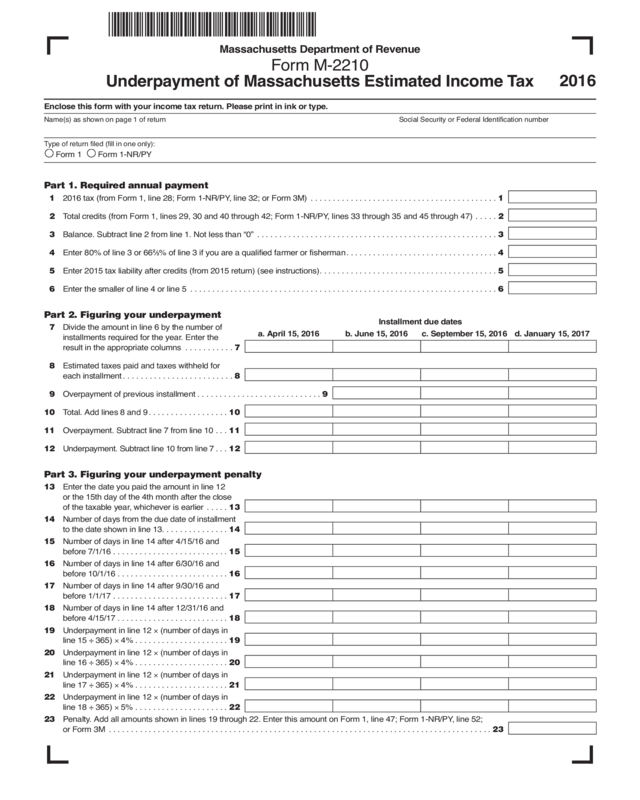

Fillable Printable Form M-2210

Fillable Printable Form M-2210

Form M-2210

Enclose this form with your income tax return. Please print in ink or type.

Name(s) as shown on page 1 of return Social Security or Federal Identification number

Type of return filed (fill in one only):

Form 1 Form 1-NR/PY

Part 1. Required annual payment

11 2016 tax (from Form 1, line 28; Form 1-NR/PY, line 32; or Form 3M) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Total credits (from Form 1, lines 29, 30 and 40 through 42; Form 1-NR/PY, lines 33 through 35 and 45 through 47) . . . . . 2

13 Balance. Subtract line 2 from line 1. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Enter 80% of line 3 or 66

2

⁄3% of line 3 if you are a qualified farmer or fisherman. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Enter 2015 tax liability after credits (from 2015 return) (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Enter the smaller of line 4 or line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Part 2. Figuring your underpayment

Installment due dates

17 Divide the amount in line 6 by the number of

a. April 15, 2016 b. June 15, 2016 c. September 15, 2016 d. January 15, 2017

installments required for the year. Enter the

result in the appropriate columns . . . . . . . . . . . 7

18 Estimated taxes paid and taxes withheld for

each installment . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Overpayment of previous installment . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total. Add lines 8 and 9. . . . . . . . . . . . . . . . . . 10

11 Overpayment. Subtract line 7 from line 10 . . . 11

12 Underpayment. Subtract line 10 from line 7 . . . 12

Part 3. Figuring your underpayment penalty

13 Enter the date you paid the amount in line 12

or the 15th day of the 4th month after the close

of the taxable year, whichever is earlier . . . . . 13

14 Number of days from the due date of installment

to the date shown in line 13. . . . . . . . . . . . . . . 14

15 Number of days in line 14 after 4/15/16 and

before 7/1/16 . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Number of days in line 14 after 6/30/16 and

before 10/1/16 . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Number of days in line 14 after 9/30/16 and

before 1/1/17 . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Number of days in line 14 after 12/31/16 and

before 4/15/17 . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Underpayment in line 12 × (number of days in

line 15 ÷ 365) × 4% . . . . . . . . . . . . . . . . . . . . . 19

20 Underpayment in line 12 × (number of days in

line 16 ÷ 365) × 4% . . . . . . . . . . . . . . . . . . . . . 20

21 Underpayment in line 12 × (number of days in

line 17 ÷ 365) × 4% . . . . . . . . . . . . . . . . . . . . . 21

22 Underpayment in line 12 × (number of days in

line 18 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . . 22

23 Penalty. Add all amounts shown in lines 19 through 22. Enter this amount on Form 1, line 47; Form 1-NR/PY, line 52;

or Form 3M . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Massachusetts Department of Revenue

Form M-2210

Underpayment of Massachusetts Estimated Income Tax

2016

Name(s) as shown on page 1 of return Social Security or Federal Identification number

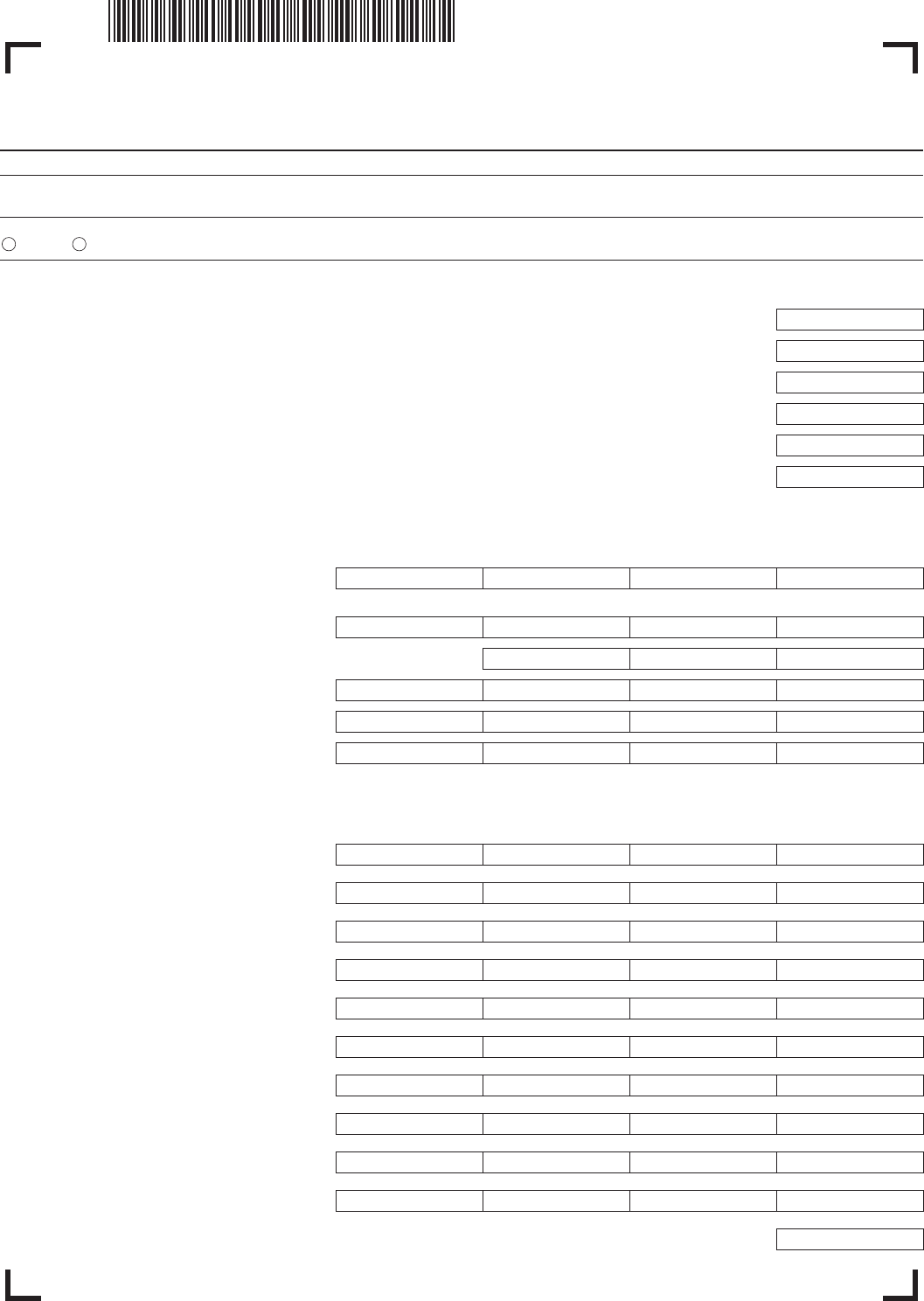

Part 4. Annualized income installment method

11 Taxable 5.1% income each period (including

long-term capital gain income taxed at 5.1%). . . 1

12 Annualization amount . . . . . . . . . . . . . . . . . . . . 2 42.41.51

13 Multiply line 1 by line 2. . . . . . . . . . . . . . . . . . . . 3

14 Tax on amount in line 3. Multiply line 3 by .051 4

15 Taxable 12% income each period . . . . . . . . . . . 5

16 Annualization amount . . . . . . . . . . . . . . . . . . . . 6

42.41.51

17 Multiply line 5 by line 6. . . . . . . . . . . . . . . . . . . . 7

18 Tax on amount in line 7. Multiply line 7 by .12 . . 8

09 Total tax. Add lines 4 and 8 . . . . . . . . . . . . . . . . 9

10 Total credits . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total tax after credits. Subtract line 10 from

line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Applicable percentage. . . . . . . . . . . . . . . . . . . 12

20% 40% 60% 80%

13 Multiply line 11 by line 12. . . . . . . . . . . . . . . . . 13

14 Enter the combined amounts of line 20 from

all preceding periods. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Subtract line 14 from line 13. If less than “0”

enter “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Divide line 6 of Form M-2210 by 4 and enter

result in each column . . . . . . . . . . . . . . . . . . . 16

17 Enter the amount from line 19 of this worksheet for the preceding

column. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Add lines 16 and 17. . . . . . . . . . . . . . . . . . . . . 18

19 If line 18 is more than line 15, subtract line 15

from line 18. Otherwise enter “0”. . . . . . . . . . . 19

20 Enter the smaller of line 15 or line 18 here

and on Form M-2210, line 7 . . . . . . . . . . . . . . 20

FORM M-2210, PAGE 2

3 Jan. 1 –March 31 Jan. 1– May 31 Jan. 1– August 31 Jan. 1– December 31

Form M-2210 Instructions

General Information

Who should use this form. If you are an individual, or a taxpayer

taxed as an individual, you should use Form M-2210 to determine if

your estimated and/or withholding tax payments were sufficient. If they

were not, an underpayment penalty will be imposed, unless you qualify

for one of the exceptions or waivers explained below.

Filing estimated tax vouchers. You are required to file estimated tax

vouchers if you reasonably expect to pay more than $400 in Mass-

achusetts income tax on income which is not covered by withholding.

For further information regarding estimated taxes, see the instructions

for Form 1-ES Payment Vouchers or the publication Should You Be

Paying Estimated Taxes?

Exceptions which avoid the penalty. No underpayment pen alty will

be imposed if:

1. Your 2016 tax due after credits and withholding is $400 or less.

2. You were a qualified farmer or fisherman who filed and paid in full

with your return by March 1, 2017. To qualify, your gross in come from

farming or fishing must be at least two-thirds of the an nual gross in-

come shown on your 2015 or 2016 return.

3. You were a resident of Massachusetts for the full 12 months of the

previous taxable year and were not liable for taxes.

4. Your 2016 estimated payments and withholding (line 8) made on or

before each installment due date in the taxable year equal or exceed

the tax shown on your 2015 return divided among the four installment

due dates provided that such return was for a full 12-month period.

If you qualify for an exception, do not complete lines 13 through 23. In-

stead, check the appropriate box on the front of this form and fill in the

“EX” oval on the back of Form 1 or Form 1-NR/PY. Enclose this form

with your return. If you qualify for the first ex cep tion (your 2015 tax due

after credits and withholding is $400 or less) you do not need to com-

plete this form.

Waiver of underpayment penalty. A waiver of underpayment penalty

for one or more installments may be granted if:

1. Your underpayment was by reason of casualty, disaster or un usual

circumstance; or

2. You retired in 2015 or 2016 after reaching age 62, or you be came

disabled and your underpayment was due to reasonable cause and

not willful neglect.

If you qualify for the waiver, complete lines 7 through 12 for the install-

ment(s) for which you are claiming a waiver, and write “WAIVER” in the

appropriate box(es) in line 13. Fill in the “EX” oval on the back of Form 1

or Form 1-NR/PY. Enclose this form and an explanation of your reasons

for claiming the waiver with your return.

Line-by-Line Instructions

Figuring your underpayment & penalty. To determine the underpay-

ment amount, complete lines 1 through 12, in order of installment due

dates, taking care to complete all four columns for lines 7 through 12.

Line 5

• If you filed a return for 2015 and it was for a full 12 months, enter your

2015 tax liability after credits.

• If you were a resident of Massachusetts for 12 months in 2015 and

you were not liable for taxes, enter “0.”

• If you did not file a return for 2015, or if your 2015 tax year was less

than 12 months, do not complete line 5. Instead, enter the amount

from line 4 in line 6.

Line 8

If more than one payment is made for a given installment, attach a sep-

arate penalty computation for each payment.

If you had any taxes withheld during the year, you may apply an equal

part of those taxes as payment on each required installment(s). If you

can establish the actual dates and amounts of your withholding, you

may consider those amounts as payments on the dates they were ac-

tually withheld.

Line 11

If line 11 shows an overpayment, that overpayment may be used as

payment of any existing underpayment amount. Overpayments used

as payments of prior underpayment amounts do not de crease the ac-

tual underpayment amount but serve to reduce in stead the period of

underpayment subject to penalty. If there are no existing underpay-

ment amounts, the overpayment is applied as a credit against the next

installment.

Line 12

If line 12 shows an underpayment, see the General Information sec-

tion to determine whether you qualify for an exception to, or waiver of,

the underpayment penalty. If you do not qualify, continue on through

line 23 to determine your underpayment penalty.

Part 4. Annualized income installment method. If you do not re ceive

taxable income evenly throughout the year, you may wish to annualize

your income to adjust your required installment amount(s). Enter any

adjusted installment amount in the appropriate column in line 7 and

calculate any underpayment penalty from those figures. Write “ANNU-

ALIZED” under the column in line 23.

Fiscal year taxpayers. If you file on a fiscal year basis and are subject

to an underpayment penalty, attach a separate statement to calculate

the penalty due based on the interest rate(s) in effect for the period(s)

of the underpayment(s).