Fillable Printable Form M-8379

Fillable Printable Form M-8379

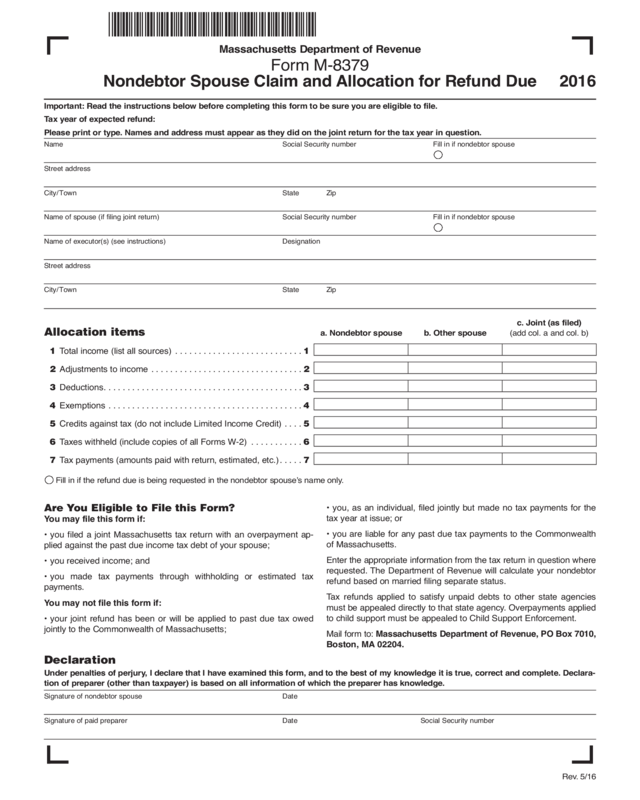

Form M-8379

Massachusetts Department of Revenue

Form M-8379

Nondebtor Spouse Claim and Allocation for Refund Due

Rev. 5/16

Important: Read the instructions below before completing this form to be sure you are eligible to file.

Tax year of expected refund:

Please print or type. Names and address must appear as they did on the joint return for the tax year in question.

Name Social Security number Fill in if nondebtor spouse

Street address

City/Town State Zip

Name of spouse (if filing joint return) Social Security number Fill in if nondebtor spouse

Name of executor(s) (see instructions) Designation

Street address

City/Town State Zip

c. Joint (as filed)

Allocation items a. Nondebtor spouse b. Other spouse (add col. a and col. b)

11 Total income (list all sources) . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Adjustments to income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

13 Deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Credits against tax (do not include Limited Income Credit) . . . . 5

16 Taxes withheld (include copies of all Forms W-2) . . . . . . . . . . . 6

17 Tax payments (amounts paid with return, estimated, etc.) . . . . . 7

Fill in if the refund due is being requested in the nondebtor spouse’s name only.

2016

Declaration

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge it is true, correct and complete. Dec lar a -

tion of preparer (other than taxpayer) is based on all information of which the preparer has knowledge.

Signature of nondebtor spouse Date

Signature of paid preparer Date Social Security number

Are You Eligible to File this Form?

You may file this form if:

• you filed a joint Massachusetts tax return with an overpayment ap-

plied against the past due income tax debt of your spouse;

• you received income; and

• you made tax payments through withholding or estimated tax

payments.

You may not file this form if:

• your joint refund has been or will be applied to past due tax owed

jointly to the Commonwealth of Massachusetts;

• you, as an individual, filed jointly but made no tax payments for the

tax year at issue; or

• you are liable for any past due tax payments to the Common wealth

of Massachusetts.

Enter the appropriate information from the tax return in question where

requested. The Department of Revenue will calculate your nondebtor

refund based on married filing separate status.

Tax refunds applied to satisfy unpaid debts to other state agencies

must be appealed directly to that state agency. Over pay ments applied

to child support must be appealed to Child Support Enforcement.

Mail form to: Massachusetts Department of Revenue, PO Box 7010,

Boston, MA 02204.