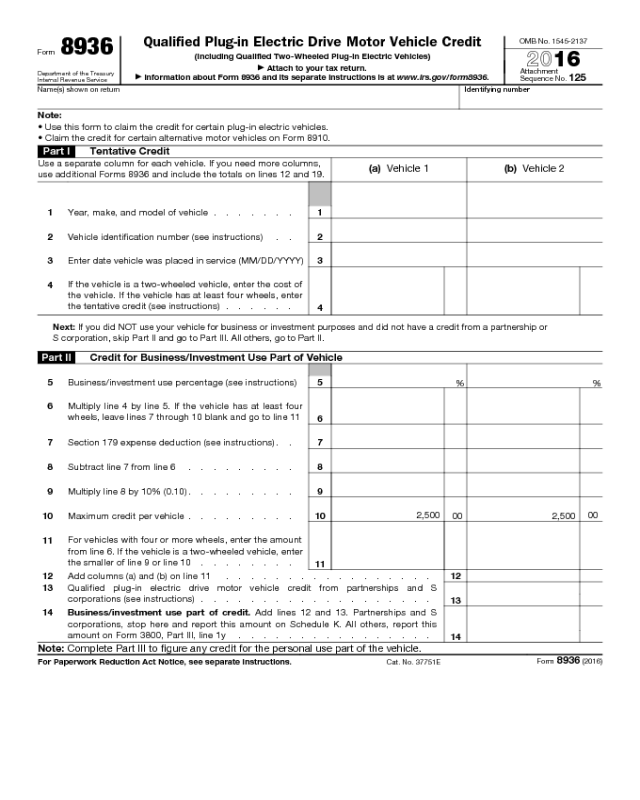

Form 8936

Form 8936

Department of the Treasury

Internal Revenue Service

Qualified Plug-in Electric Drive Motor Vehicle Credit

(Including Qualified Two-Wheeled Plug-in Electric Vehicles)

▶

Attach to your tax return.

▶

Information about Form 8936 and its separate instructions is at www.irs.gov/form8936.

OMB No. 1545-2137

2016

Attachment

Sequence No.

125

Name(s) shown on return Identifying number

Note:

• Use this form to claim the credit for certain plug-in electric vehicles.

• Claim the credit for certain alternative motor vehicles on Form 8910.

Part I Tentative Credit

Use a separate column for each vehicle. If you need more columns,

use additional Forms 8936 and include the totals on lines 12 and 19.

(a) Vehicle 1 (b) Vehicle 2

1 Year, make, and model of vehicle . . . . . . . 1

2 Vehicle identification number (see instructions) . . 2

3 Enter date vehicle was placed in service (MM/DD/YYYY) 3

4

If the vehicle is a two-wheeled vehicle, enter the cost of

the vehicle. If the vehicle has at least four wheels, enter

the tentative credit (see instructions) . . . . . .

4

Next: If you did NOT use your vehicle for business or investment purposes and did not have a credit from a partnership or

S corporation, skip Part II and go to Part III. All others, go to Part II.

Part II Credit for Business/Investment Use Part of Vehicle

5 Business/investment use percentage (see instructions) 5

% %

6

Multiply line 4 by line 5. If the vehicle has at least four

wheels, leave lines 7 through 10 blank and go to line 11

6

7 Section 179 expense deduction (see instructions) . . 7

8 Subtract line 7 from line 6 . . . . . . . . . 8

9 Multiply line 8 by 10% (0.10) . . . . . . . . . 9

10 Maximum credit per vehicle . . . . . . . . . 10

11

For vehicles with four or more wheels, enter the amount

from line 6. If the vehicle is a two-wheeled vehicle, enter

the smaller of line 9 or line 10 . . . . . . . .

11

12 Add columns (a) and (b) on line 11 . . . . . . . . . . . . . . . . . 12

13

Qualified plug-in electric drive motor vehicle credit from partnerships and S

corporations (see instructions) . . . . . . . . . . . . . . . . . . .

13

14

Business/investment use part of credit. Add lines 12 and 13. Partnerships and S

corporations, stop here and report this amount on Schedule K. All others, report this

amount on Form 3800, Part III, line 1y . . . . . . . . . . . . . . . .

14

Note: Complete Part III to figure any credit for the personal use part of the vehicle.

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 37751E

Form 8936 (2016)

2,500

00

2,500

00

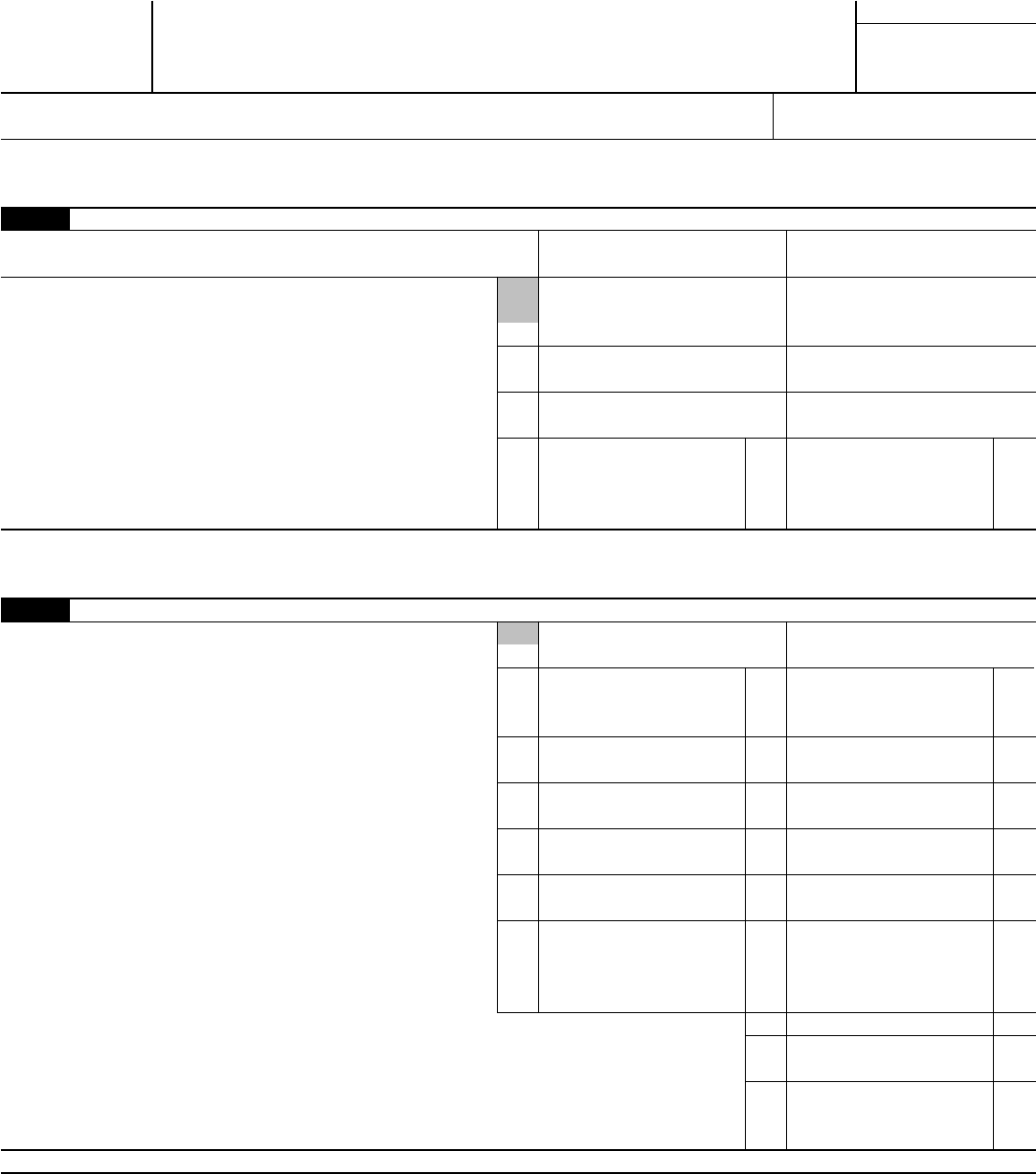

Form 8936 (2016)

Page

2

Part III Credit for Personal Use Part of Vehicle

19 Add columns (a) and (b) on line 18 . . . . . . . . . . . . . . . . . .

19

20 Enter the amount from Form 1040, line 47, or Form 1040NR, line 45 . . . . . .

20

21 Personal credits from Form 1040 or 1040NR (see instructions) . . . . . . . .

21

22 Subtract line 21 from line 20 . . . . . . . . . . . . . . . . . . . 22

23

Personal use part of credit. Enter the smaller of line 19 or line 22 here and on Form

1040, line 54, or Form 1040NR, line 51. Check box c on that line and enter “8936” in

the space next to that box. If line 22 is smaller than line 19, see instructions . . . .

23

Form 8936 (2016)

(a) Vehicle 1 (b) Vehicle 2

15

If you skipped Part II, enter the amount from line 4. If

you completed Part II, subtract line 6 from line 4. If the

vehicle has at least four wheels, leave lines 16 and 17

blank and go to line 18 . . . . . . . . . .

15

16 Multiply line 15 by 10% (0.10) . . . . . . . . 16

17

Maximum credit per vehicle. If you skipped

Part II, enter $2,500. If you completed Part II,

subtract line 11 from line 10 . . . . . . . . .

17

18

For vehicles with four or more wheels, enter the

amount from line 15. If the vehicle is a two-wheeled

vehicle, enter the smaller of line 16 or line 17 . . .

18