Fillable Printable Form 8862 (Rev. December 2012)

Fillable Printable Form 8862 (Rev. December 2012)

Form 8862 (Rev. December 2012)

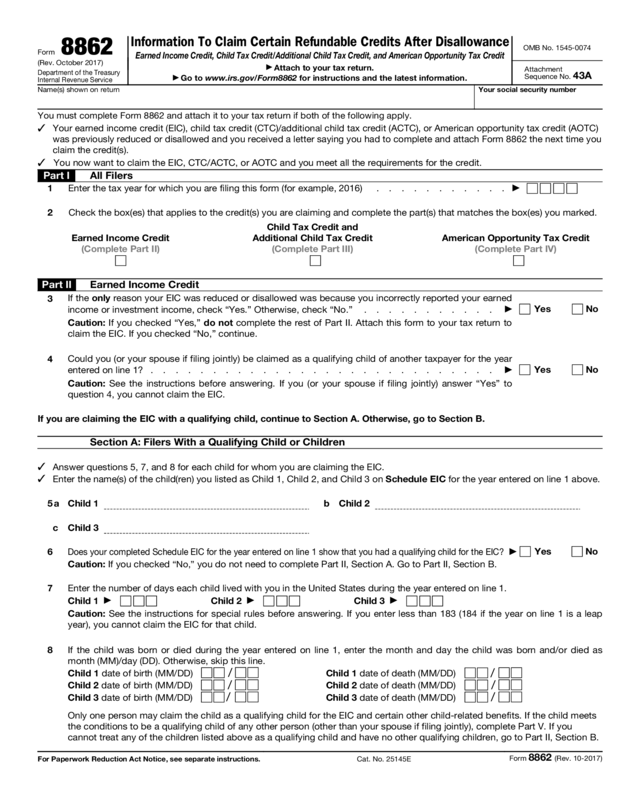

Form 8862

(Rev. October 2017)

Department of the Treasury

Internal Revenue Service

Information To Claim Certain Refundable Credits After Disallowance

Earned Income Credit, Child Tax Credit/Additional Child Tax Credit, and American Opportunity Tax Credit

▶

Attach to your tax return.

▶

Go to www.irs.gov/Form8862 for instructions and the latest information.

OMB No. 1545-0074

Attachment

Sequence No.

43A

Name(s) shown on return Your social security number

You must complete Form 8862 and attach it to your tax return if both of the following apply.

✓

Your earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), or American opportunity tax credit (AOTC)

was previously reduced or disallowed and you received a letter saying you had to complete and attach Form 8862 the next time you

claim the credit(s).

✓

You now want to claim the EIC, CTC/ACTC, or AOTC and you meet all the requirements for the credit.

Part I All Filers

1

Enter the tax year for which you are filing this form (for example, 2016) . . . . . . . . . . .

▶

2 Check the box(es) that applies to the credit(s) you are claiming and complete the part(s) that matches the box(es) you marked.

Earned Income Credit

(Complete Part II)

Child Tax Credit and

Additional Child Tax Credit

(Complete Part III)

American Opportunity Tax Credit

(Complete Part IV)

Part II Earned Income Credit

3

If the only reason your EIC was reduced or disallowed was because you incorrectly reported your earned

income or investment income, check “Yes.” Otherwise, check “No.” . . . . . . . . . . .

▶

Yes No

Caution: If you checked “Yes,” do not complete the rest of Part II. Attach this form to your tax return to

claim the EIC. If you checked “No,” continue.

4

Could you (or your spouse if filing jointly) be claimed as a qualifying child of another taxpayer for the year

entered on line 1? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

Yes No

Caution: See the instructions before answering. If you (or your spouse if filing jointly) answer “Yes” to

question 4, you cannot claim the EIC.

If you are claiming the EIC with a qualifying child, continue to Section A. Otherwise, go to Section B.

Section A: Filers With a Qualifying Child or Children

✓

Answer questions 5, 7, and 8 for each child for whom you are claiming the EIC.

✓

Enter the name(s) of the child(ren) you listed as Child 1, Child 2, and Child 3 on Schedule EIC for the year entered on line 1 above.

5a

Child 1 b Child 2

c

Child 3

6

Does your completed Schedule EIC for the year entered on line 1 show that you had a qualifying child for the EIC?

▶

Yes No

Caution: If you checked

“No,” you do not need to complete Part II, Section A. Go to Part II, Section B.

7 Enter the number of days each child lived with you in the United States during the year entered on line 1.

Child 1

▶

Child 2

▶

Child 3

▶

Caution: See the instructions for special rules before answering. If you enter less than 183 (184 if the year on line 1 is a leap

year), you cannot claim the EIC for that child.

8 If the child was born or died during the year entered on line 1, enter the month and day the child was born and/or died as

month (MM)/day (DD). Otherwise, skip this line.

Child 1 date of birth (MM/DD)

/

Child 1 date of death (MM/DD)

/

Child 2 date of birth (MM/DD)

/

Child 2 date of death (MM/DD)

/

Child 3 date of birth (MM/DD)

/

Child 3 date of death (MM/DD)

/

Only one person may claim the child as a qualifying child for the EIC and certain other child-related benefits. If the child meets

the conditions to be a qualifying child of any other person (other than your spouse if filing jointly), complete Part V. If you

cannot treat any of the children listed above as a qualifying child and have no other qualifying children, go to Part II, Section B.

Cat. No. 25145E

Form 8862 (Rev. 10-2017)

For Paperwork Reduction Act Notice, see separate instructions.

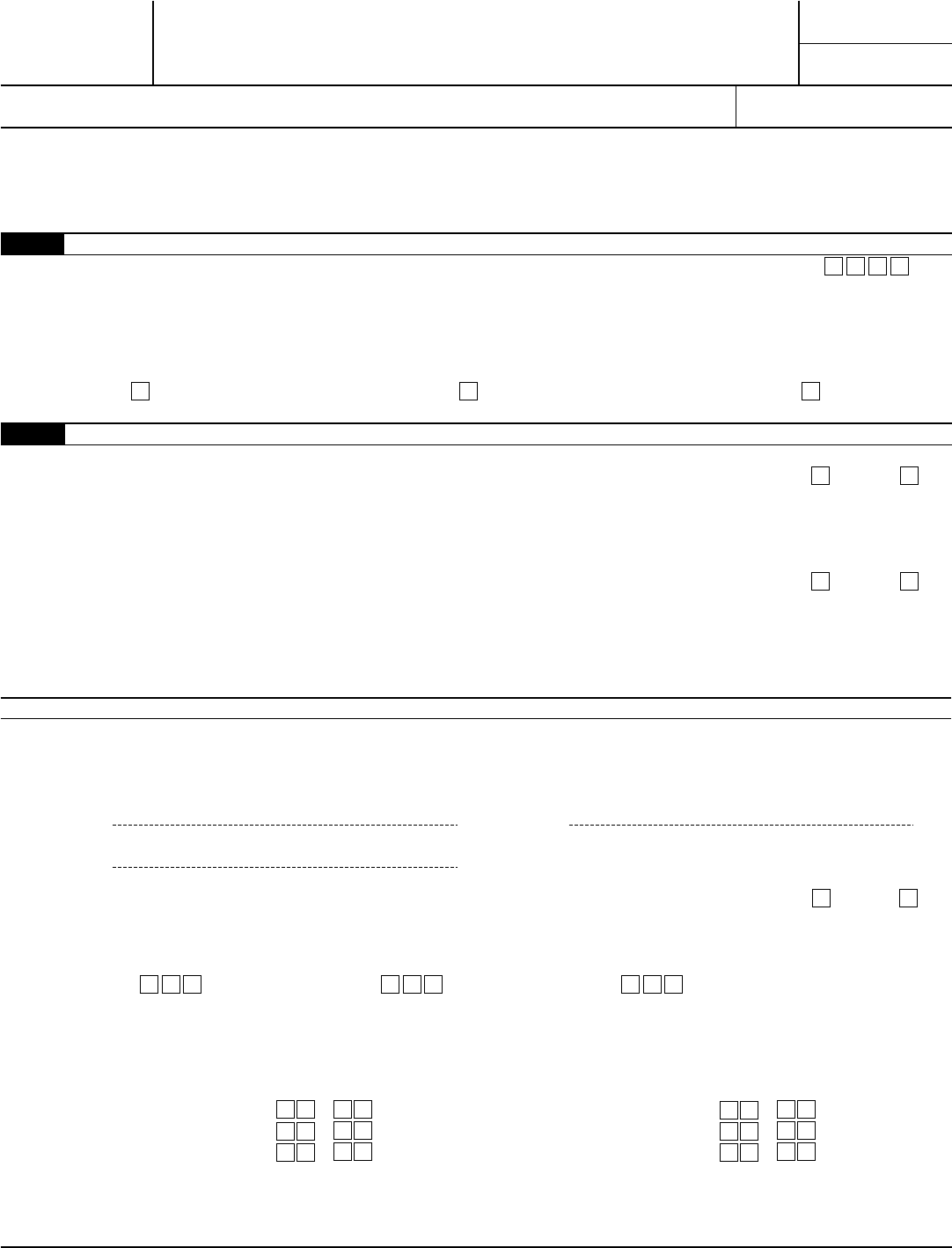

Form 8862 (Rev. 10-2017)

Page

2

Section B: Filers Without a Qualifying Child or Children

9a Enter the number of days during the year entered on line 1 that your main home was in the United States . . .

▶

b

If married filing jointly, enter the number of days during the year entered on line 1 that your spouse's main home was

in the United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

Caution: Members of the military stationed outside the United States during the year entered on line 1, see the instructions

before answering. If you enter less than 183 (184 if the year on line 1 is a leap year) on either line 9a or 9b (if filing jointly), you

cannot claim the EIC.

10a Enter your age at the end of the year on line 1 . . . . . . . . . . . . . . . . . . . . . . . .

b Enter your spouse's age at the end of the year on line 1 . . . . . . . . . . . . . . . . . . . .

Caution: If your spouse died during the year entered on line 1 or you are preparing a return for someone who died during the

year entered on line 1, see the instructions before answering. If neither you (nor your spouse if filing jointly) were at least age 25

but under age 65 at the end of the year on line 1, you cannot claim the EIC.

11a Can you be claimed as a dependent on another taxpayer's return? . . . . . . . . . . . .

▶

Yes No

b Can your spouse (if filing jointly) be claimed as a dependent on another taxpayer's return? . . . .

▶

Yes No

Caution: If either you (or your spouse if filing jointly) answer “Yes” to question 11, you cannot claim the EIC.

Part III Child Tax Credit and Additional Child Tax Credit

✓

Answer the following questions for each child for whom you are claiming the CTC/ACTC.*

✓

Enter the name(s) of the child as listed on your tax return.

12a

Child 1 b Child 2

c

Child 3

13 Did the child meet the requirements to be a qualifying child for the purpose of claiming the CTC/ACTC? If you answer “No” for

any child, you cannot claim the credit for that child. See Pub. 972 for more information.

Child 1

Yes No Child 2 Yes No Child 3 Yes No

14 Did the child live with you for more than half of the year on line 1?

Child 1 Yes No Child 2 Yes No Child 3 Yes No

Caution: See instructions for special rules before answering. If the answer is “No,” you cannot claim the CTC/ACTC for that

child.

Complete lines 15

–

18 for any child for whom you were required to complete Part I of Schedule 8812 for the year listed in line 1.

15

Is the child a resident of the United States because the child meets the substantial presence test and is not otherwise treated

as a nonresident alien?

Child 1

Yes No Child 2 Yes No Child 3 Yes No

Caution: You cannot claim the CTC/ACTC for a child who is not a citizen, national, or resident of the United States. Even if

your child does not meet the substantial presence test, your child may meet an exception or be treated as a resident of the

United States in certain circumstances. See the Instructions for Schedule 8812 for more information.

Child 1 Child 2 Child 3

16

Enter the number of days the child lived in the United States

during the year entered on line 1 . . . . . . . . .

16

17 Enter the number of days the child lived in the United States

during the calendar year before the year entered on line 1 .

17

18

Enter the number of days the child lived in the United States

in the year which is two years before the year entered on

line 1 . . . . . . . . . . . . . . . . . .

18

* If you have more than three qualifying children, attach a statement also answering questions 12

–

18 for those children.

Form 8862 (Rev. 10-2017)

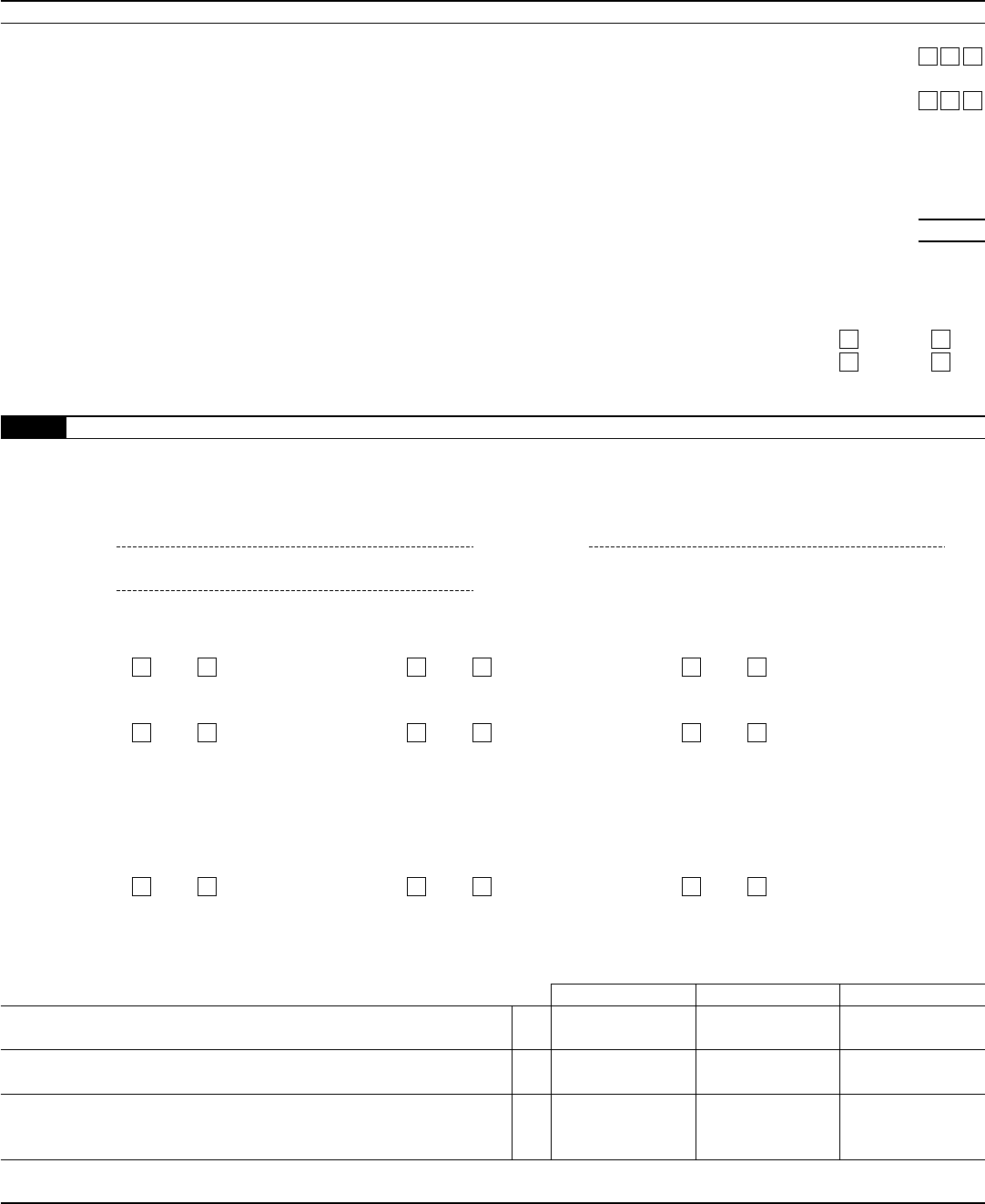

Form 8862 (Rev. 10-2017)

Page 3

Part III Child Tax Credit and Additional Child Tax Credit (continued)

Substantial Presence Test

To meet the substantial presence test a child with an ITIN must be physically present in the United States on at least:

a 31 days during the year for which you are filing this form, and

b 183 days during the 3-year period that includes the year for which you are filing this form and the two prior years, counting:

• All the days the child was present in the year for which you are filing this form, and

• 1/3 of the days the child was present in the first year prior to the year for which you are filing this form, and

• 1/6 of the days the child was present in the second year prior to the year for which you are filing this form.

For special rules and exceptions, see Pub. 519.

Only one person can claim the child as a qualifying child for the CTC/ACTC. If the child meets the conditions to be a qualifying

child of any other person (other than your spouse if filing jointly) complete Part V. If you cannot treat any of the children listed

above as a qualifying child and have no other qualifying children, you cannot claim the CTC/ACTC.

Part IV American Opportunity Tax Credit

✓

Answer the following questions for each student for whom you are claiming the AOTC.*

✓

Enter the name(s) of the student(s) as listed on Form 8863.

19a

Student 1 b Student 2

c

Student 3

20 a Did the student meet the requirements to be an eligible student for purposes of the AOTC for the year entered on line 1? See

Pub. 970 for more information.

Student 1

Yes No Student 2 Yes No Student 3 Yes No

b

Did the student receive a Form 1098‐T from the institution for the year entered on line 1 or the year immediately preceding that year?

Student 1 Yes No Student 2 Yes No Student 3 Yes No

c

Has the Hope Scholarship Credit or American opportunity credit been claimed for the student for any 4 tax years before the

year entered on line 1?

Student 1

Yes No Student 2 Yes No Student 3 Yes No

Caution: See the instructions for special rules regarding Form 1098-T before answering. If you answered “No” to questions

20a and 20b or “Yes” to question 20c, you cannot claim the credit for that student.

You cannot claim the AOTC based on qualified education expenses paid for a student by someone other than yourself or your

spouse, unless you are claiming the student as a dependent. If the student meets the conditions to be a qualifying child of any

other person (other than your spouse if filing jointly) complete Part V.

* If you have more than three students, attach a statement also answering questions 19 and 20 for those students.

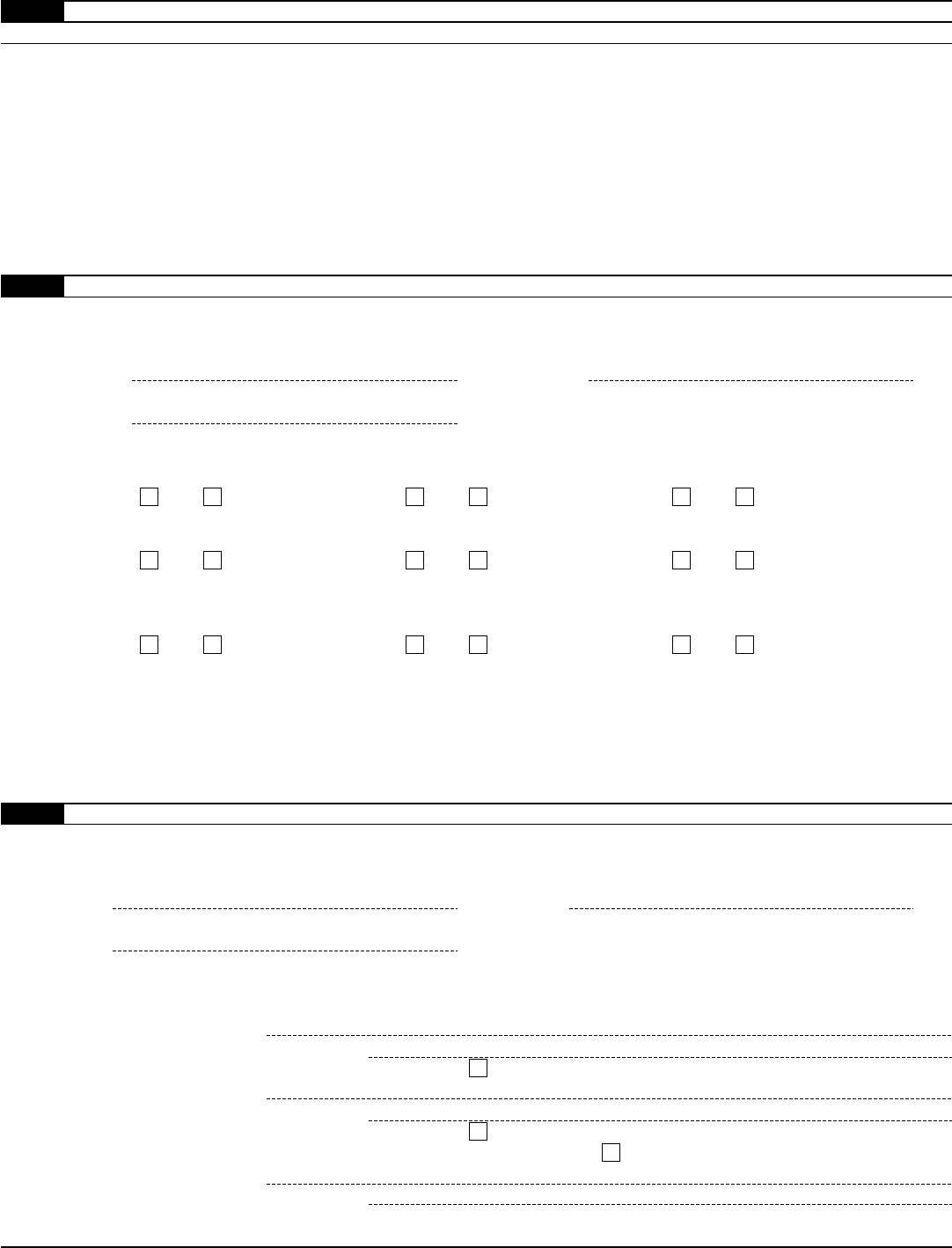

Part V Qualifying Child of More Than One Person

✓

Answer the following questions for each child who meets the conditions to be a qualifying child of any other person (other than

your spouse if filing jointly).*

21a

Child 1 b Child 2

c

Child 3

22 Enter the address where you and the child lived together during the year entered on line 1. If you lived with the child at more

than one address during the year, attach a list of the addresses where you lived.

Child 1

▶

Number and street

City or town, state, and ZIP code

Child 2

▶

If same as shown for Child 1, check this box

▶

Otherwise, enter below.

Number and street

City or town, state, and ZIP code

Child 3

▶

If same as shown for Child 1, check this box

▶

Or if same as shown for Child 2 (and

is different from the address shown for Child 1), check this box

▶

Otherwise, enter below.

Number and street

City or town, state, and ZIP code

* If you have more than three qualifying children, attach a statement also answering questions 21

–

23 for those children.

Form 8862 (Rev. 10-2017)

Form 8862 (Rev. 10-2017)

Page 4

Part V Qualifying Child of More Than One Person (continued)

23 Did any other person (except your spouse, if filing jointly, and your dependents claimed on your return)

live with Child 1, Child 2, or Child 3 for more than half the year? . . . . . . . . . . . . . .

Yes No

If “Yes,” enter the relationship of each person to the child on the appropriate line below.

Other person living with Child 1: Name

Relationship to Child 1

Other person living with Child 2:

If same as shown for Child 1, check this box

▶

Otherwise, enter below.

Name

Relationship to Child 2

Other person living with Child 3:

If same as shown for Child 1, check this box

▶

Or if same as shown

for Child 2 (and is different from the person living with Child 1), check this box

▶

Otherwise, enter below.

Name

Relationship to Child 3

To determine which person can treat the child as a qualifying child for the dependency exemption, EIC, and CTC/ACTC, see

Qualifying Child of More Than One Person in Pub. 501.

Note: The IRS may ask you to provide additional information to verify your eligibility to claim each credit.

Form 8862 (Rev. 10-2017)