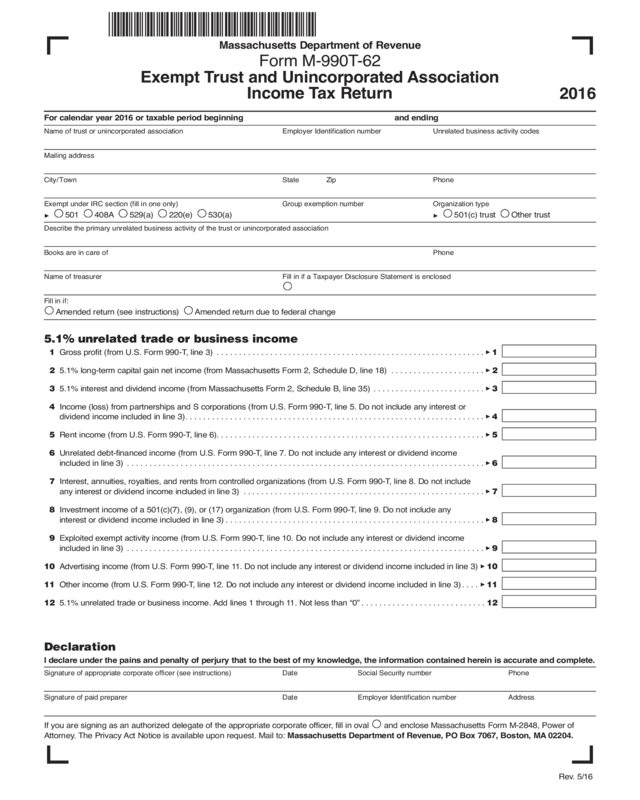

Fillable Printable Form M-990T-62

Fillable Printable Form M-990T-62

Form M-990T-62

Massachusetts Department of Revenue

Form M-990T-62

Exempt Trust and Unincorporated Association

Income Tax Return

Rev. 5/16

For calendar year 2016 or taxable period beginning and ending

Name of trust or unincorporated association Employer Identification number Unrelated business activity codes

Mailing address

City/Town State Zip Phone

Exempt under IRC section (fill in one only) Group exemption number Organization type

3

501 408A 529(a) 220(e) 530(a)

3

501(c) trust Other trust

Describe the primary unrelated business activity of the trust or unincorporated association

Books are in care of Phone

Name of treasurer Fill in if a Taxpayer Disclosure Statement is enclosed

Fill in if:

Amended return (see instructions) Amended return due to federal change

5.1% unrelated trade or business income

11 Gross profit (from U.S. Form 990-T, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

12 5.1% long-term capital gain net income (from Massachusetts Form 2, Schedule D, line 18) . . . . . . . . . . . . . . . . . . . . . 3 2

13 5.1% interest and dividend income (from Massachusetts Form 2, Schedule B, line 35) . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

14 Income (loss) from partnerships and S corporations (from U.S. Form 990-T, line 5. Do not include any interest or

dividend income included in line 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

15 Rent income (from U.S. Form 990-T, line 6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

16 Unrelated debt-financed income (from U.S. Form 990-T, line 7. Do not include any interest or dividend income

included in line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

17 Interest, annuities, royalties, and rents from controlled organizations (from U.S. Form 990-T, line 8. Do not include

any interest or dividend income included in line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

18 Investment income of a 501(c)(7), (9), or (17) organization (from U.S. Form 990-T, line 9. Do not include any

interest or dividend income included in line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

19 Exploited exempt activity income (from U.S. Form 990-T, line 10. Do not include any interest or dividend income

included in line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

10 Advertising income (from U.S. Form 990-T, line 11. Do not include any interest or dividend income included in line 3) 3 10

11 Other income (from U.S. Form 990-T, line 12. Do not include any interest or dividend income included in line 3) . . . . 3 11

12 5.1% unrelated trade or business income. Add lines 1 through 11. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

2016

Declaration

I declare under the pains and penalty of perjury that to the best of my knowledge, the information contained herein is accurate and complete.

Signature of appropriate corporate officer (see instructions) Date Social Security number Phone

Signature of paid preparer Date Employer Identification number Address

If you are signing as an authorized delegate of the appropriate corporate officer, fill in oval and enclose Massachusetts Form M-2848, Power of

Attorney. The Privacy Act Notice is available upon request. Mail to: Massachusetts Department of Revenue, PO Box 7067, Boston, MA 02204.

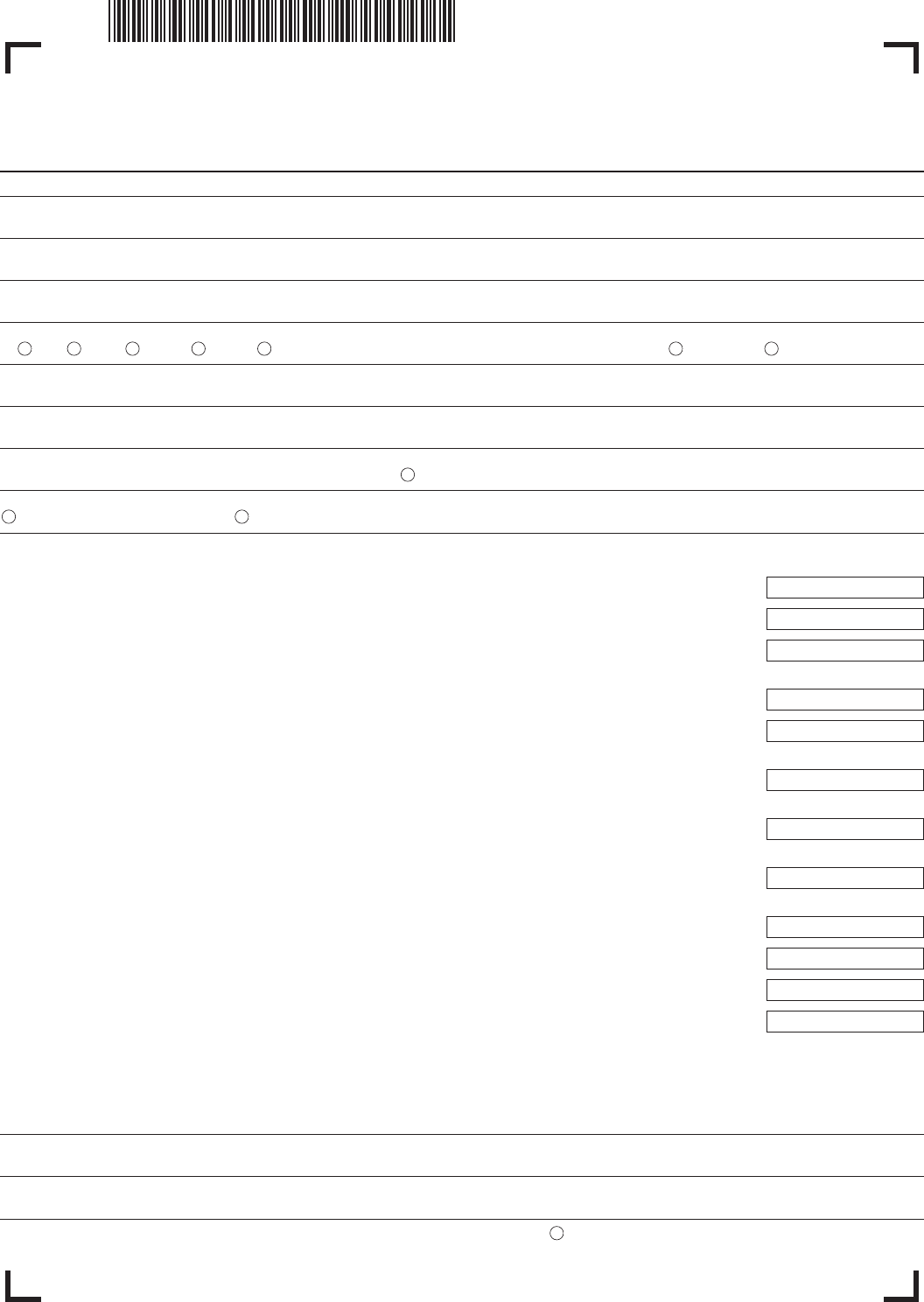

Name of trust or unincorporated association Employer Identification number Unrelated business activity codes`

Deductions not taken elsewhere and Massachusetts adjustments

13 Total deductions (from U.S. Form 990-T, line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 13

14 Charitable contributions (from U.S. Form 990-T, line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 168(k) bonus depreciation (included on U.S. Form 990-T, line 21). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Production activity deduction (included on U.S. Form 990-T, lines 13 and 28). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Add lines 14 through 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Subtract line 17 from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Massachusetts deduction for amounts payable to or permanently set aside for charitable purposes . . . . . . . . . . . . . . 3 19

20 Total deductions after Massachusetts adjustments. Add lines 18 and 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

5.1% tax

21 5.1% unrelated trade or business taxable income. Subtract line 20 from line 12. Not less than “0” . . . . . . . . . . . . . . . 3 21

22 5.1% tax. Multiply line 21 by .051 (5.1%). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

12% unrelated trade or business capital gains

23 Total 12% capital gain net income (from Massachusetts Form 2, Schedule B, line 30) . . . . . . . . . . . . . . . . . . . . . . . . . 3 23

Excess deductions

24 Excess deductions allowed against 12% unrelated trade or business capital gains. If line 20 is greater than 12,

subtract line 12 from line 20 and enter the result here. Otherwise, enter “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 24

12% tax

25 12% unrelated trade or business taxable capital gains. Subtract line 24 from line 23. Not less than “0” . . . . . . . . . . . . . 25

26 12% tax. Multiply line 25 by 12% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 26

Tax before credits

27 Credit recapture (from Credit Recapture Schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 27

28 Additional tax on installment sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 28

29 Total tax. Add lines 22 and 26 through 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 29

Credits

30 Credit for income taxes paid to other jurisdictions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 30

31 Other credits (from Credit Manager Schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 31

32 Total credits. Add lines 30 and 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

33 Tax after credits. Subtract line 32 from line 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

2016 FORM M-990T-62, PAGE 2

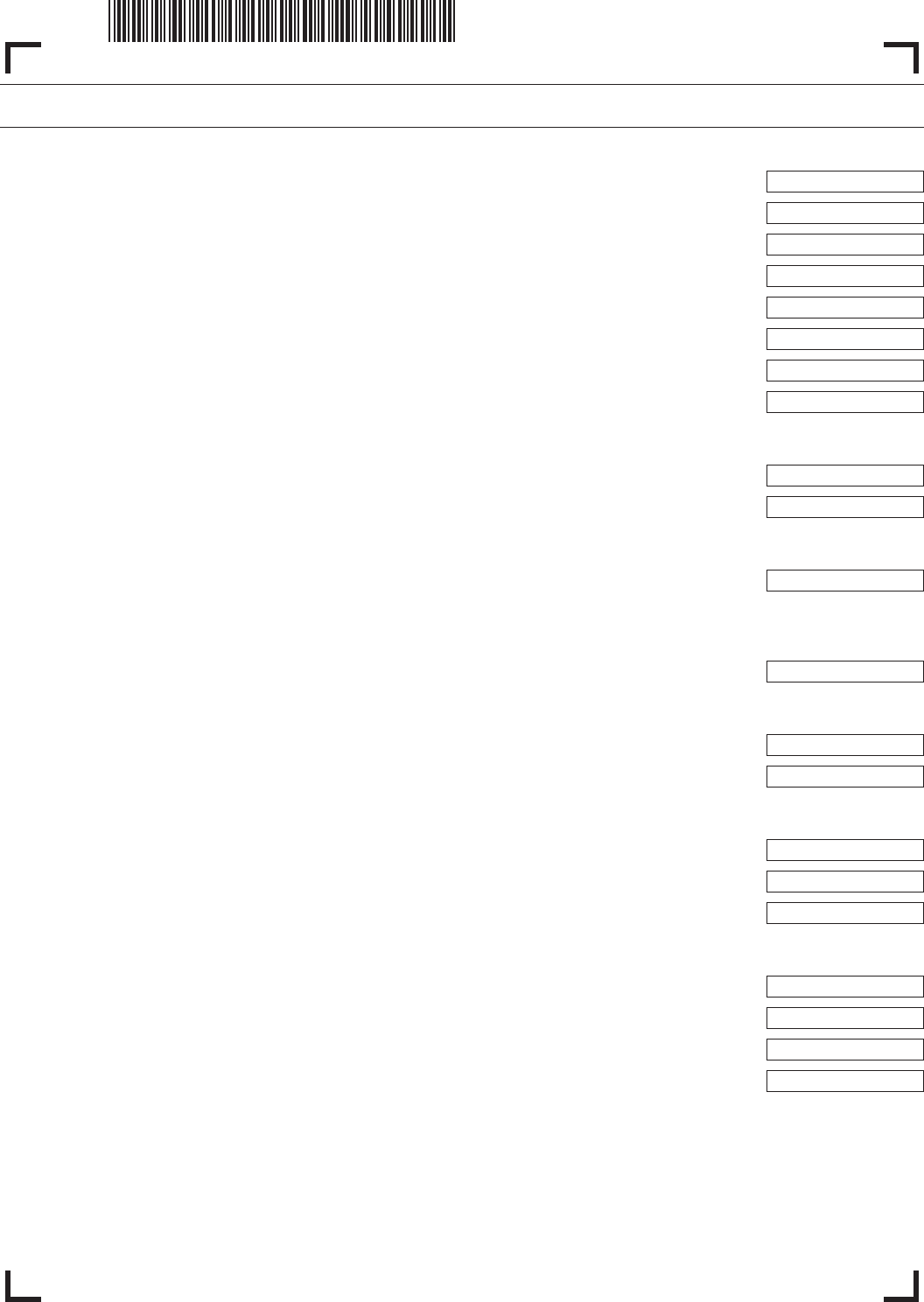

Name of trust or unincorporated association Employer Identification number Unrelated business activity codes

Payments

34 Massachusetts income tax withheld (enclose all Massachusetts Forms W-2, W-2G, 1099-G and 1099-R) . . . . . . . . . 3 34

35 2015 overpayment applied to your 2016 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 35

36 2016 Massachusetts estimated tax payments (do not include the amount in line 35) . . . . . . . . . . . . . . . . . . . . . . . . . . 3 36

37 Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 37

38 Refundable credits (from Credit Manager Schedule, Part 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 38

39 Payment with original return (use only if amending a return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 39

40 Total tax payments. Add lines 34 through 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Refund or balance due

41 Overpayment. If line 33 is smaller than line 40, subtract line 33 from line 40 and enter the result in line 42. If line 33

is larger than line 40, go to line 44 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

42 Amount of overpayment you want applied to your 2017 estimated taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 42

43 Amount of your refund. Subtract line 42 from line 41 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 43

44 Tax due. If line 33 is larger than line 40, subtract line 40 from line 33 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 44

45 M-2210F penalty; Other penalties Total penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

46 Total payment due at time of filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 46

47 Interest on unpaid balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 47

2016 FORM M-990T-62, PAGE 3