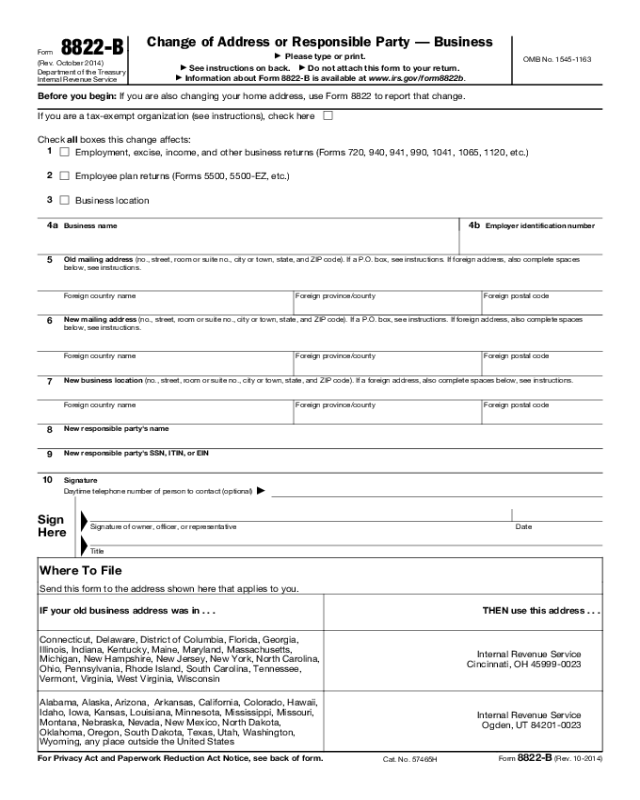

Form 8822-B (Rev. 10-2014)

Page 2

Future Developments

Information about any future

developments affecting Form 8822-B

(such as legislation enacted after we

release it) will be posted at www.irs.gov/

form8822b.

What's New

Change of responsible party. Any

entity with an EIN is now required to

report a change in its “responsible party”

by: (a) completing Form 8822-B as

appropriate, including entering the new

responsible party's name on line 8 and

the new responsible party's SSN, ITIN,

or EIN on line 9; and (b) filing the

completed form with the Internal

Revenue Service within 60 days of the

change. See Responsible Party, later, for

more information.

Purpose of Form

Use Form 8822-B to notify the Internal

Revenue Service if you changed your

business mailing address, your business

location, or the identity of your

responsible party. Also, any entities that

change their address or identity of their

responsible party must file Form 8822-B,

whether or not they are engaged in a

trade or business. If you are a

representative signing for the taxpayer,

attach to Form 8822-B a copy of your

power of attorney. Generally, it takes 4

to 6 weeks to process your address or

responsible party change.

Changing both home and business

addresses? Use Form 8822 to change

your home address.

Tax-Exempt Organizations

Check the box if you are a tax-exempt

organization. See Pub. 557, Tax-Exempt

Status for Your Organization, for details.

Addresses

Be sure to include any apartment, room,

or suite number in the space provided.

P.O. Box

Enter your box number instead of your

street address only if your post office

does not deliver mail to your street

address.

Foreign Address

Follow the country’s practice for entering

the postal code. Please do not

abbreviate the country name.

“In Care of” Address

If you receive your mail in care of a third

party (such as an accountant or attorney),

enter “C/O” followed by the third party’s

name and street address or P.O. box.

Responsible Party

Enter the full name (first name, middle

initial, last name, if applicable) and

SSN (social security number), ITIN

(individual taxpayer identification

number), or EIN (employer identification

number) of the new responsible party, as

defined next.

Responsible party defined. For entities

with shares or interests traded on a

public exchange, or which are registered

with the Securities and Exchange

Commission, “responsible party” is (a)

the principal officer, if the business is a

corporation, (b) a general partner, if a

partnership, (c) the owner of an entity

that is disregarded as separate from its

owner (disregarded entities owned by a

corporation enter the corporation's name

and EIN), or (d) a grantor, owner, or

trustor, if a trust. For tax-exempt

organizations, the “responsible party” is

commonly the same as the “principal

officer” as defined in the Form 990

instructions.

For all other entities, “responsible

party” is the person who has a level of

control over, or entitlement to, the funds

or assets in the entity that, as a practical

matter, enables the individual, directly or

indirectly, to control, manage, or direct

the entity and the disposition of its funds

and assets. The ability to fund the entity

or the entitlement to the property of the

entity alone, however, without any

corresponding authority to control,

manage, or direct the entity (such as in

the case of a minor child beneficiary),

does not cause the individual to be a

responsible party.

If the responsible party is an alien

individual with a previously assigned

ITIN, enter the ITIN in the space provided

and submit a copy of an official

identifying document. If necessary,

complete Form W-7, Application for IRS

Individual Taxpayer Identification

Number, to obtain an ITIN.

You must enter the new responsible

party's SSN, ITIN, or EIN unless the only

reason you obtained an EIN was to make

an entity classification election (see

Regulations sections 301.7701-1

through 301.7701-3) and you are a

nonresident alien or other foreign entity

with no effectively connected income

from sources within the United States.

Signature

An officer, owner, general partner or LLC

member manager, plan administrator,

fiduciary, or an authorized representative

must sign. An officer is the president,

vice president, treasurer, chief

accounting officer, etc.

▲

!

CAUTION

If you are a representative signing

on behalf of the taxpayer, you

must attach to Form 8822-B a

copy of your power of attorney.

To do this, you can use Form 2848. The

Internal Revenue Service will not complete an

address or responsible party change from an

“unauthorized” third party.

Privacy Act and Paperwork Reduction

Act Notice. We ask for the information

on this form to carry out the Internal

Revenue laws of the United States. Our

legal right to ask for information is

Internal Revenue Code sections 6001

and 6011, which require you to file a

statement with us for any tax for which

you are liable. Section 6109 requires that

you provide your identifying number on

what you file. This is so we know who

you are, and can process your form and

other papers.

Generally, tax returns and return

information are confidential, as required

by section 6103. However, we may give

the information to the Department of

Justice and to other federal agencies, as

provided by law. We may give it to cities,

states, the District of Columbia, and U.S.

commonwealths or possessions to carry

out their tax laws. We may also disclose

this information to other countries under

a tax treaty, to federal and state

agencies to enforce federal nontax

criminal laws, or to federal law

enforcement and intelligence agencies to

combat terrorism.

If you are an entity with an EIN and

your responsible party has changed, use

of this form is mandatory. Otherwise, use

of this form is voluntary. You will not be

subject to penalties for failure to file this

form. However, if you fail to provide the

IRS with your current mailing address or

the identity of your responsible party,

you may not receive a notice of

deficiency or a notice of demand for tax.

Despite the failure to receive such

notices, penalties and interest will

continue to accrue on any tax

deficiencies.

You are not required to provide the

information requested on a form that is

subject to the Paperwork Reduction Act

unless the form displays a valid OMB

control number. Books or records

relating to a form or its instructions must

be retained as long as their contents

may become material in the

administration of any Internal Revenue

law.

The time needed to complete and file

this form will vary depending on

individual circumstances. The estimated

average time is 18 minutes.

Comments. You can send us comments

by going to www.irs.gov/formspubs,

clicking on “More Information,” and then

clicking on “Give us feedback.” You can

also send your comments to the Internal

Revenue Service, Tax Forms and

Publications Division, 1111 Constitution

Ave. NW, IR-6526, Washington, DC

20224. DO NOT SEND THE FORM TO

THIS ADDRESS. Instead, see Where To

File, earlier.