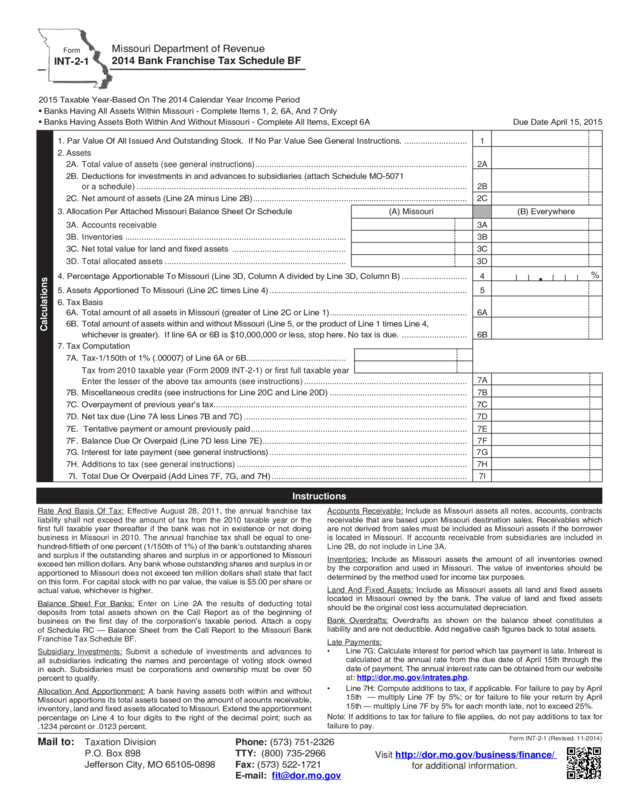

Fillable Printable Form Int-2-1 - 2014 Bank Franchise Tax Schedule Bf

Fillable Printable Form Int-2-1 - 2014 Bank Franchise Tax Schedule Bf

Form Int-2-1 - 2014 Bank Franchise Tax Schedule Bf

Form INT-2-1 (Revised. 11-2014)

Rate And Basis Of Tax: Effective August 28, 2011, the annual franchise tax

liability shall not exceed the amount of tax from the 2010 taxable year or the

rst full taxable year thereafter if the bank was not in existence or not doing

business in Missouri in 2010. The annual franchise tax shall be equal to one-

hundred-ftieth of one percent (1/150th of 1%) of the bank’s outstanding shares

and surplus if the outstanding shares and surplus in or apportioned to Missouri

exceed ten million dollars. Any bank whose outstanding shares and surplus in or

apportioned to Missouri does not exceed ten million dollars shall state that fact

on this form. For capital stock with no par value, the value is $5.00 per share or

actual value, whichever is higher.

Balance Sheet For Banks: Enter on Line 2A the results of deducting total

deposits from total assets shown on the Call Report as of the beginning of

business on the rst day of the corporation’s taxable period. Attach a copy

of Schedule RC — Balance Sheet from the Call Report to the Missouri Bank

Franchise Tax Schedule BF.

Subsidiary Investments: Submit a schedule of investments and advances to

all subsidiaries indicating the names and percentage of voting stock owned

in each. Subsidiaries must be corporations and ownership must be over 50

percent to qualify.

Allocation And Apportionment: A bank having assets both within and without

Missouri apportions its total assets based on the amount of acounts receivable,

inventory, land and xed assets allocated to Missouri. Extend the apportionment

percentage on Line 4 to four digits to the right of the decimal point; such as

.1234 percent or .0123 percent.

Accounts Receivable: Include as Missouri assets all notes, accounts, contracts

receivable that are based upon Missouri destination sales. Receivables which

are not derived from sales must be included as Missouri assets if the borrower

is located in Missouri. If accounts receivable from subsidiaries are included in

Line 2B, do not include in Line 3A.

Inventories: Include as Missouri assets the amount of all inventories owned

by the corporation and used in Missouri. The value of inventories should be

determined by the method used for income tax purposes.

Land And Fixed Assets: Include as Missouri assets all land and xed assets

located in Missouri owned by the bank. The value of land and xed assets

should be the original cost less accumulated depreciation.

Bank Overdrafts: Overdrafts as shown on the balance sheet constitutes a

liability and are not deductible. Add negative cash gures back to total assets.

Late Payments:

• Line 7G: Calculate interest for period which tax payment is late. Interest is

calculated at the annual rate from the due date of April 15th through the

date of payment. The annual interest rate can be obtained from our website

at: http://dor.mo.gov/intrates.php.

• Line 7H: Compute additions to tax, if applicable. For failure to pay by April

15th — multiply Line 7F by 5%; or for failure to le your return by April

15th — multiply Line 7F by 5% for each month late, not to exceed 25%.

Note: If additions to tax for failure to le applies, do not pay additions to tax for

failure to pay.

Form

INT-2-1

Missouri Department of Revenue

2014 Bank Franchise Tax Schedule BF

Mail to: Taxation Division Phone: (573) 751-2326

P.O. Box 898 TTY: (800) 735-2966

Jefferson City, MO 65105-0898 Fax: (573) 522-1721

E-mail: [email protected]

Visit http://dor.mo.gov/business/finance/

for additional information.

2015 Taxable Year-Based On The 2014 Calendar Year Income Period

• Banks Having All Assets Within Missouri - Complete Items 1, 2, 6A, And 7 Only

• Banks Having Assets Both Within And Without Missouri - Complete All Items, Except 6A Due Date April 15, 2015

1. Par Value Of All Issued And Outstanding Stock. If No Par Value See General Instructions. ........................... 1

2. Assets

2A. Total value of assets (see general instructions) ........................................................................................... 2A

2B. Deductions for investments in and advances to subsidiaries (attach Schedule MO-5071

or a schedule) .............................................................................................................................................. 2B

2C. Net amount of assets (Line 2A minus Line 2B) ............................................................................................ 2C

3. Allocation Per Attached Missouri Balance Sheet Or Schedule (A) Missouri (B) Everywhere

3A. Accounts receivable 3A

3B. Inventories ............................................................................................... 3B

3C. Net total value for land and fixed assets ................................................. 3C

3D. Total allocated assets .............................................................................. 3D

4. Percentage Apportionable To Missouri (Line 3D, Column A divided by Line 3D, Column B) ............................ 4

5. Assets Apportioned To Missouri (Line 2C times Line 4) ..................................................................................... 5

6. Tax Basis

6A. Total amount of all assets in Missouri (greater of Line 2C or Line 1) ........................................................... 6A

6B. Total amount of assets within and without Missouri (Line 5, or the product of Line 1 times Line 4,

whichever is greater). If line 6A or 6B is $10,000,000 or less, stop here. No tax is due. ............................ 6B

7. Tax Computation

7A. Tax-1/150th of 1% (.00007) of Line 6A or 6B ...........................................

Tax from 2010 taxable year (Form 2009 INT-2-1) or first full taxable year

Enter the lesser of the above tax amounts (see instructions) ......................................................................

7A

7B. Miscellaneous credits (see instructions for Line 20C and Line 20D) ........................................................... 7B

7C. Overpayment of previous year’s tax ............................................................................................................. 7C

7D. Net tax due (Line 7A less Lines 7B and 7C) ................................................................................................ 7D

7E. Tentative payment or amount previously paid ............................................................................................. 7E

7F. Balance Due Or Overpaid (Line 7D less Line 7E) ........................................................................................ 7F

7G. Interest for late payment (see general instructions) ..................................................................................... 7G

7H. Additions to tax (see general instructions) ................................................................................................... 7H

7I. Total Due Or Overpaid (Add Lines 7F, 7G, and 7H) .................................................................................... 7I

%

.

Calculations

Instructions

Reset Form

Print Form