- Form MV-37 - Statement of Abandoned Vehicle - New York

- Form MV-901A - Notice of Lien and Sale - New York

- Form DTF-803 - Claim for Sales and Use Tax Exemption - New York

- Form MV-51B - Statement of Ownership for Vehicles - New York

- Form MV-260F - Certified Farm Vehicle Use - New York

- Form MV-82ITP - In-Transit Permit/Title Application - New York

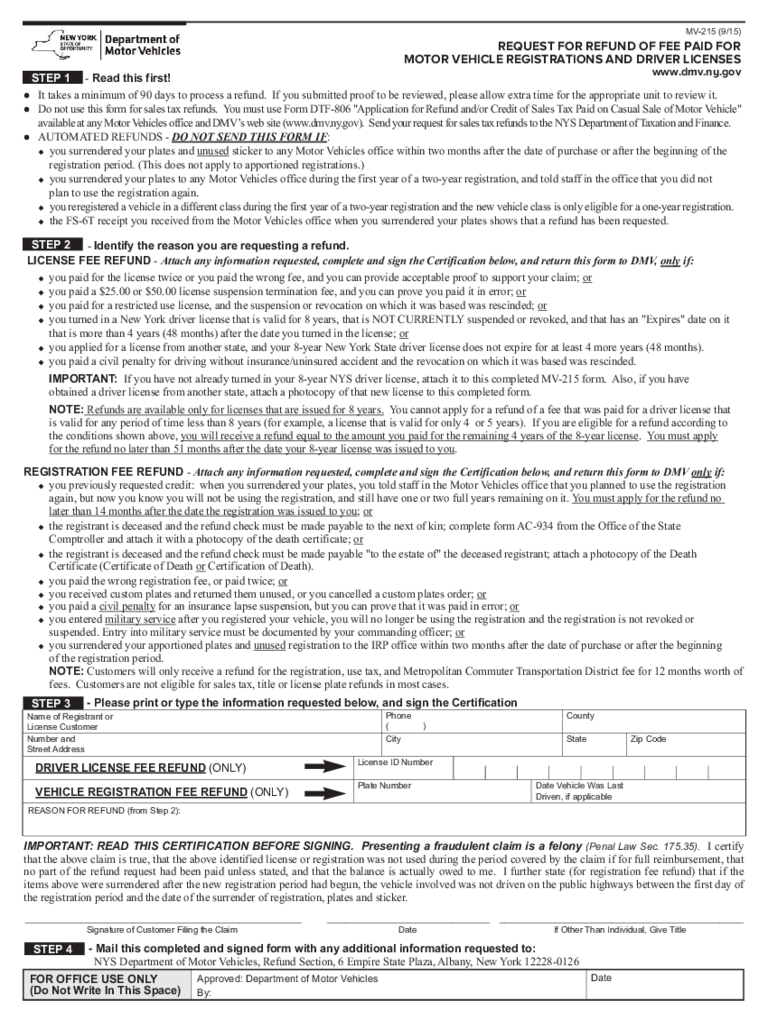

Fillable Printable Form MV-215 - Refund Request of Motor Vehicle Registrations/Driver Licenses Fee - New York

Fillable Printable Form MV-215 - Refund Request of Motor Vehicle Registrations/Driver Licenses Fee - New York

Form MV-215 - Refund Request of Motor Vehicle Registrations/Driver Licenses Fee - New York

REQUEST FOR REFUND OF FEE PAID FOR

MOTOR VEHICLE REGISTRATIONS AND DRIVER LICENSES

www.dmv.ny.gov

Name of Registrant or

License Customer

Number and

Street Address

REASON FOR REFUND (from Step 2):

Phone

( )

City State Zip Code

County

MV-215 (9/15)

l

It takes a minimum of 90 days to process a refund. If you submitted proof to be reviewed, please allow extra time for the appropriate unit to review it.

l Do not use this form for sales tax refunds. You must use Form DTF-806 "Application for Refund and/or Credit of Sales Tax Paid on Casual Sale of Motor Vehicle"

available at any Motor Vehicles office and DMV’s web site (www.dmv.ny.gov). Send your request for sales tax refunds to the NYS Department of Taxation and Finance.

l AUTOMATED REFUNDS - DO NOT SEND THIS FORM IF:

u you surrendered your plates and unused sticker to any Motor Vehicles office within two months after the date of purchase or after the beginning of the

registration period. (This does not apply to apportioned registrations.)

u you surrendered your plates to any Motor Vehicles office during the first year of a two-year registration, and told staff in the office that you did not

plan to use the registration again.

u you reregistered a vehicle in a different class during the first year of a two-year registration and the new vehicle class is only eligible for a one-year registration.

u the FS-6T receipt you received from the Motor Vehicles office when you surrendered your plates shows that a refund has been requested.

IMPORTANT: READ THIS CERTIFICATION BEFORE SIGNING. Presenting a fraudulent claim is a felony

(Penal Law Sec. 175.35). I certify

that the above claim is true, that the above identified license or registration was not used during the period covered by the claim if for full reimbursement, that

no part of the refund request had been paid unless stated, and that the balance is actually owed to me. I further state (for registration fee refund) that if the

items above were surrendered after the new registration period had begun, the vehicle involved was not driven on the public highways between the first day of

the registration period and the date of the surrender of registration, plates and sticker.

____________________________________________ __________________________ _______________________________________

License ID Number

Plate Number Date Vehicle Was Last

Driven, if applicable

Signature of Customer Filing the Claim Date If Other Than Individual, Give Title

LICENSE FEE REFUND - Attach any information requested, complete and sign the Certification below, and return this form to DMV, only if:

u you paid for the license twice or you paid the wrong fee, and you can provide acceptable proof to support your claim; or

u you paid a $25.00 or $50.00 license suspension termination fee, and you can prove you paid it in error; or

u you paid for a restricted use license, and the suspension or revocation on which it was based was rescinded; or

u you turned in a New York driver license that is valid for 8 years, that is NOT CURRENTLY suspended or revoked, and that has an "Expires" date on it

that is more than 4 years (48 months) after the date you turned in the license; or

u you applied for a license from another state, and your 8-year New York State driver license does not expire for at least 4 more years (48 months).

u you paid a civil penalty for driving without insurance/uninsured accident and the revocation on which it was based was rescinded.

IMPORTANT: If you have not already turned in your 8-year NYS driver license, attach it to this completed MV-215 form. Also, if you have

obtained a driver license from another state, attach a photocopy of that new license to this completed form.

NOTE: Refunds are available only for licenses that are issued for 8 years.

You cannot apply for a refund of a fee that was paid for a driver license that

is valid for any period of time less than 8 years (for example, a license that is valid for only 4 or 5 years). If you are eligible for a refund according to

the conditions shown above, you will receive a refund equal to the amount you paid for the remaining 4 years of the 8-year license

. You must apply

for the refund no later than 51 months after the date your 8-year license was issued to you.

REGISTRATION FEE REFUND - Attach any information requested, complete and sign the Certification below, and return this form to DMV only

if:

u you previously requested credit: when you surrendered your plates, you told staff in the Motor Vehicles office that you planned to use the registration

again, but now you know you will not be using the registration, and still have one or two full years remaining on it. You must apply for the refund no

later than 14 months after the date the registration was issued to you; or

u the registrant is deceased and the refund check must be made payable to the next of kin; complete form AC-934 from the Office of the State

Comptroller and attach it with a photocopy of the death certificate; or

u the registrant is deceased and the refund check must be made payable "to the estate of" the deceased registrant; attach a photocopy of the Death

Certificate (Certificate of Death or

Certification of Death).

u you paid the wrong registration fee, or paid twice; or

u you received custom plates and returned them unused, or you cancelled a custom plates order; or

u you paid a civil penalty for an insurance lapse suspension, but you can prove that it was paid in error; or

u you entered military service after you registered your vehicle, you will no longer be using the registration and the registration is not revoked or

suspended. Entry into military service must be documented by your commanding officer; or

u you surrendered your apportioned plates and unused registration to the IRP office within two months after the date of purchase or after the beginning

of the registration period.

NOTE: Customers will only receive a refund for the registration, use tax, and Metropolitan Commuter Transportation District fee for 12 months worth of

fees. Customers are not eligible for sales tax, title or license plate refunds in most cases.

- Please print or type the information requested below, and sign the Certification

- Mail this completed and signed form with any additional information requested to:

NYS Department of Motor Vehicles, Refund Section, 6 Empire State Plaza, Albany, New York 12228-0126

DRIVER LICENSE FEE REFUND

(ONLY)

VEHICLE REGISTRATION FEE REFUND (ONLY)

STEP 1

STEP 3

STEP 4

STEP 2

- Identify the reason you are requesting a refund.

- Read this first!

Approved: Department of Motor Vehicles

By:

Date

FOR OFFICE USE ONLY

(Do Not Write In This Space)

reset/clear