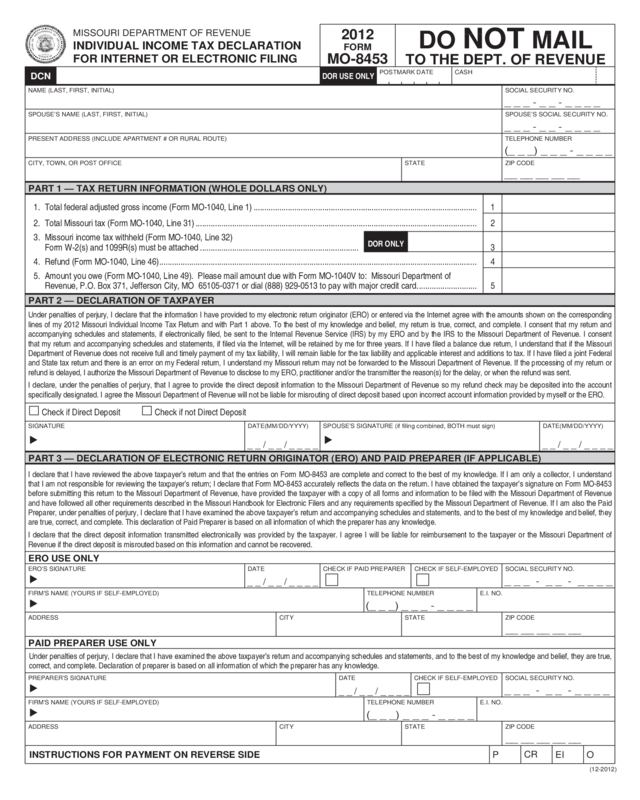

Fillable Printable Form Mo-8453 - 2012 Individual Income Tax Declaration For Internet Or Electronic Filing

Fillable Printable Form Mo-8453 - 2012 Individual Income Tax Declaration For Internet Or Electronic Filing

Form Mo-8453 - 2012 Individual Income Tax Declaration For Internet Or Electronic Filing

SIGNATURE DATE(MM/DD/YYYY) SPOUSE’S SIGNATURE (if filing combined, BOTH must sign) DATE(MM/DD/YYYY)

I declare that I have reviewed the above taxpayer’s return and that the entries on Form MO‑8453 are complete and correct to the best of my knowledge. If I am only a collector, I understand

that I am not responsible for reviewing the taxpayer’s return; I declare that Form MO‑8453 accurately reflects the data on the return. I have obtained the taxpayer’s signature on Form MO‑8453

before submitting this return to the Missouri Department of Revenue, have provided the taxpayer with a copy of all forms and information to be filed with the Missouri Department of Revenue

and have followed all other requirements described in the Missouri Handbook for Electronic Filers and any requirements specified by the Missouri Department of Revenue. If I am also the Paid

Preparer, under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best of my knowledge and belief, they

are true, correct, and complete. This declaration of Paid Preparer is based on all information of which the preparer has any knowledge.

I declare that the direct deposit information transmitted electronically was provided by the taxpayer. I agree I will be liable for reimbursement to the taxpayer or the Missouri Department of

Revenue if the direct deposit is misrouted based on this information and cannot be recovered.

NAME (LAST, FIRST, INITIAL) SOCIAL SECURITY NO.

SPOUSE’S NAME (LAST, FIRST, INITIAL) SPOUSE’S SOCIAL SECURITY NO.

PRESENT ADDRESS (INCLUDE APARTMENT # OR RURAL ROUTE) TELEPHONE NUMBER

CITY, TOWN, OR POST OFFICE STATE ZIP CODE

DOR USE ONLY

Under penalties of perjury, I declare that the information I have provided to my electronic return originator (ERO) or entered via the Internet agree with the amounts shown on the corresponding

lines of my 2012 Missouri Individual Income Tax Return and with Part 1 above. To the best of my knowledge and belief, my return is true, correct, and complete. I consent that my return and

accompanying schedules and statements, if electronically filed, be sent to the Internal Revenue Service (IRS) by my ERO and by the IRS to the Missouri Department of Revenue. I consent

that my return and accompanying schedules and statements, if filed via the Internet, will be retained by me for three years. If I have filed a balance due return, I understand that if the Missouri

Department of Revenue does not receive full and timely payment of my tax liability, I will remain liable for the tax liability and applicable interest and additions to tax. If I have filed a joint Federal

and State tax return and there is an error on my Federal return, I understand my Missouri return may not be forwarded to the Missouri Department of Revenue. If the processing of my return or

refund is delayed, I authorize the Missouri Department of Revenue to disclose to my ERO, practitioner and/or the transmitter the reason(s) for the delay, or when the refund was sent.

I declare, under the penalties of perjury, that I agree to provide the direct deposit information to the Missouri Department of Revenue so my refund check may be deposited into the account

specifically designated. I agree the Missouri Department of Revenue will not be liable for misrouting of direct deposit based upon incorrect account information provided by myself or the ERO.

PREPARER’S SIGNATURE DATE CHECK IF SELF‑EMPLOYED SOCIAL SECURITY NO.

FIRM’S NAME (YOURS IF SELF‑EMPLOYED) TELEPHONE NUMBER E.I. NO.

ADDRESS CITY STATE ZIP CODE

P

CR

EI O

1. Total federal adjusted gross income (Form MO‑1040, Line 1) ........................................................................................................ 1

2. Total Missouri tax (Form MO‑1040, Line 31) ................................................................................................................................... 2

3. Missouri income tax withheld (Form MO‑1040, Line 32)

Form W‑2(s) and 1099R(s) must be attached .......................................................................... 3

4. Refund (Form MO‑1040, Line 46) .................................................................................................................................................... 4

5. Amount you owe (Form MO‑1040, Line 49). Please mail amount due with Form MO‑1040V to: Missouri Department of

Revenue, P.O. Box 371, Jefferson City, MO 65105‑0371 or dial (888) 929‑0513 to pay with major credit card. ........................... 5

ERO’S SIGNATURE DATE CHECK IF PAID PREPARER CHECK IF SELF‑EMPLOYED SOCIAL SECURITY NO.

FIRM’S NAME (YOURS IF SELF‑EMPLOYED) TELEPHONE NUMBER E.I. NO.

ADDRESS CITY STATE ZIP CODE

MISSOURI DEPARTMENT OF REVENUE

INDIVIDUAL INCOME TAX DECLARATION

FOR INTERNET OR ELECTRONIC FILING

2012

FORM

MO‑8453

DO NOT MAIL

TO THE DEPT. OF REVENUE

(12‑2012)

DOR ONLY

t t t

t

tt

POSTMARK DATE CASH

INSTRUCTIONS FOR PAYMENT ON REVERSE SIDE

PART 1 — TAX RETURN INFORMATION (WHOLE DOLLARS ONLY)

PAID PREPARER USE ONLY

Under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true,

correct, and complete. Declaration of preparer is based on all information of which the preparer has any knowledge.

ERO USE ONLY

PART 2 — DECLARATION OF TAXPAYER

DCN

PART 3 — DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER (IF APPLICABLE)

Check if Direct Deposit Check if not Direct Deposit

_ _ _ ‑ _ _ ‑ _ _ _ _

_ _ _ ‑ _ _ ‑ _ _ _ _

_ _ _ ‑ _ _ ‑ _ _ _ _

_ _ _ ‑ _ _ ‑ _ _ _ _

(_ _ _) _ _ _ ‑ _ _ _ _

__ __ __ __ __

__ __ __ __ __

__ __ __ __ __

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

(_ _ _) _ _ _ ‑ _ _ _ _

(_ _ _) _ _ _ ‑ _ _ _ _

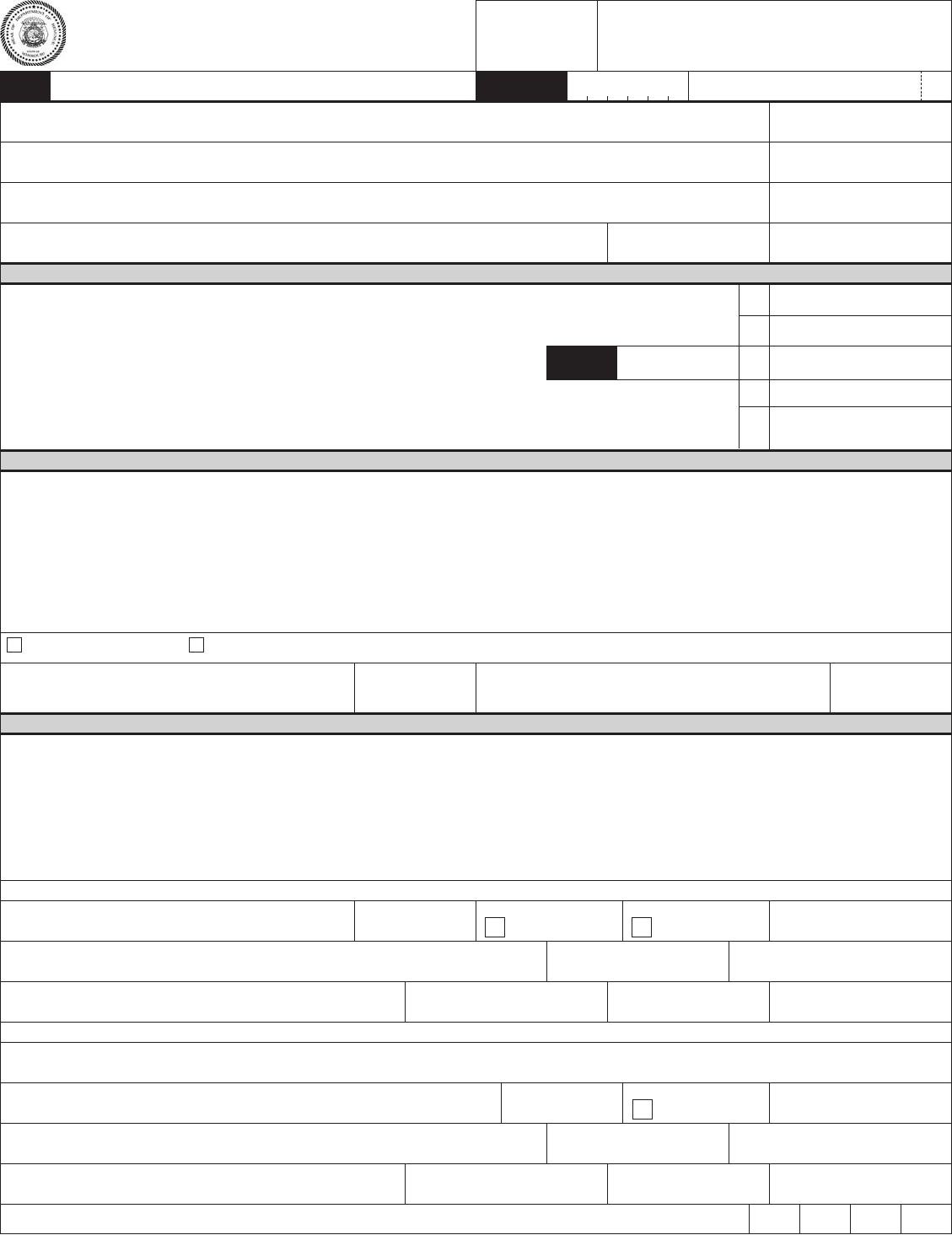

INSTRUCTIONS FOR FORM MO‑8453

NAME, ADDRESS, AND SOCIAL SECURITY NUMBER — If the taxpayer received an Income Tax Instruction Book, check to see that the

information on the label is correct. If all information is correct, use the label on the Form MO‑8453. The address must match the address

shown on the electronically filed Form MO‑1040.

PART 1 — TAX RETURN INFORMATION

Line 1 — Enter the federal adjusted gross income from Form MO‑1040, Line 1.

Line 2 — Enter the Missouri tax from Form MO‑1040, Line 31.

Line 3 — Enter the amount of refund, if any, from Form MO‑1040, Line 46.

Line 4 — Enter the amount you owe, if any, from Form MO‑1040, Line 49.

PAYMENT OF BALANCE DUE

Payment of tax due must be made by April 15, 2013, in order to avoid additions to tax and interest.

The taxpayer must submit Form MO‑1040V with payment. You may pay online at http://dor.mo.gov/personal/payonline.php or by

calling (888) 929‑0513 to pay with a major credit card.

PART 2 — DECLARATION OF TAXPAYER

Please check appropriate Direct Deposit box.

The Form MO‑8453 must be signed by the taxpayer(s).

PART 3 — DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER

The Form MO‑8453 must be signed by the ERO. A paid preparer must sign in the space provided for “Paid Preparer Use Only”, unless the

paid preparer is also the ERO, then only the “ERO Use Only” space should be completed and the paid preparer box checked.

Form MO‑8453 and supporting documentation (Form W‑2s, other state’s returns, etc.) must be retained by the ERO or by the taxpayer if

filed over the Internet. DO NOT MAIL!

(12‑2012)