Fillable Printable Form F-1

Fillable Printable Form F-1

Form F-1

___________________________________________________________________________________________________________

____________________________________________________________________________________________________________

___________________________________ ___________________________________ _____________________

______________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

______

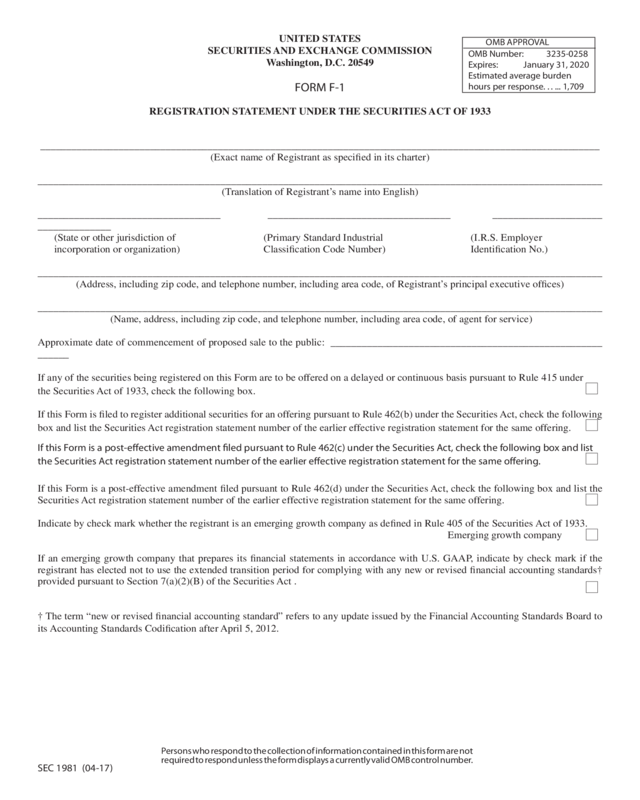

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

OMB APPROVAL

OMB Number: 3235-0258

Expires: January 31, 2020

Estimated average burden

hours per response. . . ... 1,709

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English)

(State or other jurisdiction of (Primary Standard Industrial (I.R.S. Employer

incorporation or organization) Classification Code Number) Identifi cation No.)

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: ____________________________________________________

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-eective amendment led pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier eective registration statement for the same o ering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards†

provided pursuant to Section 7(a)(2)(B) of the Securities Act .

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to

its Accounting Standards Codification after April 5, 2012.

Persons who respond to the collection of information contained in this form are not

required to respond unless the form displays a currently valid OMB control number.

SEC 1981 (04-17)

CALCULATION OF REGISTRATION FEE

Title of each

class of securities

to be registered

Amount to be

registered

Proposed maximum

offering price

per unit

Proposed maximum

aggregate offering

price

Amount of

registration fee

Note:Specific details relating to the fee calculation shall be furnished in notes to the table, including references to provisions of Rule 457

(§230.457 of this chapter) relied upon, if the basis of the calculation is not otherwise evident from the information presented in the table.

If the filing fee is calculated pursuant to Rule 457(o) under the Securities Act, only the title of the class of securities to be registered, the

proposed maximum aggregate offering price for that class of securities and the amount of registration fee need to appear in the Calculation

of Registration Fee table. Any difference between the dollar amount of securities registered for such offerings and the dollar amount of

securities sold may be carried forward on a future registration statement pursuant to Rule 429 under the Securities Act.

GENERAL INSTRUCTIONS

I. Eligibility Requirements for Use of Form F-1

A. Form F-1 shall be used for registration under the Securities Act of 1933 (“Securities Act”) of securities of all foreign private issuers

as defined in Rule 405 (§230.405 of this chapter) for which no other form is authorized or prescribed.

In addition, this form shall not be used for an offering of asset-backed securities, as defined in 17 CFR 229.1101.

B. If a registrant is a majority-owned subsidiary, which does not itself meet the conditions of these eligibility requirements, it shall

nevertheless be deemed to have met such conditions if its parent meets the conditions and if the parent fully guarantees the securities

being registered as to principal and interest. Note: In such an instance the parent-guarantor is the issuer of a separate security

consisting of the guarantee which must be concurrently registered but may be registered on the same registration statement as are

the guaranteed securities. Both the parent-guarantor and the subsidiary shall each disclose the information required by this Form

as if each were the only registrant except that if the subsidiary will not be eligible to file annual reports on Form 20-F after the

effective date of the registration statement, then it shall disclose the information specified in Forms S-1 (§239.11 of this chapter).

Rule 3-10 of Regulation S-X (§210.3-10 of this chapter) specifi es the financial statements required.

II. Application of General Rules and Regulations

A. Attention is directed to the General Rules and Regulations under the Securities Act, particularly Regulation C (§230.400 et seq. of

this chapter) thereunder. That Regulation contains general requirements regarding the preparation and filing of registration statements.

B. Attention is directed to Regulation S-K (§229.22 of this chapter) and Form 20-F (§249.220f of this chapter) for the requirements

applicable to the content of registration statements under the Securities Act. Where this Form directs the registrant to furnish

information required by Regulation S-K or Form 20-F and the item of Regulation S-K or Form 20-F so provides, information need

only be furnished to the extent appropriate.

III. Exchange Offers

If any of the securities being registered are to be offered in exchange for securities of any other issuer the prospectus shall also

include the information which would be required by Item 11 if the securities of such other issuer were registered on this Form. If such

other issuer is not eligible to use this Form F-1, then the prospectus shall include the information which would be required by Item 1 1 of

Form S-1 (§239.11 of this chapter) if the securities of such other issuer were being registered on Form S-1. There shall also be included the

information concerning such securities of such other issuer which would be called for by Item 9 if such securities were being registered.

In connection with this instruction, reference is made to Rule 409 (§229.501 of this chapter).

IV. Roll-up Transactions

If the securities to be registered on this Form will be issued in a roll-up transaction as defined in Item 901(c) of Regulation S-K (17

CFR 229.901(c)), attention is directed to the requirements of Form S-4 applicable to roll-up transactions, including, but not limited to,

General Instruction I.

2

V. Registration of Additional Securities

With respect to the registration of additional securities for an offering pursuant to Rule 462(b) under the Securities Act, the registrant

may file a registration statement consisting only of the following: the facing page; a statement that the contents of the earlier registration

statement, identifi ed by file number, are incorporated by reference; required opinions and consents; the signature page; and any price-

related information omitted from the earlier registration statement in reliance on Rule 430A that the registrant chooses to include in the

new registration statement. The information contained in such a Rule 462(b) registration statement shall be deemed to be a part of the

earlier registration statement as of the date of effectiveness of the Rule 462(b) registration statement. Any opinion or consent required

in the Rule 462(b) registration statement may be incorporated by reference from the earlier registration statement with respect to the

offering, if: (i) such opinion or consent expressly provides for such incorporation; and (ii) such opinion relates to the securities registered

pursuant to Rule 462(b). See Rule 411(c) and Rule 439(b) under the Securities Act.

VI. Eligibility to Use Incorporation by Reference

If a registrant meets the following requirements immediately prior to the time of filing a registration statement on this Form, it may

elect to provide information required by Item 3 and Item 4 of this Form in accordance with Item 4A and Item 5 of this Form:

A. The registrant is subject to the requirement to file reports pursuant to Section 13 or Section 15(d) of the Securities

Exchange Act of 1934 (“Exchange Act”);

B. The registrant has filed all reports and other materials required to be filed by Section 13(a) or 15(d) of the Exchange Act

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports and materials);

C. The registrant has filed an annual report required under Section 13(a) or 15(d) of the Exchange Act for its most recently

completed fi scal year;

D. The registrant is not:

1. And during the past three years neither the registrant nor any of its predecessors was:

(a) A blank check company as defined in Rule 419(a)(2) (§230.419(a)(2) of this chapter);

(b) A shell company, other than a business combination related shell company, each as defined in Rule 405

(§230.405 of this chapter); or

(c) A registrant for an offering of penny stock as defined in Rule 3a51-1 of the Exchange Act (§240.3a51-1

of this chapter);

2. Registering an offering that effectuates a business combination transaction as defined in Rule 165(f)(1)

(§230.165(f)(1) of this chapter);

E. If a registrant is a successor registrant it shall be deemed to have satisfied conditions A., B., C., and D.2. above if:

1. Its predecessor and it, taken together, do so, provided that the succession was primarily for the purpose of chang-

ing the state or other jurisdiction of incorporation of the predecessor or forming a holding company and that the assets and liabilities of

the successor at the time of succession were substantially the same as those of the predecessor; or

2. All predecessors met the conditions at the time of succession and the registrant has continued to do so since the

succession; and

F. The registrant makes its reports filed pursuant to Sections 13 or 15(d) of the Exchange Act that are incorporated by refer-

ence pursuant to Item 4A or Item 5 of this Form readily available and accessible on a Web site maintained by or for the registrant

and containing information about the registrant.

PART I — INFORMATION REQUIRED IN PROSPECTUS

Item 1. Forepart of Registration Statement and Outside Front Cover Page of Prospectus.

Set forth in the forepart of the registration statement and on the outside front cover page of the prospectus the information required by

Item 501 of Regulation S-K (§229.501 of this chapter).

Item 2. Inside Front and Outside Back Cover Pages of Prospectus.

3

Set forth on the inside front cover page of the prospectus or, where permitted, on the outside back cover page the information required

by Item 502 of Regulation S-K (§229.502 of this chapter).

Item 3. Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges.

Furnish the information required by Item 503 of Regulation S-K (§229.503 of this chapter).

Item 4. Information with Respect to the Registrant and the Offering.

Furnish the following information with respect to the Registrant.

a. Information required by Part I of Form 20-F.

b. Information required by Item 18 of Form 20-F (Schedules required under Regulation S-X shall be filed as “Financial Statement

Schedules Pursuant to Item 8, Exhibit and Financial Statement Schedules, of this Form), as well as any information required

by Rule 3-05 and Article 11 of Regulation S-X, except as permitted by (c) below:

c. For the registrant’s fiscal years ending before December 15, 2011, information required by Item 17 of Form 20-F may be

furnished in lieu of the information specified by Item 18 thereof if the only securities being registered are non-convertible

securities that are “investment grade securities,” as defined below, or the only securities to be registered are to be offered:

1. upon the exercise of outstanding rights granted by the issuer of the securities to be offered, if such rights are

granted on a pro rata basis to all existing security holders of the class of securities to which the rights attach and

there is no standby underwriting in the United States or similar arrangement; or

2. pursuant to a dividend or interest reinvestment plan; or upon the conversion of outstanding convertible securities

or upon the exercise of outstanding transferable warrants issued by the issuer of the securities to be offered, or by an

affiliate of such issuer.

d. For the registrant’s fiscal years ending on or after December 15, 2009, information required by Item 16F of Form 20-F.

Item 4A. Material Changes.

(a) If the registrant elects to incorporate information by reference pursuant to General Instruction VI., describe any and all material

changes in the registrant’s affairs which have occurred since the end of the latest fiscal year for which audited financial

statements were included in accordance with Item 5 of this Form and which have not been described in a report on Form 6-K, Form

10-Q or Form 8-K filed under the Exchange Act and incorporated by reference pursuant to Item 5 of this Form.

(b)1. Include in the prospectus contained in the registration statement, if not included in the reports filed under the Exchange Act

which are incorporated by reference into the prospectus contained in the registration statement pursuant to Item 5:

i. Information required by Rule 3-05 and Article 11 of Regulation S-X (§210.3-05 and §210.11 et seq. of this

chapter);

ii. Restated financial statements if there has been a change in accounting principles or a correction of an error where

such change or correction requires material retroactive restatement of fi nancial statements;

iii. Restated financial statements where one or more business combinations accounted for by the pooling of interest

method of accounting have been consummated subsequent to the most recent fiscal year and the acquired busi

nesses, considered in the aggregate, are significant under Rule 11-01(b) (§210.11-01(b) of this chapter); or

iv. Any financial information required because of a material disposition of assets outside the normal course of

business.

2. If the financial statements included in this registration statement in accordance with Item 5 are not sufficiently current to comply

with the requirements of Item 8.A of Form 20-F, financial statements necessary to comply with that Item shall be presented:

i. Directly in the prospectus;

ii. Through incorporation by reference and delivery of a Form 6-K identified in the prospectus as containing such

iii. Through incorporation by reference of an amended Form 20-F, Form 40-F, or Form 10-K, in which

case the prospectus shall disclose that the Form 20-F, Form 40-F, or Form 10-K has been so amended.

Instruction. For the registrant’s fiscal years ending before December 15, 2011, financial statements or information required to be

furnished by this Item shall be reconciled pursuant to either Item 17 or Item 18 of Form 20-F, whichever is applicable to the primary

4

financial statements. For the registrant’s fiscal years ending on or after December 15, 2011, financial statements or information re-

quired to be furnished by this Item shall be reconciled pursuant to Item 18 of Form 20-F.

Item 5. Incorporation of Certain Information by Reference.

If the registrant elects to incorporate information by reference pursuant to General Instruction VI.:

(a) It must specifically incorporate by reference into the prospectus contained in the registration statement the following

documents by means of a statement to that effect in the prospectus listing all such documents:

1. The registrant’s latest annual report on Form 20-F, Form 40-F or Form 10-K filed under the Exchange Act.

2. Any report on Form 10-Q or Form 8-K filed since the date of filing of the annual report. The registrant may also

incorporate by reference any Form 6-K meetingthe requirements of this Form.

Note to Item 5(a). Attention is directed to Rule 439 (§230.439) regarding consent to use of material incorporated by reference.

(b)1. The registrant must state:

i. That it will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of

any or all of the reports or documents that have been incorporated by reference in the prospectus contained in the

registration statement but not delivered with the prospectus;

ii. That it will provide these reports or documents upon written or oral request;

iii. That it will provide these reports or documents at no cost to the requester;

iv. The name, address, telephone number, and e-mail address, if any, to which the request for these reports or

documents must be made; and

v. The registrant’s Web site address, including the uniform resource locator (URL) where the incorporated reports

and other documents may be accessed.

Note to Item 5.(b)1. If the registrant sends any of the information that is incorporated by reference in the prospectus contained in the

registration statement to security holders, it also must send any exhibits that are specifically incorporated by reference in that infor-

mation.

2. The registrant must:

i. Identify the reports and other information that it files with the SEC; and

ii. State that the public may read and copy any materials it files with the SEC at the SEC’s Public Reference Room

at 100 F Street, N.E., Washington, DC 20549. State that the public may obtain information on the operation of the Public Reference

Room by calling the SEC at 1-800-SEC-0330. If the registrant is an electronic filer, state that the SEC maintains an Internet site that

contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC and

state the address of that site (http://www.sec.gov).

Item 5. Disclosure of Commission Position on Indemnification for Securities Act Liabilities.

Furnish the information required by Item 510 of Regulation S-K.

PART II — INFORMATION NOT REQUIRED IN PROSPECTUS

Item 6. Indemnification of Directors and Officers.

Furnish the information required by Item 702 of Regulation S-K.

Item 7. Recent Sales of Unregistered Securities.

Furnish the information required by Item 701 of Regulation S-K.

Item 8. Exhibits and Financial Statement Schedules.

a. Subject to the rules regarding incorporation by reference, furnish the exhibits required by Item 601 of Regulation S-K.

b. Furnish financial statement schedules required by Regulation S-X and Item 4(b) of this Form. These schedules shall be lettered

or numbered in the manner described for exhibits in paragraph (a).

Item 9. Undertakings.

Furnish the undertakings required by Item 512 of Regulation S-K.

5

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form F-1 and has duly caused this registration statement to be signed on its behalf by the

undersigned, thereunto duly authorized, in the City of ______________________, State of ___________on _________, 20_____.

(Registrant)________________________________________________________________________________________________

By (Signature and Title) ____________________________________________________________________________________

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following per-

sons in the capacities and on the dates indicated.

(Signature_________________________________________________________________________________________________

(Title) ___________________________________________________________________________________________________

(Date) __________________________________________________________________________________

Instructions

1. The registration statement shall be signed by the registrant, its principal executive officer or officers, its principal fi nancial offi cer,

its controller or principal accounting officer, at least a majority of the board of directors or persons performing similar func-

tions, and its authorized representative in the United States. Where the registrant is a limited partnership, the registration statement

shall be signed by a majority of the board of directors of any corporate general partner signing the registration statement.

2. The name of each person who signs the registration statement shall be typed or printed beneath his signature. Any person who oc-

cupies more than one of the specified positions shall indicate each capacity in which he signs the registration statement. Attention is

directed to Rule 402 concerning manual signatures and Item 601 of Regulation S-K concerning signatures pursuant to powers of

attorney.

INSTRUCTIONS AS TO SUMMARY PROSPECTUSES

1. A summary prospectus used pursuant to Rule 431 (§230.431 of this chapter), shall at the time of its use contain such of the informa-

tion specified below as is then included in the registration statement. All other information and documents contained in the registration

statement may be omitted.

(a) As to Item 1, the aggregate offering price to the public, the aggregate underwriting discounts and commissions and the

offering price per unit to the public;

(b) As to Item 2, a statement concerning the enforceability of civil liabilities against foreign persons [Item 502(f) of Regula-

tion S-K (§229.502 of this chapter)];

(c) i. a brief statement of the principal purposes for which the proceeds are to be used;

ii. a statement as to the amount of the offering, if any, to be made for the account of security holders;

iii. the name of the managing underwriter or underwriters and a brief statement as to the nature of the underwriter’s obliga-

tion to take the securities; if any securities to be registered are to be offered otherwise than through underwriters, a brief statement as

to the manner of distribution; and, if securities are to be offered otherwise than for cash, a brief statement as to the general purposes of

the distribution, the basis upon which the securities are to be offered, the amount of compensation and other expenses of distribution,

and by whom they are to be borne;

iv. a brief statement as to dividend rights, voting rights, conversion rights, interest, maturity, exchange controls, tax treaties,

limitations on ownership or voting;

6

v. As to Item 4, a brief statement of the general character of the business done and intended to be done, the Selected Financial

Data (Item 3.A of Form 20-F ( 249.220f of this chapter) ) and a brief statement of the nature and present status of any material pending

legal proceedings; and

(d) A tabular presentation of notes payable, long term debt, deferred credits, minority interests, if material, and the equity section of

the latest balance sheet filed, as may be appropriate.

2. The summary prospectus shall not contain a summary or condensation of any other required financial information except as pro-

vided above.

3. Where securities being registered are to be offered in exchange for securities of any other issuer, the summary prospectus also

shall contain that information specified in paragraphs 1.(c)(iv) and 1.(c)(v) above which would be required if the securities of such

other issuer were registered on this Form or Form S-1 according to General Instruction III.

4. The Commission may, upon request of the registrant, and where consistent with the protection of investors, permit the omission

of any of the information herein required or the furnishing in substitution thereof of appropriate information of comparable character.

The Commission may also require the inclusion of other information in addition to, or in substitution for, the information

herein required in any case where such information is necessary or appropriate for the protection of investors.

7