Fillable Printable Form 84

Fillable Printable Form 84

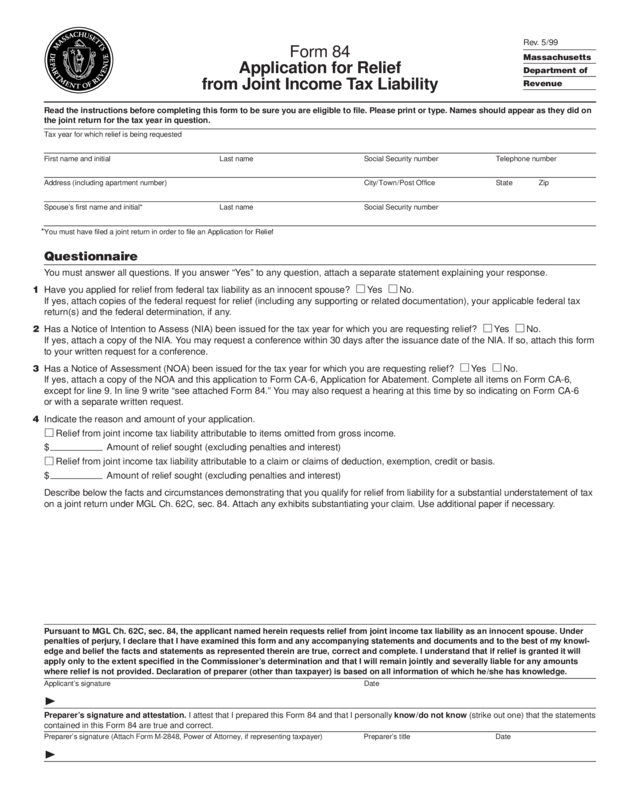

Form 84

Form 84

Application for Relief

from Joint Income Tax Liability

Rev. 5/99

Massachusetts

Department of

Revenue

Read the instructions before completing this form to be sure you are eligible to file. Please print or type. Names should appear as they did on

the joint return for the tax year in question.

Tax year for which relief is being requested

First name and initial Last name Social Security number Telephone number

Address (including apartment number) City/Town/Post Office State Zip

Spouse’s first name and initial* Last name Social Security number

*You must have filed a joint return in order to file an Application for Relief

Questionnaire

You must answer all questions. If you answer “Yes” to any question, attach a separate statement explaining your response.

1 Have you applied for relief from federal tax liability as an innocent spouse? Yes No.

If yes, attach copies of the federal request for relief (including any supporting or related documentation), your applicable federal tax

return(s) and the federal determination, if any.

2 Has a Notice of Intention to Assess (NIA) been issued for the tax year for which you are requesting relief? Yes No.

If yes, attach a copy of the NIA. You may request a conference within 30 days after the issuance date of the NIA. If so, attach this form

to your written request for a conference.

3 Has a Notice of Assessment (NOA) been issued for the tax year for which you are requesting relief? Yes No.

If yes, attach a copy of the NOA and this application to Form CA-6, Application for Abatement. Complete all items on Form CA-6,

except for line 9. In line 9 write “see attached Form 84.” You may also request a hearing at this time by so indicating on Form CA-6

or with a separate written request.

4 Indicate the reason and amount of your application.

Relief from joint income tax liability attributable to items omitted from gross income.

$ Amount of relief sought (excluding penalties and interest)

Relief from joint income tax liability attributable to a claim or claims of deduction, exemption, credit or basis.

$ Amount of relief sought (excluding penalties and interest)

Describe below the facts and circumstances demonstrating that you qualify for relief from liability for a substantial understat ement of tax

on a joint return under MGL Ch. 62C, sec. 84. Attach any exhibits substantiating your claim. Use additional paper if necessary.

Pursuant to MGL Ch. 62C, sec. 84, the applicant named herein requests relief from joint income tax liability as an innocent spouse. Under

penalties of perjury, I declare that I have examined this form and any accompanying statements and documents and to the best of m y knowl-

edge and belief the facts and statements as represented therein are true, correct and complete. I understand that if relief is granted itwill

apply only to the extent specified in the Commissioner’s determination and that I will remain jointly and severally liable for any amounts

where relief is not provided. Declaration of preparer (other than taxpayer) is based on all information of which he/she has know ledge.

Applicant’s signature Date

¨

Preparer’s signature and attestation. I attest that I prepared this Form 84 and that I personally know/do not know (strike out one) that the statements

contained in this Form 84 are true and correct.

Preparer’s signature (Attach Form M-2848, Power of Attorney, if representing taxpayer) Preparer’s title Date

¨

General Information

The Department of Revenue is authorized to grant relief from

a joint income tax liability under certain conditions. Relief can be

granted where a taxpayer and a spouse file a joint income tax

return reporting a substantial understatement of tax attributable

to grossly erroneous items of one spouse if (1) the spouse

requesting relief establishes that he or she did not know, and

had no reason to know, that there was such a substantial under-

statement; and (2) taking into account all facts and circum-

stances of a case, it would be inequitable to hold the applicant

liable for the deficiency.

For further information refer to Regulation 830 CMR 62C.84.1

Spousal Relief From Joint Income Tax Liability. This regulation

is available by calling the Rulings and Regulations Bureau at

(617) 626-3250.

Substantial Understatement

To be considered substantial, the understated tax, excluding any

interest and penalties, must exceed $200 where due to an item

omitted from gross income; or exceed $500 where due to a claim

or claims of deduction, exemption, credit or basis, for which there

is no basis in fact or law.

Inequitable Liability

Whether it is inequitable to hold a person liable for a tax defi-

ciency will be determined by all the facts and circumstances of

a case. Although no single factor is controlling, consideration will

be given to whether the applicant significantly benefited from the

substantial understatement of tax.

Application for Relief

A taxpayer wishing to apply for relief must submit this form

within the time prescribed for challenging an assessment or a

proposed assessment under MGL Ch. 62C, sections 26 and 37.

Applicants should attach copies of any federal claim for relief,

the federal determination, and the federal tax return. Applicants

should also submit any documents or exhibits substantiating

this application. The filing of this form will not stay the collection

of tax unless or until this application is approved. If the applica-

tion is approved, a refund of any resulting overpayment of tax

will be made to the applicant.

Application Prior to Assessment

If a taxpayer has received a Notice of Intention to Assess (NIA),

this application must be received within 30 days following the

issuance of the NIA. The applicant is entitled to a conference

if one is requested within this 30-day period. If a conference is

requested, this application must be attached to the written

request. Mail the completed Form 84, the NIA and all attach-

ments to the return address as shown on the NIA.

Application After Assessment

If a taxpayer has received a Notice of Assessment (NOA), this

application must be made by filing an Application for Abatement

(Form CA-6). The applicant must attach this application to Form

CA-6 and enter in Item 9 of Form CA-6, “see attached Form 84.”

The applicant is entitled to a hearing if one is requested on

either Form CA-6 or on a separate written request. Form CA-6

is available at any Department of Revenue office or by calling

(617) 887-MDOR. Mail the completed Form 84, Form CA-6 and

all attachments to: Massachusetts Department of Revenue,

Customer Service Bureau, PO Box 7031, Boston, MA 02204.

Notice of Determination

A written notice of determination will be issued to the applicant.

A grant of relief will only apply to the extent specified in the writ-

ten determination. The applicant remains jointly and severally li-

able for any amounts where relief is not granted. Also, the appli-

cant’s spouse remains liable for the entire tax determined to be

due. If the grant of relief was obtained by false or fraudulent

means, the grant of relief is void.

Form 84 Instructions