Fillable Printable Form 8880

What is a Form 8880 ?

Form 8880, usually known as a claim form of the saver's credit tax or the retirement savings contributions credit tax for IRS, you know, the Internal Revenue Service is used by the individual who has listed retirement contributions in his or her plan. Now, fill fillable form 8880 online, download blank or editable online. Sign, fax and print on Handypdf.com.

Fillable Printable Form 8880

What is a Form 8880 ?

Form 8880, usually known as a claim form of the saver's credit tax or the retirement savings contributions credit tax for IRS, you know, the Internal Revenue Service is used by the individual who has listed retirement contributions in his or her plan. Now, fill fillable form 8880 online, download blank or editable online. Sign, fax and print on Handypdf.com.

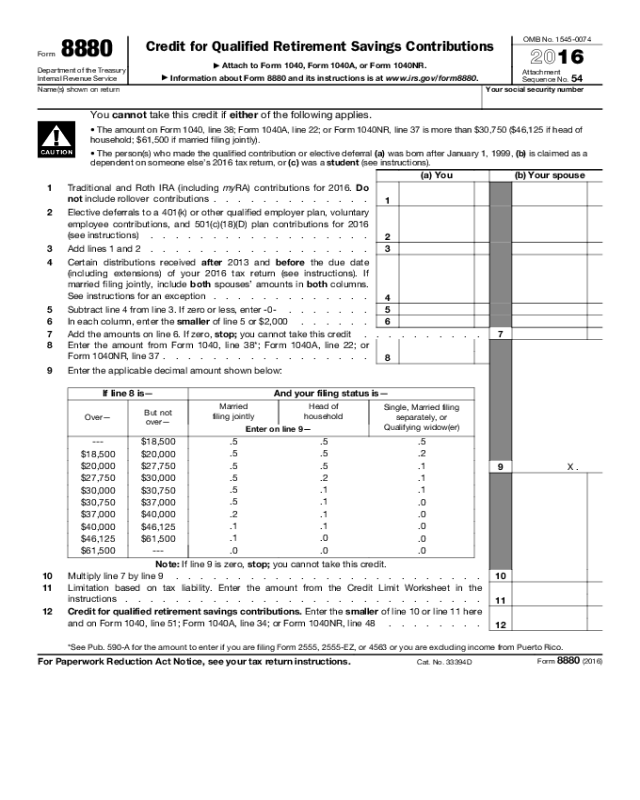

Form 8880

Form 8880

2016

Credit for Qualified Retirement Savings Contributions

Department of the Treasury

Internal Revenue Service

▶

Attach to Form 1040, Form 1040A, or Form 1040NR.

▶

Information about Form 8880 and its instructions is at www.irs.gov/form8880.

OMB No. 1545-0074

Attachment

Sequence No.

54

Name(s) shown on return

Your social security number

▲

!

CAUTION

You cannot take this credit if either of the following applies.

• The amount on Form 1040, line 38; Form 1040A, line 22; or Form 1040NR, line 37 is more than $30,750 ($46,125 if head of

household; $61,500 if married filing jointly).

• The person(s) who made the qualified contribution or elective deferral (a) was born after January 1, 1999, (b) is claimed as a

dependent on someone else’s 2016 tax return, or (c) was a student (see instructions).

(a) You

(b) Your spouse

1 Traditional and Roth IRA (including myRA) contributions for 2016. Do

not include rollover contributions . . . . . . . . . . . . .

1

2

Elective deferrals to a 401(k) or other qualified employer plan, voluntary

employee contributions, and 501(c)(18)(D) plan contributions for 2016

(see instructions) . . . . . . . . . . . . . . . . . .

2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . 3

4

Certain distributions received after 2013 and before the due date

(including extensions) of your 2016 tax return (see instructions). If

married filing jointly, include both spouses’ amounts in both columns.

See instructions for an exception . . . . . . . . . . . . .

4

5

Subtract line 4 from line 3. If zero or less, enter -0- . . . . . . .

5

6 In each column, enter the smaller of line 5 or $2,000 . . . . . . 6

7 Add the amounts on line 6. If zero, stop; you cannot take this credit . . . . . . . . . . 7

8 Enter the amount from Form 1040, line 38*; Form 1040A, line 22; or

Form 1040NR, line 37 . . . . . . . . . . . . . . . . .

8

9 Enter the applicable decimal amount shown below:

If line 8 is—

Over—

But not

over—

And your filing status is—

Married

filing jointly

Head of

household

Single, Married filing

separately, or

Qualifying widow(er)

Enter on line 9—

---

$18,500

.5 .5

.5

$18,500 $20,000

.5 .5

.2

$20,000 $27,750

.5 .5

.1

$27,750 $30,000

.5 .2

.1

$30,000 $30,750

.5 .1

.1

$30,750 $37,000

.5 .1

.0

$37,000 $40,000

.2 .1

.0

$40,000 $46,125

.1 .1

.0

$46,125 $61,500

.1 .0

.0

$61,500

--- .0 .0 .0

Note: If line 9 is zero, stop; you cannot take this credit.

9 X .

10 Multiply line 7 by line 9 . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Limitation based on tax liability. Enter the amount from the Credit Limit Worksheet in the

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Credit for qualified retirement savings contributions. Enter the smaller of line 10 or line 11 here

and on Form 1040, line 51; Form 1040A, line 34; or Form 1040NR, line 48 . . . . . . . .

12

*See Pub. 590-A for the amount to enter if you are filing Form 2555, 2555-EZ, or 4563 or you are excluding income from Puerto Rico.

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 33394D

Form 8880 (2016)

Form 8880 (2016)

Page 2

General Instructions

Section references are to the Internal Revenue Code.

Future Developments

For the latest information about developments related to Form 8880

and its instructions, such as legislation enacted after they were

published, go to www.irs.gov/form8880.

Purpose of Form

Use Form 8880 to figure the amount, if any, of your retirement

savings contributions credit (also known as the saver’s credit).

TIP

This credit can be claimed in addition to any IRA

deduction claimed on Form 1040, line 32; Form 1040A,

line 17; or Form 1040NR, line 32.

Who Can Take This Credit

You may be able to take this credit if you, or your spouse if filing

jointly, made (a) contributions (other than rollover contributions) to a

traditional or Roth IRA (including a myRA), (b) elective deferrals to a

401(k), 403(b), governmental 457(b), SEP, or SIMPLE plan,

(c) voluntary employee contributions to a qualified retirement plan

as defined in section 4974(c) (including the federal Thrift Savings

Plan), or (d) contributions to a 501(c)(18)(D) plan.

However, you cannot take the credit if either of the following

applies:

• The amount on Form 1040, line 38; Form 1040A, line 22; or Form

1040NR, line 37, is more than $30,750 ($46,125 if head of

household; $61,500 if married filing jointly).

• The person(s) who made the qualified contribution or elective

deferral (a) was born after January 1, 1999, (b) is claimed as a

dependent on someone else’s 2016 tax return, or (c) was a student.

▲

!

CAUTION

You will need to refigure the amount on Form 1040, line

38, if you are filing Form 2555, 2555-EZ, or 4563 or you

are excluding income from Puerto Rico. See Pub. 590-A

for details.

You were a student if during any part of 5 calendar months of

2016 you:

• Were enrolled as a full-time student at a school, or

• Took a full-time, on-farm training course given by a school or a

state, county, or local government agency.

A school includes technical, trade, and mechanical schools. It

does not include on-the-job training courses, correspondence

schools, or schools offering courses only through the Internet.

Specific Instructions

Column (b)

Complete column (b) only if you are filing a joint return.

Line 2

Include on line 2 any of the following amounts.

• Elective deferrals to a 401(k) or 403(b) plan (including designated

Roth contributions under section 402A), or to a governmental

457(b), SEP, or SIMPLE plan.

• Voluntary employee contributions to a qualified retirement plan as

defined in section 4974(c) (including the federal Thrift Savings Plan).

• Contributions to a 501(c)(18)(D) plan.

These amounts may be shown in box 12 of your Form(s) W-2 for

2016.

Note: Contributions designated under section 414(h)(2) are treated

as employer contributions and as such they are not voluntary

contributions made by the employee. They do not qualify for the

credit and should not be included on line 2.

Line 4

Enter the total amount of distributions you, and your spouse if filing

jointly, received after 2013 and before the due date of your 2016

return (including extensions) from any of the following types of

plans.

• Traditional or Roth IRAs (including myRAs).

• 401(k), 403(b), governmental 457(b), 501(c)(18)(D), SEP, or SIMPLE

plans.

• Qualified retirement plans as defined in section 4974(c) (including

the federal Thrift Savings Plan).

Do not include any:

• Distributions not taxable as the result of a rollover or a trustee-to-

trustee transfer.

• Distributions that are taxable as the result of an in-plan rollover to

your designated Roth account.

• Distributions from your eligible retirement plan (other than a Roth

IRA) rolled over or converted to your Roth IRA.

• Loans from a qualified employer plan treated as a distribution.

• Distributions of excess contributions or deferrals (and income

allocable to such contributions or deferrals).

• Distributions of contributions made to an IRA during a tax year

and returned (with any income allocable to such contributions) on or

before the due date (including extensions) for that tax year.

• Distributions of dividends paid on stock held by an employee

stock ownership plan under section 404(k).

• Distributions from a military retirement plan (other than the federal

Thrift Savings Plan).

• Distributions from an inherited IRA by a nonspousal beneficiary.

If you are filing a joint return, include both spouses’ amounts in

both columns.

Exception. Do not include your spouse’s distributions with yours

when entering an amount on line 4 if you and your spouse did not

file a joint return for the year the distribution was received.

Example. You received a distribution of $5,000 from a qualified

retirement plan in 2016. Your spouse received a distribution of

$2,000 from a Roth IRA in 2014. You and your spouse file a joint

return in 2016, but did not file a joint return in 2014. You would

include $5,000 in column (a) and $7,000 in column (b).

Line 7

Add the amounts from line 6 columns (a) and (b), and enter the total.

Line 11

Before you complete the following worksheet, figure the amount of

any credit for the elderly or the disabled you are claiming on Form

1040, line 54. See Schedule R (Form 1040A or 1040) to figure the

credit.

Credit Limit Worksheet

Complete this worksheet to figure the amount to enter on line 11.

1. Enter the amount from Form 1040, line 47;

Form 1040A, line 30; Form 1040NR, line 45

1.

2. Form 1040 filers: Enter the total of your

credits from lines 48 through 50 and Schedule

R, line 22.

Form 1040A filers: Enter the total of your

credits from lines 31 through 33.

Form 1040NR filers: Enter the total of your

credits from lines 46 and 47 . . . . .

2.

3. Subtract line 2 from line 1. Also enter this

amount on Form 8880, line 11. But if zero or

less, stop; you cannot take the credit—do not

file this form . . . . . . . . . .

3.