- Form DTF-803 - Claim for Sales and Use Tax Exemption - New York

- Form MV-82ITP - In-Transit Permit/Title Application - New York

- Form MV-51B - Statement of Ownership for Vehicles - New York

- Form MV-37 - Statement of Abandoned Vehicle - New York

- Form MV-260F - Certified Farm Vehicle Use - New York

- Form MV-901A - Notice of Lien and Sale - New York

Fillable Printable Form DTF-803 - Claim for Sales and Use Tax Exemption - New York

Fillable Printable Form DTF-803 - Claim for Sales and Use Tax Exemption - New York

Form DTF-803 - Claim for Sales and Use Tax Exemption - New York

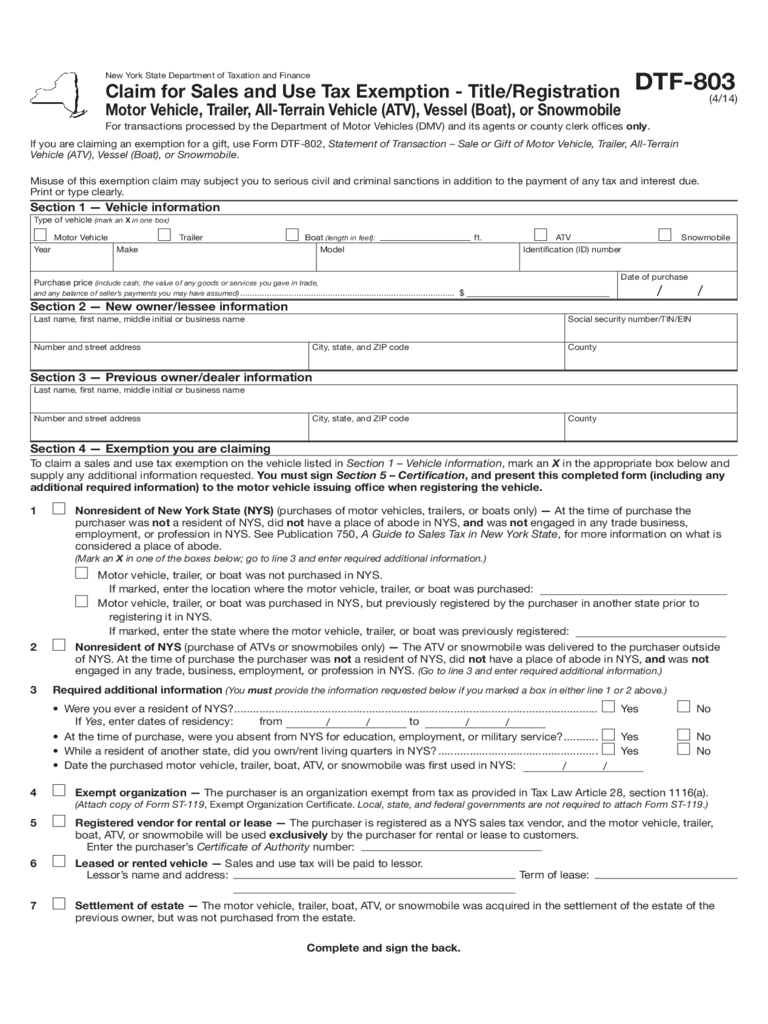

DTF-803

(4/14)

New York State Department of Taxation and Finance

Claim for Sales and Use Tax Exemption - Title/Registration

Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile

For transactions processed by the Department of Motor Vehicles (DMV) and its agents or county clerk ofces only.

Section 4 — Exemption you are claiming

Type of vehicle (mark an X in one box)

Motor Vehicle Trailer Boat (length in feet): ft. ATV Snowmobile

Year Make Model Identication (ID) number

Purchase price

(include cash, the value of any goods or services you gave in trade,

Date of purchase

and any balance of seller’s payments you may have assumed) ........................................................................................ $

Section 1 — Vehicle information

Section 2 — New owner/lessee information

Last name, rst name, middle initial or business name Social security number/TIN/EIN

Number and street address City, state, and ZIP code County

Section 3 — Previous owner/dealer information

Last name, rst name, middle initial or business name

Number and street address City, state, and ZIP code County

Misuse of this exemption claim may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest due.

Print or type clearly.

Complete and sign the back.

To claim a sales and use tax exemption on the vehicle listed in Section 1 – Vehicle information, mark an X in the appropriate box below and

supply any additional information requested. You must sign Section 5 – Certification, and present this completed form (including any

additional required information) to the motor vehicle issuing office when registering the vehicle.

1 Nonresident of New York State (NYS) (purchases of motor vehicles, trailers, or boats only) — At the time of purchase the

purchaser was not a resident of NYS, did not have a place of abode in NYS, and was not engaged in any trade business,

employment, or profession in NYS. See Publication 750, A Guide to Sales Tax in New York State, for more information on what is

considered a place of abode.

(Mark an X in one of the boxes below; go to line 3 and enter required additional information.)

Motor vehicle, trailer, or boat was not purchased in NYS.

If marked, enter the location where the motor vehicle, trailer, or boat was purchased:

Motor vehicle, trailer, or boat was purchased in NYS, but previously registered by the purchaser in another state prior to

registering it in NYS.

If marked, enter the state where the motor vehicle, trailer, or boat was previously registered:

2

Nonresident of NYS (purchase of ATVs or snowmobiles only) — The ATV or snowmobile was delivered to the purchaser outside

of NYS. At the time of purchase the purchaser was not a resident of NYS, did not have a place of abode in NYS, and was not

engaged in any trade, business, employment, or profession in NYS.

(Go to line 3 and enter required additional information.)

3 Required additional information

(You must provide the information requested below if you marked a box in either line 1 or 2 above.)

• WereyoueveraresidentofNYS? .................................................................................................................... Yes No

If Yes, enter dates of residency: from to

•Atthetimeofpurchase,wereyouabsentfromNYSforeducation,employment,ormilitaryservice? ...........

Yes No

•Whilearesidentofanotherstate,didyouown/rentlivingquartersinNYS? ...................................................

Yes No

•Datethepurchasedmotorvehicle,trailer,boat,ATV,orsnowmobilewasrstusedinNYS:

4

Exempt organization — The purchaser is an organization exempt from tax as provided in Tax Law Article 28, section 1116(a).

(Attach copy of Form ST-119, Exempt Organization Certicate. Local, state, and federal governments are not required to attach Form ST-119.)

5 Registered vendor for rental or lease — The purchaser is registered as a NYS sales tax vendor, and the motor vehicle, trailer,

boat, ATV, or snowmobile will be used exclusively by the purchaser for rental or lease to customers.

Enter the purchaser’s Certificate of Authority number:

6

Leased or rented vehicle — Sales and use tax will be paid to lessor.

Lessor’s name and address: Term of lease:

7 Settlement of estate — The motor vehicle, trailer, boat, ATV, or snowmobile was acquired in the settlement of the estate of the

previous owner, but was not purchased from the estate.

If you are claiming an exemption for a gift, use Form DTF-802, Statement of Transaction – Sale or Gift of Motor Vehicle, Trailer, All-Terrain

Vehicle (ATV), Vessel (Boat), or Snowmobile.

/ /

/ /

/ /

/ /

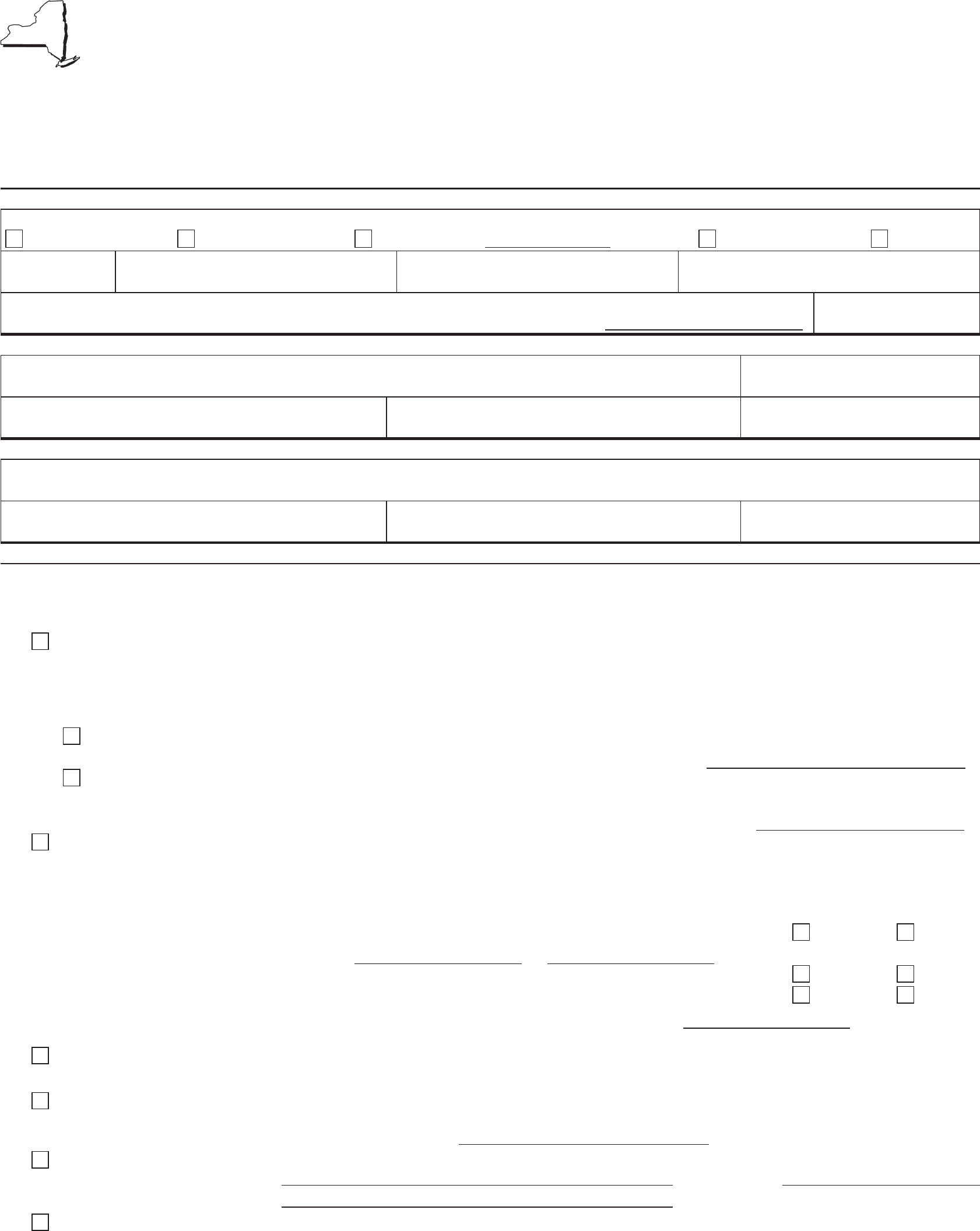

8 Tractor, trailer, or semi-trailer — The motor vehicle is a tractor, trailer, or semi trailer which is or will be used in combination where

the gross vehicle weight of the combination exceeds 26,000 pounds.

9

Direct payment (DP) permit holder — The purchaser has a DP permit issued by the Tax Department.

Enter the DP permit number (attach copy): DP —

10

New York sales and use tax paid to seller — The tax must be paid on the seller’s sales and use tax return. The buyer must attach

a copy of the bill of sale indicating tax paid. Complete the following:

Seller: Purchase price: Tax paid:

11

Individual Indian exemption — The purchaser must be an enrolled member of an exempt nation or tribe and must maintain a

permanent residence on the reservation. The purchase must not be for resale. The motor vehicle, trailer, or boat must be registered

to an address located on the reservation. If the purchase is an ATV or snowmobile, the vehicle must have been delivered to you on

the reservation. Complete the following:

Name of exempt nation or tribe:

Name of qualied reservation:

12

Military personnel (motor vehicles only) — NYS resident who purchased the vehicle outside NYS while in military service

Mark an X in the appropriate box.

a NYS tax exempt (tax paid to another state) — No NYS or local sales or use tax is due if the seller or purchaser paid sales, use,

excise, or highway use tax to another state in order to obtain the title. Complete the following:

Branch of military service: Dates of military service: from to

State where vehicle was purchased: Tax paid: Paid by: purchaser seller

Note: You must provide military ID or other documentation of military service and attach proof of tax paid to another state.

b

NYS tax deferred — No NYS or local sales or use tax is due at this time if the purchaser:

• hasbeenonactivedutycontinuouslysincethevehiclewaspurchasedoutsideNYS;

• isstillonactivedutyandisstillstationedoutsideNYS;

• hasnotbeenstationedin,norhadlivingquartersin,NYSfromthetimeofpurchasetothepresent;and

• willnotusethevehicleinNYSexceptduringauthorizedabsencefromduty.

Complete the following:

State or foreign country where vehicle was purchased (cannot be NYS):

Present duty station:

Present living quarters:

Note: upon discharge, separation, or release from active duty, or upon being stationed or quartered within NYS, the purchaser

must pay any sales and use tax due if the purchaser continues to use the motor vehicle in NYS.

13

Farm production and commercial horse boarding operation — The motor vehicle, trailer, boat, ATV, or snowmobile will be used

predominantly either in farm production or in a commercial horse boarding operation, or in both. Mark an X in the appropriate box

to indicate the type of plate registration.

Farming Commercial Registration not required (provide reason)

Agriculture Passenger

14

Other exemption (explain)

DTF-803 (4/14) (back)

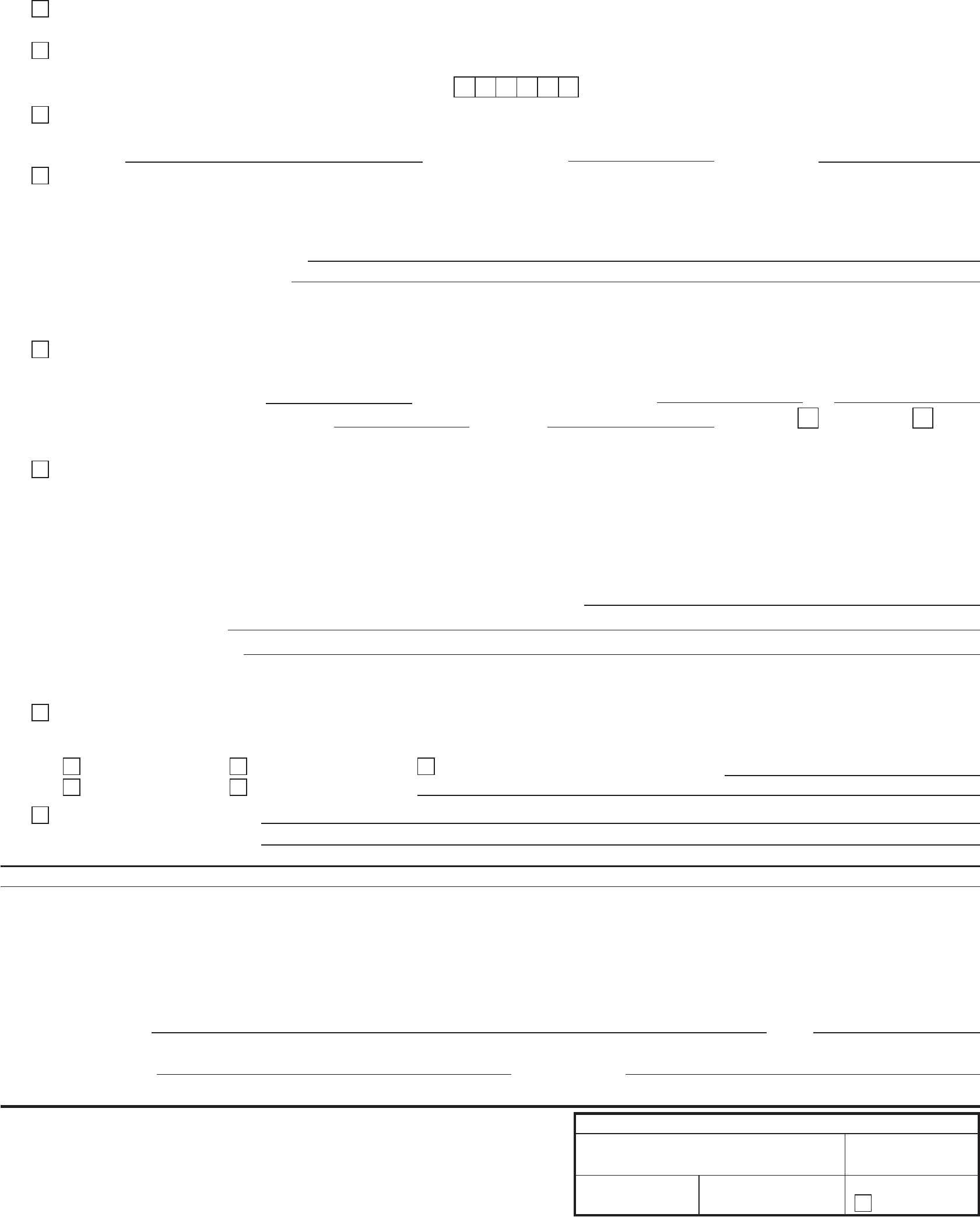

I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these statements and issue

this exemption certicate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction

or transactions for which I tendered this document and that willfully issuing this document with the intent to evade any such tax may constitute a felony or

other crime under New York State Law, punishable by a substantial ne and a possible jail sentence. I understand that the Department of Motor Vehicles

or county clerk is agent for, and acts on behalf of, New York State and any locality with respect to any state or local sales or use tax the Department of

Motor Vehicles or county clerkisrequiredtocollectfromme;thatas agent they are required to collect such taxes from me unless I properly furnish this

certicate;andthatthiscerticatewill be made available to the Tax Department. I also understand that the Tax Department is authorized to investigate the

validity of tax exemptions claimed and the accuracy of any information entered on this document.

(Sign name in full)

Date

Title (if business)

Signature of new owner

Print name of new owner

Privacy notification — The Commissioner of Taxation and Finance may collect and maintain personal information

pursuant to the New York State Tax Law, including but not limited to, sections 5-a, 171, 171-a, 287, 308, 429,

475,505,697,1096,1142,and1415ofthatLaw;andmayrequiredisclosureofsocialsecuritynumberspursuant

to 42 USC 405(c)(2)(C)(i). This information will be used to determine and administer tax liabilities and, when

authorized by law, for certain tax offset and exchange of tax information programs as well as for any other lawful

purpose. Information concerning quarterly wages paid to employees is provided to certain state agencies for

purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and

training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the

Tax Law. This information is maintained by the Manager of Document Management, NYS Tax Department,

WAHarrimanCampus,AlbanyNY12227;telephone(518)457-5181.

Section 5 — Certification

For office use only

Ofce Date

Cashier’s initials Term no. Possible audit

/ / / /