Fillable Printable Form Mo-60 - Application For Extension Of Time To File

Fillable Printable Form Mo-60 - Application For Extension Of Time To File

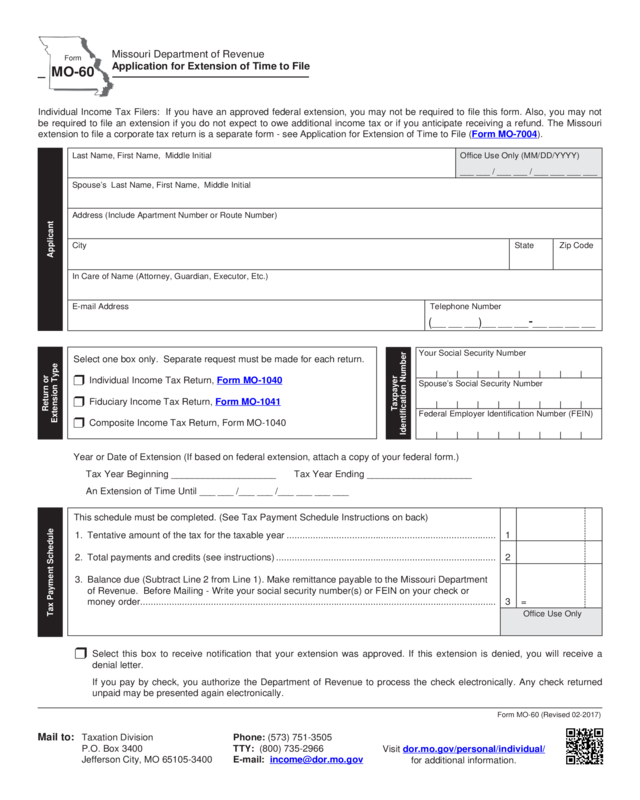

Form Mo-60 - Application For Extension Of Time To File

Year or Date of Extension (If based on federal extension, attach a copy of your federal form.)

Tax Year Beginning ____________________ Tax Year Ending ____________________

An Extension of Time Until ___ ___ /___ ___ /___ ___ ___ ___

r Select this box to receive notification that your extension was approved. If this extension is denied, you will receive a

denial letter.

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned

unpaid may be presented again electronically.

Individual Income Tax Filers: If you have an approved federal extension, you may not be required to file this form. Also, you may not

be required to file an extension if you do not expect to owe additional income tax or if you anticipate receiving a refund. The Missouri

extension to file a corporate tax return is a separate form - see Application for Extension of Time to File (Form MO-7004).

Form

MO-60

Missouri Department of Revenue

Application for Extension of Time to File

This schedule must be completed. (See Tax Payment Schedule Instructions on back)

Office Use Only

1. Tentative amount of the tax for the taxable year ................................................................................ 1

2. Total payments and credits (see instructions) .................................................................................... 2

3. Balance due (Subtract Line 2 from Line 1). Make remittance payable to the Missouri Department

of Revenue. Before Mailing - Write your social security number(s) or FEIN on your check or

money order........................................................................................................................................ 3 =

Tax Payment Schedule

Mail to: Taxation Division Phone: (573) 751-3505

P.O. Box 3400 TTY: (800) 735-2966

Visit dor.mo.gov/personal/individual/

for additional information.

Form MO-60 (Revised 02-2017)

Select one box only. Separate request must be made for each return.

r Individual Income Tax Return, Form MO-1040

r Fiduciary Income Tax Return, Form MO-1041

r Composite Income Tax Return, Form MO-1040

Return or

Extension Type

Taxpayer

Identification Number

Your Social Security Number

Spouse’s Social Security Number

Federal Employer Identification Number (FEIN)

Last Name, First Name, Middle Initial Office Use Only (MM/DD/YYYY)

Spouse’s Last Name, First Name, Middle Initial

Address (Include Apartment Number or Route Number)

City State Zip Code

In Care of Name (Attorney, Guardian, Executor, Etc.)

E-mail Address Telephone Number

___ ___ / ___ ___ / ___ ___ ___ ___

(___ ___ ___)___ ___ ___-___ ___ ___ ___

Applicant

Reset Form

Print Form

Instructions

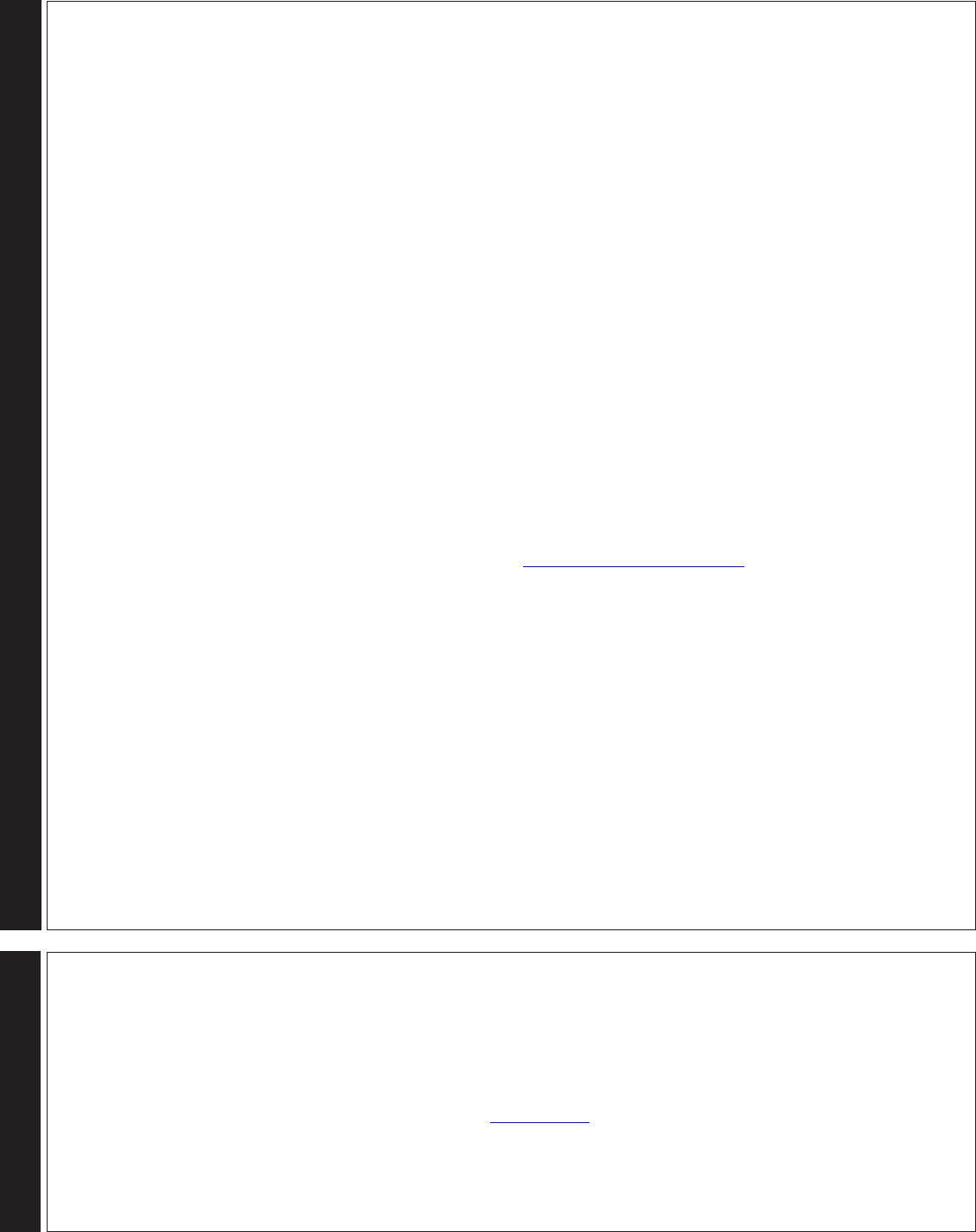

Tax Payment Schedule Instructions

Line 1 Enter the amount of estimated Missouri tax liability for the taxable year.

Line 2 Enter the total amount of payments and credits. This amount should include:

• Missouri estimated income tax payments

• Missouri income tax withheld

• Overpayment applied as a credit

• Tax credits

• Credit for income tax paid to another state (See Form MO-CR for further instructions on the completion of other

credits.)

Line 3 Subtract Line 2 from Line 1 and enter the result on Line 3. This is the balance of tax due. Enclose your check or money

order in this amount made payable to “Missouri Department of Revenue”. Be sure to print your social security number(s)

or Federal Employer Identification Number (FEIN) on your check or money order.

Form MO-60 (Revised 02-2017)

Missouri grants an automatic extension of time to file to any individual, business filing a composite return, or fiduciary if you filed

a federal extension. You do not need to file a Form MO-60 (Application for Extension of Time to File) unless:

• You expect to owe a tax liability for the period. Form MO-60 and payment are due on or before the due date of the

return.

• You want a Missouri extension but not a federal extension. See “Note” below for exception on individual income tax

returns only. Form MO-60 is due on or before the due date of the return. A copy of Form MO-60 must be enclosed

with the Missouri return when filed. An approved Form MO-60 extends the due date up to six months for the individual

and composite income tax returns. The fiduciary income tax returns due date is extended based on the federal Form

7004.

• You seek a Missouri extension exceeding the federal auto matic extension period. Form MO-60 must be filed on or

before the end of the federal automatic extension period.

You must complete a separate Form MO-60 for each return.

Individual and composite income tax filers will be granted an automatic extension of time to file until October 16, 2017.

You are not required to file a Form MO-60 if you have an approved federal extension; and a) do not expect to owe

additional income tax, or b) anticipate receiving a refund. (Enclose a copy of your federal extension when you file your Missouri

return.)

Fiduciary filers will be granted an automatic extension of time to file based on the allowed extension of time to file according to

the federal Form 7004. Please attach a copy of the federal Form 7004 to your return.

Where to File

Mail your extension application to: Missouri Department Of Revenue, P.O. Box 3400, Jefferson City, MO 65105-3400.

Payment of Tax

An extension of time to file an income tax return does not extend the time for payment of the tax. Unless an extension of time

to pay has been granted, additions to tax of 5% plus interest is charged on the tax which was not paid by the original due date

of the return. The interest rate will be posted on our website at: http://dor.mo.gov/intrates.php. Remittance should be made

payable to “Missouri Department of Revenue” and submitted with this application.

Period of Extension Past Automatic Federal Extension Period

The Missouri extension equals the extension granted for federal tax purposes. Longer extensions will not be granted unless

sufficient need for such extended period is clearly shown on the MO-60. Extensions past the automatic extension period must be

requested on Form MO-60 and filed on or before the date the federal extension expires. You will be notified by the Department of

Revenue only if your request for extension is denied.

Type of Return or Extension

Check the box to indicate the type of return or extension filed. You may only file the extension for one tax type. A separate Form

MO-60 must be filed for each tax return.

Taxpayer Identification Number

Enter the social security number(s) or tax identification number depending on the type of return or extension chosen.

Blanket and Consolidated Requests (Income Tax Only)

Blanket and consolidated requests for extensions will not be granted. A separate application must be submitted for each return

and for each member of an affiliated group filing a consolidated federal income tax return and not qualifying to file a Missouri

consolidated return.