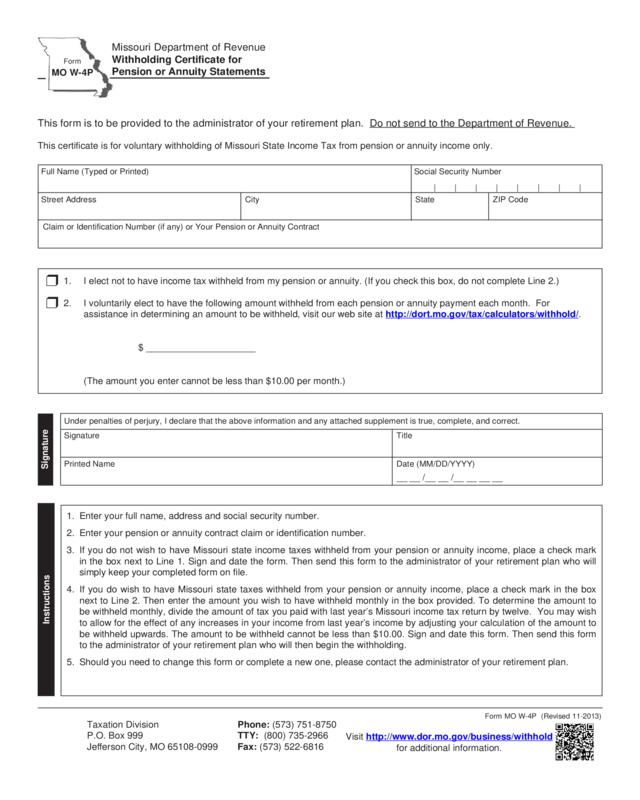

Fillable Printable Form Mo W-4P - Missouri Department Of Revenue

Fillable Printable Form Mo W-4P - Missouri Department Of Revenue

Form Mo W-4P - Missouri Department Of Revenue

This form is to be provided to the administrator of your retirement plan. Do not send to the Department of Revenue.

This certificate is for voluntary withholding of Missouri State Income Tax from pension or annuity income only.

r 1. I elect not to have income tax withheld from my pension or annuity. (If you check this box, do not complete Line 2.)

r 2. I voluntarily elect to have the following amount withheld from each pension or annuity payment each month. For

assistance in determining an amount to be withheld, visit our web site at http://dort.mo.gov/tax/calculators/withhold/.

$ _____________________

(The amount you enter cannot be less than $10.00 per month.)

Missouri Department of Revenue

Withholding Certificate for

Pension or Annuity Statements

Instructions

Form MO W-4P (Revised 11-2013)

Visit http://www.dor.mo.gov/business/withhold

for additional information.

Taxation Division Phone: (573) 751-8750

P.O. Box 999 TTY: (800) 735-2966

Jefferson City, MO 65108-0999 Fax: (573) 522-6816

1. Enter your full name, address and social security number.

2. Enter your pension or annuity contract claim or identification number.

3. If you do not wish to have Missouri state income taxes withheld from your pension or annuity income, place a check mark

in the box next to Line 1. Sign and date the form. Then send this form to the administrator of your retirement plan who will

simply keep your completed form on file.

4. If you do wish to have Missouri state taxes withheld from your pension or annuity income, place a check mark in the box

next to Line 2. Then enter the amount you wish to have withheld monthly in the box provided. To determine the amount to

be withheld monthly, divide the amount of tax you paid with last year’s Missouri income tax return by twelve. You may wish

to allow for the effect of any increases in your income from last year’s income by adjusting your calculation of the amount to

be withheld upwards. The amount to be withheld cannot be less than $10.00. Sign and date this form. Then send this form

to the administrator of your retirement plan who will then begin the withholding.

5. Should you need to change this form or complete a new one, please contact the administrator of your retirement plan.

Claim or Identification Number (if any) or Your Pension or Annuity Contract

Full Name (Typed or Printed) Social Security Number

Signature Title

Printed Name Date (MM/DD/YYYY)

Signature

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

__ __ /__ __ /__ __ __ __

Street Address City State ZIP Code

| | | | | | | |

Form

MO W-4P

Reset Form

Print Form