Form I-864 07/02/15 N

Page 8 of 12

If an intending immigrant becomes a lawful permanent resident

in the United States based on a Form I-864 that you have

signed, then, until your obligations under Form I-864 terminate,

the U.S. Government may consider (deem) your income and

assets as available to that person, in determining whether he or

she is eligible for certain Federal means-tested public benefits

and also for state or local means-tested public benefits, if the

state or local government's rules provide for consideration

(deeming) of your income and assets as available to the person.

Notify U.S. Citizenship and Immigration Services

(USCIS) of any change in your address, within 30

days of the change, by filing Form I-865.

What Other Consequences Are There?

If you do not provide sufficient support to the person who

becomes a lawful permanent resident based on a Form I-864

that you signed, that person may sue you for this support.

What If I Do Not Fulfill My Obligations?

B.

If a Federal, state, local, or private agency provided any covered

means-tested public benefit to the person who becomes a lawful

permanent resident based on a Form I-864 that you signed, the

agency may ask you to reimburse them for the amount of the

benefits they provided. If you do not make the reimbursement,

the agency may sue you for the amount that the agency believes

you owe.

If you are sued, and the court enters a judgment against you, the

person or agency that sued you may use any legally permitted

procedures for enforcing or collecting the judgment. You may

also be required to pay the costs of collection, including

attorney fees.

If you do not file a properly completed Form I-865 within 30

days of any change of address, USCIS may impose a civil fine

for your failing to do so.

This provision does not apply to public benefits specified in

section 403(c) of the Welfare Reform Act such as emergency

Medicaid, short-term, non-cash emergency relief; services

provided under the National School Lunch and Child Nutrition

Acts; immunizations and testing and treatment for

communicable diseases; and means-tested programs under the

Elementary and Secondary Education Act.

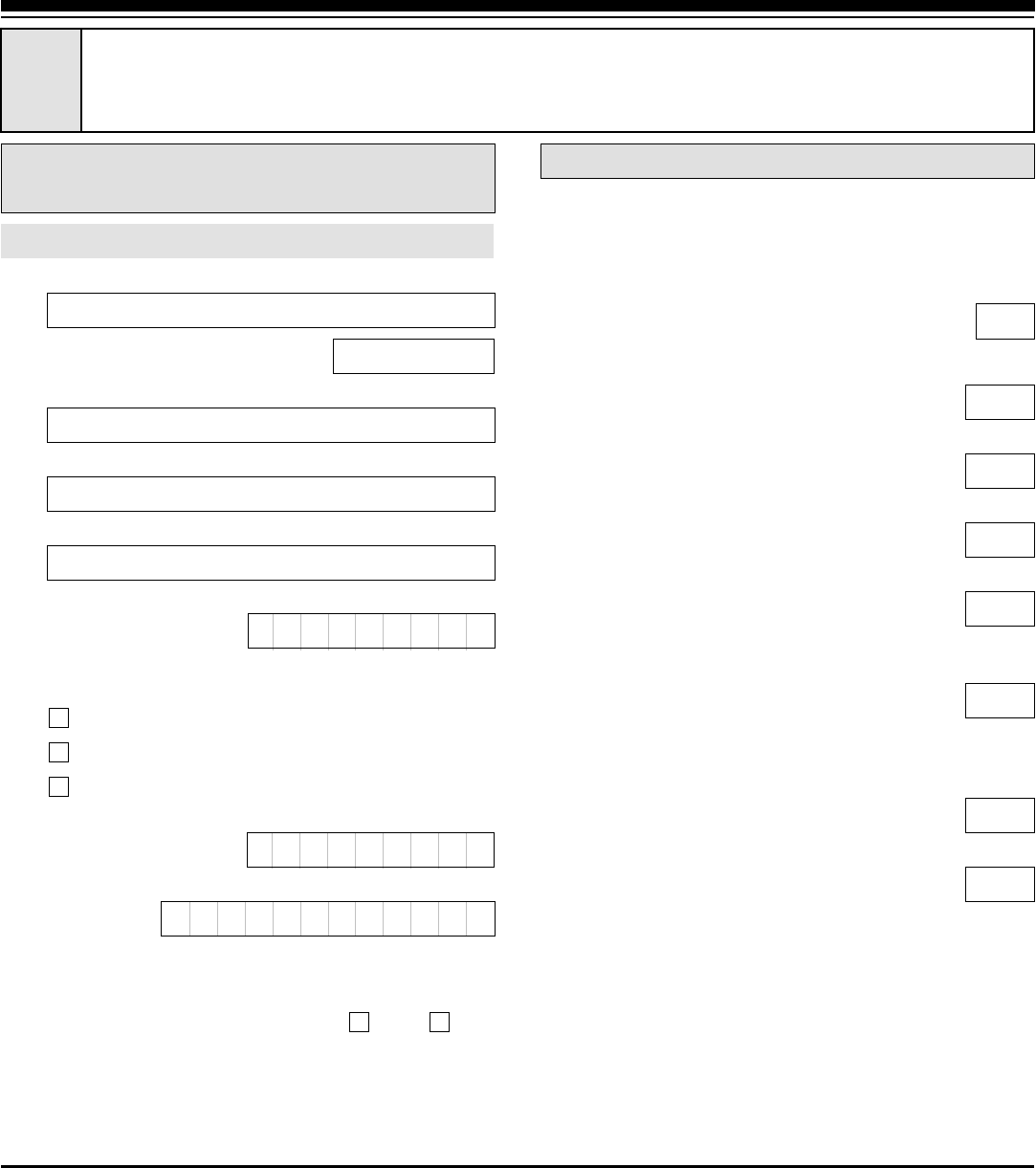

No longer has lawful permanent resident status and has

departed the United States;

Becomes a U.S. citizen;

When Will These Obligations End?

Has worked, or can receive credit for, 40 quarters of

coverage under the Social Security Act;

Your obligations under a Form I-864 that you signed will end if

the person who becomes a lawful permanent resident based on

that affidavit:

Is subject to removal, but applies for and obtains, in

removal proceedings, a new grant of adjustment of status,

based on a new affidavit of support, if one is required; or

A.

B.

C.

D.

Dies.

NOTE: Divorce does not terminate your obligations under

Form I-864.

E.

Your obligations under a Form I-864 that you signed also end if

you die. Therefore, if you die, your estate is not required to

take responsibility for the person's support after your death.

However, your estate may owe any support that you

accumulated before you died.

Sponsor's Statement

1.b. The interpreter named in Part 9. has also read to me

every question and instruction on this affidavit, as

well as my answer to every question, in

a language in which I am fluent. I understand every

question and instruction on this affidavit as translated

to me by my interpreter, and have provided complete,

true, and correct responses in the language indicated

above.

,

I can read and understand English, and have read and

understand every question and instruction on this

affidavit, as well as my answer to every question.

1.a.

NOTE: Select the box for either Item Number 1.a. or 1.b.

If applicable, select the box for Item Number 2.

Part 8. Sponsor's Contract, Statement, Contact

Information, Certification, and Signature

(continued)