Fillable Printable Form 8871

Fillable Printable Form 8871

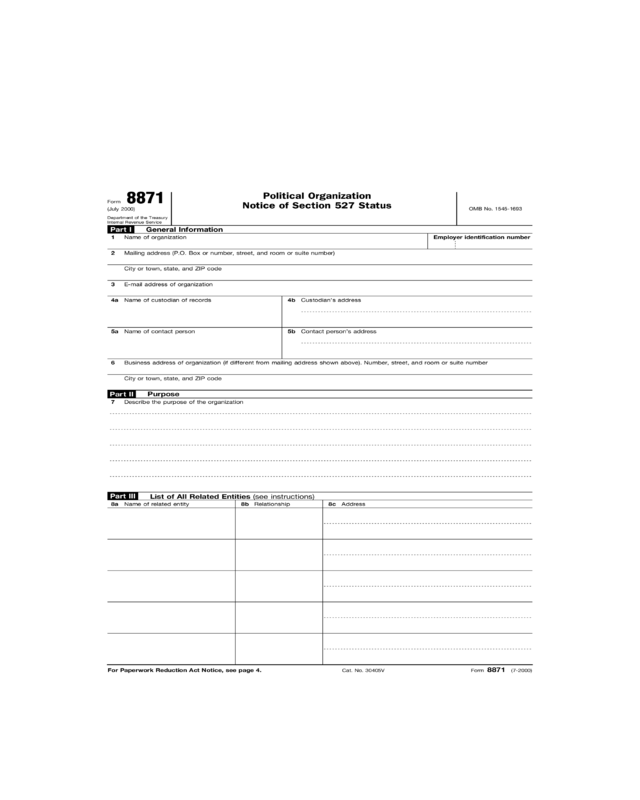

Form 8871

INSTRUCTIONS TO PRINTERS

Form 8871, PAGE 1 of 4

MARGINS: TOP 13 mm (

1

⁄2"), CENTER SIDES. PRINTS: HEAD to HEAD

PAPER: WHITE, WRITING, SUB. 20 INK: BLACK

FLAT SIZE: 203 mm (8") ⫻ 279 mm (11")

PERFORATE: ON FOLD

OMB No. 1545-1693

Political Organization

Notice of Section 527 Status

Department of the Treasury

Internal Revenue Service

For Paperwork Reduction Act Notice, see page 4. Form 8871 (7-2000)Cat. No. 30405V

3

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

TLS, have you

transmitted all R

text files for this

cycle update?

Date

Action

Revised proofs

requested

Date Signature

O.K. to print

Employer identification number

(July 2000)

Form

Part I General Information

Name of organization1

Purpose

Part II

Part III

List of All Related Entities (see instructions)

8871

Mailing address (P.O. Box or number, street, and room or suite number)2

City or town, state, and ZIP code

E-mail address of organization3

Custodian’s address4b

Contact person’s address5b

Business address of organization (if different from mailing address shown above). Number, street, and room or suite number6

City or town, state, and ZIP code

Name of custodian of records4a

Name of contact person5a

Describe the purpose of the organization7

Name of related entity8a Relationship8b Address8c

INSTRUCTIONS TO PRINTERS

FORM 8871, PAGE 2 of 4

MARGINS: TOP 13mm (

1

⁄2"), CENTER SIDES. PRINTS: HEAD TO HEAD

PAPER: WHITE, WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 203mm (8") x 279mm (11")

PERFORATE: ON FOLD

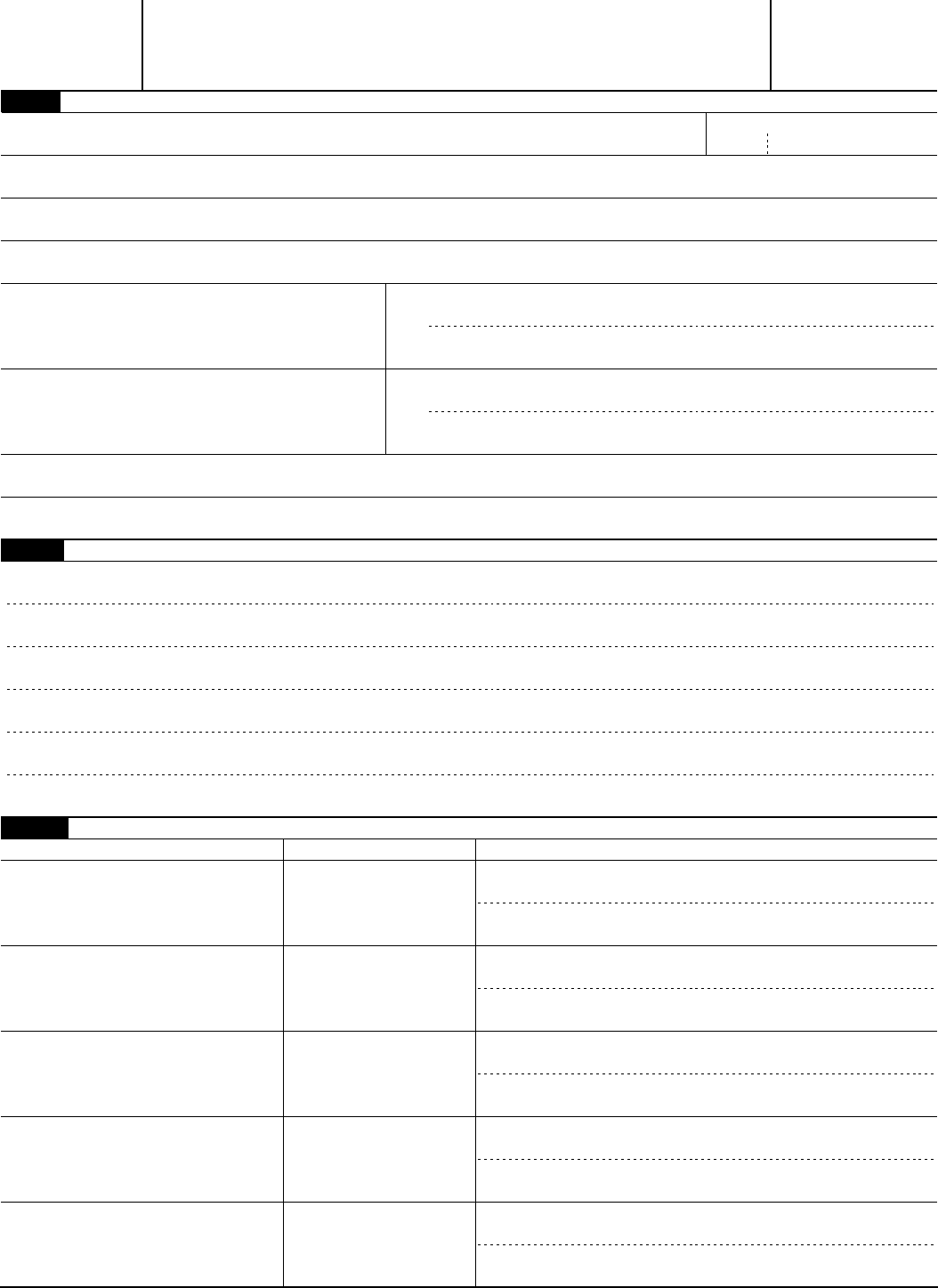

Page 2Form 8871 (7-2000)

3

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

Printed on recycled paper Form 8871 (7-2000)

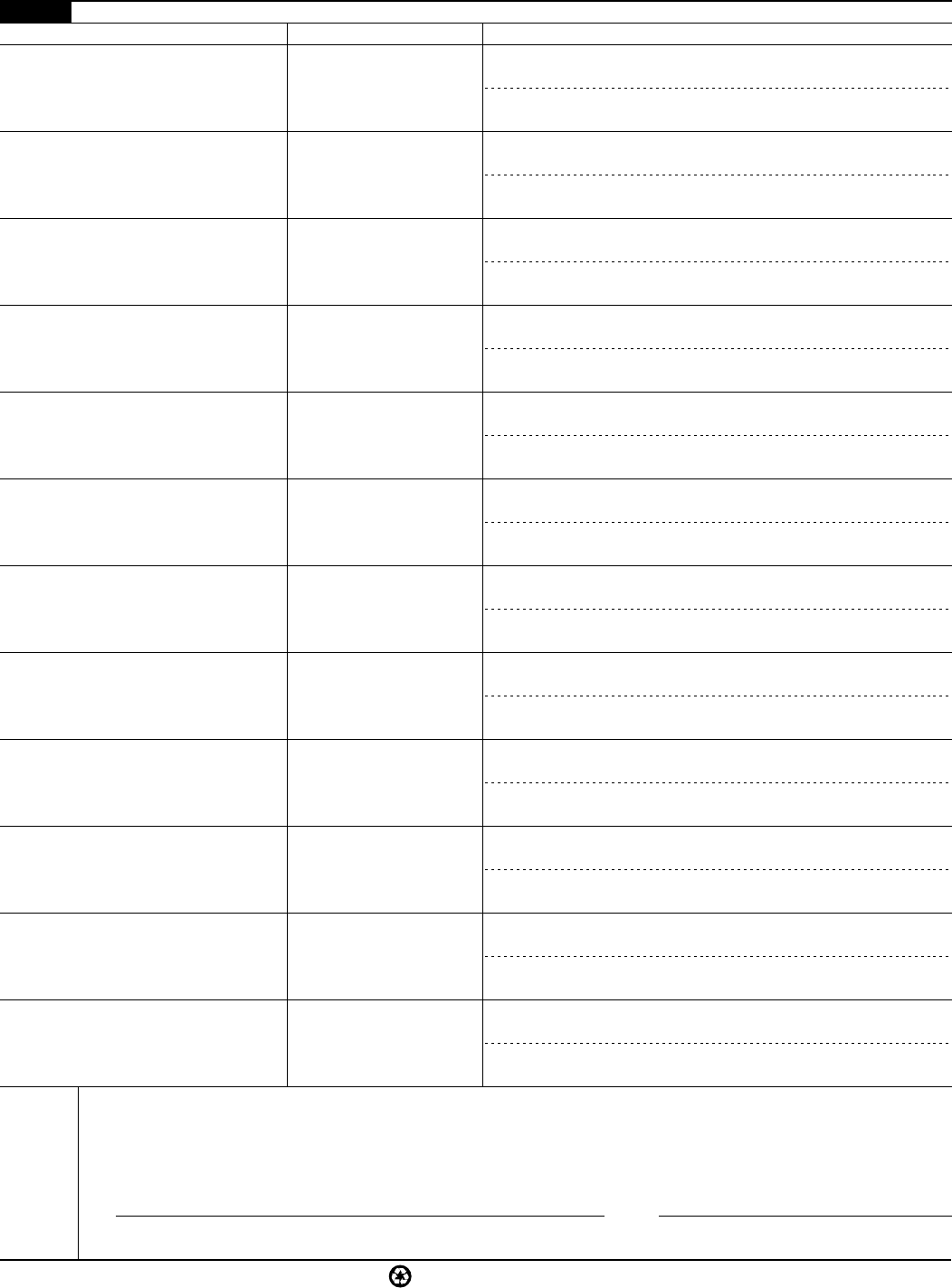

List of All Officers, Directors, and Highly Compensated Employees (see instructions)

Name9a Title9b Address9c

Part IV

Under penalties of perjury, I declare that the organization named in Part I is to be treated as an organization described in section 527 of the Internal

Revenue Code, and that I have examined this notice, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct, and complete.

Sign

Here

DateSignature of authorized official

䊳 䊳

General Instructions

Purpose of Form

Political organizations must use Form

8871 to notify the IRS that the

organization is to be treated as a section

527 organization. The IRS is required to

make publicly available on the Internet

and at its offices, a list of the

organizations that file Form 8871

(including the organization’s mailing

address, e-mail address, custodian of

records, and contact person as shown

on Form 8871).

Definitions

Political organization means a party,

committee, association, fund, or other

organization (whether or not

incorporated) organized and operated

primarily for the purpose of directly or

indirectly accepting contributions or

making expenditures, or both, for an

exempt function.

Who Must File

Every political organization that is to be

treated as a political organization under

the rules of section 527 must file Form

8871, except for:

When To File

For an organization already in existence

on June 30, 2000, Form 8871 must be

filed by July 31, 2000. For an

organization formed after June 30, 2000,

Form 8871 must be filed within 24

Where and How To File

Section 527(i)(1)(A) requires that the

organization file Form 8871 both

electronically and in writing. File Form

8871:

Effect of Failure To File

Form 8871

An organization that is required to file

Form 8871, but fails to do so on a timely

basis, will not be treated as a section

527 organization for any period before

the date Form 8871 is filed. In addition,

the taxable income of the organization

for that period will be computed by

including its exempt function income

(minus any deductions directly

connected with the production of that

income).

Other Required Reports and

Returns

An organization that files Form 8871

may also be required to file the following

forms:

Public Inspection of Form

8871 and Related Materials

Form 8871 (including any supporting

papers), and any letter or other

document the IRS issues with regard to

Form 8871, will be open to public

inspection at the IRS in Washington, DC.

Specific Instructions

Employer Identification Number

(EIN)

Enter the correct EIN in the space

provided. If the organization does not

have an EIN, it must apply for one on

Form SS-4, Application for Employer

Identification Number. Form SS-4 can be

obtained by downloading it from the IRS

Internet Web Site at www.irs.gov or by

calling 1-800-TAX-FORM.

Lines 4a and 4b

Enter the name and address of the

person in possession of the

organization’s books and records.

Lines 5a and 5b

Enter the name and address of the

person whom the public may contact for

more information about the organization.

Lines 8a through 8c

List the name, relationship, and address

of all related entities. An entity is a

related entity if either 1 or 2 below

applies:

1. The organization and that entity

have (a) significant common purposes

and substantial common membership or

(b) substantial common direction or

control (either directly or indirectly).

INSTRUCTIONS TO PRINTERS

FORM 8871, PAGE 3 of 4

MARGINS: TOP 13mm (

1

⁄2"), CENTER SIDES. PRINTS: HEAD TO HEAD

PAPER: WHITE, WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 203mm (8") x 279mm (11")

PERFORATE: ON FOLD

Page 3Form 8871 (7-2000)

3

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

Section references are to the Inter nal

Revenue Code unless otherwise noted.

Exempt function means the function of

influencing or attempting to influence the

selection, nomination, election, or

appointment of any individual to any

Federal, state, or local public office or

office in a political organization, or the

election of the Presidential or Vice

Presidential electors, whether or not

such individual or electors are selected,

nominated, elected, or appointed. It also

includes expenditures made relating to

one of these offices, which if incurred by

the individual, would be allowable as a

business deduction under section

162(a).

● An organization that reasonably

expects its annual gross receipts to

always be less than $25,000,

● A political committee required to

report under the Federal Election

Campaign Act of 1971 (2 U.S.C. 431 et

seq.), or

● A tax-exempt organization described

in section 501(c) that is treated as

having political organization taxable

income under section 527(f)(1).

● Electronically via the IRS Internet

Web Site at:

www.irs.gov/bus_info/eo/pol-file.html

and

● On paper by sending a signed copy

of the form to the Internal Revenue

Service Center, Ogden, UT 84201. You

can fill in and print out Form 8871 from

the IRS Internet Web Site.

● Form 8872, Political Organization

Report of Contributions and

Expenditures (periodic reports are

required during the calendar year).

● Form 990, Return of Organization

Exempt From Income Tax, or

Form 990-EZ, Short Form Return of

Organization Exempt From Income Tax

(or other designated annual return).

● Form 1120-POL, U.S. Income Tax

Return for Certain Political Organizations

(annual return).

2. Either the organization or that entity

owns (directly or through one or more

entities) at least a 50% capital or profits

interest in the other. For this purpose, all

entities that are defined as related

entities under 1 above must be treated

as a single entity.

Telephone Assistance

If you have questions or need help

completing Form 8871, please call

1-877-829-5500. This toll-free telephone

service is available Monday through

Friday from 8:00 a.m. to 9:30 p.m.

Eastern time.

hours of the date on which the

organization was established. If the due

date falls on a Saturday, Sunday, or legal

holiday, the organization may file on the

next business day.

Who Must Sign

Form 8871 must be signed by an official

authorized by the organization to sign

this notice.

Part I

Part III

In addition, the organization must make

available for public inspection a copy of

these materials during regular business

hours at the organization’s principal

office and at each of its regional or

district offices having at least 3 paid

employees. A penalty of $20 per day will

be imposed on any person under a duty

to comply with the public inspection

requirement for each day a failure to

comply continues.

You are not required to provide the

information requested on a form that is

subject to the Paperwork Reduction Act

unless the form displays a valid OMB

control number. Books or records

relating to a form or its instructions must

be retained as long as their contents

may become material in the

administration of any Internal Revenue

law. The rules governing the

confidentiality of Form 8871 are covered

in section 6104.

The time needed to complete and file

this form will vary depending on

individual circumstances. The estimated

average time is:

Recordkeeping

3 hr., 7 min.

If you have comments concerning the

accuracy of these time estimates or

suggestions for making this form

simpler, we would be happy to hear from

you. You can write to the Tax Forms

Committee, Western Area Distribution

Center, Rancho Cordova, CA

95743-0001. Do not send Form 8871 to

this address. Instead, see Where and

How To File on page 3.

INSTRUCTIONS TO PRINTERS

FORM 8871, PAGE 4 of 4

MARGINS: TOP 13mm (

1

⁄2"), CENTER SIDES. PRINTS: HEAD TO HEAD

PAPER: WHITE, WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 203mm (8") x 279mm (11")

PERFORATE: ON FOLD

Page 4Form 8871 (7-2000)

3

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

Learning about the law

or the form

35 min.

Preparing, copying,

assembling, and sending

the form to the IRS

41 min.

Paperwork Reduction Act Notice. We

ask for the information on this form to

carry out the Internal Revenue laws of

the United States. If the organization is

to be treated as a section 527

organization, you are required to give us

the information. We need it to ensure

that you are complying with these laws.

If 1 applies, enter “connected” under

relationship. If 2 applies, enter

“affiliated” under relationship.

Lines 9a through 9c

Enter the name, title, and address of all

of the organization’s officers, members

of the board of directors, and highly

compensated employees. Highly

compensated employees are the five

employees (other than officers and

directors) who are expected to have the

highest annual compensation over

$50,000. Compensation includes both

cash and noncash amounts, whether

paid currently or deferred, for the

accounting period that includes the date

the organization was formed (if the

organization was formed after June 30,

2000). If the organization was already in

existence on June 30, 2000, use the

accounting period that includes July 1,

2000.

Part IV

If there are more than five related

entities, use either:

● Additional copies of page 1 of the

form with only the organization’s name,

EIN, and Part III completed or

● Additional sheets the same size as the

form with all the information requested

in Part III and in the same format as

Part III.

If there are more than 12 individuals

required to be listed in Part IV, use

either:

● Additional unsigned copies of page 2

of the form or

● Additional sheets the same size as the

form with all the information requested

in Part IV and in the same format as

Part IV.