Fillable Printable Form Member Information

Fillable Printable Form Member Information

Form Member Information

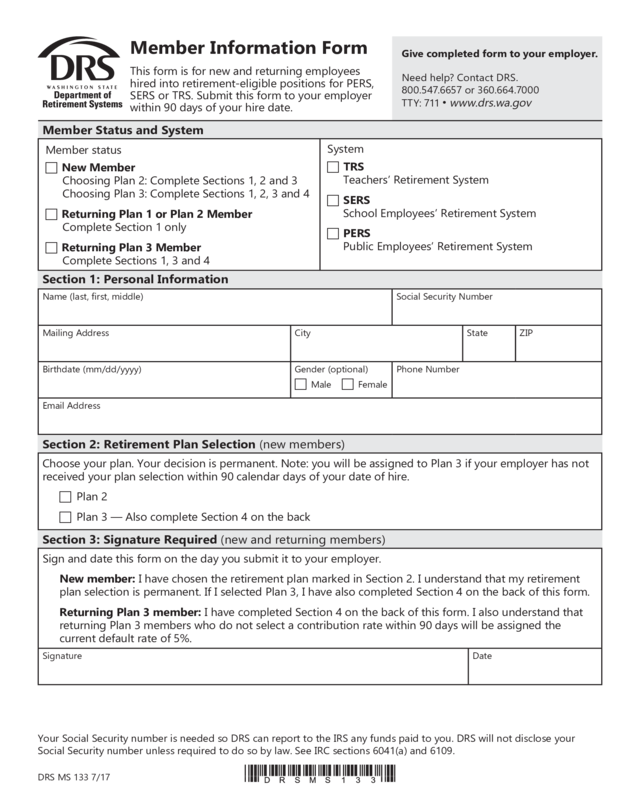

Member Information Form

This form is for new and returning employees

hired into retirement-eligible positions for PERS,

SERS or TRS. Submit this form to your employer

within 90 days of your hire date.

Give completed form to your employer.

Need help? Contact DRS.

800.547.6657 or 360.664.7000

TTY: 711 ꔷ

www.drs.wa.gov

Member Status and System

Member status

c New Member

Choosing Plan 2: Complete Sections 1, 2 and 3

Choosing Plan 3: Complete Sections 1, 2, 3 and 4

c Returning Plan 1 or Plan 2 Member

Complete Section 1 only

c Returning Plan 3 Member

Complete Sections 1, 3 and 4

System

c TRS

Teachers’ Retirement System

c SERS

School Employees’ Retirement System

c PERS

Public Employees’ Retirement System

Section 2: Retirement Plan Selection (new members)

Choose your plan. Your decision is permanent. Note: you will be assigned to Plan 3 if your employer has not

received your plan selection within 90 calendar days of your date of hire.

c Plan 2

c Plan 3 — Also complete Section 4 on the back

Section 3: Signature Required (new and returning members)

Sign and date this form on the day you submit it to your employer.

New member: I have chosen the retirement plan marked in Section 2. I understand that my retirement

plan selection is permanent. If I selected Plan 3, I have also completed Section 4 on the back of this form.

Returning Plan 3 member: I have completed Section 4 on the back of this form. I also understand that

returning Plan 3 members who do not select a contribution rate within 90 days will be assigned the

current default rate of 5%.

Signature Date

Section 1: Personal Information

Name (last, rst, middle) Social Security Number

Mailing Address City State ZIP

Birthdate (mm/dd/yyyy) Gender (optional)

c Male c Female

Phone Number

Email Address

Your Social Security number is needed so DRS can report to the IRS any funds paid to you. DRS will not disclose your

Social Security number unless required to do so by law. See IRC sections 6041(a) and 6109.

DRS MS 133 7/17

Clear Form

Return the completed form to your employer.

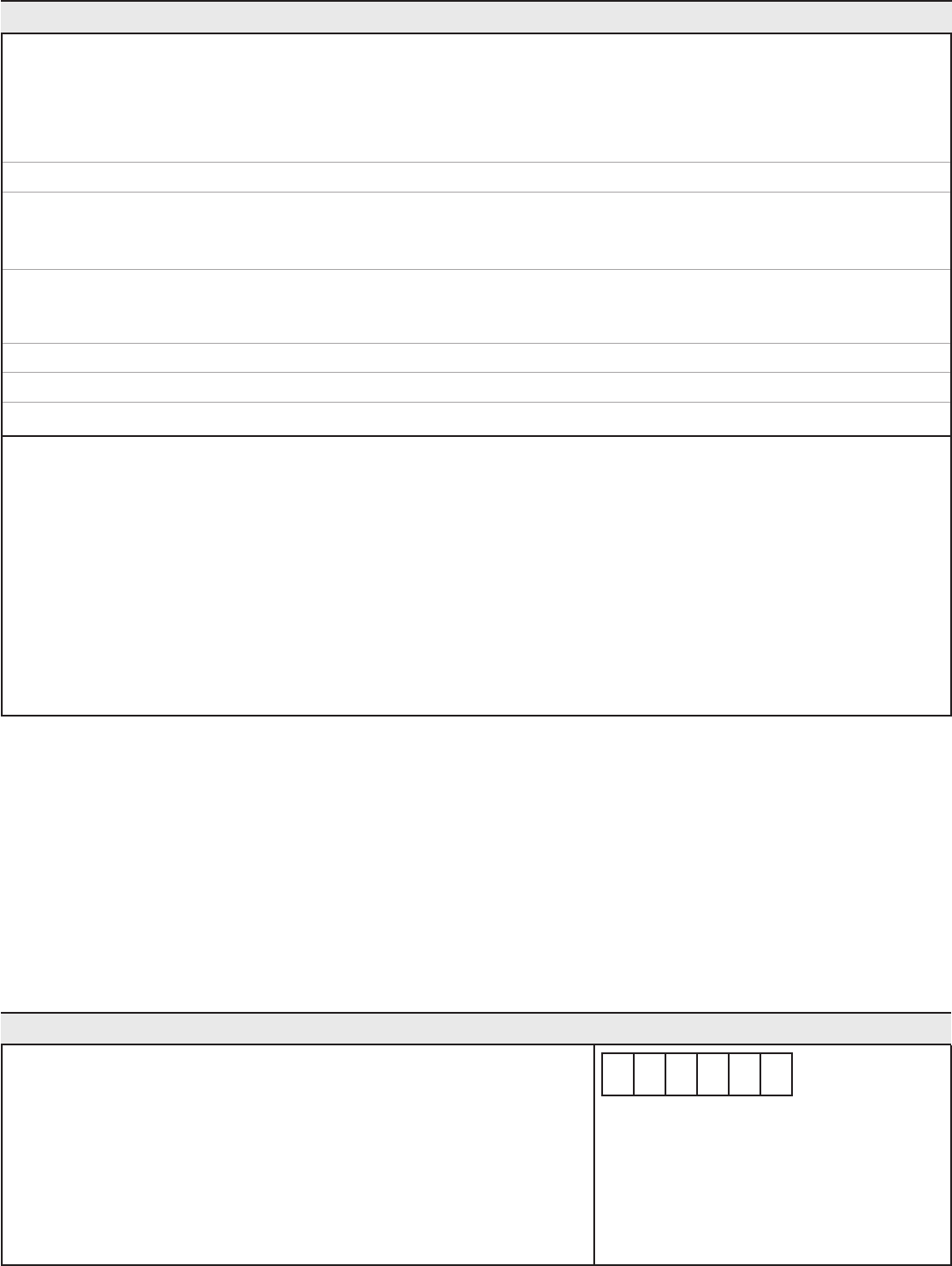

Section 5: To Be Completed by Employer

Employer Name and Mailing Address

Reporting Group

Employers: Mail the original of this form

to DRS only if Section 2 was required.

Department of Retirement Systems; PO

Box 48380; Olympia, WA 98504-8380

Section 4: Plan 3 Contribution Rate and Investment Program Selection

Choose an income contribution rate. If you do not choose an option, your default will be Option A. Once

established by selection or default, you may change your rate option only with a change of employer or

through the purchase of optional service credit from work as a substitute teacher.

Age

Member

Contribution Rate

c Option A

All ages 5.0%

c Option B

Up to age 35

Ages 35 to 44

Ages 45 and older

5.0%

6.0%

7.5%

c Option C

Up to age 35

Ages 35 to 44

Ages 45 and older

6.0%

7.5%

8.5%

c Option D

All ages 7.0%

c Option E

All ages 10.0%

c Option F

All ages 15.0%

Choose an investment program. If you do not choose an investment program, you will be defaulted

into the Self-Directed Investment Program and all of your contributions will be invested in the Retirement

Strategy Fund that assumes you’ll retire at age 65. You can change your investment program at any time.

c Washington State Investment Board (WSIB) Investment Program

c Self-Directed Investment Program

You must choose how your contributions will be invested. You may do so by phone at 888-327-5596

or online at

drs.wa.gov/login

.

If you do not choose your investment allocations, your contributions will

be invested in the Retirement Strategy Fund that assumes you’ll retire at age 65.

For more information about these investment programs, contact the DRS record keeper Empower

Retirement at 888-327-5596.