Fillable Printable Form 8594

Fillable Printable Form 8594

Form 8594

INSTRUCTIONS TO PRINTERS

FORM 8594, PAGE 1 of 4

MARGINS: TOP

1

⁄2", CENTER SIDES. PRINTS: HEAD TO HEAD

PAPER: WHITE WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 17" x 11"

FOLD TO: 8

1

⁄2" x 11" PERFORATE: (ON FOLD)

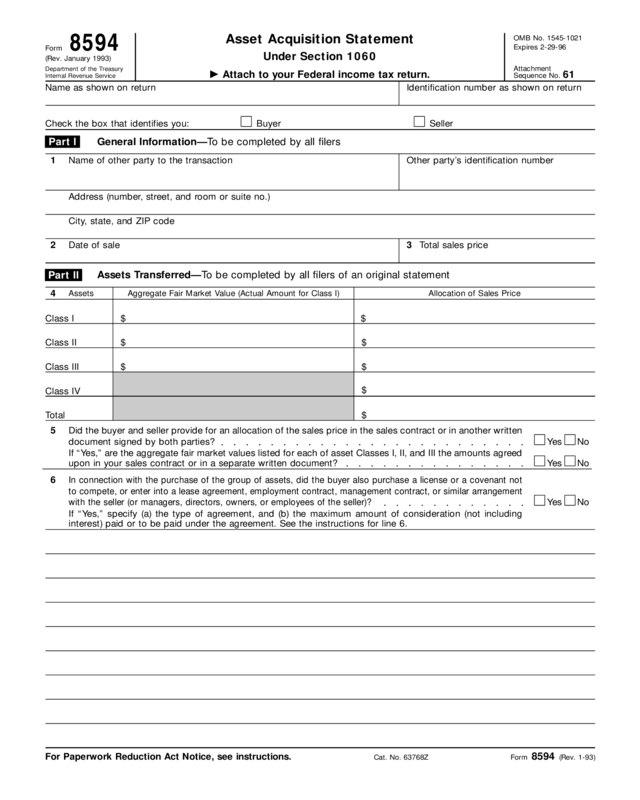

OMB No. 1545-1021

Asset Acquisition Statement

Expires 2-29-96

8594Form

Under Section 1060

(Rev. January 1993)

Department of the Treasury

Internal Revenue Service

Attachment

Sequence No.

61

©

Attach to your Federal income tax return.

Name as shown on return Identification number as shown on return

SellerBuyerCheck the box that identifies you:

General Information—To be completed by all filers

1 Name of other party to the transaction Other party’s identification number

Address (number, street, and room or suite no.)

City, state, and ZIP code

Total sales price3Date of sale2

Assets Transferred—To be completed by all filers of an original statement

Allocation of Sales PriceAggregate Fair Market Value (Actual Amount for Class I)Assets

4

$$Class I

$$Class II

Class III $$

Class IV

$

Total $

Did the buyer and seller provide for an allocation of the sales price in the sales contract or in another written

document signed by both parties?

5

NoYes

If “Yes,” are the aggregate fair market values listed for each of asset Classes I, II, and III the amounts agreed

upon in your sales contract or in a separate written document?

Yes No

In connection with the purchase of the group of assets, did the buyer also purchase a license or a covenant not

to compete, or enter into a lease agreement, employment contract, management contract, or similar arrangement

with the seller (or managers, directors, owners, or employees of the seller)?

6

NoYes

If “Yes,” specify (a) the type of agreement, and (b) the maximum amount of consideration (not including

interest) paid or to be paid under the agreement. See the instructions for line 6.

Form 8594 (Rev. 1-93)For Paperwork Reduction Act Notice, see instructions.

4

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

TLS, have you

transmitted all R

text files for this

cycle update?

Date

Action

Revised proofs

requested

Date Signature

O.K. to print

Part I

Part II

Cat. No. 63768Z

INSTRUCTIONS TO PRINTERS

FORM 8594, PAGE 2 of 4

MARGINS: TOP

1

⁄2", CENTER SIDES. PRINTS: HEAD TO HEAD

PAPER: WHITE WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 17" x 11" FOLD TO: 8

1

⁄2" x 11"

PERFORATE: (ON FOLD)

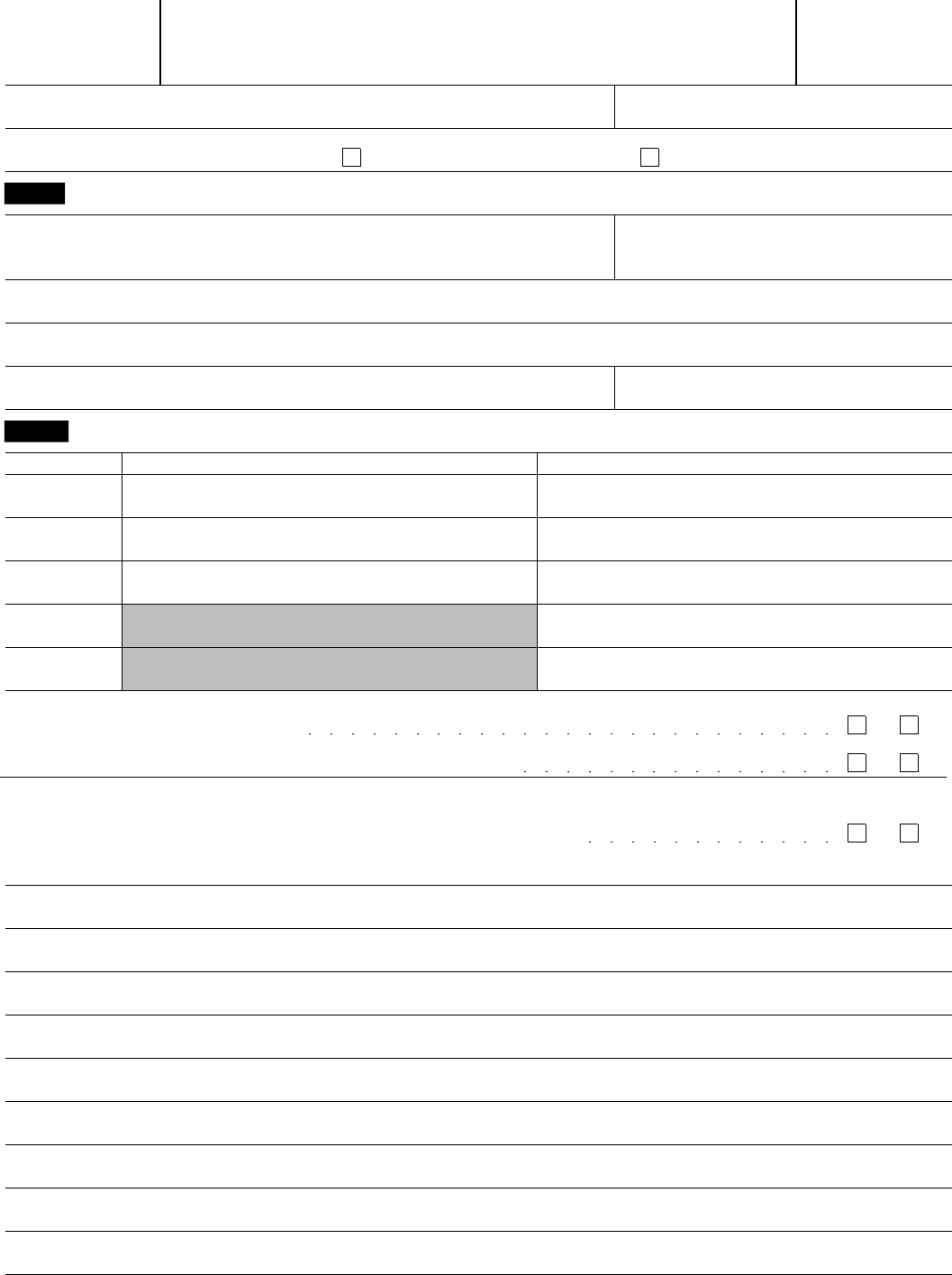

Page 2Form 8594 (Rev. 1-93)

Class III, Intangible Amortizable Assets Only—Complete if applicable. The amounts shown below also

must be included under Class III assets in Part II. Attach additional sheets if more space is needed.

Allocation of Sales PriceUseful LifeFair Market ValueAssets

$$

$$

$$

$$

$$

$$

$$

$$

Supplemental Statement—To be completed only if amending an original statement or previously filed

supplemental statement because of an increase or decrease in consideration.

Allocation of Sales Price as Previously Reported Redetermined Allocation of Sales PriceIncrease or (Decrease)Assets

7

Class I $$$

Class II $$$

Class III $$$

$$$Class IV

$$Total

Reason(s) for increase or decrease. Attach additional sheets if more space is needed.8

9 Tax year and tax return form number with which the original Form 8594 and any supplemental statements were filed.

$$

4

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

Part III

Part IV

INSTRUCTIONS TO PRINTERS

FORM 8594, PAGE 3 of 4

MARGINS: TOP

1

⁄2", CENTER SIDES PRINTS: HEAD TO HEAD

PAPER: WHITE WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 17" x 11" FOLD TO: 8

1

⁄2" x 11"

PERFORATE: (ON FOLD)

Page 3Form 8594 (Rev. 1-93)

“Class III assets” are all tangible and

intangible assets that are not Class I, II,

or IV assets. Examples of Class III

assets are furniture and fixtures, land,

buildings, equipment, a covenant not to

compete, and accounts receivable.

When To File

General Instructions

Section references are to the Internal

Revenue Code unless otherwise noted.

Paperwork Reduction Act Notice.—We

ask for the information on this form to

carry out the Internal Revenue laws of

the United States. You are required to

give us the information. We need it to

ensure that you are complying with

these laws and to allow us to figure and

collect the right amount of tax.

“Class IV assets” are intangible assets

in the nature of goodwill and going

concern value.

Allocation of Consideration

An allocation of the purchase price must

be made to determine the buyer’s basis

in each acquired asset and the seller’s

gain or loss on the transfer of each

asset. Use the residual method for the

allocation of the sales price among the

goodwill and other assets transferred.

See Regulations section 1.1060-1T(d).

The amount allocated to an asset, other

than a Class IV asset, cannot exceed its

fair market value on the purchase date.

The amount you can allocate to an asset

also is subject to any applicable limits

under the Internal Revenue Code or

general principles of tax law. For

example, see section 1056 for the basis

limitation for player contracts transferred

in connection with the sale of a

franchise.

Penalty

The time needed to complete and file

this form will vary depending on

individual circumstances. The estimated

average time is:

Recordkeeping

10 hr., 46 min.

Definitions

Learning about the

law or the form

30 min.

“Applicable asset acquisition” means a

transfer of a group of assets that makes

up a trade or business in which the

buyer’s basis in such assets is

determined wholly by the amount paid

for the assets. An applicable asset

acquisition includes both a direct and

indirect transfer of a group of assets,

such as a sale of a business.

Preparing and sending

the form to the IRS

42 min.

If you have comments concerning the

accuracy of these time estimates or

suggestions for making this form more

simple, we would be happy to hear from

you. You can write to both the IRS and

the Office of Management and Budget

at the addresses listed in the

instructions of the tax return with which

this form is filed.

A group of assets makes up a “trade

or business” if goodwill or going concern

value could under any circumstances

attach to such assets. A group of assets

could qualify as a trade or business

whether or not they qualify as an active

trade or business under section 355

(relating to controlled corporations).

Factors to consider in making this

determination include (a) any excess of

the total paid for the assets over the

aggregate book value of the assets

(other than goodwill and going concern

value) as shown in the buyer’s financial

accounting books and records, or (b) a

license, a lease agreement, a covenant

not to compete, a management

contract, an employment contract, or

other similar agreements between buyer

and seller (or managers, directors,

owners, or employees of the seller).

Consideration should be allocated as

follows: (a) reduce the consideration by

the amount of Class I assets transferred,

(b) allocate the remaining consideration

to Class II assets in proportion to their

fair market values on the purchase date,

(c) allocate to Class III assets in

proportion to their fair market values on

the purchase date, and (d) allocate to

Class IV assets.

Purpose of Form

Reallocation After an

Increase or Decrease in

Consideration

Who Must File

If an increase or decrease in

consideration that must be taken into

account to redetermine the seller’s

amount realized on the sale or the

buyer’s cost basis in the assets occurs

Exceptions. You are not required to file

Form 8594 if any of the following apply:

1. The acquisition is not an applicable

asset acquisition (defined below).

The buyer’s “consideration” is the cost

of the assets. The seller’s

“consideration” is the amount realized.

“Fair market value” is the gross fair

market value unreduced by mortgages,

liens, pledges, or other liabilities.

“Class I assets” are cash, demand

deposits, and similar accounts in banks,

savings and loan associations and other

depository institutions, and other similar

items that may be designated in the

Internal Revenue Bulletin.

“Class II assets” are certificates of

deposit, U.S. Government securities,

readily marketable stock or securities,

foreign currency, and other items that

may be designated in the Internal

Revenue Bulletin.

4

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

Line 6 now has to be completed by the

buyer and seller.

2. A group of assets that makes up a

trade or business is exchanged for

like-kind property in a transaction to

which section 1031 applies. However, if

section 1031 does not apply to all the

3. A partnership interest is transferred.

See Regulations section 1.755-2T for

special reporting requirements.

A Change To Note

Both the seller and buyer of a group of

assets that makes up a trade or

business must use Form 8594 to report

such a sale if goodwill or a going

concern value attaches, or could attach,

to such assets and if the buyer’s basis

in the assets is determined only by the

amount paid for the assets (“applicable

asset acquisition,” defined below). Form

8594 must also be filed if the buyer or

seller is amending an original or a

previously filed supplemental Form 8594

because of an increase or decrease in

the buyer’s cost of the assets or the

amount realized by the seller.

Subject to the exceptions noted below,

both the buyer and the seller of the

assets must prepare and attach Form

8594 to their Federal income tax returns

(Forms 1040, 1041, 1065, 1120, 1120S,

etc.).

assets transferred, Form 8594 is

required for the part of the group of

assets to which section 1031 does not

apply. For information about such a

transaction, see Regulations section

1.1060-1T(b)(4).

Generally, attach Form 8594 to your

Federal income tax return for the year in

which the sale date occurred. If the

amount allocated to any asset is

increased or decreased after Form 8594

is filed, the seller and/or buyer (whoever

is affected) must complete Part I and the

supplemental statement in Part IV of a

new Form 8594 and attach the form to

the Federal tax return for the year in

which the increase or decrease is taken

into account.

If you fail to file a correct Form 8594 by

the due date of your return and you

cannot show reasonable cause, you may

be subject to a penalty. See sections

6721 through 6724.

However, for determining the seller’s

gain or loss, generally, the fair market

value of any property is not less than

any nonrecourse debt to which the

property is subject.

INSTRUCTIONS TO PRINTERS

FORM 8594, PAGE 4 of 4

MARGINS: TOP

1

⁄2", CENTER SIDES PRINTS: HEAD TO HEAD

PAPER: WHITE WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 17" x 11" FOLD TO: 8

1

⁄2" x 11"

PERFORATE: (NONE)

Page 4

Form 8594 (Rev. 1-93)

Specific Allocation

Allocation of Decrease

Line 2.—Enter the date on which the

sale of the assets occurred.

Line 3.—Enter the total consideration

transferred for the assets.

Line 4.—For a particular class of assets,

enter the total fair market value of all the

assets in the class and the total

allocation of the sales price.

You cannot decrease the amount

allocated to an asset below zero. If an

asset has a basis of zero at the time the

decrease is taken into account because

it has been disposed of, depreciated,

amortized, or depleted by the buyer, the

decrease in consideration allocable to

such asset must be properly taken into

account under principles of tax law

applicable when the cost of an asset

(previously reflected in basis) is reduced

after the asset has been disposed of,

depreciated, amortized, or depleted. An

Enter in Part III only those Class III

assets that are intangible and

amortizable. Be sure to enter the total

Class III assets in Part II.

Specific Instructions

For an original statement, complete

Parts I, II, and, if applicable, III. For a

Supplemental Statement, complete Parts

I and IV.

Complete Part IV and file a new Form

8594 for each year that an increase or

decrease in consideration occurred. Give

the reason(s) for the increase or

decrease in allocation. Also, enter the

tax year and form number with which

the original and any supplemental

statements were filed. For example,

enter “1988 Form 1040.”

Enter your name and taxpayer

identification number (TIN) at the top of

the form. Then identify yourself as the

buyer or seller by checking the proper

box.

Patents, Copyrights, and

Similar Property

Line 1.—Enter the name, address, and

TIN of the other party to the transaction

(buyer or seller). You are required to

enter the TIN of the other party. If the

other party is an individual or sole

proprietor, enter the social security

number. If the other party is a

corporation, partnership, or other entity,

enter the employer identification number.

4

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

Allocation of Increase

Part I

Part II

Line 6.—This line must be completed by

the buyer and the seller. To determine

the maximum consideration to be paid,

assume that any contingencies specified

in the agreement are met and that the

consideration paid is the highest amount

possible. If you cannot determine the

maximum consideration, state how the

consideration will be computed and the

payment period.

Part IV

Part III

For an increase or decrease related

to a patent, copyright, etc., see

Specific Allocation, below.

after the purchase date, the seller and/or

the buyer must allocate the increase or

decrease among the assets. If the

increase or decrease occurs in the same

tax year as the purchase date, consider

the increase or decrease to have

occurred on the purchase date. If the

increase or decrease occurs after the

tax year of the purchase date, consider

it in the tax year in which it occurs.

Allocate an increase in consideration as

described under Allocation of

Consideration. If an asset has been

disposed of, depreciated, amortized, or

depleted by the buyer before the

increase occurs, any amount allocated

to such asset by the buyer must be

properly taken into account under

principles of tax law applicable when

part of the cost of an asset (not

previously reflected in its basis) is paid

after the asset has been disposed of,

depreciated, amortized, or depleted.

Allocate a decrease as follows: (a)

reduce the amount previously allocated

to Class IV assets, (b) reduce the

amount previously allocated to Class III

assets in proportion to their fair market

values on the purchase date, and (c)

reduce the amount previously allocated

to Class II assets in proportion to their

fair market values on the purchase date.

You must make a specific allocation

(defined below) if an increase or

decrease is the result of a contingency

that directly relates to income produced

by a particular intangible asset, such as

a patent, a secret process, or a

copyright, and the increase or decrease

is related only to such asset and not to

other assets. If the specific allocation

rule does not apply, make an allocation

of any increase or decrease as you

would for any other assets as described

under Allocation of Increase and

Allocation of Decrease.

Limited to the fair market value of the

asset, any increase or decrease is

allocated first specifically to the patent,

copyright, or similar property to which

the increase or decrease relates, and

then to the other assets in the order

described under Allocation of Increase

and Allocation of Decrease. For

purposes of applying the fair market

value limit to the patent, copyright, or

similar property, the fair market value of

such asset is redetermined when the

increase or decrease is taken into

account by considering only the reasons

for the increase or decrease. However,

the fair market values of the other

assets are not redetermined.

asset is considered to have been

disposed of to the extent the decrease

allocated to it would reduce its basis

below zero.