Fillable Printable Form Mo W-3

Fillable Printable Form Mo W-3

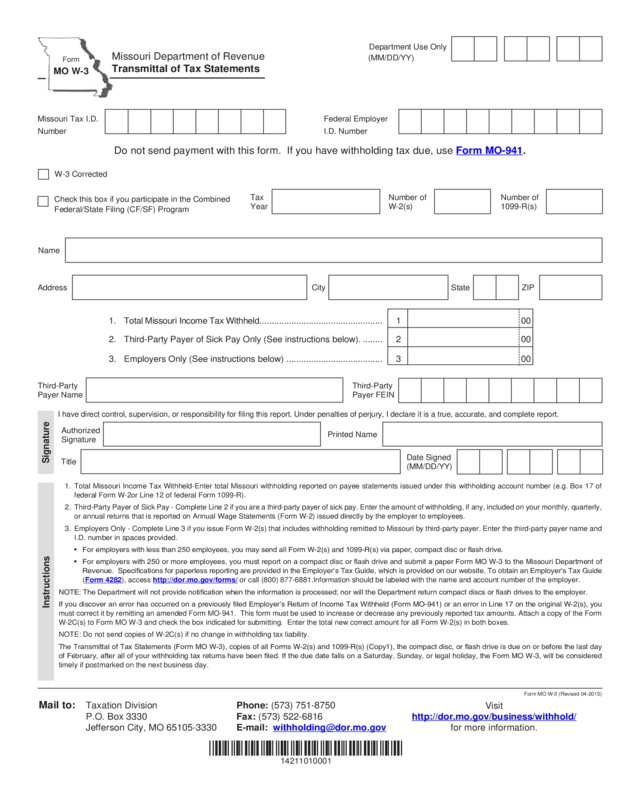

Form Mo W-3

Name

Signature

I have direct control, supervision, or responsibility for filing this report. Under penalties of perjury, I declare it is a true, accurate, and complete report.

Authorized

Signature

Printed Name

Title

Date Signed

(MM/DD/YY)

1. Total Missouri Income Tax Withheld.................................................. 1 00

2. Third-Party Payer of Sick Pay Only (See instructions below). ........ 2 00

3. Employers Only (See instructions below) ....................................... 3 00

Address City State ZIP

W-3 Corrected

Do not send payment with this form. If you have withholding tax due, use Form MO-941.

Form MO W-3 (Revised 04-2015)

Number of

W-2(s)

Number of

1099-R(s)

Tax

Year

Visit

http://dor.mo.gov/business/withhold/

for more information.

Mail to: Taxation Division Phone: (573) 751-8750

P.O. Box 3330 Fax: (573) 522-6816

*14211010001*

14211010001

Check this box if you participate in the Combined

Federal/State Filing (CF/SF) Program

Third-Party

Payer FEIN

Third-Party

Payer Name

Instructions

1. Total Missouri Income Tax Withheld-Enter total Missouri withholding reported on payee statements issued under this withholding account number (e.g. Box 17 of

federal Form W-2or Line 12 of federal Form 1099-R).

2. Third-Party Payer of Sick Pay - Complete Line 2 if you are a third-party payer of sick pay. Enter the amount of withholding, if any, included on your monthly, quarterly,

or annual returns that is reported on Annual Wage Statements (Form W-2) issued directly by the employer to employees.

3. Employers Only - Complete Line 3 if you issue Form W-2(s) that includes withholding remitted to Missouri by third-party payer. Enter the third-party payer name and

I.D. number in spaces provided.

• Foremployerswithlessthan250employees,youmaysendallFormW-2(s)and1099-R(s)viapaper,compactdiscorashdrive.

• Foremployerswith250ormoreemployees,youmustreportonacompactdiscorashdriveandsubmitapaperFormMOW-3totheMissouriDepartmentof

Revenue.SpecicationsforpaperlessreportingareprovidedintheEmployer’sTaxGuide,whichisprovidedonourwebsite.ToobtainanEmployer’sTaxGuide

(Form 4282), access http://dor.mo.gov/forms/ or call (800) 877-6881.Information should be labeled with the name and account number of the employer.

NOTE:TheDepartmentwillnotprovidenoticationwhentheinformationisprocessed;norwilltheDepartmentreturncompactdiscsorashdrivestotheemployer.

IfyoudiscoveranerrorhasoccurredonapreviouslyledEmployer’sReturnofIncomeTaxWithheld(FormMO-941)oranerrorinLine17ontheoriginalW-2(s),you

must correct it by remitting an amended Form MO-941. This form must be used to increase or decrease any previously reported tax amounts. Attach a copy of the Form

W-2C(s) to Form MO W-3 and check the box indicated for submitting. Enter the total new correct amount for all Form W-2(s) in both boxes.

NOTE: Do not send copies of W-2C(s) if no change in withholding tax liability.

TheTransmittalofTaxStatements(FormMOW-3),copiesofallFormsW-2(s)and1099-R(s)(Copy1),thecompactdisc,orashdriveisdueonorbeforethelastday

ofFebruary,afterallofyourwithholdingtaxreturnshavebeenled.IftheduedatefallsonaSaturday,Sunday,orlegalholiday,theFormMOW-3,willbeconsidered

timely if postmarked on the next business day.

Form

MO W-3

Missouri Department of Revenue

Transmittal of Tax Statements

Department Use Only

(MM/DD/YY)

Missouri Tax I.D.

Number

Federal Employer

I.D. Number

Reset Form

Print Form