Fillable Printable Form M-2220

Fillable Printable Form M-2220

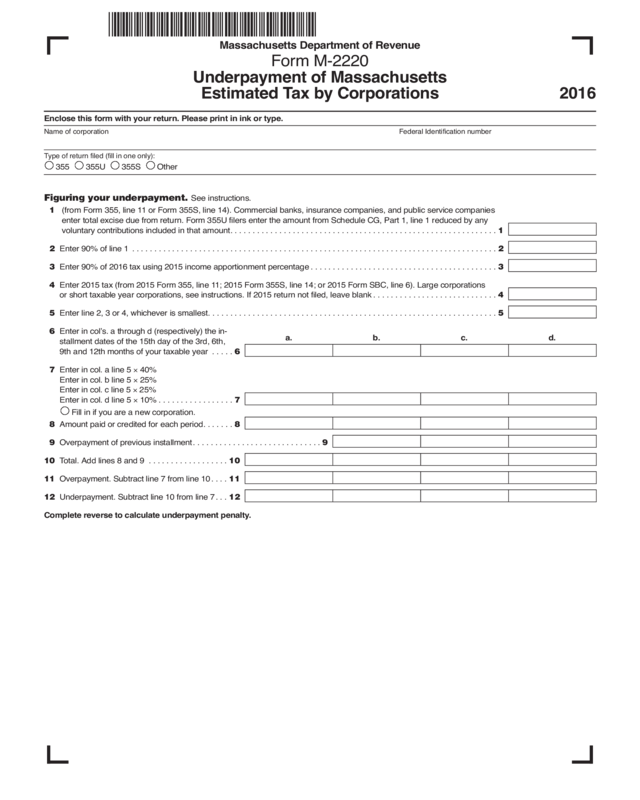

Form M-2220

Enclose this form with your return. Please print in ink or type.

Name of corporation Federal Identification number

Type of return filed (fill in one only):

355 355U 355S Other

Figuring your underpayment. See instructions.

11 (from Form 355, line 11 or Form 355S, line 14). Commercial banks, insurance companies, and public service companies

enter total excise due from return. Form 355U filers enter the amount from Schedule CG, Part 1, line 1 reduced by any

voluntary contributions included in that amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Enter 90% of line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

13 Enter 90% of 2016 tax using 2015 income apportionment percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Enter 2015 tax (from 2015 Form 355, line 11; 2015 Form 355S, line 14; or 2015 Form SBC, line 6). Large corporations

or short taxable year corporations, see instructions. If 2015 return not filed, leave blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Enter line 2, 3 or 4, whichever is smallest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Enter in col’s. a through d (respectively) the in-

a. b. c. d.

stallment dates of the 15th day of the 3rd, 6th,

9th and 12th months of your taxable year . . . . . 6

17 Enter in col. a line 5 × 40%

Enter in col. b line 5 × 25%

Enter in col. c line 5 × 25%

Enter in col. d line 5 × 10% . . . . . . . . . . . . . . . . . 7

Fill in if you are a new corporation.

18 Amount paid or credited for each period. . . . . . . 8

19 Overpayment of previous installment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total. Add lines 8 and 9 . . . . . . . . . . . . . . . . . . 10

11 Overpayment. Subtract line 7 from line 10 . . . . 11

12 Underpayment. Subtract line 10 from line 7 . . . 12

Complete reverse to calculate underpayment penalty.

Massachusetts Department of Revenue

Form M-2220

Underpayment of Massachusetts

Estimated Tax by Corporations

2016

Name of corporation Federal Identification number

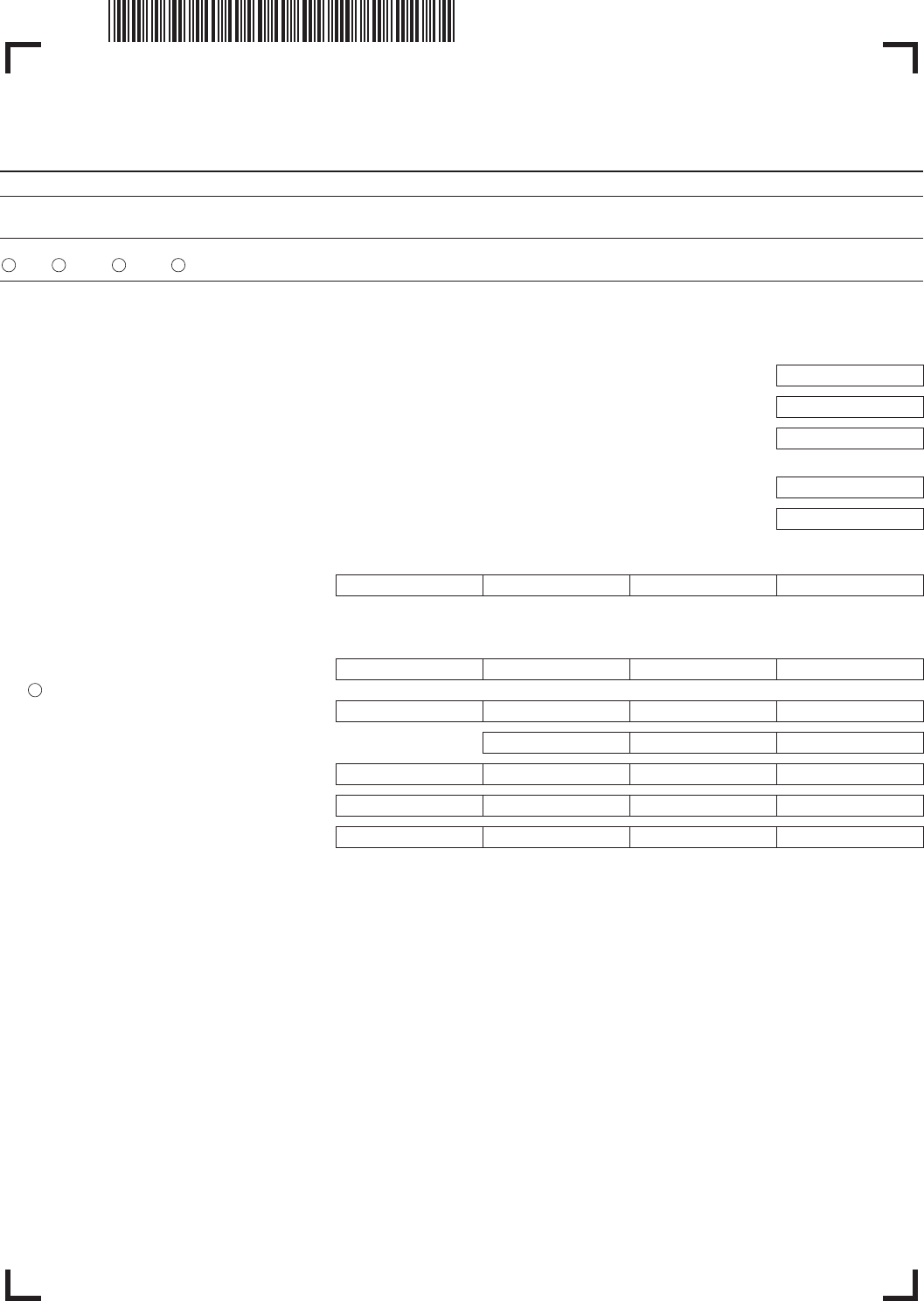

Figuring your underpayment penalty a. b. c. d.

Enter same installment dates used in line 6 . . . . . . . 3

13 Amount of underpayment from line 12 . . . . . . . 13

14 Enter the date of payment or the 15th day of

the 3rd month after the close of the taxable

year, whichever is earlier . . . . . . . . . . . . . . . . . 14

15 Number of days from due date of installment

to the date shown in line 14 . . . . . . . . . . . . . . . 15

16 Number of days in line 15 after 3/15/16 and

before 4/1/16. . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Number of days in line 15 after 3/31/16 and

before 7/1/16. . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Number of days in line 15 after 6/30/16 and

before 10/1/16. . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Number of days in line 15 after 9/30/16 and

before 1/1/17. . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Number of days in line 15 after 12/31/16 and

before 4/1/17. . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Number of days in line 15 after 3/31/17 and

before 7/1/17. . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Number of days in line 15 after 6/30/17 and

before 10/1/17. . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Number of days in line 15 after 9/30/17 and

before 1/1/18. . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Number of days in line 15 after 12/31/17 and

before 2/16/18. . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Underpayment in line 13 × (number of days

in line 16 ÷ 365) × 4% . . . . . . . . . . . . . . . . . . . . 25

26 Underpayment in line 13 × (number of days

in line 17 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . 26

27 Underpayment in line 13 × (number of days

in line 18 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . 27

28 Underpayment in line 13 × (number of days

in line 19 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . 28

29 Underpayment in line 13 × (number of days

in line 20 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . 29

30 Underpayment in line 13 × (number of days

in line 21 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . 30

31 Underpayment in line 13 × (number of days

in line 22 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . 31

32 Underpayment in line 13 × (number of days

in line 23 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . 32

33 Underpayment in line 13 × (number of days

in line 24 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . 33

34 Add lines 25 through 33 . . . . . . . . . . . . . . . . . . 34

35 Total of amounts in line 34. Enter on Form 355, line 24; Form 355U, line 41; Form 355S, line 27; or Form 355 SC, line 29 35

FORM M-2220, PAGE 2

Form M-2220 Instructions

General Information

Who should use this form. Corporations taxed under Ch. 63 of the

Massachusetts General Laws should use Form M-2220 to determine

whether they paid the correct amount of estimated tax by the proper due

date. If not, a penalty may be imposed on the underpayment amount.

Note: If you are claiming a refundable film credit on your return, you are

not subject to the underpayment penalty. Do not file this form.

Short year. Corporations are liable for estimated payments even if

there was no return filed for 2015 or if a return filed for 2015 was for

less than 12 months. Corporations meeting either of these conditions

should enter the smaller of lines 2 or 3 in line 5. See Massachusetts

Regulation 830 CMR 63B.2.2 for additional information.

Large corporation. Any corporation having $1 million or more of fed-

eral taxable income in any of its three preceding taxable years (IRC

Sec. 6655(g)) may only use its prior year tax liability to calculate its first

quarterly estimated payment. Any reduction in the first installment pay-

ment must be added to the second installment payment.

Note: New corporations in their first full taxable year with less than 10

em ployees have lower payment percentages — 30-25-25-20%; 55-

25-20%; and 80-20%. New corporations should check the box in line

7 and use these percentage amounts to complete line 7.

Commercial banks, insurance companies and public service com -

panies. Enter in line 1 the Total Excise Due amount from the re turn

being filed. Also, if an underpayment penalty is due, show this amount

in the bottom margin of page 1 of your respective return as “underpay-

ment pen alty” and increase your total payment due or de crease excess

payment to be refunded.

Line Instructions

Line 3. Multiply 2016 income measure of excise and non-income mea-

sure of excise (tangible property or taxable net worth) by 2015 appor-

tionment factor. Then multiply the result by 2015 tax rate. Multiply that

result by .90 (90%) and enter the result on line 3.

Lines 7 through 12. To determine the underpayment amount, com-

plete lines 7 through 12 for each appropriate column. If line 11 shows

an overpayment, that overpayment may first be used as a payment of

any existing underpayment amount. Overpayments used as payments

of prior underpayment amounts do not decrease the actual underpay-

ment amount but serve to reduce instead the period of underpayment

subject to penalty. If there are no existing underpayment amounts, the

overpayment is applied as a credit against the next installment. If more

than one payment is made for a given installment, attach separate com-

putations for each payment.