Fillable Printable Form F-6

Fillable Printable Form F-6

Form F-6

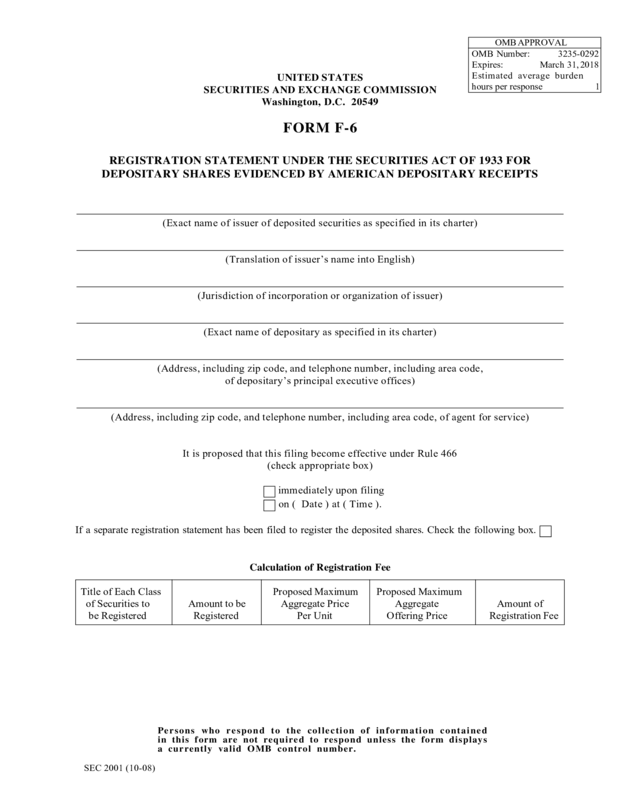

OMB APPROVAL

OMB Number: 3235-0292

Expires: March 31, 2018

Estimated average burden

hours per response 1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-6

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 FOR

DEPOSITARY SHARES EVIDENCED BY AMERICAN DEPOSITARY RECEIPTS

(Exact name of issuer of deposited securities as specified in its charter)

(Translation of issuer’s name into English)

(Jurisdiction of incorporation or organization of issuer)

(Exact name of depositary as specified in its charter)

(Address, including zip code, and telephone number, including area code,

of depositary’s principal executive offices)

(Address, including zip code, and telephone number, including area code, of agent for service)

It is proposed that this filing become effective under Rule 466

(check appropriate box)

immediately upon filing

on ( Date ) at ( Time ).

If a separate registration statement has been filed to register the deposited shares. Check the following box.

Calculation of Registration Fee

Title of Each Class

of Securities to

be Registered

Amount to be

Registered

Proposed Maximum

Aggregate Price

Per Unit

Proposed Maximum

Aggregate

Offering Price

Amount of

Registration Fee

Persons who respond to the collection of information contained

in this form are not required to respond unless the form displays

a currently valid OMB control number.

SEC 2001 (10-08)

GENERAL INSTRUCTIONS

I. Eligibility Requirements for Use of Form F-6.

A. General. Form F-6 may be used for the registration under the Securities Act of 1933 (the “Securities

Act”) of Depositary Shares evidenced by American Depositary Receipts (“ADRs”) issued by a

depositary against the deposit of the securities of a foreign issuer (regardless of the physical location

of the certificates) if the following conditions are met:

(1) The holder of the ADRs is entitled to withdraw the deposited securities at any time subject only

to (i) temporary delays caused by closing transfer books of the depositary or the issuer of the

deposited securities or the deposit of shares in connection with voting at a shareholders’ meeting,

or the payment of dividends, (ii) the payment of fees, taxes, and similar charges, and (iii)

compliance with any laws or governmental regulations relating to ADRs or to the withdrawal of

deposited securities;

(2) The deposited securities are offered or sold in transactions registered under the Securities Act or

in transactions that would be exempt therefrom if made in the United States; and

(3) As of the filing date of this registration statement, the issuer of the deposited securities is reporting

pursuant to the periodic reporting requirements of section 13(a) or 15(d) of the Securities

Exchange Act of 1934 or the deposited securities are exempt therefrom by Rule 12g3-2(b) (§240.

l2g3-2(b) of this chapter) unless the issuer of the deposited securities concurrently files a

registration statement on another form for the deposited securities.

B. Registration of Deposited Securities. Form F-6 is available for registration of the Depositary Shares

only. The registration of the deposited securities, if necessary, shall be on any other form the registrant

is eligible to use. Alternatively, Depositary Shares may also be registered on any form used to register

the deposited securities if such registration statement also conforms to the requirements of Parts I and

II of Form F-6 and either the depositary or the legal entity created by the agreement for the issuance of

ADRs signs the registration statement with respect to the disclosure and undertakings made in response

to such requirements. The amount of fees charged need not be disclosed in the prospectus if the

depositary makes and follows the undertakings in Item 4(c) and if the prospectus lists the various

services for which fees may be charged, states that such fees may differ from those other depositaries

charge, states that the fee schedule is available without charge from the depositary, and states that each

registered holder of an ADR will receive thirty days notice of a change in the fee schedule.

II. Amount of Securities; Filing Fee

An ADR evidences one or more Depositary Shares, as defined in Rule 405 (§230.405 of this chapter). The

registration statement relates to Depositary Shares, not the number of physical certificates issued. For example,

if an ADR is issued against a Depositary Share, which equals two common shares in a foreign issuer, the

registration of 100,000 Depositary Shares represents 200,000 common shares. If the depositary issues a certificate

for 10,000 Depositary Shares and another for 15,000 Depositary Shares, then 75,000 (100,000 minus 25,000)

Depositary Shares (not 99,998) remain available for distribution under the registration statement.

Rule 457(k) (§230.457(k) of this chapter) describes the method of computing the filing fee.

III. Application of General Rules and Regulations

A. Attention is directed to the General Rules and Regulations under the Securities Act, particularly

Regulation C (§230.400 et seq. of this chapter). That Regulation contains general requirements

regarding the preparation and filing of registration statements.

2

B. The prospectus may consist of the ADR certificate if it includes the information required in Part I of

this Form. Such prospectus need not conform to the requirements of Rule 420 (§240.420 of this chapter)

except that the type shall be roman type at least as large as 5½-point modern type.

C. You must file the Form F-6 registration statement in electronic format via the Commission’s Electronic

Data Gathering, Analysis, and Retrieval (EDGAR) system in accordance with the EDGAR rules set

forth in Regulation S-T (17 CFR Part 232). For assistance with technical questions about EDGAR or

to request an access code, call the EDGAR Filer Support Office at (202) 942-8900. For assistance with

the EDGAR rules, call the Office of EDGAR and Information Analysis at (202) 942-2940.

If filing the registration statement in paper under a hardship exemption in Rule 201 or 202 of Regulation

S-T (17 CFR 232.201 or 232.202), or as otherwise permitted, you must file the number of copies of the

registration statement and of each amendment required by Securities Act Rules 402 and 472 (17 CFR

230.402 and 230.472), except that you need only file three additional copies instead of the ten referred

to in Rule 402(b) (17 CFR 230.402(b)). You may also file only three additional copies instead of the

eight referred to in Securities Act Rule 472(a) (17 CFR 230.472(a)).

PART I — INFORMATION REQUIRED IN PROSPECTUS

Item 1. Description of Securities To Be Registered.

Furnish the information required by Item 12.E. of Form 20-F (§249.220f of this chapter).

Item 2. Available Information. Provide the information in either (a) or (b) below, whichever is applicable.

(a) State that the foreign issuer publishes information in English required to maintain the exemption from

registration under Rule 12g3-2(b) under the Securities Exchange of 1934 on its Internet Web site or

through an electronic information delivery system generally available to the public in its primary trading

market. Then disclose the address of the foreign issuer’s Internet Web site or the electronic information

delivery system in its primary trading market.

(b) State that the foreign issuer is subject to the periodic reporting requirements of the Securities Exchange

Act of 1934 and accordingly files reports with the Commission. Then disclose that these reports are

available for inspection and copying through the Commission’s EDGAR system or at public reference

facilities maintained by the Commission in Washington, D.C.

Note to Item 2: In the case of an unsponsored ADR facility, you may base your representation that the issuer

publishes information in English required to maintain the exemption from registration under Exchange Act Rule

12g3-2(b) upon your reasonable, good faith belief after exercising reasonable diligence.

PART II — INFORMATION NOT REQUIRED IN PROSPECTUS

Item 3. Exhibits.

Subject to the rules as to incorporation by reference, the exhibits specified below shall be filed as a part of

the registration statement. Exhibits shall be appropriately lettered or numbered for convenient reference. Exhibits

incorporated by reference may bear the designation given in the previous filing. Instruction l to Item 601 of

Regulation S-K applies to this paragraph.

(a) A copy of the Deposit Agreement or Deposit Agreements under which the securities registered

hereunder are issued. If the Deposit Agreement is amended during the offering of the Depositary Shares,

3

such amendments shall be filed as amendments to the registration statement.

(b) Any other agreement, to which the depositary is a party relating to the issuance of the Depositary Shares

registered hereby or the custody of the deposited securities represented thereby.

(c) Every material contract relating to the deposited securities between the depositary and the issuer of the

deposited securities in effect at any time within the last three years.

(d) An opinion of counsel as to the legality of the securities being registered, indicating whether they will

when sold be legally issued, and entitle the holders thereof to the rights specified therein.

(e) If the procedure in Rule 466 is being used, a certification in the following form:

Certification under Rule 466

The depositary, represents and certifies the following:

(1) That it previously had filed a registration statement on Form F-6 (Name and File No.), which the

Commission declared effective, with terms of deposit identical to the terms of deposit of this

registration statement except for the number of foreign securities a Depositary Share represents.

(2) That is ability to designate the date and time of effectiveness under Rule 466 has not been

suspended.

[Depositary]

By [Signature and Title]

Item 4. Undertakings.

Notwithstanding the provisions of Rule 4l5(a)(2) (§230.4l5(a)(2) of this chapter), the undertakings in Item

512(a) of Regulation S-K are not required. Furnish the following undertakings:

(a) The depositary hereby undertakes to make available at the principal office of the depositary in the

United States, for inspection by holders of the ADRs, any reports and communications received from

the issuer of the deposited securities which are both (1) received by the depositary as the holder of the

deposited securities; and (2) made generally available to the holders of the underlying securities by the

issuer.

(b) If the amounts of fees charged are not disclosed in the prospectus, the depositary undertakes to prepare

a separate document stating the amount of any fee charged and describing the service for which it is

4

charged and to deliver promptly a copy of such fee schedule without charge to anyone upon request.

The depositary undertakes to notify each registered holder of an ADR thirty days before any change in

the fee schedule.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable

grounds to believe that all the requirements for filing on Form F-6 are met and has duly caused this registration

statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of ____________ State

of ____________________________________, on __________________________, 20_____ .

[Legal entity created by the agreement

for the issuance of American Depositary Receipts

for shares of

By [Signature and Title]

[Registrant]

By [Signature and Title]

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the

following persons in the capacities and on the dates indicated.

[Signature]

[Title]

(Date]

Instructions.

1. The legal entity created by the agreement for the issuance of ADRs shall sign the registration statement as

registrant. The depositary may sign on behalf of such entity, but the depositary for the issuance of ADRs itself

shall not be deemed to be an issuer, a person signing the registration statement, or a person controlling such

issuer. If the issuer of the deposited securities sponsors the ADR arrangement, the registration statement shall

also be signed by the issuer and its principal executive officer or officers, its principal financial officer, its

controller or principal accounting officer, at least a majority of the board of directors or persons performing

similar functions, and its authorized representative in the United States.

2. The name of each person who signs the registration statement shall be typed or printed beneath his signature.

Any person who occupies more than one of the specified positions shall indicate each capacity in which he

signs the registration statement. Attention is directed to Rule 402 concerning manual signatures and Item 601

of Regulation S-K concerning signatures pursuant to powers of attorney.

5