed

r Compressed Natural Gas (CNG) r Liquefied Natural Gas (LNG) r Propane r Other ______________

Mail to: Taxation Division Phone: (573) 751-2611

P.O. Box 300 Fax: (573) 522-1720

Jefferson City, MO 65105-0300 TTY: (800) 735-2966

E-mail: [email protected]

Visit http://www.dor.mo.gov/business/fuel/

for additional information.

Form 795 (Revised 09-2017)

Supplier or Permissive Supplier _________________________

Distributor __________________________________________

Transporter _________________________________________

Terminal Operator ___________________________________

Eligible Purchaser

r Yes r No

Office Use Only

(License Numbers)

Reset Form

Print Form

Page 2

Terminal Number Where

Product Is Received

How Product

Is Received

Activity Type

Phone Number

Federal I.D.

Number

License

Number

Product

Type

Name of Supplier

or Customers

Type of Ownership

Section 5

Please indicate your ownership type.

r Sole Owner (may include spouse) r Non-Missouri Corporation – Certificate of Authority Number ___________

r Partnership Limited Liability Company:

r Limited Partnership – LP Number ________________________ r Taxed as a Partnership r Taxed as a Sole Owner

r Limited Liability Partnership – LLP Number ________________ r Government r Taxed as a Corporation LLC Number ___________

r Limited Liability Limited Partnership – LLLP Number __________ r Not required to register with Missouri Secretary of State

r Trust r Date Incorporated (MM/DD/YYYY) __ __/__ __/__ __ __ __

r Other ______________________________________________ r State of Incorporation and Date Registered in Missouri

_____________________________________________________ (MM/DD/YYYY) __ __/__ __/__ __ __ __

Previous ownership information (complete only if you purchased an exsisting business).

Section 7

Name of Previous Owner of Business Date Business Closed or Changed Ownership (MM/DD/YYYY)

__ __/__ __/__ __ __ __

Business Name License Number(s)

Ownership Information - Provide information for sole proprietor, all partners, all members of any partnerships or principal officers of any LLC or

corporation (attach a list if necessary).

Section 6

Name (Last, First, Middle Initial) Title

Social Security Number Effective Date (MM/DD/YYYY) Ending Date (MM/DD/YYYY) Birthdate (MM/DD/YYYY)

__ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __

Home Address City State ZIP Code County

Name (Last, First, Middle Initial) Title

Social Security Number Effective Date (MM/DD/YYYY) Ending Date (MM/DD/YYYY) Birthdate (MM/DD/YYYY)

__ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __

Home Address City State ZIP Code County

Name (Last, First, Middle Initial) Title

Social Security Number Effective Date (MM/DD/YYYY) Ending Date (MM/DD/YYYY) Birthdate (MM/DD/YYYY)

__ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __

Home Address City State ZIP Code County

Section 8

Names of any persons associated with this company who presently or previously owned, operated, or managed another motor fuel company

(attach a list if necessary).

Company Name Name (Last, First, Middle Initial)

Title Social Security Number Birthdate (MM/DD/YYYY)

__ __/__ __/__ __ __ __

Home Address City State ZIP Code License Number(s)

Company Name Name (Last, First, Middle Initial)

Title Social Security Number Birthdate (MM/DD/YYYY)

__ __/__ __/__ __ __ __

Home Address City State ZIP Code License Number(s)

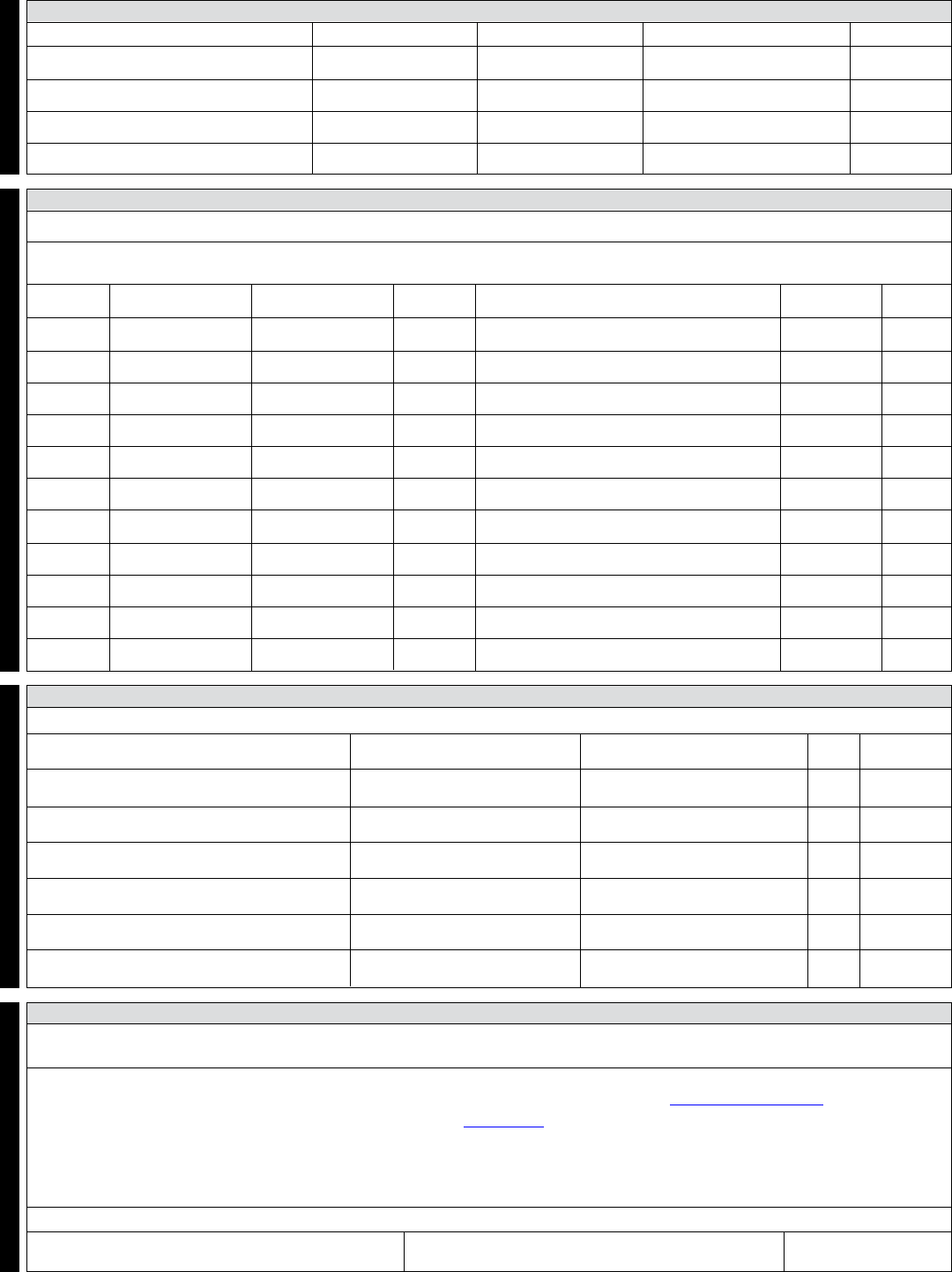

Fuel suppliers, customers, or position holders (attach a list if necessary).

Section 9

Suppliers - List to whom you sell fuel Distributors - List your suppliers

Transporters - List those for whom you contract to haul fuel Terminal Operators - List all position holders in your terminal

1. Terminal Street Address Terminal Code City State ZIP Code

T - -

2. Terminal Street Address Terminal Code City State ZIP Code

T - -

3. Terminal Street Address Terminal Code City State ZIP Code

T - -

4. Terminal Street Address Terminal Code City State ZIP Code

T - -

5. Terminal Street Address Terminal Code City State ZIP Code

T - -

6. Terminal Street Address Terminal Code City State ZIP Code

T - -

7. Terminal Street Address Terminal Code City State ZIP Code

T - -

Page 3

Transporter Name

Federal I.D. Number License Number ModePhone Number

List all common carriers you hire to transport fuel

Section 10

Year

State

Registered

Vehicle Identification Number

or Trailer Serial Number

Total Capacity

Gallons

Tank

Wagon

Make

Conveyance method used for transportating fuel

Section 11

If using your own transport trucks, list transportation equipment (attach list if necessary)

If you wish to obtain tank wagon permits for any vehicles listed below, please indicate by placing a check mark in the last column.

r Pipeline r Barge r Ship r Railroad r Truck r Stationary Transfer r Other

Model

__ __ __ __

__ __ __ __

__ __ __ __

__ __ __ __

__ __ __ __

__ __ __ __

__ __ __ __

__ __ __ __

__ __ __ __

__ __ __ __

__ __ __ __

Terminal Information (attach list if necessary)

Section 12

Terminal Operators list in-state terminals; Suppliers list in-state terminals; Permissive Suppliers list out-of-state terminal information

We elect to treat all removals from all out-of-state terminals with a destination into Missouri as shown on the terminal-issued shipping papers as if

the removals were removed across the rack by the supplier from a terminal in Missouri as provided in Section 142.839, RSMo.

We agree to precollect the Missouri motor fuel tax in accordance with Chapter 142 on all removals from a qualied terminal where we are a position

holder without regard to the license status of the person acquiring the fuel, the point or terms of the sale or the character of delivery.

We further agree to waive any defense that the State of Missouri lacks jurisdiction to require collection on all out-of-state sales by such person as to

which the person had knowledge that the shipments were destined for Missouri and that Missouri imposes the requirements under its general police

powers to regulate the movement of motor fuels.

Notice of Election must be signed by an authorized representative of the company as listed on page 2, Section 6 of the license application.

Signature of Owner, Partner, or Authorized Ofcer Name of Person Signing (Print or Type Name) Date (MM/DD/YYYY)

__ __/__ __/__ __ __ __

Notice of Election (Suppliers and Permissive Suppliers Only)

Section 13

This notice of election provides for the precollection of the Missouri motor fuel tax on all removals from all out-of-state terminals listed above

where suppliers or permissive suppliers are position holders.

Page 4

Product Type

Total Tank Capacity

County

City or Town

Missouri Storage Tank Information (attach list if necessary)

Section 14

Product Types r Gasoline r Aviation Gasoline r Undyed Kerosene r Undyed Diesel Fuel r LNG

r Alcohol r Gasohol r Jet Fuel r Dyed Kerosene r Dyed Diesel Fuel r Other _________________

List storage tank information by product type, city or town location, total tank capacity per city or town and the county.

Bond Information (estimated number of gallons of fuel handled per month per activity type)

Section 15

Signature

Under the penalty of perjury, I hereby certify that information contained herein is true, complete and correct. If indicated in Section 3, I hereby elect to

obtain “eligible purchaser” status.

Section 16

Company Name

Signature of Owner, Partner or Authorized Officer Print Name of Person Signing the Application Date (MM/DD/YYYY)

__ __/__ __/__ __ __ __

Gas ______________________ Gas ______________________ Gas _______________________ Gas ________________________

Gasohol ___________________ Gasohol ___________________ Gasohol ___________________ Gasohol _____________________

Diesel _____________________ Diesel _____________________ Diesel _____________________ Diesel ______________________

Kerosene __________________ Kerosene __________________ Kerosene __________________ Kerosene ____________________

Dyed Diesel ________________ Dyed Diesel ________________ Dyed Diesel ________________ Dyed Diesel __________________

Dyed Kerosene _____________ Dyed Kerosene _____________ Dyed Kerosene ______________ Dyed Kerosene _______________

AV Gas ___________________ AV Gas ____________________ AV Gas ____________________ AV Gas _____________________

Jet Fuel ___________________ Jet Fuel ___________________ Jet Fuel ___________________ Jet Fuel _____________________

Alcohol ____________________ Alcohol ____________________ Alcohol ____________________ Alcohol ______________________

CNG______________________ CNG ______________________ CNG ______________________ CNG _______________________

LNG ______________________ LNG ______________________ LNG ______________________ LNG ________________________

Propane ___________________ Propane ___________________ Propane ___________________ Propane _____________________

r Surety Bond r Surety Bond r Surety Bond r Surety Bond

r Certificate of Deposit r Certificate of Deposit r Certificate of Deposit r Certificate of Deposit

r Letter of Credit r Letter of Credit r Letter of Credit r Letter of Credit

r Cash Bond r Cash Bond r Cash Bond r Cash Bond

r Proof of Financial r Pool Bond

Responsibility (See Instructions)

(See Instructions)

Distributor

Supplier or Permissive

Supplier

Terminal Operator

Transporter

Distributor

Supplier or Permissive

Supplier

Terminal Operator

Transporter

List gallons handled by product types as grouped below

Bond Type

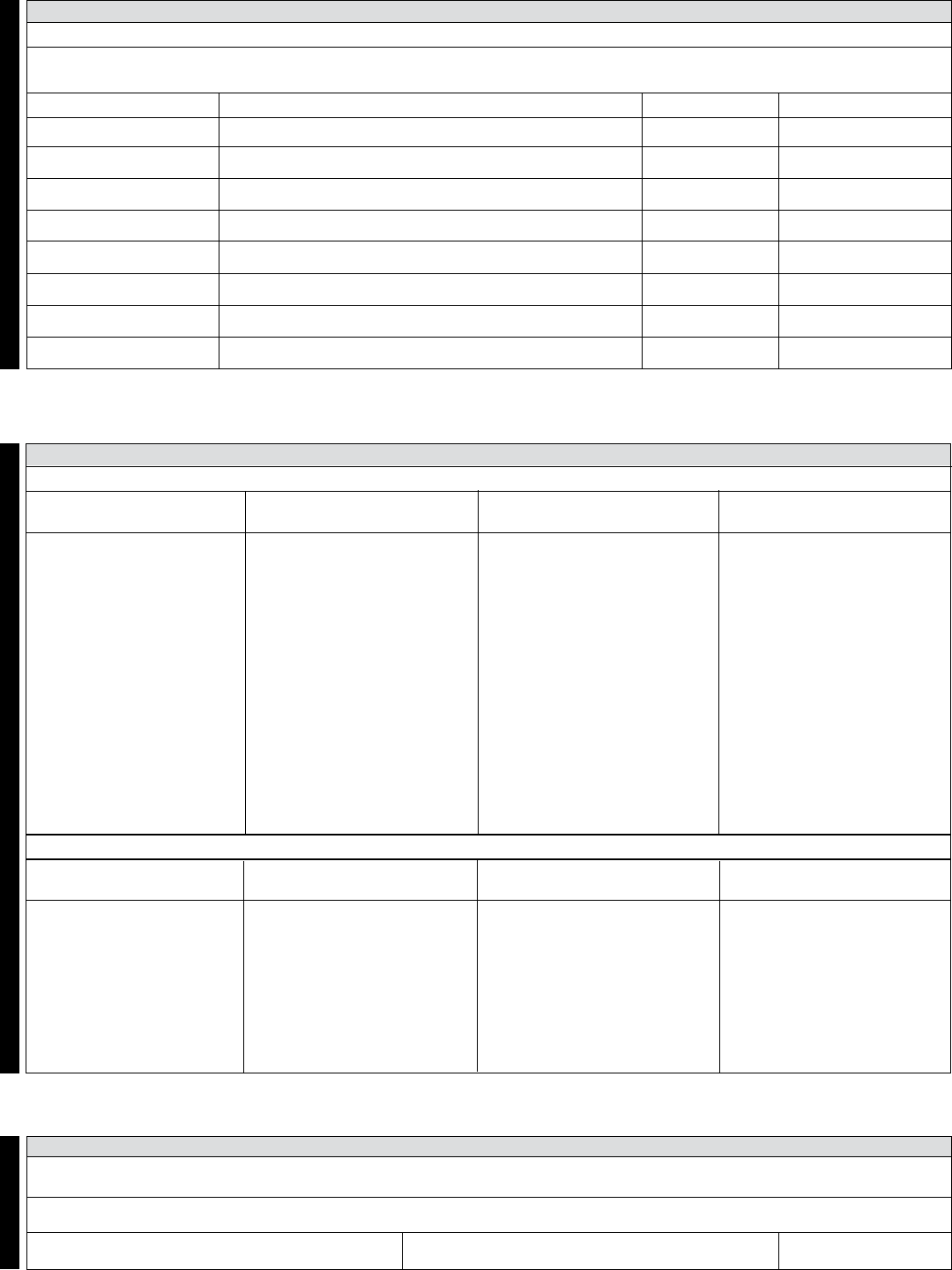

Form 795, Missouri Motor Fuel Tax License Application

Type of Application

Place a check mark in the appropriate box. If you already have a Missouri fuel tax number and wish to make changes or

have your license reinstated, please provide license number in the space provided.

Missouri Tax I.D. Number

If you have an 8-digit Missouri Tax I.D. Number, enter that number in the space provided, otherwise leave blank.

IRS 637 Number (Number issued by IRS for various excise tax activities)

If you have an IRS 637 Number, enter that number in the space provided. If you do not have an IRS 637 number, leave blank.

Federal Employer I.D Number

Enter the Federal Employer Identification Number issued to your company by the Federal Government. If you do not have

a Federal Employer I.D. Number, leave blank.

Section 1 - Business Name and Location

Enter your business name, DBA, physical location of business, mailing address, address where books and records are

kept, county, fax number, telephone number, if you have Internet access and/or a web page and your email address.

Section 2 - Contact Persons

Missouri Statute 32.057, RSMo, states that all tax records and information maintained by the Missouri Department

of Revenue are confidential. The tax information can only be given to the owner, partner, member, or officer who is

listed with us as such. If you wish to give an employee, attorney, or accountant access to your tax information, you

must supply us with a power of attorney giving us the authority to release confidential information to them.

Section 3 - Type of Activity

For each activity you plan to conduct in Missouri, place a check mark in the appropriate box and provide the requested

information.

Please indicate the effective date for your license for each activity type you are applying for. This date should not be

before the issue date of the bond you will be posting.

Section 4 - Product Types

For each type of motor fuel you plan to handle, place a check mark in the appropriate box. If a product is not listed, check

the box marked “other” and list the name of the product(s).

Section 5 - Type of Ownership

Place a check mark in the box that describes the ownership structure of your business and provide the required information.

If your company is not in compliance with the Missouri Secretary of State’s office, you will need to contact them in order

to determine if you need to be registered. You may reach them by telephone at (573) 751-3827 or visit their website at

http://www.sos.mo.gov/. If your company does not meet their requirements to register, please remit a letter along with

your application stating the reason for exemption.

Section 6 - Ownership Information

Provide the requested information for the owners, partners, members or officers of the business.

Section 7 - Previous Ownership Information

Provide the requested information only if you purchased an existing business.

Section 8 - Previous Motor Fuel Experience

Provide the requested information for any owner, officer, or employee who presently or previously, owned, operated or

managed another motor fuel company.

Section 9 - Fuel Suppliers/Customers

Complete this section as follows:

Suppliers - List to whom you sell fuel, phone number, Federal I.D. Number, License Number, product type, Terminal

Number where product is received, how received. (Example: ABC Refinery, 555-555-5555, 44-4444444, S0000, gas,

T-43-MO-3700, Pipeline)

Distributors - List the suppliers from whom you purchase fuel, telephone number, Federal I.D. Number,

License Number, Product Type, Terminal number where product is, how received.

(Example: ABC Oil Co, 555-555-5555, 44-4444444, S0000, diesel, T-43-MO-3700, Truck)

Transporters - List the companies for whom you haul fuel, telephone number, Federal ID Number, License

Number, Product Type, Terminal number where product is received, transport method. (Example: ABC Oil Co,

555-555-5555, 44-4444444, D0000, gas, T-43-MO-3700, Truck)

Terminal Operators - List the companies that are position holders in your terminal, telephone number, Federal I.D.

Number, License Number, Product Type, Terminal number where product is received, how product is received.

(Example: ABC Oil Co, 555-555-5555, 44-4444444, S0000, gas, 43-MO-3700, Pipeline or Barge)

Section 10 - Common Carrier Information

Provide the requested information for the companies that you hire to transport your fuel.

Section 11 - Conveyance Method

If you are a transporter, supplier or distributor transporting your own fuel or hauling for hire, select the appropriate box

for transport method. If you are using your own transport trucks, please provide the requested information. If you have a

tank wagon operation and wish to obtain tank wagon permits for your vehicles, please provide the requested information

and place a check mark in the “Tank Wagon” column. (Obtaining tank wagon permits allows you to import fuel that the

Missouri fuel tax and fees have not been precollected on, without calling for an import verification number and without

having to pay the fuel taxes and fees within three (3) days.)

Section 12 - Terminal Information

Suppliers - Provide the requested information for Missouri terminals in which you are a position holder and any out-of-

state terminal in which you are a position holder and will collect the Missouri tax on all removals destined to Missouri.

Permissive Suppliers - Provide the requested information for any out-of-state terminal in which you are a position holder

and agree to precollect the Missouri tax on all removals destined for Missouri.

Terminal Operators - Provide the requested information for the Missouri terminal you operate.

Section 13 - Notice of Election

Indicate if you are a position holder or supplier in an out-of-state terminal and agree to collect Missouri taxes and fees on

all removals destined for Missouri without regard to the license status of the person acquiring the motor fuel. If you make

this election, you must collect Missouri taxes and fees on all removals destined for Missouri from all terminals in which you

are a position holder.

Section 14 - Missouri Storage Tank Information

Please furnish the requested information for all storage tanks you have in Missouri. It is not necessary to list individual

tanks. Show the total storage capacity for each product type for each location.

Section 15 - Bond Information

Provide the estimated number of gallons you will handle for each activity and product type as listed.

Place a check mark in the box for each activity type you are applying for and the type of bond you are submitting. Bond

amount is based on 3 times the monthly liability based on the number of all gallons handled.

All persons applying for more than one activity type must submit a separate bond for each activity. The only exception is for

suppliers and permissive suppliers. Only suppliers and permissive supplier may provide “proof of financial responsibility”

in lieu of filing a bond.

Proof of financial responsibility may be provided for the entire bond, 1/2 of the required bond or 1/4 of the required bond

(submit annual financial report)

1. $5,000,000 net worth in lieu of total bond amount required

2. $2,500,000 net worth in lieu of 1/2 of bond amount required Net worth is calculated on a company,

not individual state basis

3. $1,250,000 net worth in lieu of 1/4 of bond amount required

Transporters may meet the initial bonding requirement by posting a $1,500 bond. The director may request an increase

up to the maximum amount.

Distributors that were licensed prior to January 1, 1999, and were not required to provide a bond under the previous law

and distributors, licensed after January 1, 1999, who have 3 consecutive years of satisfactory tax compliance, may elect

to participate in the pool bond. The current pool bond rate is .0024 per gallon of motor fuel, .0013 per gallon of aviation

fuel and .0007 per gallon of CNG, LNG, or propane based on all gallons purchased in Missouri or on all gallons imported

into Missouri.

Section 16 - Signature

Provide the requested information. The person signing the application must be listed in Section 6 or there must be a

Power of Attorney attached for the person signing. In addition the person whose signature appears in this section is

attesting that “Eligible Purchaser Status” was requested in Section 3.