Fillable Printable Form Mo-Nrp - 2015 Nonresident Partnership Form

Fillable Printable Form Mo-Nrp - 2015 Nonresident Partnership Form

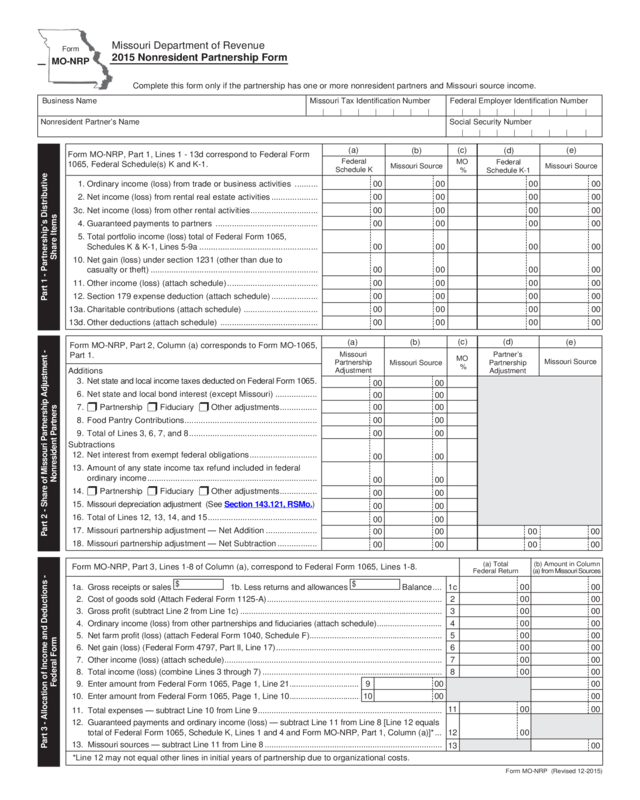

Form Mo-Nrp - 2015 Nonresident Partnership Form

1a. Gross receipts or sales

$

1b. Less returns and allowances

$

Balance .... 1c 00 00

2. Cost of goods sold (Attach Federal Form 1125-A) .............................................................................. 2 00 00

3. Gross profit (subtract Line 2 from Line 1c) .......................................................................................... 3 00 00

4. Ordinary income (loss) from other partnerships and fiduciaries (attach schedule) ............................. 4 00 00

5. Net farm profit (loss) (attach Federal Form 1040, Schedule F) ........................................................... 5 00 00

6. Net gain (loss) (Federal Form 4797, Part II, Line 17) .......................................................................... 6 00 00

7. Other income (loss) (attach schedule) ................................................................................................. 7 00 00

8. Total income (loss) (combine Lines 3 through 7) ................................................................................ 8 00 00

9. Enter amount from Federal Form 1065, Page 1, Line 21 ............................... 9 00 00

10. Enter amount from Federal Form 1065, Page 1, Line 10 ............................... 10 00 00 00

11. Total expenses — subtract Line 10 from Line 9 ..................................................................................

11 00 00

12. Guaranteed payments and ordinary income (loss) — subtract Line 11 from Line 8 [Line 12 equals

total of Federal Form 1065, Schedule K, Lines 1 and 4 and Form MO-NRP, Part 1, Column (a)]* ... 12 00

13. Missouri sources — subtract Line 11 from Line 8 ...............................................................................

13 00

Missouri Source

Form

MO-NRP

Missouri Department of Revenue

2015 Nonresident Partnership Form

Form MO-NRP (Revised 12-2015)

Complete this form only if the partnership has one or more nonresident partners and Missouri source income.

1. Ordinary income (loss) from trade or business activities .......... 00 00 00 00

2. Net income (loss) from rental real estate activities .................... 00 00 00 00

3c. Net income (loss) from other rental activities ............................. 00 00 00 00

4.

Guaranteed payments to partners

............................................ 00 00 00 00

5.

Total portfolio income (loss) total of Federal Form 1065,

Schedules K & K-1, Lines 5-9a

................................................... 00 00 00 00

10. Net gain (loss) under section 1231 (other than due to

casualty or theft) ........................................................................ 00 00 00 00

11. Other income (loss) (attach schedule) ....................................... 00 00 00 00

12. Section 179 expense deduction (attach schedule) .................... 00 00 00 00

13a. Charitable contributions (attach schedule) ................................ 00 00 00 00

13d. Other deductions (attach schedule) .......................................... 00 00 00 00

Federal

Schedule K

Federal

Schedule K-1

Missouri Source

(a)

(b)

(c)

(d)

(e)

Part 1 - Partnership’s Distributive

Share Items

MO

%

*Line 12 may not equal other lines in initial years of partnership due to organizational costs.

Nonresident Partner’s Name Social Security Number

Business Name Missouri Tax Identification Number Federal Employer Identification Number

| | | | | | | | | | | | | | |

| | | | | | | |

Additions

3. Net state and local income taxes deducted on Federal Form 1065 .

00 00

6. Net state and local bond interest (except Missouri) ..................

00 00

7. r Partnership r Fiduciary r Other adjustments ................ 00 00

8. Food Pantry Contributions ......................................................... 00 00

9. Total of Lines 3, 6, 7, and 8 ....................................................... 00 00

Subtractions

12. Net interest from exempt federal obligations .............................

00 00

13. Amount of any state income tax refund included in federal

ordinary income .........................................................................

00 00

14. r Partnership r Fiduciary r Other adjustments ................

00 00

15. Missouri depreciation adjustment (See Section 143.121, RSMo.)

00 00

16. Total of Lines 12, 13, 14, and 15 ...............................................

00 00

17. Missouri partnership adjustment — Net Addition ......................

00 00 00 00

18. Missouri partnership adjustment — Net Subtraction .................

00 00 00 00

Form MO-NRP, Part 2, Column (a) corresponds to Form MO-1065,

Part 1.

Missouri

Partnership

Adjustment

Missouri Source

MO

%

Partner’s

Partnership

Adjustment

(a) (b)

(c)

(d)

(e)

Part 2 - Share of Missouri Partnership Adjustment -

Nonresident Partners

(b) Amount in Column

(a) from Missouri Sources

Form MO-NRP, Part 3, Lines 1-8 of Column (a), correspond to Federal Form 1065, Lines 1-8.

(a) Total

Federal Return

Part 3 - Allocation of Income and Deductions -

Federal Form

Missouri Source

Form MO-NRP, Part 1, Lines 1 - 13d correspond to Federal Form

1065, Federal Schedule(s) K and K-1.

Reset Form

Print Form

Form MO-NRP (Revised 12-2015)

Taxation Division Phone: (573) 751-3505

P.O. Box 3000 Fax: (573) 526-7939

Visit http://dor.mo.gov/business/partner/

for additional information.

Federal Privacy Notice

The Federal Privacy Act requires the Missouri Department of Revenue

(department) to inform taxpayers of the department’s legal authority for requesting

identifying information, including social security numbers, and to explain why the

information is needed and how the information will be used.

Chapter 143 of the Missouri Revised Statutes authorizes the department to

request information necessary to carry out the tax laws of the state of Missouri.

Federal law 42 U.S.C. Section 405 (c)(2)(C) authorizes the states to require

taxpayers to provide social security numbers.

The department uses your social security number to identify you and pro-

cess your tax returns and other documents, to determine and collect the

correct amount of tax, to ensure you are complying with the tax laws, and to

exchange tax information with the Internal Revenue Service, other states, and the

Multistate Tax Commission (Chapters 32 and 143, RSMo). In addition, statutorily

provided non-tax uses are: (1) to provide information to the Department of

Higher Education with respect to applicants for financial assistance under

Chapter 173, RSMo and (2) to offset refunds against amounts due to a state

agency by a person or entity (Chapter 143, RSMo). Information furnished to

other agencies or persons shall be used solely for the purpose of administering

tax laws or the specific laws administered by the person having the statutory right

to obtain it as indicated above. (For the department’s authority to prescribe forms

and to require furnishing of social security numbers, see Chapters 135, 143, and

144, RSMo.)

You are required to provide your social security number on your tax return.

Failure to provide your social security number or providing a false social security

number may result in criminal action against you.

Instructions

Form MO-NRP of the partnership return is provided to aid the partnership in computing the information required to be reported to each nonresident partner, and is

required to be completed only when the partnership has (1) a nonresident partner, and (2) income from Missouri sources.

Form MO-NRP must be completed and a copy (or its information) supplied to the nonresident partner. An individual partner who is a nonresident of

Missouri must report his or her share of the Missouri income indicated on Form MO-NRP and his or her Missouri source modifications on his or her

Missouri Individual Income Tax Return (Form MO-1040), Form MO-NRI.

Nonresident Share of Missouri Source Items

The instructions for Parts 1 and 2 are based upon the nonresidents ratably sharing Missouri source income, deductions, and modifications. Attach a detailed

explanation (including extracts from the partnership agreement) if a nonresident partner is allocated a disproportionate share. The explanation must include

the nontax purposes and effects of the allocation methods.

Note: At the time the Department printed their tax booklets, the Internal Revenue Service had not finalized the federal income tax forms.

Part 1

1. Nonresident Partner’s Name. Copy the name from Federal Form 1065, Schedule K-1 for each nonresident. Omit Form MO-NRP if all partners are

residents of Missouri. Use additional Forms MO-NRP if more than one nonresident partner.

2. Column (a) — Copy amounts from Federal Form 1065, Schedule K. Form MO-NRP, Part 1, Column (a), Lines 1 through 13d are derived from the

corresponding lines of Federal Form 1065, Federal Schedule(s) K and K-1.

3. Columns (b) and (c) — Each amount in Column (a) must be analyzed to determine whether it is derived from Missouri sources. See instructions on

Missouri source income. Enter both the Missouri amount in Column (b) and the Missouri percentage in Column (c). Column (c) is determined by

dividing Column (b) by Column (a).

4. Column (d) — Copy amounts from Federal Form 1065, Schedule K-1 for each nonresident partner.

5. Column (e) — Enter in Column (e) the portion of the amount in Column (d) that is derived from Missouri sources. Generally, this is determined by

multiplying each partner’s Column (d) amount by the percent in Column (c). Attach a detailed explanation if any other method is used.

6. Example: Assume $20,000 income from a business deriving $16,000 (80%) from Missouri and a single 60% nonresident partner. Columns will

appear: (a) $20,000, (b) $16,000, (c) 80%, (d) $12,000, and (e) $9,600.

Part 2

1. Column (a) — Copy amounts from Form MO-1065, Part 1. Omit Form MO-NRP, Part 2 if you are not required to complete Form MO-1065,

Parts 1 and 2.

2. Column (b) — Indicate the portion of each amount in Column (a) that is related to items in Part 1, Column (b), Missouri Source Amounts. Total the

column.

3. Column (c) — Divide amount in Column (b) by amount in Column (a). Enter percentage in Column (c).

4. Column (d) — Copy amount of each nonresident partner’s part nership adjustment from Form MO-1065, Part 2, Column 5.

5. Column (e) — Enter in Column (e) the portion of the amount in Column (d) that is derived from Missouri sources. Generally, this is determined by

multiplying each partner’s Column (d) amount by the percent in Column (c). Attach a detailed explanation if any other method is used.

Part 3

Items of partnership income, gain, loss, and deduction that enter into a nonresident’s federal adjusted gross income must be analyzed to determine, if part or

all is from Missouri sources. These include amounts attributable to the ownership or disposition of any Missouri property and business income that is attrib-

utable to Missouri sources. Whether nonbusiness income is attributable to Missouri sources is often determined by whether the property sold or producing

income is located in Missouri.

Business or ordinary income is wholly attributable to Missouri, if the business is only carried on in Missouri. If not carried on only in Missouri, the income must

be divided between Missouri and other states. Part 3, Allocation of Income and Deductions, is provided for use if accompanying records clearly reflect income

from Missouri sources. Part 3, Line 13, indicates the Missouri source amount that is equal to the total of Part 1, Lines 1 and 5, Column (b). The Missouri

percentage is then computed and entered in Part 1, Column (c).

When Part 3 is not applicable, all business income should be apportioned by using the Multistate Tax Compact three factor apportionment method. The

three factors are: (1) Property, (2) Payroll and (3) Sales. Complete Form MO-MSS, Part 1, Lines 1 through 4 and attach to Form MO-1065. The per cent age

is the average of three factors, only if all three factors are applicable. The apportionment factor per centage from Form MO-MSS, Part 1, Line 4 is entered on

Form MO-NRP, Part 1, Line 1, Column (c). Line 1, Column (b) is computed by multiplying the percentage in Column (c) by the amounts in Column (a). The

percentage is also entered on other lines in Column (c) if the items are integral parts of the business.