Fillable Printable Form Mo-Njd - Missouri Department Of Revenue

Fillable Printable Form Mo-Njd - Missouri Department Of Revenue

Form Mo-Njd - Missouri Department Of Revenue

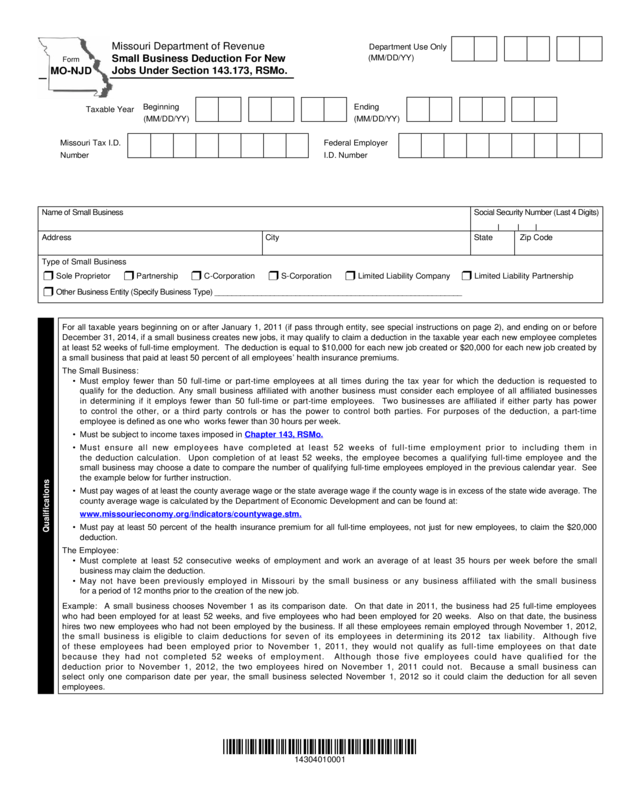

Name of Small Business Social Security Number (Last 4 Digits)

Qualifications

For all taxable years beginning on or after January 1, 2011 (if pass through entity, see special instructions on page 2), and ending on or before

December 31, 2014, if a small business creates new jobs, it may qualify to claim a deduction in the taxable year each new employee completes

at least 52 weeks of full-time employment. The deduction is equal to $10,000 for each new job created or $20,000 for each new job created by

a small business that paid at least 50 percent of all employees’ health insurance premiums.

The Small Business:

• Must employ fewer than 50 full-time or part-time employees at all times during the tax year for which the deduction is requested to

qualify for the deduction. Any small business affiliated with another business must consider each employee of all affiliated businesses

in determining if it employs fewer than 50 full-time or part-time employees. Two businesses are affiliated if either party has power

to control the other, or a third party controls or has the power to control both parties. For purposes of the deduction, a part-time

employee is defined as one who works fewer than 30 hours per week.

• Must be subject to income taxes imposed in Chapter 143, RSMo.

• Must ensure all new employees have completed at least 52 weeks of full-time employment prior to including them in

the deduction calculation. Upon completion of at least 52 weeks, the employee becomes a qualifying full-time employee and the

small business may choose a date to compare the number of qualifying full-time employees employed in the previous calendar year. See

the example below for further instruction.

• Must pay wages of at least the county average wage or the state average wage if the county wage is in excess of the state wide average. The

county average wage is calculated by the Department of Economic Development and can be found at:

www.missourieconomy.org/indicators/countywage.stm.

• Must pay at least 50 percent of the health insurance premium for all full-time employees, not just for new employees, to claim the $20,000

deduction.

The Employee:

• Must complete at least 52 consecutive weeks of employment and work an average of at least 35 hours per week before the small

business may claim the deduction.

• May not have been previously employed in Missouri by the small business or any business affiliated with the small business

for a period of 12 months prior to the creation of the new job.

Example: A small business chooses November 1 as its comparison date. On that date in 2011, the business had 25 full-time employees

who had been employed for at least 52 weeks, and five employees who had been employed for 20 weeks. Also on that date, the business

hires two new employees who had not been employed by the business. If all these employees remain employed through November 1, 2012,

the small business is eligible to claim deductions for seven of its employees in determining its 2012 tax liability. Although five

of these employees had been employed prior to November 1, 2011, they would not qualify as full-time employees on that date

because they had not completed 52 weeks of employment. Although those five employees could have qualified for the

deduction prior to November 1, 2012, the two employees hired on November 1, 2011 could not. Because a small business can

select only one comparison date per year, the small business selected November 1, 2012 so it could claim the deduction for all seven

employees.

r Sole Proprietor r Partnership r C-Corporation r S-Corporation r Limited Liability Company r Limited Liability Partnership

r Other Business Entity (Specify Business Type) __________________________________________________________

Address City State Zip Code

Type of Small Business

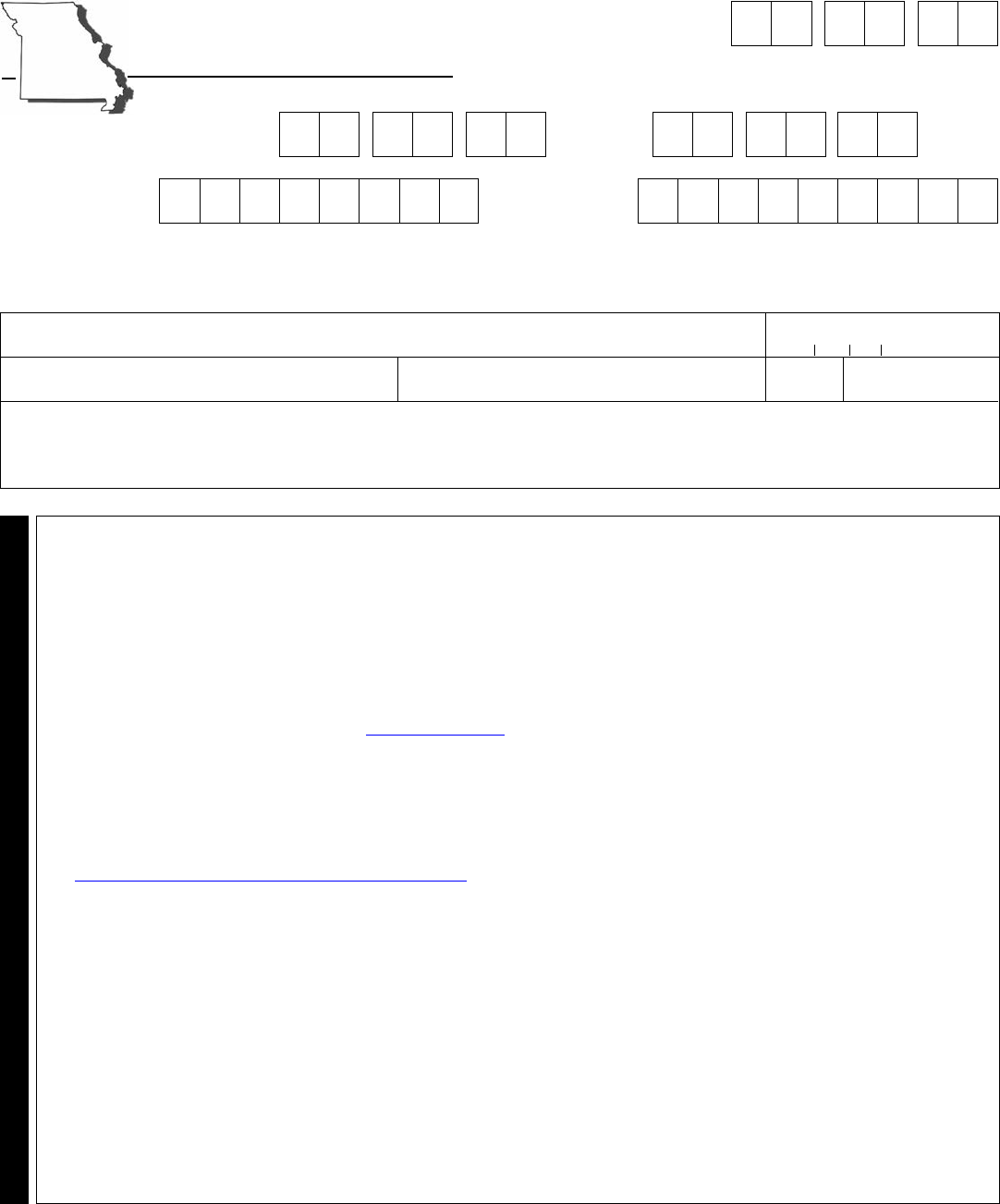

Form

MO-NJD

Missouri Department of Revenue

Small Business Deduction For New

Jobs Under Section 143.173, RSMo.

Department Use Only

(MM/DD/YY)

Beginning

Taxable Year

(MM/DD/YY)

Ending

(MM/DD/YY)

Missouri Tax I.D.

Number

Federal Employer

I.D. Number

*14304010001*

14304010001

Reset Form

Print Form

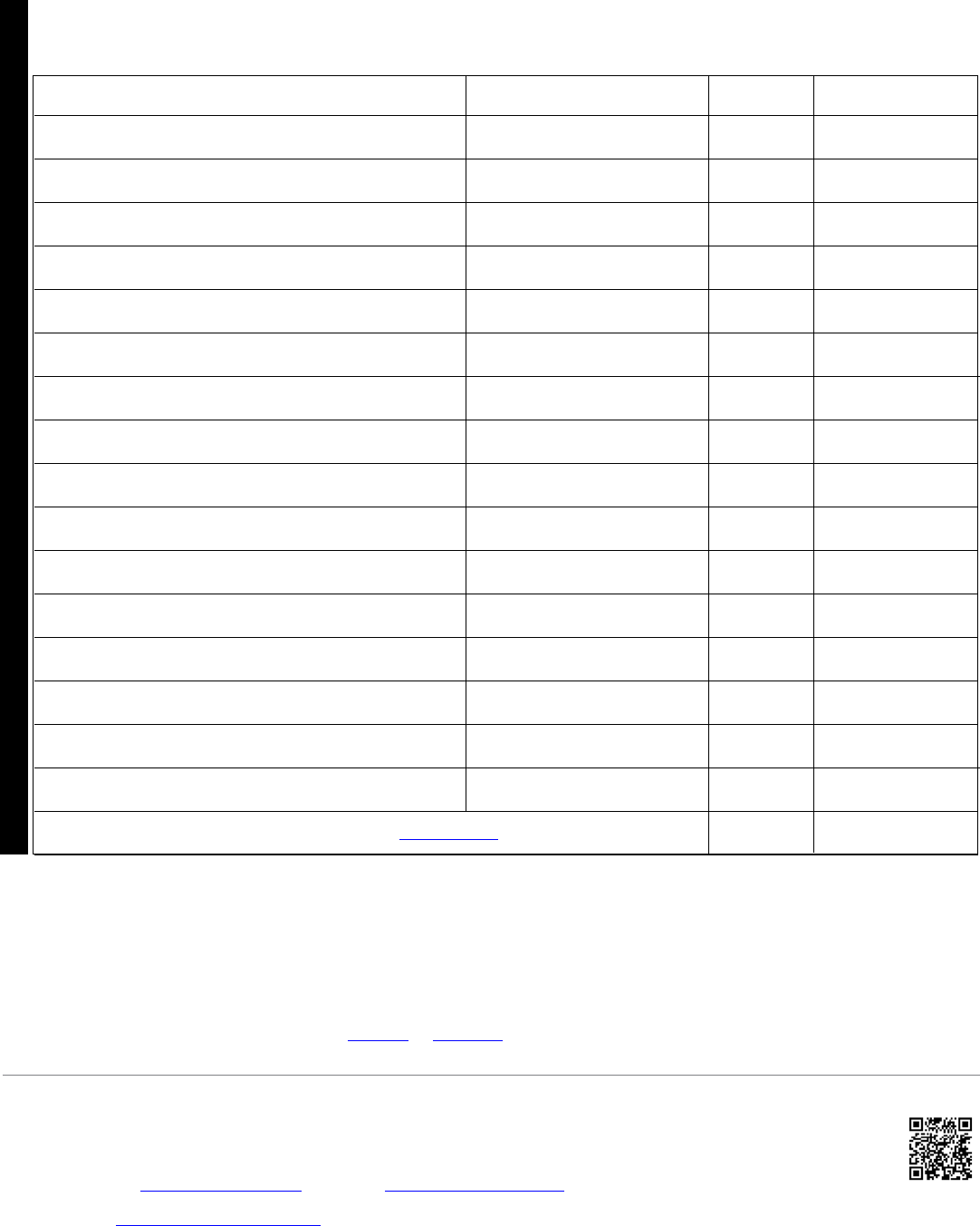

Total Wages

Paid For 52

Consecutive

Weeks

Annual County

Average Wage

County Where

Employee Worked

Employee Social

Security Number

(Last Four Digits)

Total

Deduction

Employee Name

First, Middle Initial, Last

Employee Title or

Position Code

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Total Deduction: Enter your total deduction here and on Form MO-1040, Line 18B; or on Form MO-1120, Line 7. ...............

If you hired more than ten new employees, please print an additional page(s).

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

For tax years ending on or after August 28, 2012, S-corporations, limited liability companies, limited liability partnerships or other pass-through business

entities may also qualify for the small business deduction for new jobs under Section 143.173, RSMo.

Special Instructions for Pass-Through Entities:

The deduction year comparison date can be any date within the tax year and the previous year comparison date will be one year earlier. Each partner,

member or shareholder must attach a completed Form MO-NJD when claiming the small business deduction on their income tax return.

__ __ /__ __ /__ __ __ __

Signature Title

Printed Name Date (MM/DD/YYYY)

1. Comparison Date: Each small business must choose a date to compare the number of full-time employees in the

deduction year and the number employed in the immediately preceding year. Enter your comparison date: (MM/DD/YYYY) .. 1

2. Employees in Deduction Year: The number of full-time employees employed on your comparison date in the deduction year. 2

3. Employees in Previous Year: The number of full-time employees employed on your comparison date in the immediately

preceding year. ......................................................................................................................................................................... 3

4. Subtract Line 3 from Line 2 to determine the number of eligible employees ............................................................................ 4

In the table below, enter the requested information for each new employee reflected on Line 4.

Note: If the employee worked in more than one county, enter the county in which he or she worked for the majority of his or her 52 weeks of employment.

Instructions

Signature

__ __ /__ __ /__ __ __ __

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I am the owner of or an officer of the

above business and am authorized to apply for the small business deduction for new jobs on behalf of the small business identified above. I hereby certify to the

Department of Revenue that the employees listed on page 2 meet the requirements outlined in Section 143.173, RSMo, and the small business claiming a deduction

meets the requirements outlined in this document and in Section 143.173, RSMo.

*14304020001*

14304020001

0

0.00

Form MO-NJD (Revised 12-2014)

Taxation Division

Personal Tax Corporate Tax Phone: (573) 751-4541

P.O. Box 385 P.O. Box 3365 Fax: (573) 522-1721

Jefferson City, MO 65105-0385 Jefferson City, MO 65105-3365

Visit http://smallbiztax.mo.gov/ for additional information.

Complete the Allocation Schedule below listing each partner, member, or shareholder and their applicable amount of the total small business deduction

(round to whole numbers). The deduction must be allocated in the same proportion as income is allocated for income tax purposes. The pass-through

entity qualifying for the deduction must provide a copy of this form to each partner, member or shareholder claiming the deduction, who must le the copy

with their return. If you have more than fifteen partners, members or shareholders, please print an additional page(s).

Name of Partner, Member or Shareholder

Last Four Digits of Social Security

Number or Complete FEIN

Share %

Deduction Amount

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

%

%

%

%

%

%

%

%

%

%

Total Deduction: Enter your total deduction here and on Form MO-1040, Line 18B. .................

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

%

%

%

%

%

%

Example: Joe Smith XXX-XX-1234 or 12-3456789 50 500.00

Allocation Instructions and Schedule

Schedule MO-NJD must be led with Form MO-1040, MO-1120, or MO-1120S. Please attach to the form and mail to the appropriate address as shown

on page 1 of the form.

%

100

*14304030001*

14304030001

0.00